How likely is a Second Wave of COVID-19?

Most economic forecasts and home price forecasts released up until now have assumed:

COVID-19 control measures will remain in place in Canada through the spring and then will be gradually relaxed at a relatively slow pace—but not eliminated entirely—over the remainder of 2020. There will not be a second or third ‘lock-down’ in response to new waves of infection.

This ‘single wave pandemic’ would be followed by a ‘V’ or ‘U’ shaped economic recovery.

Unemployment will remain in the low double digits and bounce back quickly. Most models project that unemployment will not exceed 15%.

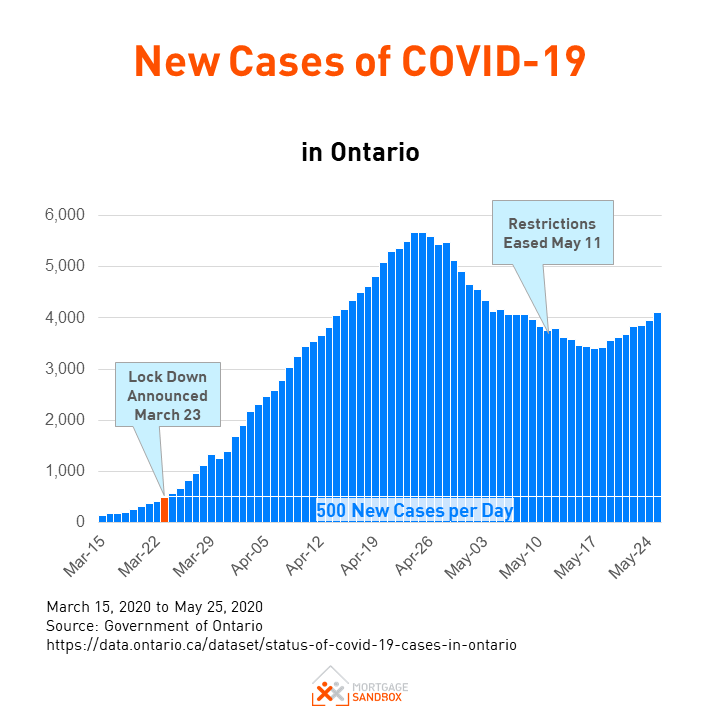

Some economists, including the Bank of Canada, have acknowledged the possibility of a second wave of the pandemic, but they consider this a worst-case scenario, and they haven’t published projections using this scenario. As we relax our social distancing measures across Canada, it seems prudent to plan for what comes next.

At Mortgage Sandbox, we are placing greater emphasis on the forecasts that include a ‘second wave” of infection because, based on our analysis of published epidemiological research, we believe this is a realistic outcome.

Dr. Anthony Fauci, director of the [U.S.] National Institute of Allergy and Infectious Diseases, believes the second wave of coronavirus infections is "inevitable." In his words, “It is so transmissible, and it is so widespread throughout the world, that even if our infections get well controlled and go down dramatically during the summer, there is virtually no chance it will be eradicated."

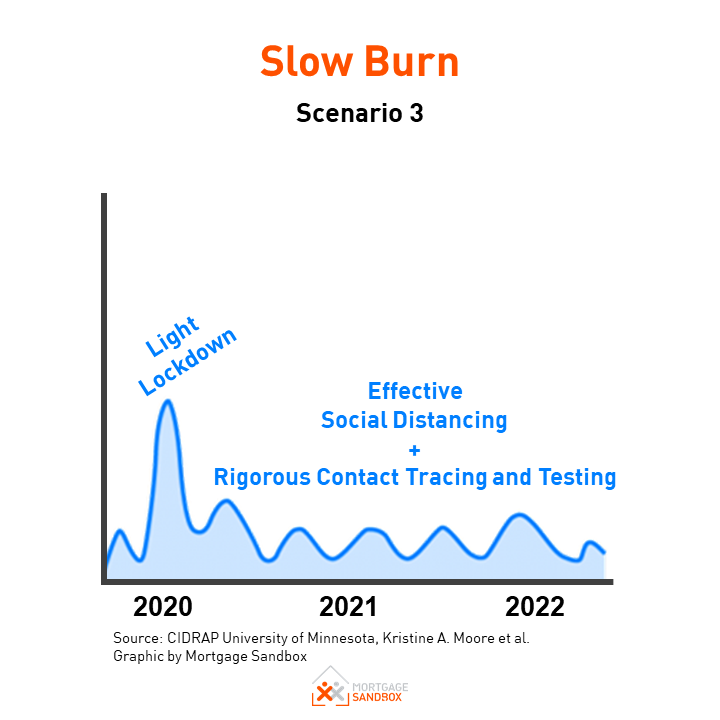

A study headed by Dr. Kristine A. Moore, the medical director at the University of Minnesota Center for Infectious Disease Research and Policy, also warns that the pandemic will not be over soon and that people need to be prepared for possible periodic resurgences of disease.

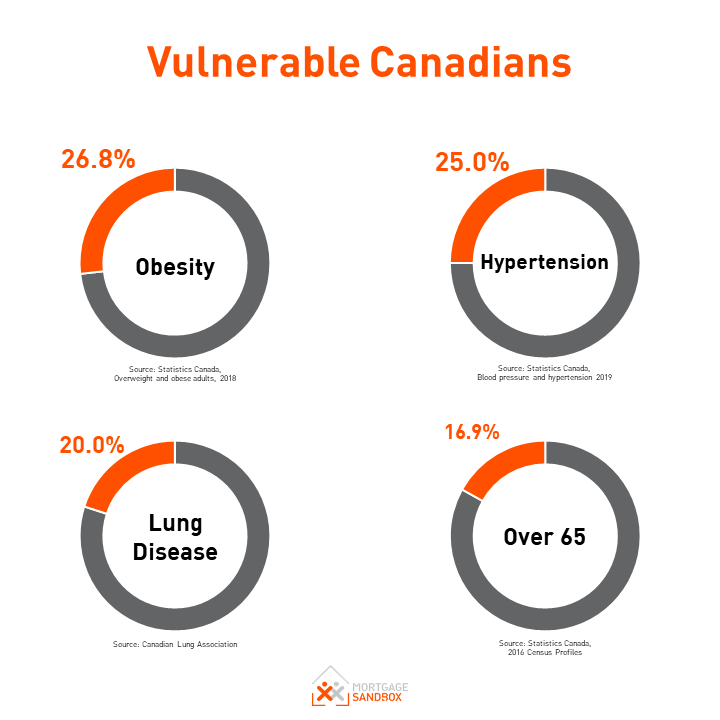

Optimistically, a vaccine will not be widely available until mid-2021, and 70% of the population would need to be infected to provide herd immunity. Unfortunately, more than 30% of the Canadian population have conditions that make them vulnerable. Dr. Moore’s research was conducted in collaboration with pandemic experts from Harvard and Tulane universities.

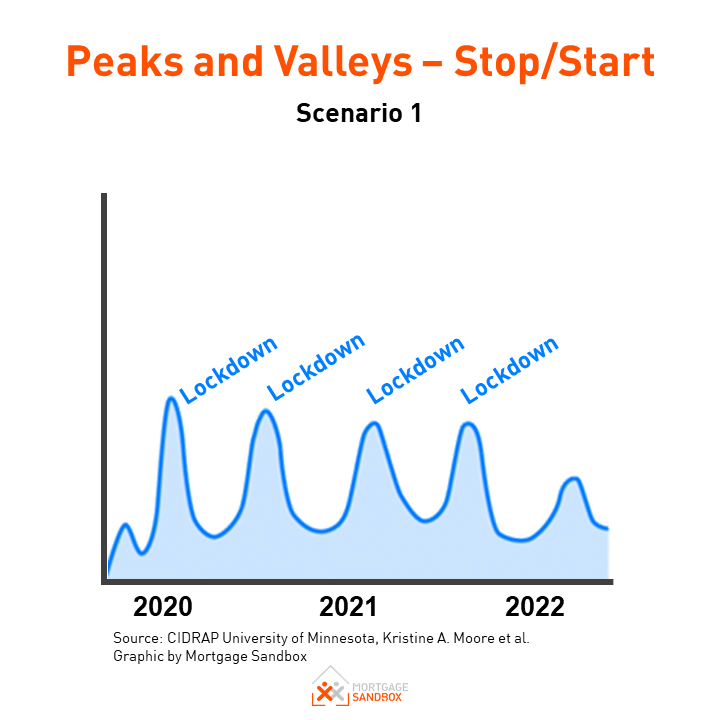

Scenario 1: Small waves of infections contained by repeated lock-downs

Repeatedly mothballing and re-opening businesses will take a toll on business finances and employment.

This is symptomatic of lax or ineffective social distancing, and every peak will coincide with a higher than necessary hospital admissions.

In this scenario, the economy and the housing market will take up to two years before a recovery gathers steam.

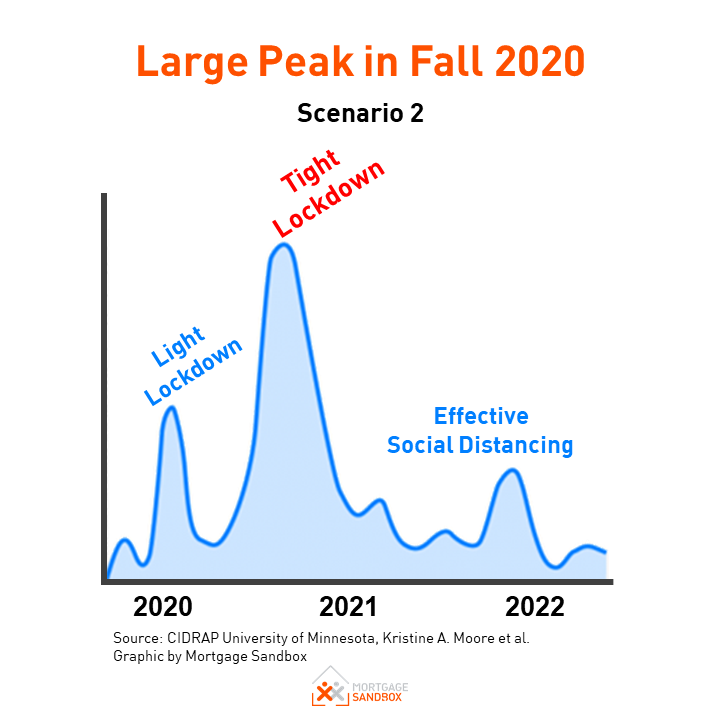

Scenario 2: A second, larger wave of infections this Fall

We would face only one additional prolonged and strict lock-down.

However, it implies that complex infections will likely overwhelm hospitals. That means many Canadians who need hospitalization, may be asked to wait while higher priority cases are treated.

After this large wave, we may get close to herd immunity, so future waves would be much milder and easier to control.

This scenario might be traumatic, given the potential for loss of life. Society and the economy would be more likely to open in 2021. Economic growth would then be followed by rising home buyer intentions and upward pressure on home prices.

Scenario 3: A 'slow burn' of ongoing transmission

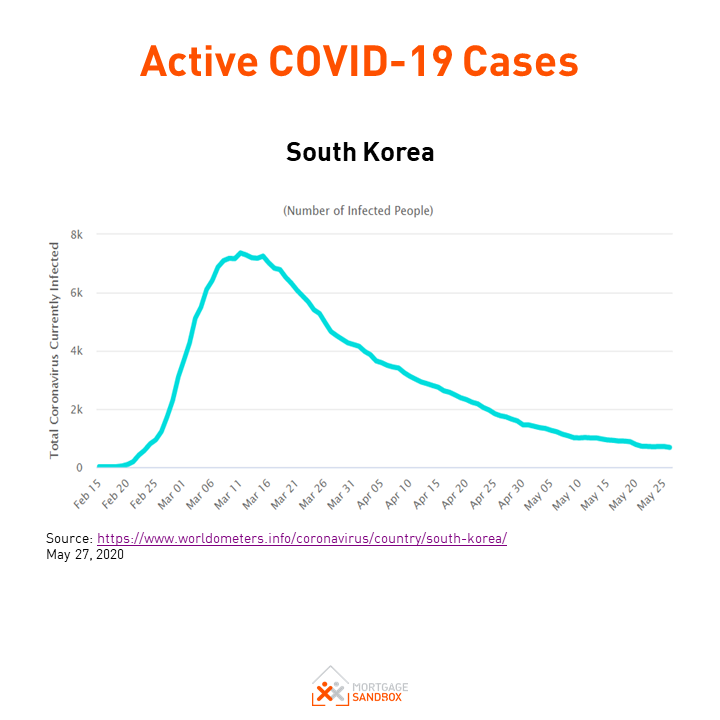

This follows a path similar to South Korea. South Korea has been praised for its use of technology in containing the coronavirus. S. Korea has still suffered job losses and an economic contraction however they have been able to contain the infection and their economy has performed better than other developed countries.

Unfortunately, South Korea’s methods are more difficult to implement in Canada. The tools and technology deployed by Korean authorities are readily available in Canada. What sets Korea apart is its political willingness to use these tools to their full potential in supporting a public health response.

The Korean government has used electronic payment data, mobile phone location logs, and surveillance camera footage to support their contact tracing on a national scale. This has allowed them to focus on testing and quarantining people who are likely to have been in contact with known infected individuals.

A rigorous contact tracing and testing approach, like South Korea’s, is difficult for Canada to duplicate.

Canadians would bristle at the government having access to all this data. It is a violation of our right to privacy as enshrined in The Canadian Charter of Rights and Freedoms. As well, data privacy falls under both provincial, territorial, and federal responsibility. Since it makes no sense for Ottawa to have a different system than Gatineau, a Canadian solution would require intra-provincial and federal collaboration.

The Canadian federal government does not have jurisdiction in health matters and clinical records. Electronic contact tracing, testing, and quarantining on a national scale would require all the provinces to agree on an approach, where to locate a central command centre, and what technology to use. The provinces’ current approach is to fund dozens of local start-ups to develop mobile phone apps to collect voluntary data from Canadians.

Canadians are not nearly as digitally connected as Koreans. 96% of Korean households have high-speed internet access, and 95% of adults have smartphones. By comparison, only 37% of rural Canadian households have access to high-speed internet, compared with 97% of urban homes, and only 24% of Indigenous households. 83% of Canadians have smartphones.

Canada does not have the necessary pre-existing infrastructure. Following Korea’s experience with Middle Eastern Respiratory Syndrome in 2015, the government amended the Infectious Disease Control and Prevention Act to include provisions for real-time surveillance during outbreaks. These provisions have allowed health authorities to collect the same information as law enforcement, significantly enhancing their ability to focus testing and quarantine on those individuals more likely to be infected. Canada does not have similar laws in place nor have we built the technological infrastructure to deliver the data in a usable format to health professionals.

Canadians are too far behind in the implementation of the available technologies to replicate Korea’s approach in a timely manner and, likely, we don’t have the political will or public desire to make the necessary legal and constitutional changes to allow for a Korea-like approach.

Begin Your Plan for a Second Wave

In a presentation to the Federal Standing Committee on Finance on May 19th, CMHC’s CEO revealed that the agency now expects average Canadian house prices to fall between 9 and 18% by June 2021.

“CMHC doesn’t seem to understand the sheer number of sellers that would have to accept this kind of price reduction, in order for average housing prices to plummet to this degree in such a short time span,” says Christopher Alexander, Executive Vice President and Regional Director, RE/MAX of Ontario Atlantic Canada. “Sellers simply won’t accept that kind of discount on their listings. A statement of this nature is panic-inducing and irresponsible.”

Yet at the same time, Canadian Prime Minister Justin Trudeau says his government is beginning to prepare for a second wave of the Covid-19 pandemic.

Is the CMHC irresponsibly inducing panic? Or is the agency simply trying to help the government and Canadians to plan for a realistic possible outcome? We could question how accurate CMHC’s forecast will be in hindsight, but today the agency that insures 44% of all Canadian mortgages against default has used the information at its disposal to develop an assessment of the impact of the job losses from a Coronavirus Recession on home prices.

Whether Canada experiences a large wave in the Fall or a series of smaller waves, it is highly likely that Canada will have another wave. Perhaps not every city and province will be hit, or perhaps different geographic areas will peak at different times.

We believe that, realistically, every Canadian should develop a personal financial plan and an approach to personal health for each of the above scenarios. Active homebuyers and active home sellers should also keep in mind what might happen to home prices if each of the three scenarios come to be.

The Canadian government is planning for a second wave, so shouldn’t you?

Like this post? Like us on Facebook for the next one in your feed.