Moody's Expects Housing Downturn to Continue

Canada's housing market has reached its previous peak and is in a period of declining house prices, reduced home sales and a weaker overall market. The Bank of Canada's tightening of interest rates, together with falling affordability, are to blame for the new environment. However, the impact in individual provinces has been uneven; overvalued markets like Toronto, Hamilton and Vancouver have suffered significant losses compared to previous years.

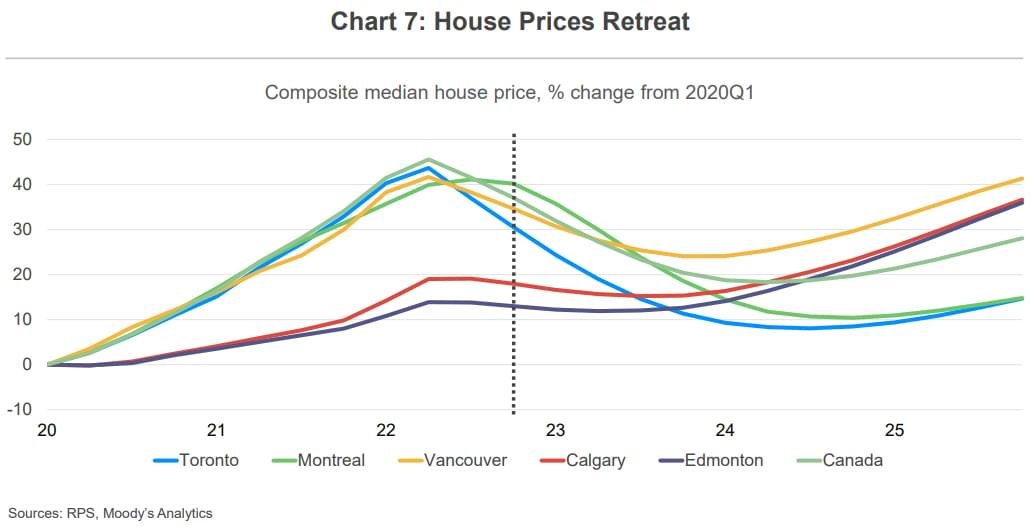

According to the baseline forecast, median house prices are expected to fall by 15% from their mid-2022 peak before bottoming out at the beginning of 2024, with the Prairies maintaining better affordability than other markets. The decline in house price appreciation won't be a bad thing, given that the previous property growth outpaced income growth and also households are straining to make their mortgage payments. The feverish pace of construction work that is currently being done should slow down in response to the correction in housing prices, returning to the pre-pandemic average.

Current Conditions

The housing market in Canada is suffering as a result of rising mortgage rates which lead to declining affordability. The five-year mortgage rate has risen to its highest level since December 2008, up more than 2.5 percent in 2022. The affordability ratio, a calculation of the share of a household’s monthly after-tax income they would need to spend to afford a home purchase, has recently increased to its highest level since the late 1980s as a result of rising homeownership costs—of which mortgage payments is the largest component.

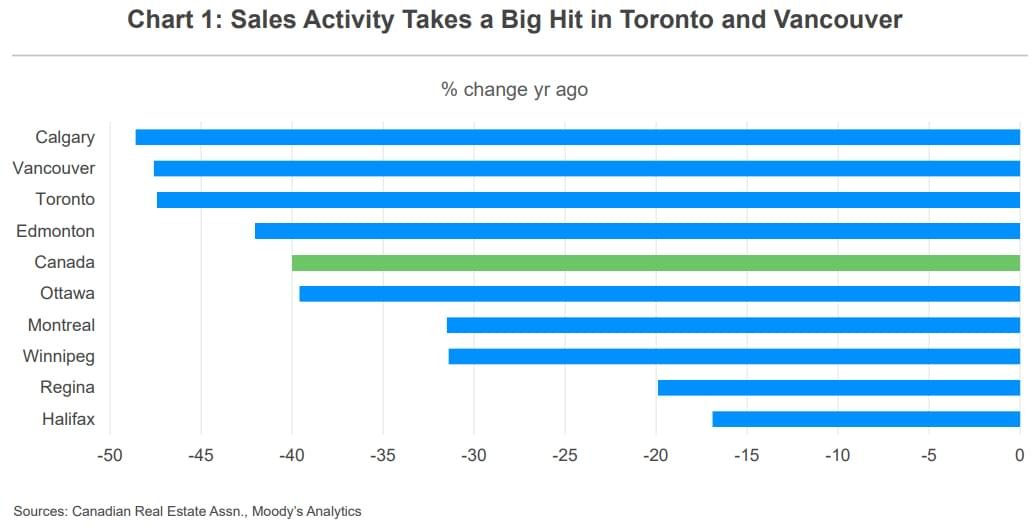

Existing-home sales have been rising steadily in recent months, increasing by 2 per cent in February over January. They are still down 40% from the heated levels of a year ago, though. Except for the pandemic lockdown period, sales volumes are approaching a pace last seen during the Great Recession. High interest rates discouraged homeowners from putting their homes on the market and gave up their extremely low mortgage rates, driving away potential buyers.

While sales have fluctuated greatly, new listing flows have also slowed, supporting the idea that there isn't much forced selling happening right now. While active listings are more than double the amount from the beginning of 2022, the months' supply of existing homes is currently hovering around four months. Supply this low still provides sellers with a negotiating advantage.

The decline in existing-home sales in 2022 was the main factor in this. While the national existing-home sales decline is significant, there is notable regional variation, with Toronto and Vancouver both seeing 47 per cent declines from their year-ago levels. In Montreal, the summertime sales decline was not as severe, but it has since accelerated and is now roughly in line with the national average.

Cities in the Prairie provinces have also been impacted. Sales in Calgary decreased from the previous year but are still in line with long-term trends. Despite the slowdown, existing-home sales in Edmonton are still above of pre-pandemic levels. While home sales in Canada fell by 40%, they fell by about 17% in Halifax.

House prices retreat

The astronomical increase in housing prices came to an end over the summer of 2022. Since then and up until February, house prices declined, according to the RPS Metropolitan Composite Index. Some of the biggest price drops since the Great Recession were recorded by the index, which monitors Canada's 13 largest metropolises.

While prices have risen in February and March, it is too early to call a house price recovery. Mortgage rates are still very high, consumer confidence is low, and there are still recessionary clouds on the economic horizon.

Driving Factors

Building Permits

The value of building permits is a useful barometer of the health of the housing market and could be a leading indicator for the broader economy. Construction activity tends to recover early in an economic upturn and decline as a recession sets in. As economic growth continues to slow and a mild technological recession looms, approvals are expected to decline accordingly.

After sustained upward momentum in the first half of 2022, residential building permit totals trended downward, especially in the fourth quarter. Building permits are volatile. Movements like February's uptrend should be taken with caution and placed in the broader context of multi-month movements. The recent downward pressure on permit levels may be partially explained by seasonality, as construction activity tends to slow down in the winter. After rising 4.1% and 9.6% in January and December, respectively, the February figure decreased by 15.2% year-on-year. Moreover, housing metrics and broader macroeconomic indicators suggest there are more factors than just bad weather.

Among other things, this includes the fact that the housing market is particularly interest rate sensitive. The Bank of Canada’s policy rate is at a 15-year high even if its forward guidance suggests a pause in rate increases. High mortgage rates have pushed many potential homeowners out of the market, easing demand for housing. Additionally, high interest increases the costs of loans and expected investor returns for construction projects. This is a supply-side constraint. Keep in mind that prices have dropped in real terms, if the price drops were adjusted for inflation, they would be roughly 7 percent lower.

Overall, the pace of permit approvals has responded to slower economic growth and will continue to decline in the short term, contrary to the notion that seasonality alone is responsible for the recent weakness. A decline in construction permits now will lead to a decline in housing starts in the months. Housing starts increased rapidly for most of the first half of 2022, and outperformed the trend in the second quarter.

Moody’s expects the number of homes under construction hit a record high of over 378,000 units toward the end of 2023.

Absorption Rates

Absorption rates are the per cent of new housing units occupied within a market as they are completed. The demand side of the story becomes even more apparent when looking at the absorption rate of new homes in the market. According to the Canadian Mortgage and Housing Corporation, the "completed absorption rate" of detached homes has been steadily declining since the summer of 2022, but the number of "completed unabsorbed" detached homes is gradually increasing. This means demand for single-family homes is slowing, in response higher mortgage rates.

It has been suggested that the rental housing market is relatively less sensitive to higher interest rates than the mortgage-backed housing market. Ultimately, looking at the noise, it's clear that the housing market is cooling. With a significant number of permits and new projects still in the pipeline and underway, housing stock will continue to be built over the next few months. A weaker economic outlook in the short term will create significant headwinds for markets on all fronts.

Foreign buyers’ prohibition

In June, the Canadian Parliament passed a law banning home purchases by non-Canadian citizens and non-Canadian permanent residents. The law, formally known as the Prohibition on the Purchase of Residential Property by Non-Canadians Act, officially entered into force on January 1 and expires in 2025. It is unlikely to have much impact on the housing market.

The debate revolved around the impact of foreign buyers speculating on real estate. Proponents argued that foreign speculators artificially inflated prices by buying high-end homes in the hot real estate markets and crowding out Canadian buyers. This has impacted affordability for Canadian residents.

Taxing foreign buyers is widely supported domestically. In 2016, British Columbia introduced a 20% tax on foreign buyers and a 0.5% tax on vacant properties. Ontario passed a similar tax in 2017.

Moody’s analysis of home values in Ontario and B.C. show that prices didn’t drop in response to the introduction of foreign buyer taxes but any price corrections that did occur were better correlated to mortgage rate increases.

It should also be noted that the share of non-resident owners is small. Non-resident owners account for 5% and 3.4% of property owners in Vancouver and Toronto, respectively.

Likewise, and most relevant for the 2023 nationwide ban, the areas that saw the fastest price appreciation after the pandemic were not markets that historically experienced high levels of foreign investment.

Finally, the timing of the foreign buyers ban is ill-conceived. While the bill was passed during the height of house price inflation, it did not take effect until January 1. House prices had already begun to drop as a result of mortgage rate increases when the ban had come into effect, and more declines are likely to come.

For potential investors or house flippers, shrinking profits are a more powerful disincentive.

The longer term outlook

Economic growth is expected to slow sharply over the next six months as households run out of savings, private consumption is impacted by rising interest rates, and businesses cut back on employment due to weak demand.

GDP will fall slightly as high interest rates, a key driver of the current business cycle, weigh heavily on the economy, but the cost of borrowing alone is unlikely to trigger a full-blown recession.

An imminent slowdown contrasts with previous recessions as the negative impact on the job market will likely be lower than usual. Managers should be reluctant to initiate mass layoffs when companies face severe hiring challenges and high turnover. Most of the expected rise in the unemployment rate next year will come from new entrants to the labour market finding companies have stopped hiring.

The basic forecast is that the economy will survive this difficult period with minimal damage, but the economy is highly vulnerable to external shocks during this period. In this weak state, even the slightest shock could push the economy into a deeper recession.

Most notably, the baseline forecast is for inflation to continue to decline throughout the year. Falling energy prices helped drive the initially sharp slowdown in inflation. However, progress might be slow.

Improving inflation allowed the Bank of Canada to halt rate hikes in January. The Bank of Canada overnight rate should remain at 4.5% for most of 2023.

Historically, interest rate spikes have tended to be short-lived. Once inflation has been brought to 2 per cent, concerns about low growth and rising unemployment will rise.

Consumer and business sentiment could pick up again in the second half of 2023 and expectations of interest rate normalization. The economy should emerge from the slump at the start of 2024.

The property market forecast

While the Canadian economy is likely to survive 2023 with little damage, the same cannot be said for the real estate market.

A sharp rise in interest rates, a sharp drop in affordability after two years of massive inflation, rising unemployment and a surge in new housing supply should drive prices down sharply.

Overall, median home prices across the country are expected to decline 15% from their peak in mid-2022 and bottom out in early 2024. The price has already fallen by about 8%, meaning half of the losses are yet to come.

Sales activity slowed as expected monthly mortgage payments surged and buyer sentiment plummeted. In addition, as prices have started to fall, potential buyers have tended to wait in anticipation of further price declines, further pushing down demand and prices.

But this momentum also means pent-up demand will rise when interest rates peak in 2023. As economic growth picks up again in late 2023 and into 2024, and interest rates begin to fall as the Bank of Canada normalizes monetary policy, the pent-up buyer demand will be released, and rapid price increases are expected to return.

Canada needs more housing to meet the increased demand caused by the country's immigration targets. Canada set a recent immigration record in 2022, and 2023 is on trend to surpass that record.

Risks

Rising mortgage rates and poor affordability are the most prominent short-term risks to the housing market. Monthly mortgage payments have risen prohibitively for millions of households, especially first-time buyers. Further increases in mortgage rates could reduce the pool of eligible buyers and drive down home prices.

Inflation remains a secondary risk to the outlook as the cost of necessities constrains housing spending.

A key upside risk to the outlook includes a significant improvement in inflation. This will support households and allow the Bank of Canada to get on a faster trajectory of returning interest rates to neutral levels quickly.

About the RPS - Moody’s Analytics House Price Forecasts

RPS – Moody's Analytics house price forecasts are based on a locally tailored economic model that captures the dynamics of housing supply and demand and the long-term effects on house prices, such as unemployment and changes in mortgage rates. Forecasts are updated monthly and provide perspectives for the next ten years. They are available across Canada, ten provinces, and 33 metropolitan areas in various scenarios.

Source:

Canada Housing Market Outlook: More Struggles Ahead, April 2023