Calgary's Housing Market: May 2025 presents buyers with their best opportunity in years

Calgary's residential property market is at an intriguing inflection point. While sellers retain nominal control over pricing negotiations, the underlying dynamics suggest a significant shift in buyers' favour, making May 2025 an opportune moment for prospective homeowners to enter the market.

The statistics tell a compelling story of rebalancing. Detached house inventory has surged dramatically, with months of supply climbing from a meagre 0.9 to 2.3 year-over-year; it is still a 156% increase that fundamentally alters the market's character. This expansion reflects two converging forces: purchase demand has contracted by 17%, while the supply of active listings has more than doubled, rising 107%.

For apartment buyers, the transformation appears even more pronounced. Condominium inventory has expanded from 1.2 to 3.2 months of supply, representing a striking 167% increase. Here, declining demand has been more severe, falling 28%, while new listings have nearly doubled with a 96% increase.

These inventory expansions signal the end of the severe supply constraints that have characterised Calgary's housing market in recent years. The shift from sub-one-month inventory levels to multi-month supplies represents a qualitative change in market dynamics, moving conditions from scarcity-driven to choice-abundant.

Price resilience amid changing fundamentals

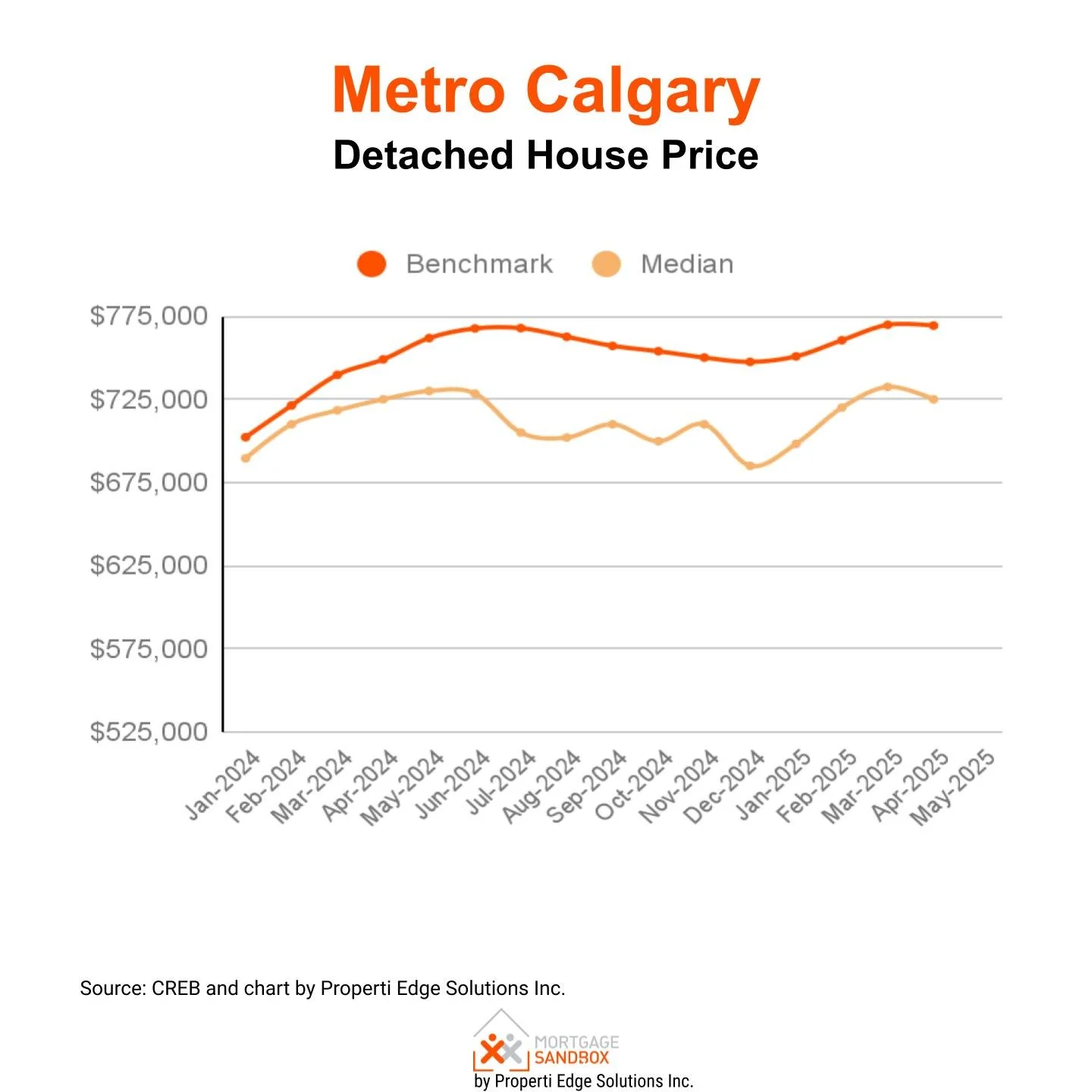

Despite the inventory surge, price movements remain relatively modest. Detached house benchmarks sit at $769,300, having appreciated 2% over the past quarter. Condominium prices, at $336,000, have managed a 1% quarterly gain. This price stickiness reflects sellers' reluctance to acknowledge changed market conditions—a common phenomenon during market transitions.

The persistence of modest price appreciation alongside dramatically increased inventory suggests prices may be vulnerable to downward pressure in coming months. Sellers' current pricing power appears increasingly disconnected from underlying supply-demand fundamentals, creating potential opportunities for patient buyers.

Strategic timing considerations

For buyers, the current moment presents several advantages. First, the expanded inventory provides genuine choice—a luxury absent during the market's constrained years. Second, while sellers maintain negotiating strength on paper, the underlying metrics suggest this advantage is eroding rapidly.

The market's characterisation as seller-dominated while "trending in favour of buyers" captures this transitional moment precisely. Smart buyers can leverage the growing inventory cushion while sellers have yet to fully adjust expectations to new realities.

Sectoral distinctions matter

The condominium market appears particularly attractive for buyers. With over three months of inventory and more severe demand contraction, apartment purchasers face better conditions than their detached house counterparts. The $336,000 benchmark price point also offers greater accessibility, particularly relevant as mortgage rates remain elevated.

Detached house buyers face a more mixed proposition. While inventory has improved substantially, the market retains more seller-friendly characteristics. There is still some distance between today’s conditions and a balanced market with 4 to 6 months of inventory.

Forward outlook

Several factors support the buyer-friendly trend continuing. Interest rate environments remain challenging for demand generation, while construction activity has boosted supply pipelines. Economic uncertainties may further dampen buyer enthusiasm, potentially accelerating the market's rebalancing.

For prospective buyers, May 2025 represents a strategic entry point. The combination of expanded choice, gradually shifting negotiating dynamics, and price levels that have yet to fully reflect supply-demand changes creates a compelling opportunity. Those waiting for dramatic price reductions may find themselves disappointed, but buyers seeking improved selection and negotiating position will find current conditions markedly superior to recent years.

This burst of supply may be short-lived, or the trade war and knock-on effect on the critical oil and gas industry could lead to more favourable buying conditions in the future.