Metro Ottawa Home Price Forecast - Apr 2021

HIGHLIGHTS

Metro Ottawa home values are rising in all categories.

The Canadian national housing agency has identified Ottawa as one of the few high-risk property markets in Canada.

Mortgage rates are rising from historic lows, and unemployment is still high.

Current demand and price increases appear to be primarily driven by the effects of pandemic-related restrictions - people are desperate for more living space. Often buyers are moving away from the cities so they can afford a larger home. It is unclear if this will persist after the pandemic is over.

We are in the midst of the third wave of infections, but luckily this is probably the last wave.

This article covers:

What is the state of the Ottawa property market?

Where are prices headed?

Should investors sell?

Is this a good time to buy?

1. What is the state of the Ottawa property market?

Home Price Overview

Metro Ottawa has a population of roughly 1 million and was ranked 67 of the world's best 100 cities.

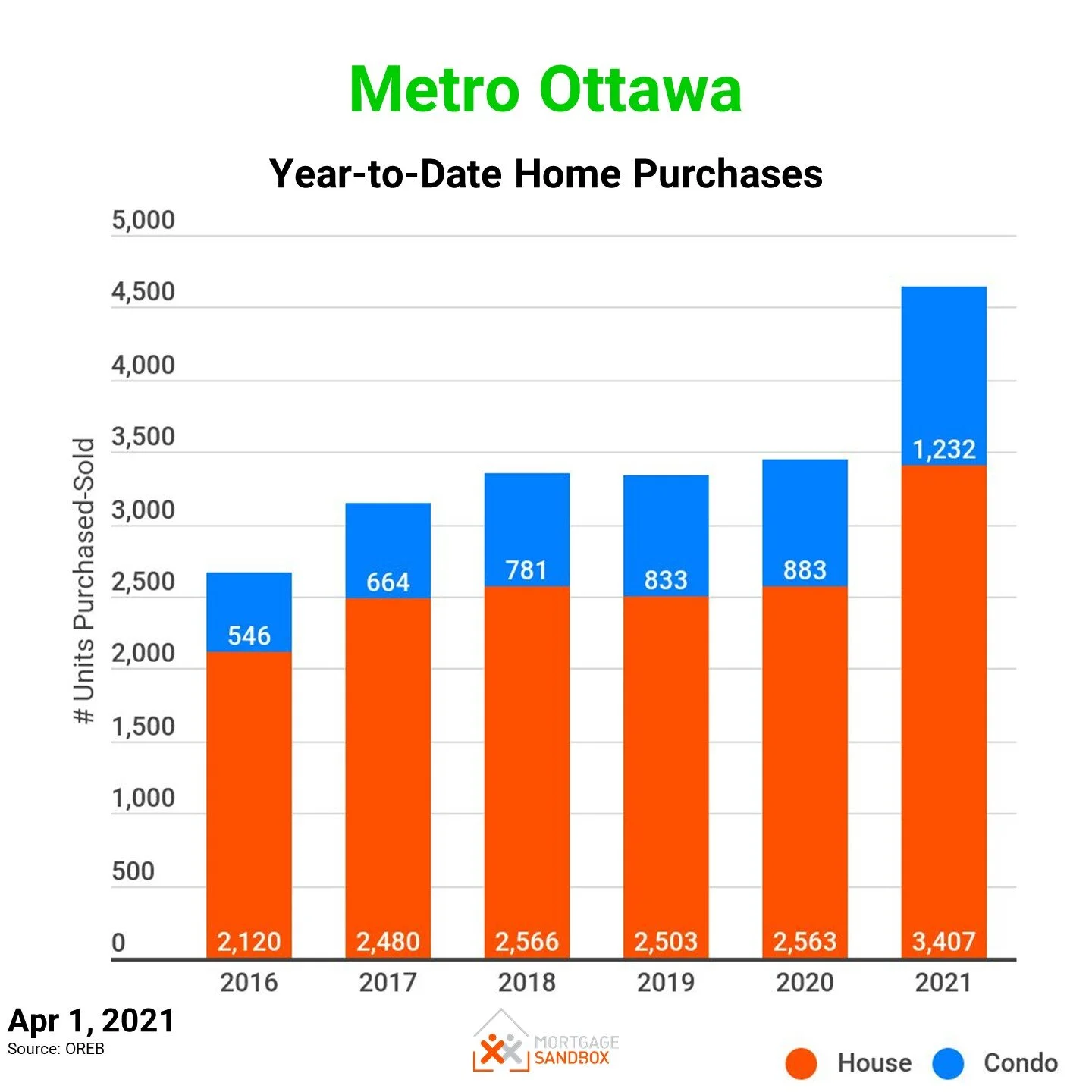

Ottawa's home prices have accelerated significantly in the past few months, pushing more potential home buyers out of the market.

During the pandemic, people upsizing were the first wave of buyers. They needed more space to work from home and segregated spaces for two parents to work and kids to learn. Following the acceleration of house prices (and weakness of condo values), many renters began to fear missing out on another home price rally. First-time homebuyers wanting to build equity have jumped into the apartment market.

A recent CIBC survey found that more than 20% of people currently working from home will be returning to the office. As well, we expect the vast majority of students to return to their schools full-time. This points to a possible bounce back to the migration to the outer suburbs, exurbs, and cottage country. An important question raised by the current demand is:

If work-from-home and school-from-home are temporary market drivers, what will happen when the pandemic is over?

This uncertainty is a core component of risk, and we delve into this later.

People currently planning to sell a home will take heart because home values are at all-time highs and want to push ahead and sell during the pandemic.

People planning to buy a home could wait for a possible market correction, but there’s no guarantee that prices will be lower by the end of 2021.

The recession, high unemployment, and the eventual lifting of restrictions are now the primary sources of uncertainty for home values. Some pundits predict consumer behaviour similar to the ‘roaring twenties’ post-pandemic. Canadians who prioritize newfound freedom, nightlife, and travel will feel less hurry to go home shopping.

Ottawa Detached House Prices

A long-term perspective shows house prices accelerating after the recession begins.

The recent aggressive and accelerating price growth across Canada has triggered government intervention. In April, the bank regulator proposed to increase the mortgage stress test by roughly 0.5%. The change goes into effect in June 2021.

Ottawa-Gatineau New Construction Home Prices

In June 2019, Ottawa pre-sale and new construction home prices accelerated. In June 2020, the level of acceleration kicked into a higher gear.

It seems unlikely that record house prices will be sustained through the next 12 months based on economic fundamentals.

Market Risk

House price growth in Ottawa has been very high. Overall, according to the CMHC, there is a high risk of a price correction in Ottawa.

The “soft landing” that government policymakers were targeting has become more elusive. We believe politicians were hoping to guide the market toward a typical annual real estate cycle with price growth in the range of 1 to 3% annually – in line with income growth.

Metro Ottawa Condo Apartment Prices

Ottawa apartment prices are also rising, and luckily, a condo apartment is still affordable without help from family. Perhaps all the people who move to the suburbs have had to sell to unlock their equity for the house purchase? While purchases are up in the Condo segment, there are far more listings than in the house market.

With more people working from home, we expect developers will begin marketing larger (i.e., 2 and 3 bedrooms) apartments to meet buyer preferences. As the supply of more generous floor plans comes to the market, it may depress the values for small floor plan condos.

At Mortgage Sandbox, we would like developers to build 4 and 5 bedroom condos because:

Not everyone can afford to buy a house for their family.

Canadians who now work from home need more room to segregate workspace from living space within their homes.

Many Canadians with longer working hours find it challenging to stay on top of necessary house upkeep (i.e., mowing lawns, clearing eaves, shovelling sidewalks).

Many people prefer to live in higher-density neighbourhoods with all the essential amenities within walking distance.

2. Where are Ottawa home prices headed?

There is a lot of uncertainty in the forecasts for 2021 and 2022. Many of the forecasters we've surveyed have different expectations for:

How long will the third wave of COVID-19 infections and associated restrictions last?

Will Canadians be able to fully return to their offices and classrooms in September or December 2021?

Will the federal government succeed in achieving its aggressive immigration targets during a pandemic and with high unemployment?

Since the mortgage payment deferrals expired in October, will the anticipated distressed home sellers appear in the housing market?

As a result of their varying assumptions, some forecasters expect prices to continue rising, while others expect are more likely prices to drop.

For example:

Central 1, the economists for the credit unions, predicts Ottawa prices will rise 10% in 2021.

RE/MAX believes Ottawa prices will rise only 7%.

Moody’s Analytics, which develops mortgage risk software for Canadian banks, predicts a modest 3% drop in Ottawa.

CMHC, the government housing agency, predicts a peak-to-trough drop of between 9% and 19%. They expected government aid and mortgage deferrals would cushion the blow in 2020. The market will be impacted in 2021 and then recover in 2022.

There is no consensus among economists. Market sentiment and government stimulus have led to price acceleration and record home purchases even though most economic fundamentals have faltered.

CMHC sells insurance to banks to help limit their losses if a mortgage goes bad, and Moody’s Analytics sells software to banks to help them assess the risk of their mortgage portfolios. These two forecasts help paint the worst-case scenario. There is downside risk in the market.

Curious how we arrive at our forecast range? Check out our full assessment of the five factors that drive these forecasts. These five forces help explain why several forecasters are anticipating price drops.

READ REPORT: 5-FACTORS DRIVING ONTARIO PRICES

At Mortgage Sandbox, we provide a price range rather than attempting a single prediction because many risks in real estate can impact prices. Risks are events that may or may not happen. As a result, we review various forecasts from leading lenders and real estate firms, and we then present the most optimistic estimates, the most pessimistic prediction, and the average forecast. Do you want to learn more about real estate risk? We've written a comprehensive report that explains the level of uncertainty in the Canadian real estate market.

Our forecast inputs:

3. Should Investors Sell?

Once the pandemic lockdown pressures are released from a seller's perspective, we are left with more economic downward price pressures.

Now might be a better time to sell than in two years, and the annual real estate cycle usually favours sellers in the first half of the year.

Sellers should always consult a mortgage broker early to prioritize flexible loan conditions and reduce the risk of mortgage cancellation penalties. Find out more about the benefits of a mortgage broker.

Planning to Sell? Check out our Complete Home Seller’s Guide.

4. Is this a good time to buy?

It’s hard to say, prices have been rising, but there is a downside risk. It seems unlikely that prices will be lower in December than they are today.

Prices are still trending upward, but Coronavirus containment efforts are inflating prices. Once vaccinations are rolled out and restrictions are lifted, prices will likely soften in the second half of 2021.

Regardless, the annual real estate cycle usually favours buyers in late summer.

The wild card is the Coronavirus. At this stage, it's difficult to determine how much it will impact the market.

If you are thinking of buying, be sure to drive a hard bargain and pay as close to market value as you can. As well, when it comes to financing, don't bite off more than you can chew.

Planning to Buy? Check out our Complete Home Buyer’s Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

Here are some recent headlines you might be interested in:

Hot real estate market causes problems for some renters amid COVID-19 pandemic (CTV, Apr 21)

George Fallis: It's a housing bubble in Toronto, not a supply squeeze (Financial Post, Apr 1)

From first time buyers to luxury homes, Canada's real estate market is on fire (CTV, Mar 30)

Canadian Immigration Interrupted: A Look Ahead Into 2021 (RBC Economics, Feb 16)

Douglas Todd: Condo prices in border-lockdown limbo in Vancouver, Toronto (Vancouver Sun, Feb 4)

Like this report? Like us on Facebook.