Top Real Estate Trends Coming Out of the “Great Lockdown”

Our lives have been turned upside-down by COVID-19. Many of us now work from home and visit our family and friends using Zoom Calls.

The real estate industry is also being transformed. Some changes – while jarring and disruptive – may remain ingrained behaviours after the crisis recedes. But which ones?

We believe these new real estate trends will gain traction and stay with us forever.

1. Tech Start-ups that help Canadians find a Mortgage Broker and Realtor®

The first step in your house-hunting search is setting the budget. You can get a reasonable estimate of your budget using a home buying budget calculator do find out what you can afford. Yet, mortgage qualification is a tricky business, so you should get a mortgage pre-approval from a Mortgage Broker before you finalize your budget.

You can find more details about setting the budget in our home buying guide

Traditionally, people have found a mortgage broker by getting names from friends and family, or work colleagues. The same applies to Realtor recommendations.

However, we expect co-worker referrals will become less common because the Coronavirus is forcing employers to cultivate productive remote workforces. As employers master productive remote workforces, they will embrace the cost benefits and resist shifting work back to expensive downtown offices.

With remote work, more interactions get funnelled into formal calls and online meetings, and there is less ‘watercooler talk,’ ‘smoke breaks,’ and ‘coffee meetings.’

What does this mean for people looking for real estate professionals? Several start-ups help Canadians find a mortgage broker and real estate agent, and they fall into four categories:

Rating Sites

·Auction Sites

Rate Comparison Sites

Work Style Compatibility Matching

Rating Sites

Many online sites showcase ‘reviewed’ or ‘rated’ agents and brokers. It’s common knowledge that reviews on Google and Yelp are often ‘gamed’ (fake reviews and ratings). Sites like Rate-My-Agent and RankMyAgent have more controls in place, but generally hand that control to the professionals.

A recent report found that 90% of U.S. consumers now read online reviews, but 50% of those people believe the ratings and reviews are being manipulated.

Learn more about Why you should avoid a ‘Top Agent.’

Benefits

A 5-star rating may give you peace of mind that the professional is providing top-notch service.

Challenges

Fake Review: Not all good ratings and reviews are genuine or trustworthy. Services exist that allow people to buy good reviews.

Front-end Filtering: Most clients only rate a professional on a site after being asked to so by the agent. Agents, therefore, can filter out bad ratings by only inviting people they suspect will give them good grades.

Back-end Filtering: Sometimes bad ratings get filtered out by ‘gatekeeper’ processes. The agent must accept an evaluation before it is shared on the platform.

Sample Size: Some platforms charge professionals a monthly listing fee, so many agents chose not to be listed, and other agents don’t want to pay to be listed on more than one; therefore the agents on the platform are not a representation of everyone available in your area.

Auction Sites

Several platforms offer real estate agents the opportunity to bid on your business by discounting their sales commissions.

For example, feeDuck is an online auction, where real estate agents bid down their commissions to win a chance to sell your home.

Benefits

You pay less commission for the sale of your home.

Challenges

You may miss some upside in your final sale price because of how buyer realtors earn commissions. As well, you could get a similar result by simply contacting the aptly named 1% One Percent Realty or 2% Realty.

Learn more about how Realtor commission is calculated and why low commission models may hurt your sale price.

Rate Comparison Sites

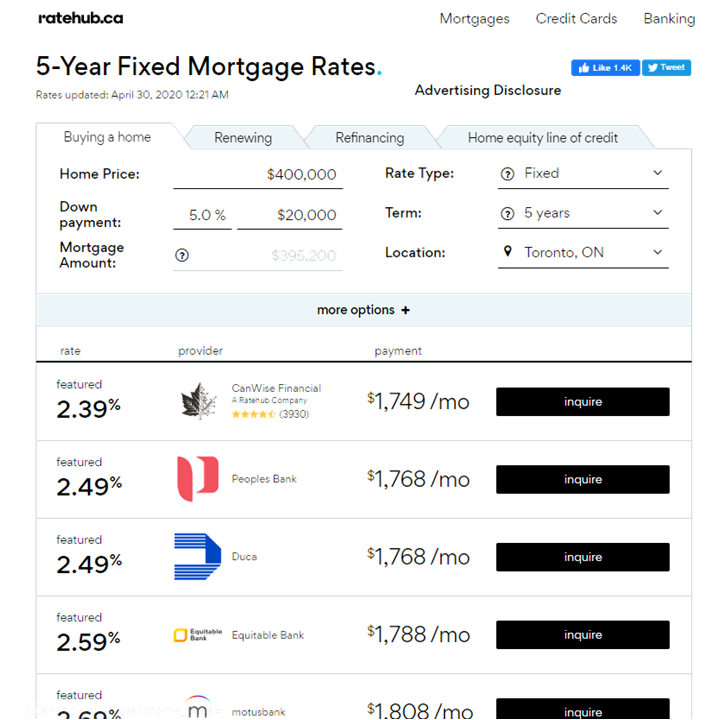

Ratehub, Lowestrates, Ratespy, and Ratesupermarket are online mortgage rate comparison sites where mortgage brokers and lenders post the lowest rate they have available. When consumers click on the rate and enter their contact information, a broker calls them up to see if they qualify for the rate.

Benefits

You will get a competitive mortgage rate.

Challenges

You may waste your time with ‘bait-rates.’ For a lender to quote you an accurate rate, they need to know:

Purpose: Lenders have different rates if the home is a principal residence, rental, or vacation property.

Value of the home: Homes valued at over $1 million get a different rate than those worth less.

Size of down-payment: If your lender is giving you their best rate, then different rates can apply if your down payment is 5%, 10%, 20%, 35%, or 50%.

Repayment Timeframe: Different rates apply when you pay back a mortgage within 25 years, 30 years or 35 years.

Income Source: Sometimes, entrepreneurs, contractors, or people whose income is not a standard wage or salary will get different rates than other Canadians.

Fees and Penalties: The very lowest rates often come with higher fees and penalties. The lender gives on the rate and takes back somewhere else. You could compare this practice to mobile phone companies who sell you a cheap phone but make up the difference with a two-year contract and high monthly text and data charges.

The key point is to highlight that without a full understanding of your personal situation, it is not possible to quote a competitive mortgage rate. An advertised ‘rock-bottom’ rate will always come with strings attached.

As well, these sites aren’t all impartial. Ratehub owns the mortgage brokerage “CanWise Financial” and in the screenshot from their site, you can see that their captive brokerage is listed at the top of the search results.

Learn more about how Mortgage Broker commission is calculated and why the lowest rate may cost you later.

Work Style Compatibility Matching

Only one Canadian start-up tries to help people find professionals predisposed to work well with them. Mortgage Sandbox combines the theories behind eHarmony and Tinder to match Canadians with a Realtor and Mortgage Broker. You answer ten simple questions and get introduced to local, pre-screened professionals with the most compatible work styles.

We believe matching people based on aligned values lead to better working relationships and a more successful home buying, home selling, or financing experience.

Benefits

You are predisposed to work well with your professional matches, and you get to choose who you want to work with.

Challenges

It’s up to you to negotiate competitive commissions and mortgage rates; however, we provide up-to-date market information on what competitive rates and commissions should be.

Try Mortgage Sandbox

2. Silver Tsunami of Housing Supply

According to a recent survey, 32 percent of baby boomers are planning to ‘right-size’ to a luxurious condominium in the next 3 years. We refer to this move to an apartment as ‘right-sizing’ because moving into a luxury apartment building hardly sounds like downsizing. A full 41 percent of boomers have expressed an intention to right-size in retirement, so most of the sales activity will come sooner rather than later.

Another survey from RBC says, “Over the coming decade, we expect baby boomers to ‘release’ half a million homes they currently own—the result of the natural shrinking of their ranks, and their shift to rental forms of housing, such as seniors’ homes, for health or lifestyle reasons.”

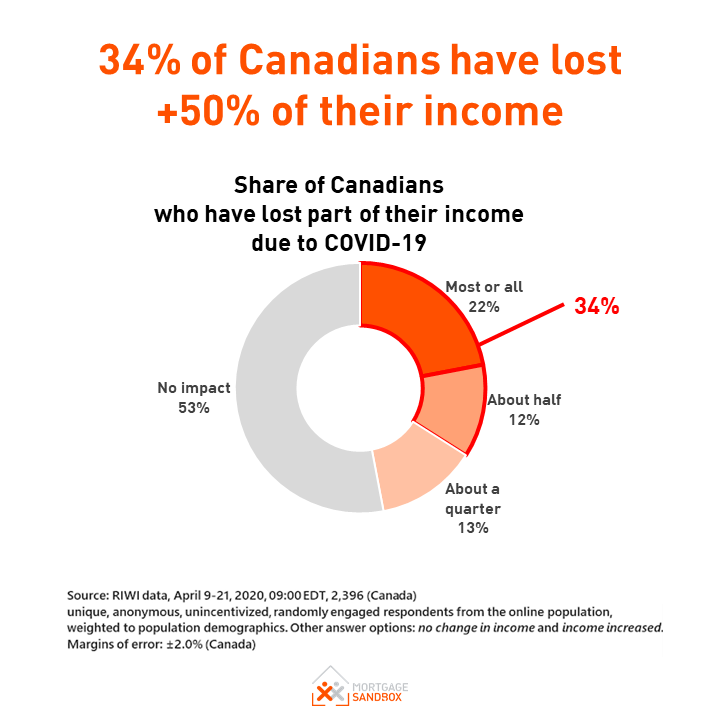

There is also a concern that the Coronavirus could accelerate the Baby Boomers’ exodus from the single-family house market because of job losses and the vulnerability of people in their golden years.

Many Baby Boomers who lose their jobs or close their businesses in the Coronavirus Recession will be pushed into early retirement without having reached their retirement savings goals.

With a large part of their savings tied up in homes, these Boomers may accelerate their plans to ‘right-size’ from houses into condos to unlock their savings. You can get a lot of bang for your buck selling land to buy a condo and often condos these days come with access to a beautiful pool, sauna, gym, and even a party room.

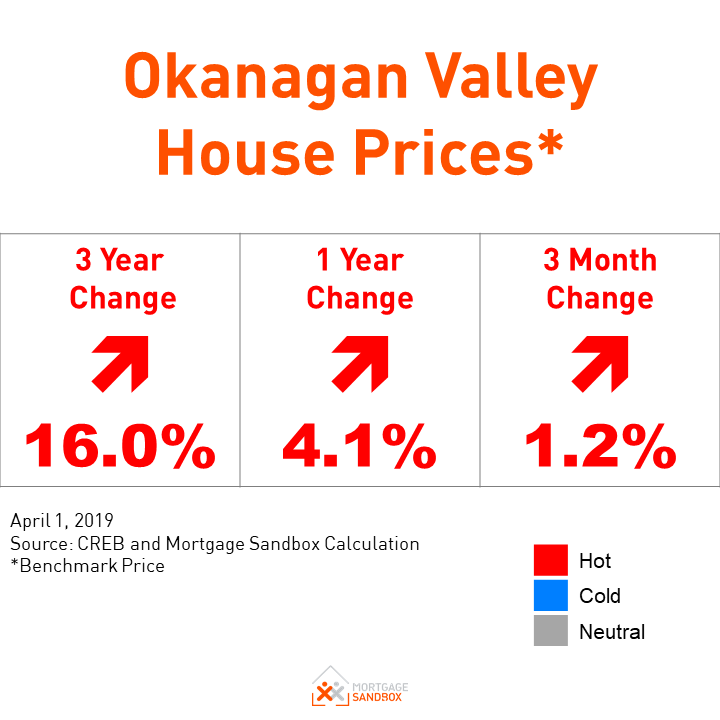

This swell in house supply is fantastic news for Gen-Zers and Millennials who can sell a starter condo for top-dollar to find a bargain on a house.

Benefits

Houses may become more affordable for younger families while boomers unlock cash from their expensive houses and get to enjoy their early retirement.

Challenges

Baby boomers banking on a huge sale price for their real estate investments may be disappointed to have missed the peak in the market.

3. Remote Home Viewings

Coronavirus has undoubtedly led to a rise in all things virtual, and this applies to home viewings as well. Although a lot of the technology for remote viewing has been available for years, social distancing will help them take off!

Live Digital Walkthroughs

Virtual tours offer home buyers a remote, video-enabled walkthrough of a property that will give them the sensation that they're actually there—or at least darn close.

For an effective virtual walkthrough, Agents will need to prepare a walking route and talking points.

Video Recording

In the simplest type of digital walkthrough, real estate agents use their smartphone camera to record a video as they walk through the home, showing off each room while narrating the key features.

Video Call

A more interactive option is to live-stream a one-on-one or group chat showing with the buyer and buyer realtor. This gives the buyer more control over where the camera is pointing. Video calls are most often set-up using FaceTime, WhatsApp, Google Hangouts, or Skype.

Video Conference Open House

Another option is a virtual open house. The seller agent invites several buyers and their agents to a video conference call. Like a video call, the agent will walk the group through each room in the home, any outside spaces, and any common areas.

Buyers often enjoy seeing the ‘raw footage’ that a virtual open house or showing can offer, as opposed to a professionally produced video.

We recommend using Zoom to host live virtual open houses however, here is a helpful review of the 11 most common conferencing apps.

Here is a list of other tips for hosting zoom meetings.

The agent can show potential buyers around the home and anyone on the call can ask to have the camera pointed at something of interest. When conducting a group tour, it’s important to set out ground rules such as:

Wait until the agent has shown an area before asking questions.

The agent will ask if anyone has a special request before moving to the next area.

If your question takes more than 30 seconds to answer, then schedule a one-on-one viewing later to address your question.

Real estate agents used digital tours before COVID-19 as a unique marketing tool. Now, online tours are essential since they're the only easy way for buyers to view a home without physically entering the property.

Virtual Reality

Technology in this area is advancing fast, and we expect to see more virtual reality (VR) renderings of homes. These can be viewed on a mobile phone, tablet, laptop, or wearing a specialized headset. We think the laptop-tablet based VR tours will be most popular in 2020.

To create a VR rendering of an existing home, a professional photographer uses a special 3D camera to capture images of the home. The photos are analyzed by software that renders the visuals in 3D, creating a virtual home that can be toured from anywhere.

We believe VR will be more popular for viewing pre-construction homes. For pre-sale viewings, the developer shares their detailed drawings, floorplans, and marketing material with the VR company, and they are converted into 3D renderings of the homes.

VR is pricey, so you will likely see it more frequently in virtual presentation centres for new developments and sales of homes valued over $1 million.

Benefits

Homebuyers can get more detailed information about homes before visiting them physically. As well, buyers can visualize pre-construction homes without visiting a presentation centre.

Challenges

We know that angles, lenses, and photo retouching can make homes appear better than they might in real-life. In a market that still follows a “buyer beware” philosophy, nothing will fully replace a physical viewing.

4. Touchless Building Controls

The Coronavirus Pandemic has made us much more aware of all the places we pick up germs. When it comes to communal touchpoints, apartment building residents are more conscious of how many people have used the main entrance and the elevators. The anxiety people have about these communal touchpoints will linger beyond the pandemic.

We can expect to see more innovation using facial and voice recognition combined with automatic sliding doors for completely touchless entry. Again, here is an example of adapting leading-edge technology used in commercial buildings to address changing consumer needs.

Likewise, elevators could easily accept voice commands with buttons used as back-up.

Touchless controls will make life easier, healthier (e.g., protection against seasonal cold and flu), and more secure (no more building audits to track down extra/missing keys and security fobs).

These features will be more common in new construction, but you may also see existing buildings retrofit for touchless entry to eliminate the need to touch anything between your apartment door and the street.

Benefits

Buildings will have fewer communal touchpoints that can spread germs.

Challenges

Higher costs to retrofit older buildings, so these will likely upgrade to touchless when replacing elevators and security equipment that has reached end-of-life.

5. The Age of the Home Office

The pandemic has forced many Canadians to work from home. It has proved the skeptics, who believed most jobs couldn't be done productively from home, wrong.

While working from home comes with challenges, we expect that in the future, many companies will make greater use of the option of working entirely or in-part from home. At the same time, companies will reduce the size of their corporate offices and primarily use them for team building. This is an extension of the Bring-Your-Own-Device (BYOD) trend when employers began asking employees to use their personal mobile phones and laptops for work purposes. Now employers will expect employees to carve out space in their home for an office

To make working from home more sustainable, we expect homeowners will convert garages and storage rooms into home offices. As well, apartment buyers will demand more rooms so that one can be used as an office.

As well, they will demand that buildings be set-up for high-speed internet access.

People used to have their Amazon packages delivered to work, but now their packages need to be delivered at home. In residential buildings without a security desk, expect homebuyers to look for Amazon delivery lockers to be installed.

Benefits

Save 1 to 4 hours a day with your family and friends that you used to spend commuting.

Workplace performance shifts toward measuring success by outcomes rather than ‘bums in seats’

Challenges

Expect further infringements into the Bring-Your-Own-X realm. Whereas they used to ask you to use your personal laptop and mobile phone for work purposes, soon employers will expect you to find a home big enough to have your own workspace and supply your own ergonomic office furniture.

As employers shift office expenses to employees, employees will feel shortchanged because they do not get to deduct these expenses from their personal taxes.

Change Is the New Normal

We should expect many of our new COVID behaviours to stick. The next few years represent opportunities and challenges. Hopefully, we will respond to the challenges by taking steps to transform into a more productive and healthier society.

Like this post? Like us on Facebook for the next one in your feed.