Canada's Population Boom Nears End as Temporary Residents Face Cuts

Record Growth Fueled by Immigration, But Policy Shift to Dampen Housing Demand

Canada's population continues to surge, reaching a record 40.8 million on January 1, 2024, according to data released today. This marks a 3.2% increase year-over-year, the fastest growth since the 1950s. However, economists warn this trend may be nearing its end due to a recent policy shift.

The rapid rise in population, driven largely by temporary residents, has had a significant impact on the Canadian economy. While it stimulates demand for goods and services, it also contributes to inflation pressures the Bank of Canada is currently battling. However, the strong labour market integration of permenent newcomers has also helped address labour shortages, potentially mitigating wage-driven inflation.

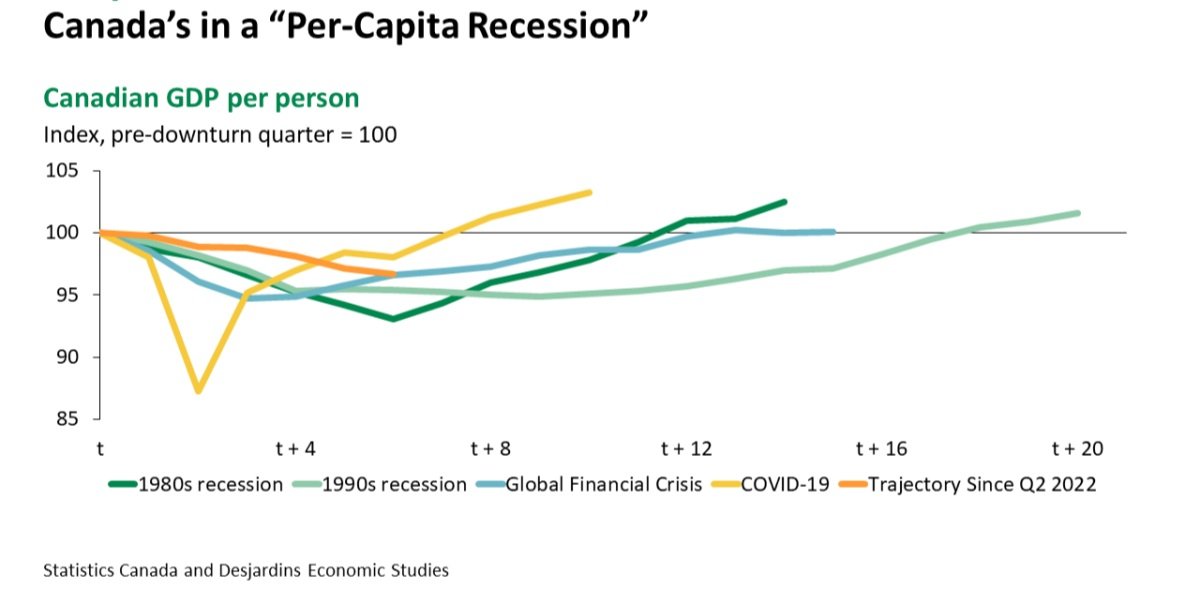

Population growth has also hidden an alarming trend. GDP per person has been falling. If the population hadn’t grown at a record pace in 2023, then Canada would have experienced a recession (i.e., the economy would have shrunk).

A Silver Lining for Affordability

A key takeaway from this report is the changing policy landscape. The federal government's announcement to reduce the national temporary resident population will likely be the main driver behind the slowdown in population growth. This could have a dampening effect on economic growth, particularly in provinces like Ontario and British Columbia, which have heavily relied on temporary workers and educational institutions dedicated to international students.

The reduction in non-permanent residents (NPRs) is expected to provide some relief for Canada's affordability crisis, particularly in housing. With fewer people competing for a limited number of homes, price pressures may ease. Additionally, a decrease in population growth could lead to a modest increase in real GDP per capita and real wages.

Interprovincial Migration Shifts

The report also highlights a potential shift in interprovincial migration patterns. The outflow of residents from Ontario, particularly younger individuals seeking more affordable housing, appears to be slowing down. While net outflows remain near record highs, Alberta has emerged as a major beneficiary, reversing the exodus it experienced between 2016 and 2021.

However is the flow of Canadians from other provinces to Alberta drops significantly, it could weigh on the red hot Calgary property market.

Economic Uncertainty Persists

Despite the changing population dynamics, the Bank of Canada is still expected to maintain its current interest rate policy until at least June 2024. The central bank remains focused on controlling inflation, despite the concerning decline in per capita GDP growth. The full impact of recent rate hikes and the upcoming policy changes on temporary residents creates significant uncertainty regarding Canada's long-term economic prospects.

Looking Ahead

While Canada's population boom may be nearing its peak, the implications for the economy are multifaceted. The slowdown in growth may provide some relief for housing affordability, but it also raises questions about future economic output. As Canada navigates this changing landscape, careful policy decisions will be crucial to ensure a smooth transition and continued prosperity.