Canada's Housing Market: Rock Solid or Ready to Crack?

A Summary of Key Risks and What They Mean for Buyers and Sellers

Last Updated December 8, 2025.

HIGHLIGHTS

Home prices in major cities are still well below their 2022 peaks.

Over one-third of Canadian mortgages will renew by 2026, many at significantly higher rates.

The Bank of Canada has flagged household debt and real estate imbalances as top financial risks.

Condo supply is rising in Toronto, Vancouver, and London. In Toronto, 70 percent of new rentals are losing money monthly.

Buyer confidence has weakened, and many expect further price drops and are waiting on the sidelines.

Affordability has improved across Canada, but ownership is still out of reach for most Canadians, with ownership costs now over 90 percent of the median income in Vancouver.

Smaller markets like Kelowna and Victoria face higher volatility, while Montreal and Ottawa remain more stable.

Investor sentiment has shifted from growth optimism to cash flow discipline, reshaping housing demand dynamics.

Federal immigration targets have been reduced, dampening expected housing demand growth through 2026

Summary: How to Use This Risk Map

Whether you're buying your first home, moving up the property ladder, or selling a condo downtown, the state of your local housing market should guide your decisions.

This report maps risk across Canadian cities based on apartment and house market fundamentals, volatility, and affordability.

It distills complex indicators into accessible insights. Think of it as a weather forecast for real estate: helpful not just for planning a move, but for understanding when to hold, when to negotiate harder, and when to wait.

1. The Big Picture: A Market Losing Steam

Teranet-National Bank Composite House Price Index™

| Metro | % change m/m | % change m/m, SA | % change y/y | From peak | Peak date |

|---|---|---|---|---|---|

| Calgary | 0.22 | 0.09 | 1.72 | -0.52 | Aug-25 |

| Edmonton | 0.59 | 0.44 | 5.34 | 0.00 | Oct-25 |

| Kelowna | 1.73 | 2.76 | 3.59 | -6.66 | Jul-22 |

| Vancouver | -0.11 | 0.54 | 4.47 | -7.56 | Aug-24 |

| Victoria | 0.75 | 0.62 | 1.53 | -5.56 | May-22 |

| Hamilton | 0.53 | 0.01 | -3.98 | -19.13 | May-22 |

| London | -0.07 | 1.26 | -3.15 | -16.62 | Apr-22 |

| Ottawa-Gatineau | 0.30 | 1.42 | 1.63 | -3.71 | Jun-22 |

| Toronto | -1.29 | 0.27 | -7.15 | -17.89 | May-22 |

| Montréal | -0.99 | -0.23 | 5.20 | -2.35 | Jun-25 |

Source: The Teranet-National Bank House Price Index™, October 2025

The National narrative is dominated by the Toronto market, where prices peaked in early 2022 after years of strong demand and cheap credit. Since then, prices have dropped with declines as steep as 25 percent in some areas.

While transaction volumes remain well below their ten-year average. Prices are still breaking records in Alberta and Quebec. British Columbia has seen some froth come off prices, but only Ontario has seen a double-digit correction.

The lower purchase activity stems from several compounding factors.

1. Higher Mortgage Rates

Interest rates have risen sharply from their pandemic-era lows, putting pressure on mortgage affordability.

While the prime rate has dropped significantly from the 2024 peak, it is still very high compared to the period from 2009 to 2021. Based on recent experience, it is possible that it will not return below 3 percent and instead behave more like it did before 2009.

2. High Household Debt Levels

The Bank of Canada has consistently flagged elevated household debt as an area of concern. Mortgage rates remain above four percent, and the central bank estimates that more than a third of mortgages will renew by the end of 2026, many at significantly higher rates. This creates a ticking affordability time bomb for many households.

At the same time, the economic tailwinds that fuelled demand: high immigration, cheap mortgages, and pandemic-induced lifestyle changes have reversed.

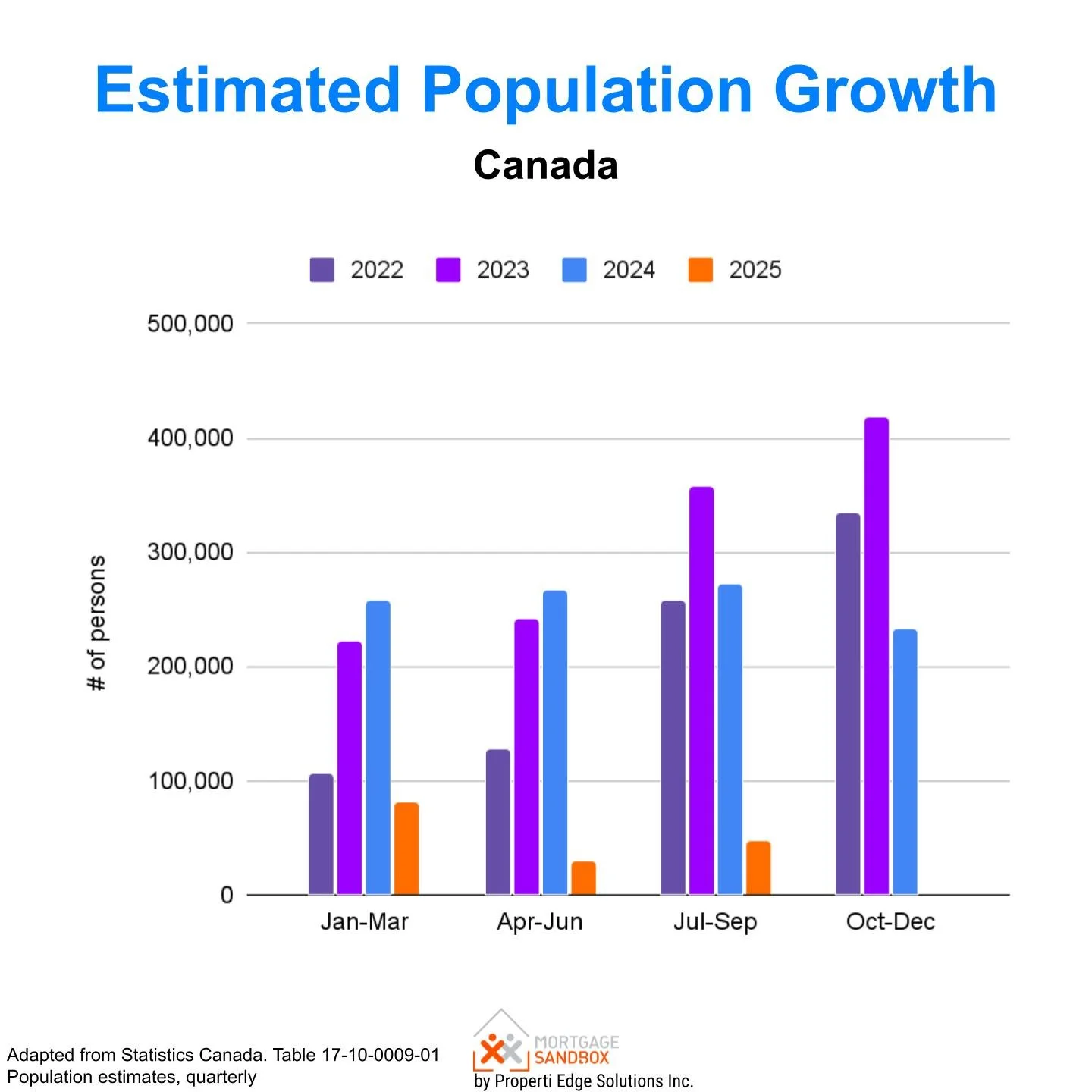

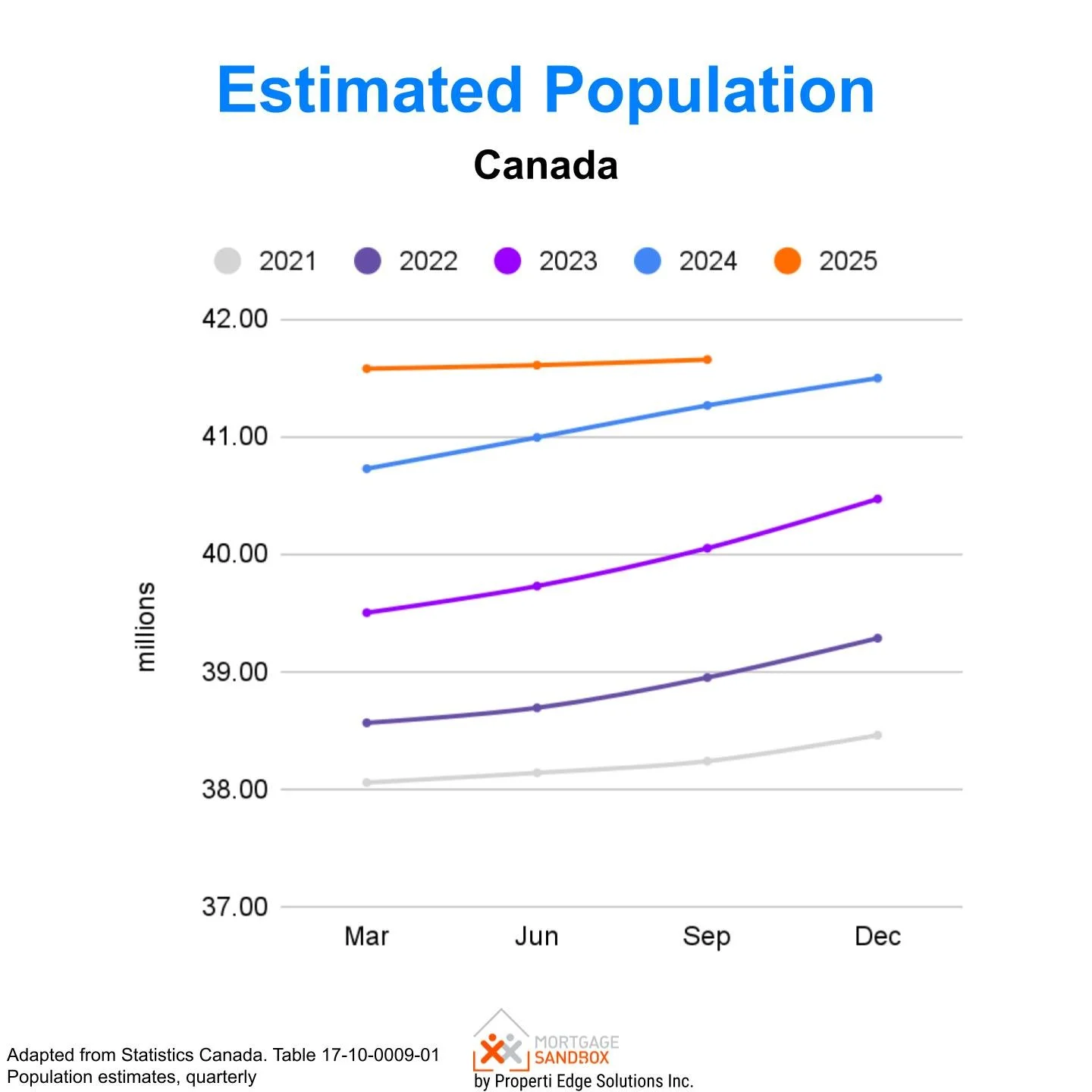

Federal immigration targets were scaled back in 2024, and net population growth is expected to contract slightly in 2025 before recovering. Without population-driven demand, markets that were already stretched are likely to weaken further.

2. Price Risk: Volatility and Overvaluation in Key Markets

Across major cities, home prices are still adjusting. In Greater Toronto, home values are down significantly from their 2022 peak. Hamilton has fallen even more steeply and Ottawa has weathered the storm slightly better. In British Columbia, results have been mixed. Vancouver saw a brief rebound after its 2022 correction but now appears to be stalling. Kelowna has faced sustained price pressure due to its small market size and exposure to investor sentiment.

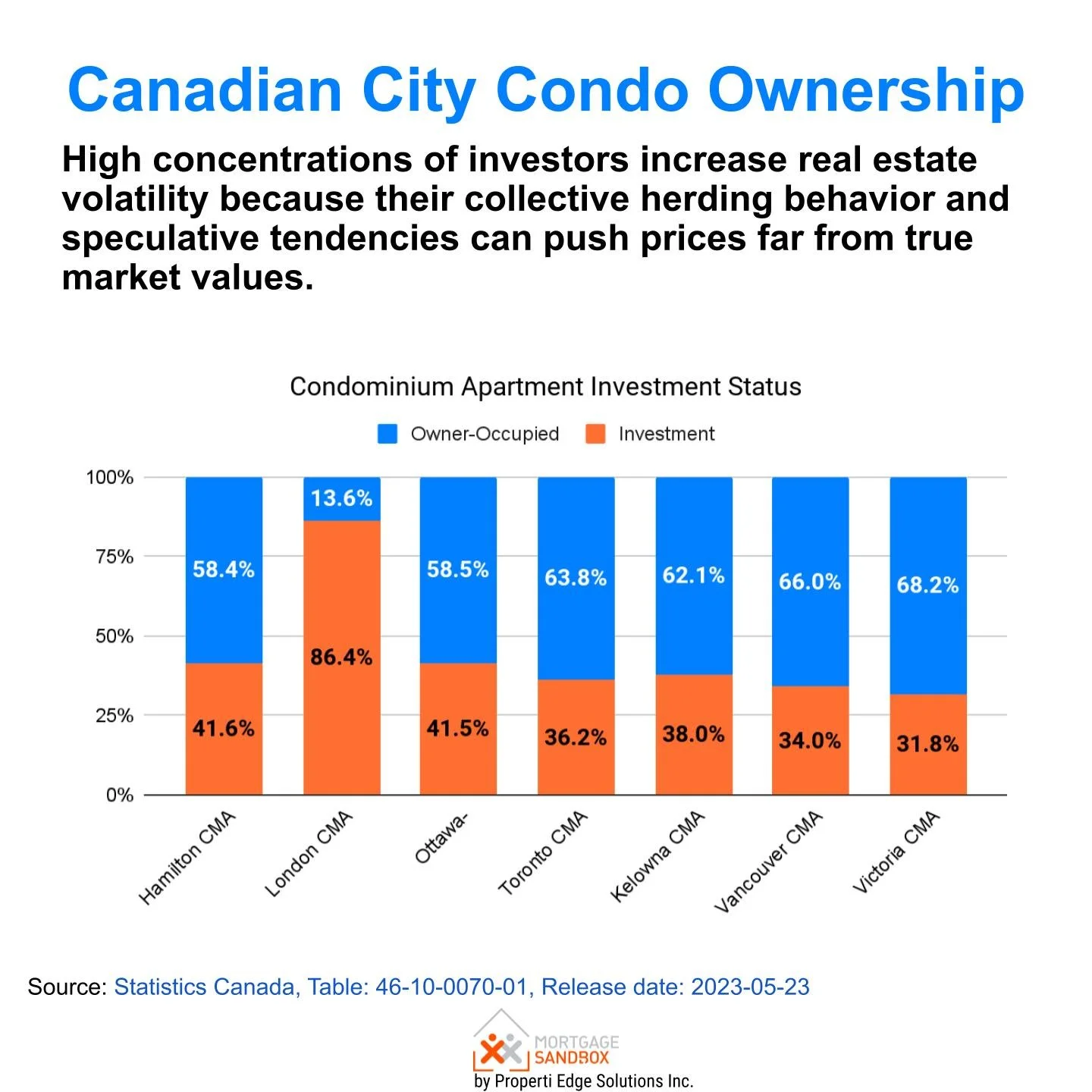

The sharp price movements are not random. Cities like Vancouver, Toronto, Victoria, and Kelowna have all been flagged for high price volatility, limited affordability, and signs of overvaluation. Even in markets where supply is constrained, prices remain decoupled from local incomes. In Vancouver, for example, the cost of owning a home now exceeds 90 percent of the median household income. That level of financial strain is rarely sustainable.

From an economic standpoint, the risk of further declines remains significant. Prices that outrun wages eventually correct. The key question is whether this correction will continue to be slow and uneven or become more sudden and broad-based.

3. Supply Shock: Too Many Condos, Not Enough Buyers

A growing concern in 2025 is the “oversupply” of apartments in urban centres.

Toronto has seen active condo listings climb to record highs. Many of these units were purchased by investors betting on rising rents and prices.

That bet is not paying off. At the peak in 2022, the benchmark Toronto apartment price was $826,000, and the median price was $803,000. In June 2025, the benchmark is $648,000 (down 22%) and the median is $611,000 (down 24%). A correction of this magnitude is typically indicative of a market “bubble bursting.”

While supply is much higher, it has only recently crossed into a buyer’s market. 7 months of supply is not “oversupply”, it is still within the normal range of a healthy functioning market. The reality is more nuanced. In the extremely undersupplied market from 2016 to 2022, the market was so biased in favour of sellers that prices likely reached unsustainable levels.

Now that the market has normalized and buyers have some room to negotiate, there isn’t enough pressure from demand to sustain the peak prices. It is as if the Toronto market has become addicted to undersupply and struggles to function under more normal market conditions.

The lesson for other markets is that market imbalances lead to risk. Even if Toronto can’t build enough apartments to provide homes for all of the pent-up demand of the past decade, a significant upward shift in supply can still affect prices.

As well, according to recent data, 81 percent of new condo rentals in Toronto are now cash-flow negative. Rising mortgage, maintenance, and utility costs and falling rents are squeezing landlords, and the pressure to sell is mounting.

The same pattern is emerging in other cities with large condo pipelines, including Vancouver, Hamilton, and London. Active listings are growing, and resale values are under pressure. As interest rates reset higher, more investor-owned units may hit the market. Higher losses for investor owners with high mortgage costs could accelerate the correction, especially if rental vacancies increase.

A Canadian housing agency report in 2024 found that 1 in 3 new housing starts are rental apartments in major urban Canadian cities. Construction of these buildings will be completed in 2026 and 2027.

4. The Debt Trap: Household Budgets Under Strain

Canada has among the highest household debt-to-income ratios in the developed world. That burden has become harder to carry now that borrowing costs have doubled. Mortgage interest costs have risen faster than incomes, eroding disposable cash flow for millions of households.

Many households are "financially stretched," according to TransUnion’s Consumer Pulse study, which finds that 27% of respondents report being unable to meet all their financial obligations. A growing number are turning to credit cards and lines of credit to make ends meet. Equifax data shows a surge in delinquency rates, particularly in large urban centres like Montreal, Vancouver, and Toronto. Meanwhile, TransUnion reports that nearly one-third of Canadians expect to miss at least one payment in 2025. These aren’t isolated anecdotes—they reflect systemic stress.

Renewals are the next pressure point. As fixed-rate mortgages come due, many owners will be forced to refinance at significantly higher rates. This is especially troubling in higher-priced cities, where people took out large mortgages under lower mortgage rate conditions. The risk of distressed sales is rising, particularly among households that relied on secondary income sources such as downstairs rental suites or short-term rentals.

5. Market Sentiment: From FOMO to Fear

The mood in Canada’s housing market has shifted. In 2021, buyers worried about missing out. In 2025, they worry about overpaying. A 2025 national housing agency survey found that 54% of repeat homebuyers were concerned they overpaid.

Survey data shows that homebuyer confidence is low, and expectations for future price growth have diminished. In April 2021, 68 percent of Canadians thought property values would be higher in 12 months. Today, fewer than 40 percent feel values will rise in the short term. This is a significant change because housing markets are driven as much by psychology as by fundamentals.

Buyers are taking a wait-and-see approach. Many believe prices have further to fall, especially in condo-heavy areas with high investor participation.

Sellers, on the other hand, are still anchored to peak valuations. This has created a standoff. Fewer listings are closing, and more are sitting on the market. Arguably, there is plenty of pent-up demand, and prices simply need to drop low enough for buyers to jump back into the market. In affordable and busy markets like Alberta and Quebec, prices will likely remain stable. In higher prices and slow markets like British Columbia and Ontario, there could be more room for prices to slip downward.

Until there is a broader alignment between buyer budgets and seller expectations, transaction volumes are likely to remain subdued.

Government policy is reinforcing the adjustment. The federal government reduced immigration quotas through 2026 in an effort to ease infrastructure and a housing crisis. This reduces a key source of demand in urban housing markets. Meanwhile, new housing completions are still arriving, especially in the condo sector, exacerbating the supply-demand mismatch.

Mark Carney’s housing plan focuses on boosting supply and affordability through federal intervention. The Build Canada Homes (BCH) initiative aims to construct affordable housing on public lands, backed by $25 billion in financing for prefab homes and $10 billion for deeply affordable housing. The plan also includes bulk orders of modular homes to speed up construction. Additional measures include cutting development charges, reviving tax incentives for rental housing, and offering GST cuts for first-time buyers of new construction homes under $1 million. The goal is to double annual construction to 500,000 homes per year while modernizing building techniques.

For context, there were 140,000 housing completions across Canada in 2024. The government’s targets envision a 250 percent increase in home construction and new units to be absorbed by the market.

The policies aim to stabilize prices without causing a sharp decline. Some aspects of the plan increase supply (more government subsidized housing and incentives for rental construction), and other aspects boost demand (reduced taxes).

If the policy is successful, the direct price impacts are difficult to forecast, but indirectly, more supply on this scale in a free-market economy should lead to a lower or flat trajectory for home prices.

6. Regional Breakdown: Risk Profiles by City

The latest Properti Edge analysis offers a city-by-city look at market risk across Canada.

Canada Major City | Detached House Market Risk Assessment

Canada Major City | Condominium Apartment Market Risk Assessment

In terms of bubble risk, Toronto and Vancouver still top the charts simply because prices of homes are so stretched when compared to local incomes.

What This Means for You

If you're a first-time buyer in B.C. or Ontario, patience may pay off. The housing market remains in a correction phase, and prices are unlikely to rebound quickly. Interest rates are expected to fall further in the second half of 2025, which could improve affordability.

Sellers need to be more strategic. If you plan to sell within the next three years, you may want to consider listing sooner rather than later. Waiting for prices to return to 2021 levels could take years, especially in higher-priced areas.

If your retirement or next move depends on unlocking home equity, talk to a real estate agent and financial advisor to gauge timing. In a perfect world, you will sell into a seller’s market and buy your next home in a buyer’s market. While that exact scenario is unlikely to unfold, you can take advantage of imbalances where the months of inventory in the market you are selling are lower than the months of inventory in the market or sub-market you plan to buy into.

Investors should tread carefully. Buying pre-construction condos in hopes of rapid appreciation is no longer a safe bet. Cash flow should be the priority. Look for properties that can support themselves at current rents and interest rates. Seek out stable rental demand, modest price-to-income ratios, and avoid areas with heavy investor turnover. Focus on long-term fundamentals, not speculative gains.

A Final Word

Canada’s housing market has absorbed a significant shock, but the full impact has yet to play out. As mortgage renewals accelerate in 2026 and buyer sentiment remains subdued, further downward price pressure is likely. Market conditions vary by city and property type, but across the board, the message is the same: affordability has overtaken scarcity as the dominant force.

In this kind of environment, prudence beats timing. Focus on your household budget, the fundamentals of the local market, and the utility of the property itself. Whether you’re buying, selling, or investing, the best time to act is when your finances are ready, not when the market headlines suggest a trend.

Before making any decision, revisit your city’s risk profile. In a volatile market, clear-eyed strategy and financial discipline are the most valuable assets you can bring to the table.

Like this post? Like us on Facebook for the next one in your feed.