Metro Vancouver

Real Estate Trends and Price Forecast

HIGHLIGHTS

Home values in Metro Vancouver have been volatile in recent years, see-sawing up and down since 2021.

While industry experts have declared that market conditions are improving when compared to 2023, purchase activity in 2024 is unlikely to reach the 10-year average.

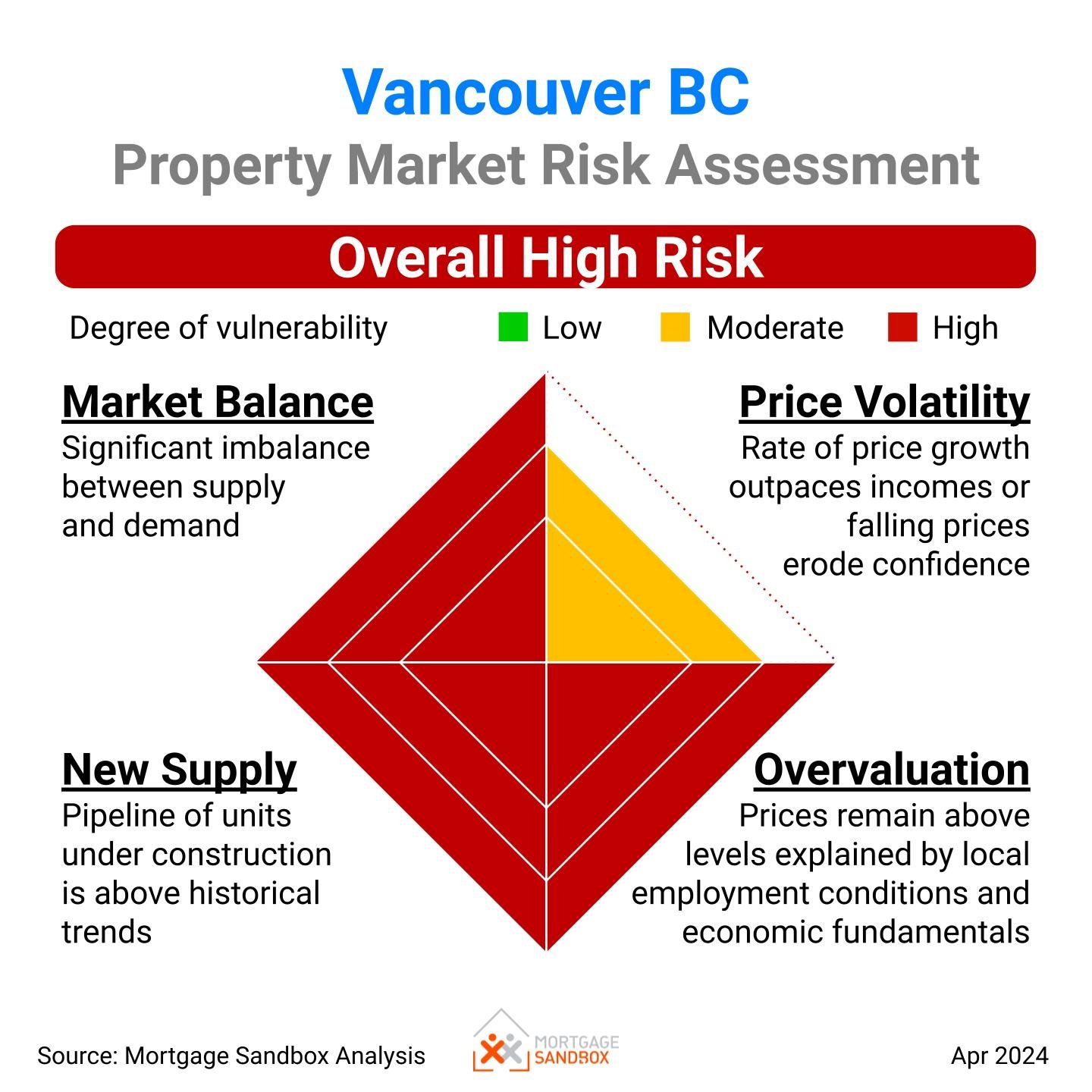

A multi-factor analysis identifies Metro Vancouver as a higher-risk real estate market.

Budgets for home purchases are under strain due to the significant increase in mortgage rates since their historical lows. Promised rate cuts keep getting delayed because inflation has been more difficult to control than expected.

This article covers:

What is the state of the Vancouver real estate market?

Which way are prices going?

Should I sell?

Is now a wise time to purchase?

1. What is the state of the Vancouver real estate market?

Overview of the Property Market

Metro Vancouver is a bustling city of 2.7 million people that has earned recognition as one of the top 100 cities in the world, coming in at number 69.

During the pandemic, ultra-low mortgage rates turbocharged Metro Vancouver's housing market, driving up prices remarkably and pushing aspiring homeowners further away from their dreams.

Post-pandemic, the federal government embarked on an aggressive immigration program to find replacement workers for retiring baby boomers. This combined inflation and higher mortgage rates led to higher aspirational or “latent” demand but worse affordability than in the 1980s when mortgage rates were above 10 per cent. Even more potential buyers now sit on the sidelines.

For those contemplating selling their homes, time is of the essence. Early Spring is the best time to sell because there is typically less supply. Already, we are seeing a growing supply, not only higher than earlier in the year but higher than in the past three years.

Prospective homebuyers might consider waiting for a lighter mortgage burden. Mortgage rates are relatively high but are forecast to fall in late 2024. Buyers seeking affordable financing will need patience because analysts keep revising their predictions, pushing out the date when they expect rates to drop.

The market fundamentals are riddled with risk and uncertainty as consumer sentiment has taken a substantial hit. But remember, consumer sentiment can be volatile and an unreliable predictor of future price trends.

|

Not sure about your bank's mortgage offer?Talk to one of our affiliated Mortgage Brokers

|

Metro Vancouver Detached House Prices

Since the peak in Spring 2022, house prices in Vancouver have resembled a roller coaster. The benchmark price fluctuated between 300,000 and 100,000 dollars up and down.

Our politicians strive to return the market to a more typical real estate cycle, where prices grow consistently and modestly at an annual rate of 1 to 3%, in line with income growth. They are orchestrating efforts to guide the market toward this balanced trajectory without much success.

Demand and purchases in Greater Vancouver are low. Many people want to buy a home, but affordability is so poor, that would-be buyers have been sidelined. Significantly fewer people can realize their homeownership dream in these market conditions.

New homebuyers can’t afford to get onto the first rung of the homeownership ladder, and high rates trap existing owners. Families that want to upgrade to a larger home can’t qualify for a new mortgage at the current rates.

Price rises were mostly fuelled by the low supply of active listings, but today, listings are running higher than in the past 3 years.

Are you interested in specific areas of Metro Vancouver? Try these reports!

Metro Vancouver New Construction Home Prices

Prices of new homes have been flat. Based on economic fundamentals, they are unlikely to accelerate in the medium term.

Does this concern you? Read the Pros and Cons of Buying Pre-sale Homes

Despite claims that developers are struggling, pres-sales have continued in line with the ten-year average of just over one thousand units released monthly.

|

Your Realtor will want you to get pre-approvedTalk to one of our affiliated Mortgage Brokers

|

Market Risk

Based on Mortgage Sandbox Analysis, Vancouver is at a high risk of a significant market correction.

Metro Vancouver Condo Apartment Prices

Like house prices, the Metro Vancouver benchmark apartment price is trending downward.

Condo purchases in 2023 were relatively lacklustre. 2024 is shaping up better than last year but below average.

Today's purchases are much lower than in most of the previous three years.

Supply varies greatly between Vancouver sub-regions. You can use this information to avoid the most brutal bidding wars.

With more people working from home or hybrid, we expect developers will begin marketing larger (i.e., 2 and 3 bedrooms) apartments to meet buyer preferences. As the supply of more generous floor plans comes to the market, it may depress the values for small floor plan condos.

At Mortgage Sandbox, we would like developers to build 4 and 5 bedroom condos because:

Not everyone can afford to buy a house for their family.

Canadians who now work from home need more room to segregate workspace from living space within their homes.

Many Canadians with longer working hours find it challenging to stay on top of necessary house upkeep (i.e., mowing lawns, clearing eaves, shovelling sidewalks).

Many people prefer to live in higher-density neighbourhoods with all the essential amenities within walking distance.

Metro Vancouver Townhouse Prices

|

Is your mortgage coming due for renewal?Talk to one of our affiliated Mortgage Brokers

|

Still a challenge for first-time homebuyers

Vancouver home prices remain unaffordable for most residents. A first-time homebuyer household earning $75,000 (the median Metro Vancouver household before-tax income) can only get a $300,000 mortgage. To buy a benchmark priced $680,000 condo, a first-time homebuyer needs to save $380,000 cash for a down payment or receive a very generous gift from mom and dad. For most people, that’s just not on the cards.

How much home can you afford?

Our mortgage calculator takes uses up-to-date mortgage rates and calculates the price of a home you could afford.

What about the rest of BC?

Read the Victoria Forecast and Okanagan Forecast.

2. Where are Metro Vancouver home prices headed?

There is a lot of uncertainty in the forecasts for 2024, 2025 and 2026. Many of the forecasters we've surveyed have different expectations for:

Will the federal government achieve its aggressive immigration targets?

There is no consensus among economists.

How do we arrive at our forecast range? Check out our full assessment of the five factors that drive these forecasts. These five forces help explain why several forecasters are anticipating price drops.

Need a Realtor?

We match you with local, pre-screened, values-aligned Realtors and Mortgage Brokers.

At Mortgage Sandbox, we provide a price range rather than attempting a single prediction because many real estate risks can impact prices. Risks are events that may or may not happen. As a result, we review various forecasts from leading lenders and real estate firms. We then present the most optimistic estimates, the most pessimistic prediction, and the average forecast. Do you want to learn more about real estate risk? We've written a comprehensive report explaining the uncertainty level in the Canadian real estate market.

Our forecast inputs:

Get a mortgage broker to pre-approve you

Realtors want you to be pre-approved before you look at homes

3. Should Investors Sell?

From a seller’s perspective, more changes in the market influence prices downward so now may be a better time to sell than in two years, and the annual real estate cycle usually favours sellers in the first half of the year.

Sellers should consult a mortgage broker early to prioritise flexible loan conditions and reduce the risk of penalties for cancellation. Find out more about the benefits of a mortgage broker.

Planning to Sell? Check out our Complete Home Seller’s Guide.

Fixed or Variable rate mortgage?

Find out where mortgage rates are headed before you start to negotiate.

4. Is this a good time to buy?

It’s hard to say. Prices have been falling, but interest rates (borrowing costs) are high, so prices could fall further. It's almost impossible to time the market. If you are buying your forever home and don't plan to sell for ten years, then the risks of buying now are lower.

Regardless, the annual real estate cycle usually favours buyers in late summer.

If you are considering buying, be sure to drive a hard bargain and pay as close to market value as possible. Also, don't bite off more than you can chew when it comes to financing.

Planning to Buy? Check out our Complete Home Buyer’s Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

Here are some recent headlines you might be interested in:

Bank of Canada: era of very low rates is likely over, people and firms must adjust (Reuters)

Bank of Canada deliberations show some felt rates may need to rise higher (Global News)

Bank of Canada likely done raising rates, to cut by mid-2024 say economists: Reuters poll (Reuters)

Rising rates on homeowners and the shocks that lie ahead (CMHC)

Upcoming mortgage renewals have homeowners concerned (Edmonton Journal)

Canada is in for a cooler winter in real estate as sales slow: CREA (Global News)

Home Prices in Canada Are So Stretched That Even Owners Want Them to Fall (Reuters)

Posthaste: The risk of forced home sales is rising in Canada, warns economist (Financial Post)

B.C. real estate market notches downward amid climbing interest rates, association says (Vancouver Sun)

LACKIE: Bleak times for Toronto real estate market (Toronto Sun)

Calgary Real Estate Board reports 17 per cent increase in October home sales (Calgary Herald)

Vaughn Palmer: End of the line for single-family neighbourhoods in most of B.C.(Vancouver Sun)

Like this report? Like us on Facebook.