What are the two main real estate cycles and how do they work?

In Canadian real estate, we observe two distinct cyclical patterns in real estate. The long-term real estate cycle is closely intertwined with the global economic cycle. This long-term cycle typically takes around a decade to complete and has major effects on the price of homes. The other cycle is the annual real estate cycle. By comparison, the annual cycle has a less dramatic effect on prices, but a savvy buyer or seller can save (or earn) significantly more money by observing the annual real estate cycle.

In this article we will explore:

The four stages of the annual real estate cycle

The four stages of the economic real estate cycle

The Annual Real Estate Cycle

Stage 1: Winter

January – March

The new year brings new optimism into the real estate market. Homebuyers realize that they can finalize a purchase and then move into their new home as spring begins to set in. Realtors are looking to start their year strong and get some big sales in the first few months (especially after some excess Christmas spending). They will push hard and get people into homes to make purchases.

Sellers are keen to take advantage of Spring sales too but, since they often get tied up in light renovations, they miss the Spring sales window.

The combination of high buyer interest and fewer homes for sale starts to drive prices up.

Stage 2: Spring

April – June

This is typically the time of year where prices grow the fastest. Homebuyers, many of whom have kids, feel urgency to find a place so they can make their move over the summer school break. Moving is far less disruptive for the kids when this is done at the end of the school year.

Weather also plays a factor. This might explain why warm cities such as Brisbane, Australia do not see the same kind of seasonal price fluctuation that we experience here in Canada.

The Spring rush leads to a surge in buyer interest with tight timelines which provides sellers an upper hand in negotiations.

Stage 3: Summer

July – September

This quarter of the year is somewhat similar to the “shoulder season” in a tourist destination. The number of purchases starts to decline but sellers are trying to complete a sale before the winter sets in. Price growth tends to slow down but is yet to start declining. Parents can still move during this period and ensure their child starts the new school year in the school they will be attending going forward. Buyers will slowly get more negotiating power as it gets closer to the Fall.

The trade-off for buyers for waiting to pressure sellers into giving discounts is two-fold. For one, there is a risk of missing out on their dream home and secondly, having to move during a less convenient time of year. Carefully pondering this trade-off is important and will be different for any buyer or seller.

Generally, in the Summer, there are strong purchases but more homes for sale than there are earlier in the year.

Stage 4: Fall

October – December

This is traditionally when price growth really starts to decline and even drop. At this time of the year, many sellers have had their home on the market since Spring hoping to get a high price for their home. These sellers are losing confidence and just want the open houses to end so they will likely accept price concessions. As a buyer, the market advantage is in your favour and this is a good opportunity to save a lot of money. The drawback, for buyers, is that they’ll be moving during the winter and will have to deal with winter weather. Usually, buyers will save more on the home price than the cost of professional movers who make a winter move less arduous. In my opinion, a winter move is more than worth the inconvenience in order to save a significant amount of money on the purchase of a home.

The Economic Real Estate Cycle

Before we dive into what is occurring in each phase it is important to define some key vocabulary:

Vacancy – The percentage of vacant (empty) units that are unoccupied and on the market.

Construction rates – The number of new units built in a given period.

Rental Rate – The cost of renting a unit.

Absorption – The rate at which homes for sale are purchased.

Recession – 9 consecutive months of negative economic growth.

Buyer’s Market – A real estate market where there are enough homes for sale that it would take 9 or more months to sell everything available. In this situation, the negotiating power lies with the buyer. Seller’s will likely offer or accept discounts.

Seller’s Market – A real estate market where there are only enough homes for sale that it would take 5 or less months to sell everything available. Here, the negotiating power lies with the seller. This leads to bidding wars and home values will be inflated above there fair market value.

Phase 1: Recovery

The recovery phase comes immediately after a recession when demand is slow but growing. This phase is characterized by low absorption rates, very few homes under construction, high (but decreasing) vacancy rates and slowly rising prices.

The recovery period can be hard to distinguish from the recession, but it can be thought of as the phase in which market conditions are experiencing a small shift in momentum.

Housing prices slowly increase as the real estate purchases rise and the economy recovers from a recession. Cautiously optimistic buyers re-enter the market slowly. The recovery phase begins in a buyer’s market and ends in a sellers market.

Phase 2: Expansion

The expansion phase happens when the economy growing at full strength, unemployment has dropped significantly, and construction rates are growing. Buyer demand is growing, and consumer confidence is accelerating. Absorption rates rise, vacancy rates drop, and interest in rental investment properties is high.

At this point the market is firmly in “seller’s market” territory, meaning more buyers want homes relative to the number of willing sellers, prices are rising, and buyer competition may lead to bidding wars.

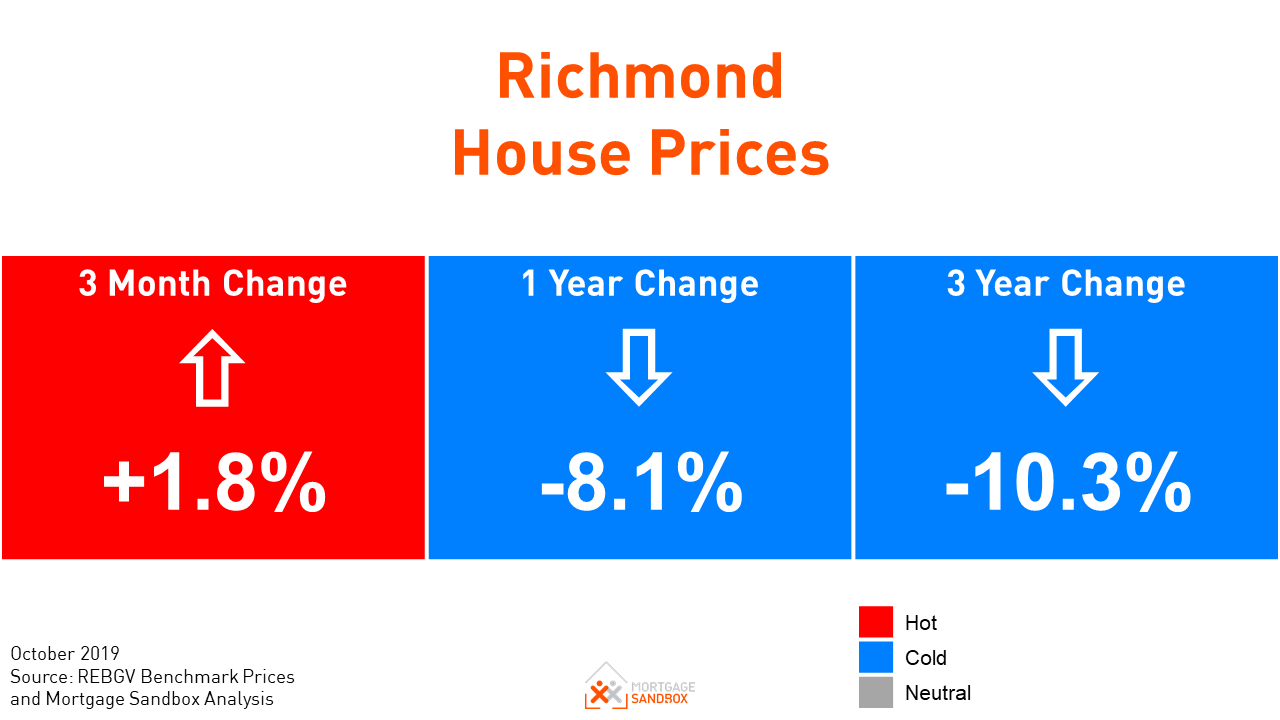

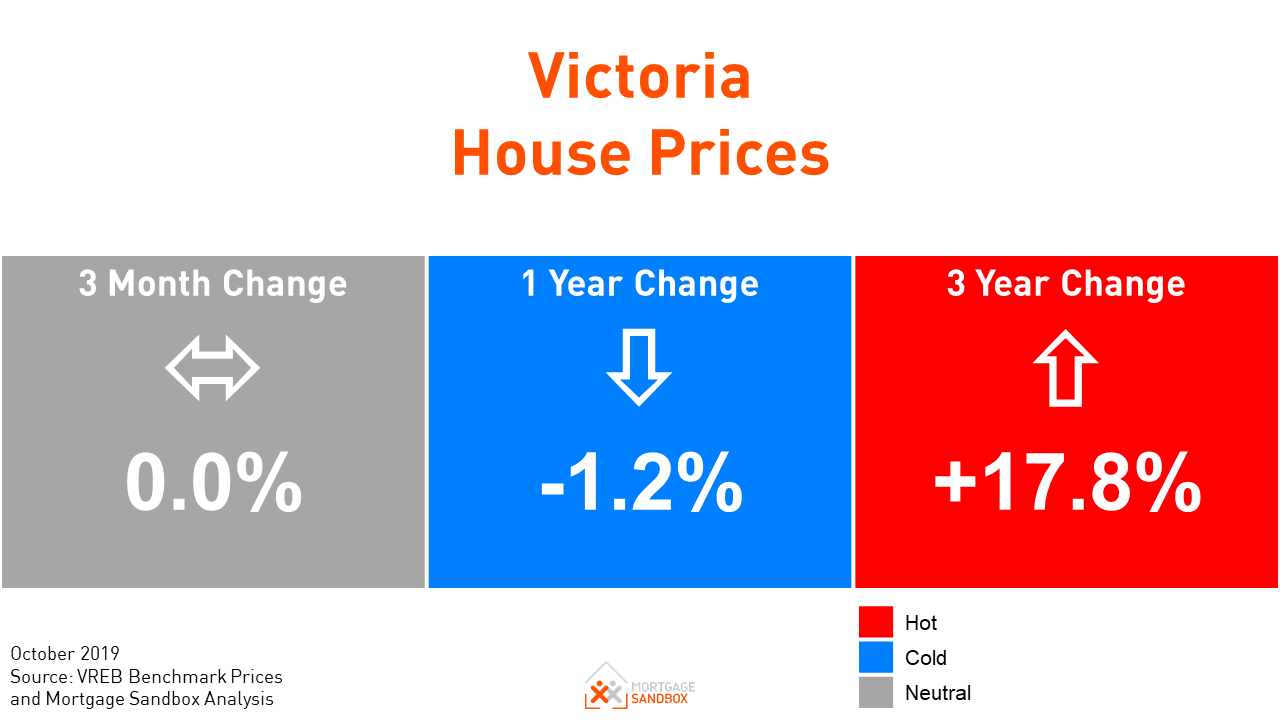

Phase 3: Hyper-supply

This is characterized by a plateau and the beginning of the decline. During this stage, construction completion rates outgrow buyer demand, which leads to lower absorption rates, increasing vacancy and more unoccupied properties for sale on the market. During the hyper-supply phase, prices start to drop because buyers have many competing properties to choose from. This phase is often the most difficult to predict. Low buyer interest and the growing number of “For Sale” signs in are signalling that Canada is in this phase.

Meanwhile, housing starts plummet and with them construction jobs disappear, and the economy contracts. Absorption rates fall and vacancies rise. What is being seen in Vancouver right now could be a sign of things to come for the rest of the country.

Phase 4: Recession

A recession is characterized by a strong buyer’s market – supply heavily outweighs demand and prices are on the decline. Strategic investment opportunities during a recessive period can set you up for life if you buy the right place at the right time.

Rent growth is either negative or below the rate of inflation, for which many investors resort to offering concessions or rent reductions to retain tenants. Therefore, don’t buy during this phase with the expectation of immediately renting out the unit.

Overview

We have historical examples of the economic cycle playing out in Toronto, Calgary, and Vancouver.

Adjusted for inflation you can see the real scope of the Toronto housing bubble of 1980s. 21 years later, in 2010, real average home price matched the 1989 peak.

The 1981-82 house price inversion in Vancouver led to the collapse of the Bank of British Columbia, which was bailed out (purchased) by HSBC in 1986. Vancouver homes didn’t recover they value for 12 years.

Calgary prices peaked on the early 1980s as a result of high oil prices triggered by the the 1970s OPEC Oil Crisis. Once the price of oil dropped, the price of homes followed and it took 30 years for home values to recover, on an inflation adjusted basis.

Conclusion

These two housing price cycles are underlying forces influencing home price trends. Both have similar characteristics, growth and then a decline fueled largely by the same drivers. However, the magnitude of change and length of the cycles defers. With this knowledge, you can make a more informed decision about where prices are likely to be headed. Before you make a purchase, make sure to consult an expert that you trust about what stage of the cycle we are in. Ultimately, buy a home for its primary purpose, a place to live, and not purely for investment reasons.