Canadian Recession Looms

A recession in 2023 is very likely. The Royal Bank of Canada Economics has said, “the most likely scenario is still that the U.S. and Canadian economies will both enter mild recessions over the middle-quarters of 2023,” and they’re not alone. According to a Bank of Canada Survey, “Canadians see a recession as the most likely scenario for the economy in the next 12 months.”

If Canada faces the challenges of a moderate recession in 2023, it also stands at the forefront of technological transformations that hold immense potential for economic growth. While the recession may present hurdles, these challenges can be mitigated if all levels of government embrace innovative technologies and foster collaboration between industries and policymakers to help pave the way towards a more prosperous. Throwing money at the problem with government funds or mortgage subsidies is not the solution this time.

Canadian’s are already highly leveraged.

Canadian Household Credit Market Debt to Disposable Income, Jan 2023

Canadians are in a more precarious financial position than Portugal and Spain! Now is not the time to take on more debt.

The Recession's Impact on Household Debt and Housing

The recession in Canada is expected to be more pronounced than in other advanced economies due to prevailing household debt and housing imbalances. These factors, combined with higher mortgage and consumer finance interest rates, will contribute to a deeper contraction in GDP. Additionally, the correction in housing prices, currently experiencing a bounceback, is forecasted to continue to decline and will pose challenges for highly indebted households.

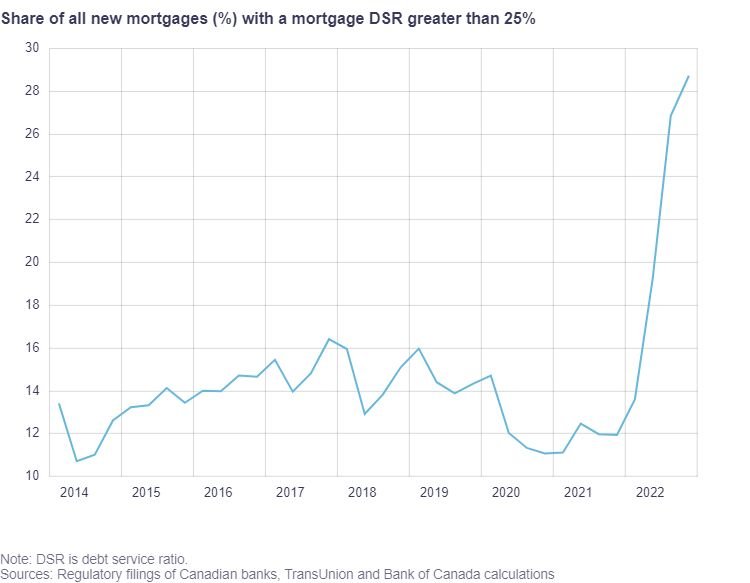

Already, new mortgage debt service ratios (DSR) have skyrocketed. DSR is the share of your disposable income consumed by debt repayments.

For example, if your annual disposable income was $100,000 and you had to make monthly mortgage payments of $3333 ($40,000 annually), then your DSR would be 40%.

Add to this the renewals of existing mortgages at higher rates. Up until now, roughly 30% of existing mortgages have been renewed ar higher rates. By the end of 2023, roughly half of mortgage holders will have had to renew at higher rates and higher monthly payments.

Already, more Canadians are falling behind on loan payments. Typically, people are more comfortable falling behind on loans and credit cards before they miss a payment on car loans and mortgages.

Inflation and The Bank of Canada

Inflation rates are expected to fall but remain above the central bank's 2% target. As the economy recovers, factors such as falling energy and commodity prices, improved global supply chains, lower house prices, weaker aggregate demand, and domestic labor market slack will contribute to easing inflation.

However, the Bank of Canada is unlikely to ease monetary policy during 2023. Why?

Because home prices, even though demand is low, are rising again, adding inflationary pressures. As well, the labour market has remained stubbornly tight. These factors raise the risk of a further rate hike from the Bank of Canada instead of the hoped-for holding pattern.

If inflation continues to be subdued, then the Bank of Canada should maintain a policy rate of 4.5% until early 2024.

Given the need to manage inflation, a major new federal and provincial stimulus is unlikely unless the recession deepens significantly. Trying to stimulate the economy is at cross purposes to the battle against inflation.

Policymakers will likely avoid undermining the efforts of the Bank of Canada to curb inflation. However, targeted measures may be implemented to support specific sectors and address the most pressing challenges arising from the recession.

What can we expect in the recession?

As Canada navigates the challenges of a moderate recession, it will announce programs to embrace the potential of technological advancements to drive economic growth and resilience. Policymakers will hope to leverage Artificial Intelligence, Connected Devices (i.e., Internet of Things - IoT), and clean energy to create a foundation for recovery and future prosperity.

They are unlikely to lower interest rates until inflation is under control. They are also unlikely to splash out government benefits like they did in the pandemic because COVID was an extraordinary circumstance and a mild recession is a regular occurrence.

Canadian working households are likely to spend the next decade paying down debt and fighting to keep taxes low while aging baby boomers put increasing demands on pensions, social services, and healthcare.