How will jobs in different Canadian cities be impacted by Coronavirus

Accommodation & Food Services

Most restaurants are struggling to stay afloat due to significant drops in revenue and are pleading with provincial governments for assistance to prevent bankruptcies. While many restaurants have switched to take out, the drop in revenue for many makes it not financially feasible to keep their doors open.

Many restaurants have shut down indefinitely due to the virus and this has led to mass layoffs or furloughs of employees. Restaurants Canada estimates that 800,000 foodservice jobs have already been lost nationwide due to COVID-19 and might not return if current conditions continue. Operators that are staying open for takeout are still forced to lay off parts of their staff and reduce hours of those remaining.

Some operators are considering closing down permanently if the outbreak lasts more than a couple of months. Nearly one out of every 10 restaurants has already closed permanently.

Prime Minister Justin Trudeau has announced a spending package, which includes a wage subsidy for small businesses and the ability to defer tax payments until August, to help Canadians and businesses through the outbreak.

The Hotels & Motels industry in Canada and other tourism-related industries have experienced losses already as Chinese tourists account for a significant portion of tourism. According to the Conference Board of Canada, Chinese tourist spending is expected to be cut by one-third this year. The largest dollar-value impact will be felt by British Columbia and the largest proportional impact will occur in Prince Edward Island. Chinese tourists accounted for 10% of total international visitors in 2019, more than double the US percentage.

Canada has closed its borders to noncitizens, with the exception of United States citizens, due to the coronavirus. Furthermore, in hopes to slow the spread, non-essential domestic travel is discouraged.

Most tourist attractions, provincial parks, national parks, and ski mountains have been closed indefinitely.

Accordingly, most hotel and motel operators have either laid off or furloughed the majority of their staff as they have very little revenue.

Agriculture, Forestry & Fishing

Vancouver, Calgary, Edmonton, and Halifax

This sector is expected to experience asymmetric setbacks from the coronavirus outbreak, as some industries are more dependent on exports than others. For example, the Fishing & Seafood Aquaculture industry is expected to experience a decline in exports to China. According to the Conference Board of Canada, live and fresh lobster exports to China were valued at more than $450.0 million in 2019.

Many farmers face potential labour shortages as a result of the coronavirus outbreak. Recently, Justin Trudeau announced the closure of Canada’s borders to foreigners in an attempt to limit the spread. However, during seasonal harvests, operators in this sector rely on temporary labour, some of which come from outside countries. Ultimately, this could reduce the overall yield from this sector, reducing the total food supply in Canada and limiting revenue for operators.

Already one of the most highly regulated sectors in Canada, operators in this sector face increased scrutiny regarding food production and distribution. To limit the spread of coronavirus, regulators are expected to increase sanitation requirements, in addition to minimizing transportation of sector products.

Concerns about the potential transmission of coronavirus among animals will require further monitoring. Previous outbreaks, such as the swine flu and bird flu, have shown the ability to spread among humans and animals. This would increase the possible spread of the coronavirus and further increase scrutiny and control on a variety of industry products.

Mining, Oil & Gas

Vancouver, Calgary, Edmonton, and Toronto

Since this sector is highly globalized and dependent on commodity prices, it is expected to be one of the hardest-hit sectors in the Canadian economy. A drop in Chinese consumption of raw materials will bring overall oil and gas prices down. Demand for jet fuel has already declined, and natural gas prices have declined to a record low. This will curtail Canadian production.

The Oil and Gas Extraction subsector will likely curb oil drilling to adjust to lower demand levels. The price of Western Canada Select crude is down approximately 17.5% year-to-date.

Gold prices are rising in Canada as investors shy away from risky assets in this time of uncertainty. In fact, the price of gold in Canada recently reached its highest level since 2013.

Further damaging this sector, is the proximity of workers to each other during operations. Most health organizations have advised social distancing protocol, which dictates at least six feet of separation between individuals. Mine operators have widely begun the shuttering or closure of mines, as they are unable to ensure the safety of workers while the spread continues. Some operators have recently increased investment in autonomous mining technologies to replace workers, something that had already been in development, though less urgently.

Construction

Upstream supply chain issues may restrict construction material availability, hindering sector operations. For example, the Lighting Fixtures Manufacturing industry is heavily reliant on Chinese imports.

The sector will benefit from a coronavirus-related interest rate cut by the Bank of Canada.

With employees not working during the pandemic, construction activity is expected to halt.

Projects funded under the Investing in Canada Plan are expected to experience prolonged completion.

Nonresidential construction activity is reliant on crude oil prices, with the novel coronavirus posing a threat to global prices.

Key commercial downstream markets are expected to experience supply chain disruption, hindering demand for industry services.

Manufacturing

Toronto, Hamilton, and Montreal

The Manufacturing sector will be adversely affected by disrupted global supply chains and lower Chinese consumption. The most significant economic blow within the sector will most likely be from the Computer and Electronic Product Manufacturing in Canada subsector.

Certain pockets of the sector, including Pharmaceutical and Medicine Manufacturing and Soap, Cleaning Compound, and Toilet Preparation Manufacturing, will likely experience heightened demand for industry products.

The Motor Vehicle Manufacturing subsector is expected to see disruption as major automakers are idling their North American factories until at least the end of April. Motor Vehicle Parts manufacturers are also expected to follow suit.

Non-medical equipment and supplies manufacturers are also retooling their facilities to assist in the production of medical equipment and supplies such as ventilators and protective masks.

Retail

The Hobby, Toy & Game Stores industry among other retail industries including clothing stores and furniture stores are expected to experience significant supply chain disruption since suppliers are heavily dependent on Chinese imports.

Prime Minister Justin Trudeau has announced a spending package, which includes a wage subsidy for small businesses and the ability to defer tax payments until August, to help Canadian residents and businesses through the outbreak.

Grocery stores and big-box retailers are able to stay open and are expected to see increases in sales as consumers stock-up. Furthermore, Walmart Canada announced a plan to hire 10,000 workers to keep stores open during the pandemic. Many stores have also implemented a system where the first hour of store opening is reserved for senior citizens and people with disabilities.

Many retailers have laid off employees as they close their doors and wait out the pandemic. Some larger retailers have agreed to pay their staff for their scheduled shifts up until certain dates even after temporarily closing.

Transportation & Warehousing

Air transportation is being significantly impacted, with massive layoffs as travel is restricted. Air Canada is going to suspend a majority of its international and US flights by the end of March. Furthermore, the frequency of existing air routes is also being slashed.

The Scenic and Sightseeing Transportation subsector will likely see a slump in revenue due to fewer international tourists, especially Chinese tourists.

Public transportation is experiencing much lower than normal passenger volumes. This is due to more people working from home as well as people travelling to social events and other destinations. Public transportation agencies will most likely need government assistance to continue operating.

While more consumers may take advantage of online shopping due to social distancing, consumer spending will almost certainly decline. Thus, freight volumes are expected to decrease, which will lower revenues for industries that support the Transportation sector.

Information Technology & Media

Toronto, Montreal, and Vancouver

Similar to the United States, Canada’s Information sector is not expected to be significantly affected by the coronavirus pandemic, chiefly due to the sector’s enduring reliance on domestic demand, low probability of supply chain disruption and its importance in disseminating data to companies and individuals alike, often in times of crisis).

Canada’s motion picture and sound recording subsector, however, is expected to experience a decrease in revenue in at least the short run due to many film and television shoots pausing their production activities in the wake of the virus. For instance, the City of Toronto reported that, of 16 films and TV series shooting in the city the week of March 9, at least six had undertaken the decision to suspend production as a preventative public health measure. According to the same source, production investments in film, TV and other digital media contributed nearly $2.0 billion to the local economy in 2018 (latest data available).

Banking, Finance & Insurance

Toronto and Montreal

Stock exchanges are profiting from higher trading volumes.

Canada’s six largest banks are allowing the deferral of mortgage payments up to six months. they will add the deferred mortgage interest to the mortgage balances, and will effectively be charging ‘interest on interest’. Loan growth will, however, slow significantly as fewer businesses and individuals will be able to qualify for loans.

Lower interest rates have reduced expectations of revenue growth among banks as the net interest margin shrinks and lending activity declines.

Loan losses are expected to increase as businesses and individuals are put under more financial stress. This is particularly true for lenders with relatively high levels of their loan portfolio in the oil and gas sector, which saw a steep decline in the price of oil recently.

Real Estate , Property Rental & Leasing

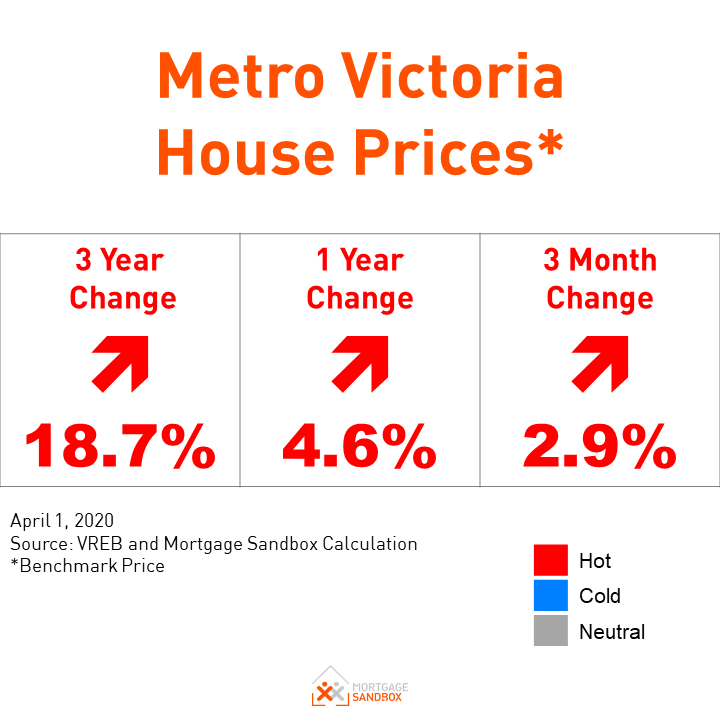

Real estate brokerage firms are expected to see fewer transactions as bans on open houses make marketing properties more difficult.

Many buyers will also delay home purchases due to employment security concerns. Interest rates have been lowered, but lower consumer confidence is expected to offset the benefit of interest rate cuts.

Professional, Scientific & Technical Services

Consultants and advisors are expected to experience volatile contract renewals from key clients during times of uncertainty.

Advertising agencies and services are expected to experience a drop in investment as key clients are not operational or have reduced output capabilities.

Digital services that promote the ability to collaborate online, organize projects and support business infrastructure are expected to increase as businesses are forced to operate remotely.

Education

The Education sector is expected to be greatly affected by the coronavirus outbreak, namely in the form of increasing numbers of school closures and an increasing shift to online-only classes as an alternative to physical school attendance.

As of the time of this writing, every province in Canada has closed its schools in an attempt to halt the spread of the novel coronavirus. The province of British Columbia, in fact, was the last Canadian province to declare that it was going to shutter its elementary and secondary schools indefinitely due to COVID-19, with officials investigating electronic learning as a viable option in the meantime.

The Colleges and Universities industry in Canada, however, may benefit despite its wide-reaching closures should essential medical research among universities as well as university-affiliated institutions continue as medical professionals and public health officials scramble to find treatments for the novel coronavirus while simultaneously attempting to contain its spread.

Institutions who were subsidizing operations with tuition from foreign students may face a greater struggle to balance the books.

Arts, Entertainment & Recreation

Movie theatres across the country have closed indefinitely in an effort to help contain the virus. Many movie release dates have been postponed or the movies have been released on streaming services till a time when moviegoers could see it in the theatre.

Many art institutions, including concert tours, museums, theatres and symphonies, are closed as restrictions on large public gatherings have been put into place, but are offering online virtual tours and performances to help ease boredom and fear during the pandemic.

Most art institutions have postponed or cancelled events, and are either closed or are switching to limited services. This has led to temporary layoffs of many of these institutions’ employees.

Every sporting event in the country is cancelled or delayed with various timelines for each sport.