Market Sentiment is Strong: Does that help foretell the future?

"We know that it's precisely when all the smart money is on one side of the market that there's the greatest risk of prices moving in the opposite direction." — Barry Eichengreen, writing in The Financial Times

In real estate, consumer sentiment is one of the 5 forces believed to drive home prices. Entering 2022, 51% percent of Canadians believe home prices will rise in the next 6 months, but only 24% expect the economy will improve.

An economist would tell you that in a recession, like the pandemic induced recession we are experiencing today, home prices are likely to fall in the short to medium term. However, homebuyers are not economists.

Does high confidence in rising home values mean home values will increase in the future? Or is high confidence in home values merely a reflection of home values rising in the past six months? Does consumer sentiment impact future behaviour, or is it just an echo of the most recent headlines?

In the long-run, the market is fundamentally driven by economic forces. Still, sentiment can propel prices beyond economically sustainable levels in the short-run.

What is Consumer Sentiment?

"Sentiment" refers to the aggregation of Canadians' opinions concerning their future well-being and the real estate market. The signals or metrics from these surveys, Google trends, and opinions are believed can reliably forecast the market direction in the not-too-distant future. Sentiment is measured in several ways:

Consumer surveys

Counting positive and negative headlines in the press

Realtor newsletters

Keyword counts in social media posts

Google search trends

Sentiment reflects how Canadians process facts, rumours, and past experience to develop feelings, attitudes, and opinions about the future.

Sentiment takes in everyone, including the "shoeshine boy".

"In 1929 Joseph Patrick "Joe" Kennedy, Sr. JFK's father, claimed that he knew it was time to get out of the stock market when he got investment tips from a shoeshine boy. On that moment Joe Kennedy had the intuition that we were at the end of the bull market and subsequently he decided to short the market… Ever since, the shoeshine boy has been the metaphor for "time to get out"; for the end of the mania phase in which everyone, even the shoeshine boy, wants in."

Likewise, when your Amazon delivery person or Uber driver begins dispensing real estate advice on getting rich quick, you should take note.

The blend of viewpoints, some of which may be more accurate or researched than others, influences the market in the immediate sense. But sentiment is usually reactive. If the market stumbles for any reason, most consumers are happy to delay a home purchase.

In other words, sentiment is a helpful predictor so long as market conditions do not change. Popular sentiment can be volatile and easily influenced by the latest headlines. Sentiment can shift quickly, as witnessed in the past two years.

Interpreting Consumer Sentiment

Consumers and individuals are wrong most of the time, so interpretation might be straightforward. Do the opposite. It is often a profitable strategy. Industry analysts and economists' formal opinions are also best read "backwards." They will usually predict that what happened in the past will continue to occur in the future. They rarely attempt to forecast a change in market conditions.

The obvious interpretation of market euphoria is that prices will rise, but the opposite often happens. Many industry professionals interpret optimistic, enthusiastic, and beaming consumer opinion as a sure sign that the market is at the top of a cycle and headed for a downturn.

With that in mind, what are sentiment metrics signalling now?

What is Sentiment Telling Us Today?

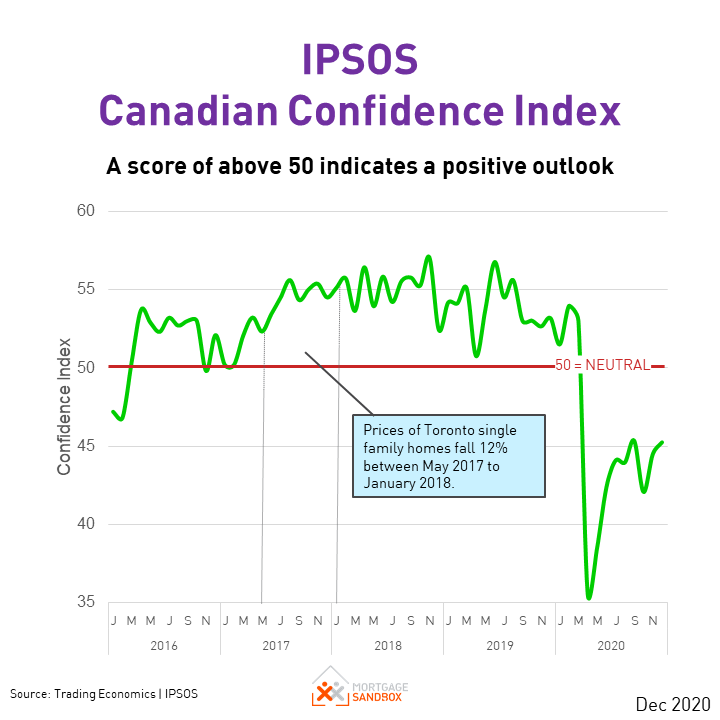

The Ipsos-Reid and Nanos Canadian Confidence Index showed a noticeable drop in 2020 and are now on the mend.

Canadian consumer confidence has improved significantly, buoyed by positive views on real estate. Half of Canadians believe home prices in their neighbourhood will rise over the next six months even though most expect the economy will still be in the dumps.

High consumer sentiment, riding atop a zombie economy, seems to point to the top of a market cycle.

Timing is Everything

Most house price corrections in Canada begin between May and July. If a price correction will happen in 2021, there is a good chance it will start in late Spring or the Summer.

Below are the recent market peaks in various Canadian cities:

Edmonton – June 2007

Calgary – July 2007

Toronto – May 2008

Vancouver – June 2008

Vancouver – May 2012

Calgary – July 2014

Edmonton – June 2015

Vancouver – July 2016

Toronto – May 2017

Vancouver – April 2018

Each peak was followed by a price drop.

The May to July timeframe is more likely to coincide with a correction because of the annual real estate cycle dynamics.

The market usually has a lower supply from February to May, but more listings come online in April and May. As well, buyers are most active in Spring, but families are less likely to look for a home in the summer months because it's prime vacation time.

In 2021, most timelines predict that vaccinations will be complete sometime between June and September. At that time, immigration may lead to population growth once again.

But can we believe a real estate price correction is possible? Has the psychology of the pandemic fundamentally changed the real estate market?

Can Supply Save the Day?

Prices can rise with weak demand if supply drops even more.

There may be enough pent-up demand to hold up prices. On the other hand, the most recent population statistics show that British Columbia and Ontario's population shrank between September and December 2020.

We'll soon see if a correction is imminent

Perhaps a little giddiness is in order as the vaccines start rolling out in the past 30 days. A "light at the end of the tunnel" can be a potent elixir.

The pandemic government stimulus spending has been compared to the spending on World War II. As WWII approached its conclusion, most observers predicted a recession, combined with rising inflation. Instead, the North American economy launched on a multi-decade expansion.

The pent-up demand may, like a coiled spring, explode upwards when the crisis is over.

Sentiment metrics may be pointing true.

Like this post? Like us on Facebook and the next post will show up in your feed.