Victoria real estate is riskiest in Canada

HIGHLIGHTS

|

Economists measure risk in terms of volatility and uncertainty. If prices in a market move dramatically (i.e., up or down) and unpredictably (e.g., not connected to local economics) then it is considered risky. Let’s look at volatility and uncertainty in Canadian real estate.

Volatility In Canadian Real Estate

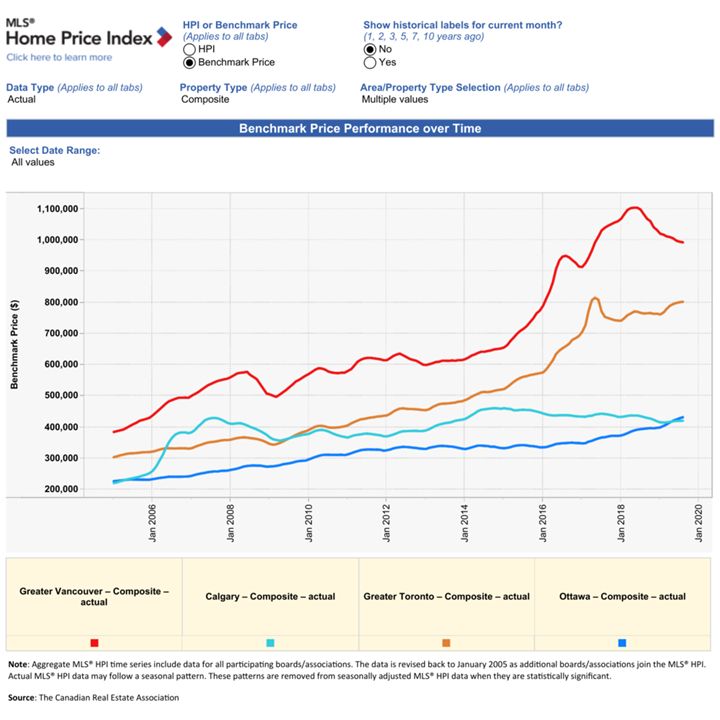

We can see the run up in Calgary home prices during the oil boom and that’s no surprise, but did you know that a benchmark Calgary home is cheaper now than it was in 2017? Whoever promises real estate prices only up in the long-term must have a very long time horizon in mind.

In the past two years Toronto and Vancouver prices have risen and fallen by 10%. Toronto house prices haven’t recaptured their 2017 peak and Vancouver prices are well below their 2018 peak. In contrast, Ottawa’s home price growth looks slow and steady, with seasonal fluctuations but no wild price swings.

Is Canada experiencing a real estate bubble? Do all bubbles eventually burst? At present, the Toronto and Vancouver housing markets (which touch almost 1 in 3 Canadians) are more volatile than blue chip stock indices like the S&P 500, which would be considered a safe investment by most. From an economist’s standpoint, a market that swings wildly upward has a higher likelihood of swinging wildly downward, hence growing concern that years of record breaking highs could lead to a period of declining prices.

Uncertainty

As property prices distance themselves from local incomes and economic fundamentals they become more dependent on market sentiment which increases the uncertainty in the industry. Since the price movements and size don’t make sense to most people, we start reaching for explanations.

Our platform matches you with local, pre-screened, values-aligned Realtors and Mortgage Brokers

Shared values lead to better working relationships.

For example, if the market were slow and steady then nobody would be tempted to read this article about risk. People would think this article was of little value. Uncertainty prompts people to read an article like this and it also prompts them to take a “wait-and-see” approach when they see a hot the market softening significantly. In essence, potential homebuyers are waiting around for news that inspires more confidence of upwards movement in prices.

ICYMI: Governor Poloz said that while vulnerabilities associated with housing market imbalances remain significant, fundamentals in the housing sector are solid overall. #cdnecon https://t.co/3JEgAUFFYy pic.twitter.com/XsKUZqLzBA

— Bank of Canada (@bankofcanada) May 21, 2019

Vancouver and Toronto home prices have outpaced Calgary prices even though median Calgary households still earn $20,000 (before-tax) more than Toronto and Vancouver households. So Toronto and Vancouver prices are clearly not tethered to local incomes. They charts below show what’s affordable based on household incomes in different Canadian cities.

Who else believes there is risk?

Some of the most respected and conservative economic analysts in the world believe there is concrete evidence that the Canadian real estate market is at a high risk of a major correction.

Of course, there are also experts like the CEO of Scotiabank and the Chief Economist for CIBC, who feel that these risks are much less likely to affect Canada. It is worth noting that these banks have very large mortgage portfolios and are therefore closely watching these risks and managing their shareholders’ concerns. These same banks have been tightening their mortgage rules.

| Bank | Total Mortgage Balances (CAD) |

|---|---|

| RBC Royal Bank | 281 Billion |

| Scotiabank | 213 Billion |

| CIBC | 202 Billion |

| TD | 192 Billion |

| BMO | 108 Billion |

| National Bank | 68 Billion |

| Total | 1.1 Trillion |

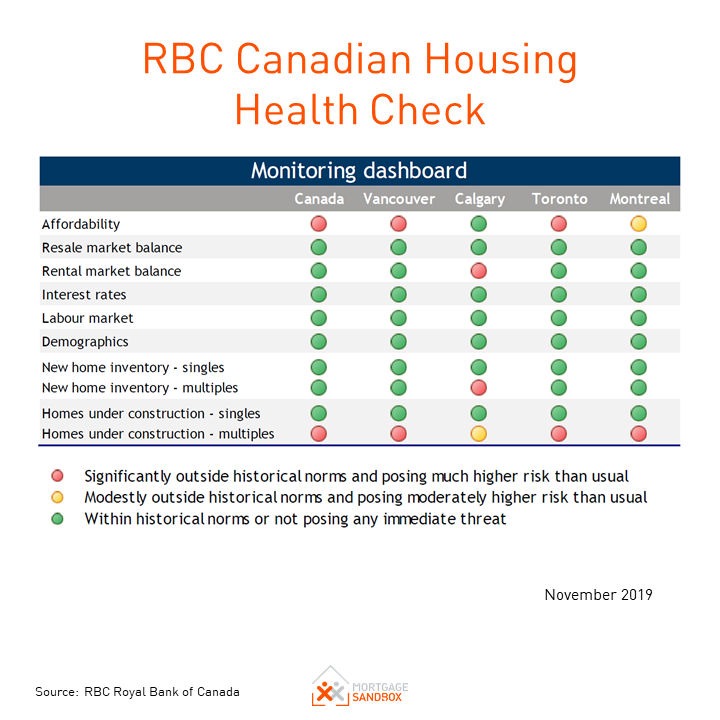

RBC began publishing a periodic report on real estate risk a few years ago as prices in Vancouver and Toronto broke records. They identified high risk factors in every major Canadian city. By their assessment, Calgary and Vancouver seem most vulnerable to a downturn in home buyer sentiment.

What does the Canadian Government think?

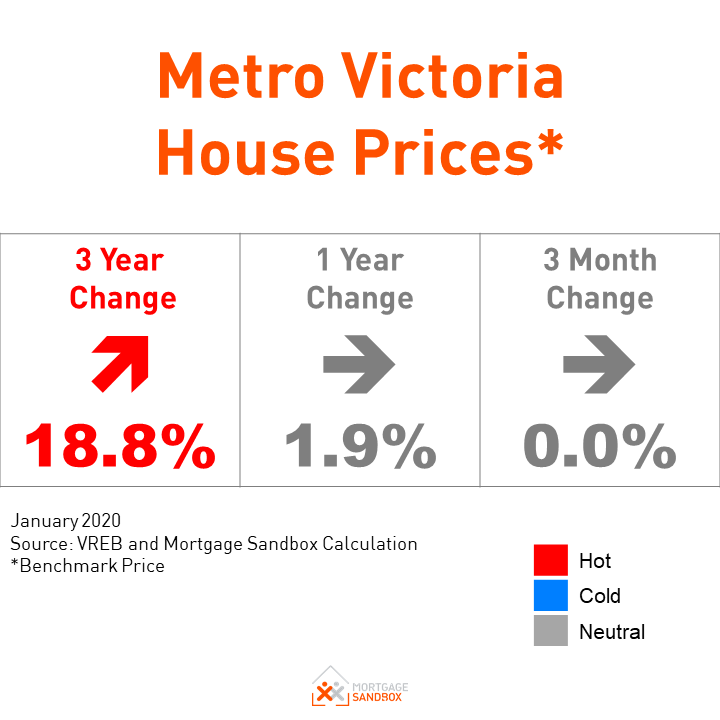

The Canadian Mortgage and Housing Corporation (CMHC) is the federal housing agency mandated to help Canadians buy homes. They believe there is a high degree of overall vulnerability in Victoria and moderate vulnerability in Vancouver, Toronto and Hamilton because of price acceleration, overheating, and overvaluation. Most notably, high evidence of overvaluation is still observed in Toronto, Vancouver, Victoria, and Hamilton where house prices remain far higher than levels supported by economic and demographic fundamentals.

Concerned by real estate market risk, CMHC and the Canadian Federal Bank Regulator began enacting policies as far back as 2008 to reduce how much Canadians could borrow.

2008: Reduced the maximum lifespan of a mortgage from 40 years to 35 years.

2010: Applied a stress test against the 5-year contract rate for mortgages with a down payment of less than 20%.

2011: Reduced the maximum lifespan of a mortgage from 35 years to 30 years.

2012: Reduced the maximum lifespan of a mortgage from 30 years to 25 years on mortgages with a down payment of less than 20%.

2016: Applied a stress test against the 5-year posted rate for mortgages with a down payment of less than 20%.

2016: Banned default insurance on refinances, mortgages greater than 25 years, and single-unit rentals.

2018: Applied a stress test to mortgages with a down payment of greater than 20%.

2020: Recalibrated how the stress test is applied to mortgages with a down payment of less than 20%. Not a material change.

The July 2008 change was presented as part of a "responsible and measured approach by the Government to ensure Canada’s housing market remains strong and to reduce the risk of a U.S.-style housing bubble developing in Canada."

Recently, the federal regulator OSFI mandated that the 6 Canadian Banks with the largest mortgage portfolios set aside more cash in case a financial stress event happens.

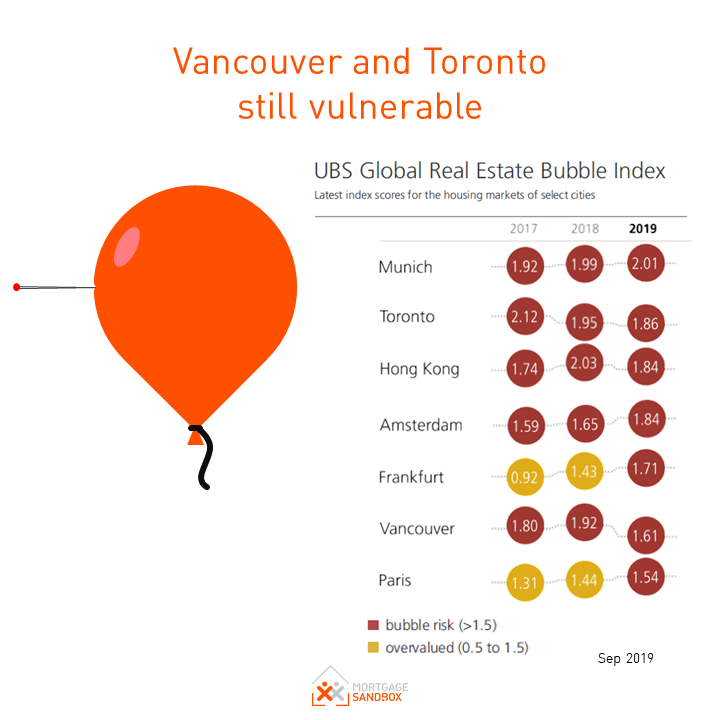

Toronto and Vancouver make this list of global cities at risk of having a real estate bubble. Toronto looks particularly bubble-icious.https://t.co/5LNwPha1W8

— Rob Carrick (@rcarrick) July 26, 2018

What does the Canadian Bank Regulator think about Canadian real estate bubble risk?

The Office of the Superintendent of Financial Institutions (OSFI) the government agency that oversees bank risk says “key vulnerabilities include Canadian household indebtedness” and on June 4th, 2019 raised the amount of capital that Canadian banks need to hold in order to weather a financial crash. Essentially, the regulator ordered Canadian banks to take out a bigger insurance policy against a financial crisis.

This is the same arm of the government that, in January 2018, required Canadian banks to apply a stress test when Canadian borrowers apply for a mortgage.

What does the Bank of Canada think?

In May of 2019, the Bank of Canada updated their Financial System Review and highlighted that the top two Canadian risks are:

Bank of Canada Vulnerability #1: High household debt

Canadian Debt to Disposable Income has been Rising Steadily

“Highly indebted households are those that have a lot of debt relative to their income. They have less flexibility to deal with sudden changes, such as a decline in income or in the price of their home. When many households are highly indebted, the effects of negative shocks on the financial system and the economy are greater.

Overall, the vulnerability associated with high household indebtedness remains significant, although it has declined modestly. As households adjust to changes in mortgage policies and past increases in interest rates, the pace of borrowing has slowed and the quality of new mortgages has improved. Nonetheless, a large amount of debt in Canada is held by highly indebted households.”

By the way, when a Bank of Canada economist says that a vulnerability remains significant that is code for, “Oh jeez, hold on tight!” After reading this quote, it becomes clear that any politicians seeking to remove the stress test or bring back 30-year mortgages to allow Canadians to take on more debt to buy a home have missed an important memo. That type of policy would increase Canada’s chances of a high financial stress event.

In a 2013, the Bank of Canada published a paper that provides past examples of financial stress events. Keep in mind these impacted financial markets and often resulted in recessions, but they did not necessarily result in a significant house price drop. The past high financial stress event listed by the Bank of Canada were:

2007 - Lehman Brothers bankruptcy leads to Great Recession

2001 - Bursting of dot-com bubble

1998 - Long-Term Capital Management collapse

1994 - Mexican peso crisis

1992 - Black Wednesday, European exchange rate mechanism crisis

1989 - Toronto house price collapse

1987 - Black Monday, October 1987 stock market collapse

Bank of Canada Vulnerability #2: Imbalances in the housing market

Okay so the Bank of Canada’s biggest concern is that Canadians are taking out large mortgages to buy housing, and it’s no coincidence that their second most pressing concern is the housing market.

“When house prices grow at a faster pace than can be explained by economic fundamentals, a price correction that leads to financial stress becomes more likely. This can be serious when buyers are highly indebted.

Overall, imbalances in housing have diminished but remain an important vulnerability. Froth from rising expectations of house price growth has declined in housing markets in the Toronto and Vancouver areas over the past two years. While the Toronto market appears to be stabilizing, prices and resale activity continue to decline in Vancouver. Ongoing difficulties in the oil sector are weighing on housing markets in oil-producing provinces.”

Basically, they are saying that if homes become too unaffordable, then there is a risk that eventually prices will drop and make them affordable because every property needs to be sold (i.e., affordable to a buyer)…eventually.

What about other Central Banks?

The Bank of Canada analysis is supported by an October 2017 International Monetary Fund (IMF) Report pointing to Canadian vulnerability, and also by the U.S. Federal Reserve who in a February 2018 presentation identified Canadian housing as so overheated that it exceeded their “Evidence of Exuberance Scale.” The IMF and U.S. Fed were looking at Canada as a whole. Vancouver and Toronto are well above the Canadian average.

On March 11th, the Bank of International Settlements (BIS) issued a warning that the “indicators” they use to predict financial stress are flashing red for Canada.

Based on BIS’ analysis Canada has a better than 50% chance of a financial correction (BIS would call it a “stress event”).

Finally in June, the IMF said that in the event of a downturn, the Canadian banks will be fine but Canadian households are vulnerable. The impact on households would be significant as the share of households with debt at risk (defined as households with mortgage payments greater than 40 percent of income) would increase from 17 percent to 29 percent. If that happened, defaults would rise and the Federal government would have to inject C$15 billion into the Canada Mortgage and Housing Corporation (CMHC).

All of there international institutions are concerned that we have a lot of debt relative to our income, that our regular debt payments are too high relative to our income, and that the situation will worsen as interest rates rise to their natural levels or if a recession brings unemployment and wage reductions.

At the core of these warnings is a belief that people’s loans should not exceed their ability to repay them. Since most Canadian debt is to support home purchases, this means smaller home buying budgets.

Who are the concerned economists?

Risk of a Recession Triggering a Housing Downturn

Most experts say there’s no need to panic just yet, but there are a number of reports you may want to watch to help anticipate future economic conditions. They’re referred to as “indicators,” and they’re what economists watch when checking the health of the economy.

We are watching 5 key early warning indicators of a recession.

1. Inverted yield curve

Inverted Canadian Yield Curve

One of the most reliable indicators of an impending recession is an inverted “yield curve.” Canada has had an inverted yield curve since April of 2019 and the U.S. has had an inverted yield-curve since May 2019.

The “yield” is the interest rate paid to the owner of a bond or short-term debt investment. These investments ask investors to commit their money for differing lengths of time and that is referred to as their “maturity”. Some investments require a one-month commitment while others last 30 years. The yield-curve compares how must interest investors expect for different length maturities. Typically, when an investor commits their cash for a longer timeframe, they expect more interest in return. If you’re an investor, and you’re given the choice for investing for a month or investing for 10 years, you would say, ‘Hey, a lot more can change in 10 years than in 1 month. I’m going to demand a higher interest rate, a higher yield,” and that’s why the yield curve is positive sloping – most of the time.

An inverted yield curve, or downward sloping yield-curve, describes a situation where investors' expectations are opposite to what would be normal. They are buying long-term investments that pay less than short term investments. The only logical explanation for this behaviour is that they expect short-term rates to drop significantly in the future. They believe they will make more money accepting a lesser return on a long-term investment now because in the future the investment will pay more than a short-term investment.

There is a Canadian yield-curve and a U.S. yield-curve and since the Canadian economy is intertwined with the U.S., you should probably pay attention to both.

This article will explore other recession predicting indicators, however, research by the U.S. Federal Reserve has found that the yield curve—specifically between 3 months and 10 years—significantly outperforms other indicators in predicting recessions six to eighteen months in advance.

Every recession in the past 50 years has been preceded by an inverted yield-curve so it has a high correlation, but it is not necessarily a guarantee of a recession. This time could be different.

Nevertheless, if you believe the yield curve is an accurate indicator then a recession is very likely in 2020.

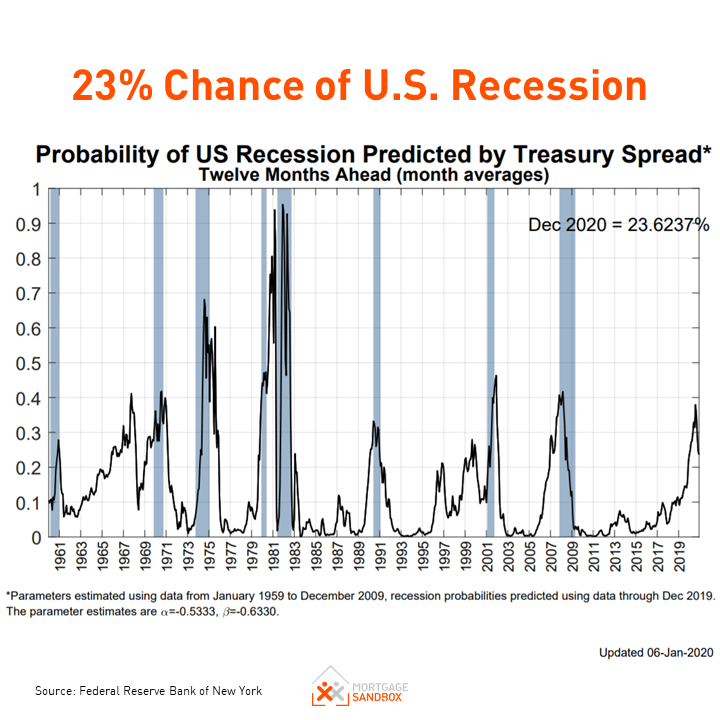

2. The Federal Reserve Bank of New York’s recession probability model

What happens to the U.S. economy usually spills over into Canada because the U.S. buys 80% of Canadian exports.

Based on the spread between the 10-year and three-month Treasury yields, the regional New York Fed compiles data about the likelihood of a recession in the year ahead. It’s updated typically at the beginning of each month.

To be honest, this indicator is calculated using the yield-curve so it would be misleading to imply this is a separate indicator from the yield-curve. However, it’s helpful that they use the yield curve to calculate the likelihood of a recession. In August 2019, the Federal Reserve’s model calculated a 23% chance of a U.S. recession by August 2020 and from the chart, we can observe that the likelihood of recession is rising quickly. Click here to see the latest Recession Probability Model by the U.S. Fed.

Even though it has only reached the 23 percent threshold, earlier in 2019 it was nearly 40% and there are many economists who forecast that a recession could happen in 2020. Below, Conference Board chart forecasts the U.S. economy could contract soon.

Conference Board U.S. Leading Indicator

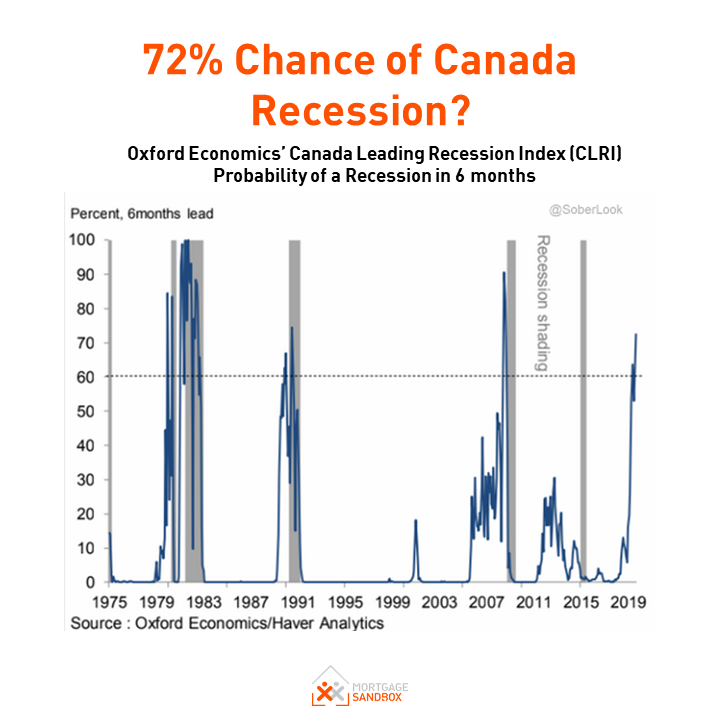

The Bank of Canada doesn’t publish a model like this for predicting a Canadian Recession but the Macdonald-Laurier Institute and Oxford Economics do. Oxford Economics believes there is a 72% chance of a recession in 2020.

Oxford Economics Canada Leading Recession Index (CLRI)

The most recent Macdonald-Laurier Institute Leading Economic Indicator (LEI) update reveals that Canada’s trend of slow economic growth is set to continue for the first half of 2020.

According to the institute, “this slow growth is not just restricted to Canada. Large parts of Europe and Japan have essentially stalled.” However, despite fears that 2020 could be the year that heralds in a new recession, they have cautioned that such fears are premature.

3. Vehicle Sales

Manufacturing accounts for accounting for 12% Ontario GDP and 7% of British Columbia’s. In Ontario, much of that is building cars destined for the U.S.

When auto sales in Canada and the U.S. drop then there are fewer orders to factories to replenish the dealership lots, so watching auto sales is a good leading indicator of whether factories will idle capacity or layoff workers. Canadian Auto sales did not go well in 2019.

No need to panic

Predicting when a recession will arrive is nearly impossible. Pay attention to these indicators, but there will never be a clear-cut signal.

If a recession happens, your retirement savings should already be in a balanced investment portfolio that reduces your exposure to economic impacts. Your home is where you live and you likely won’t sell it for years. You may lose out on a raise or bonus but most people will come out on the other side in the same job they started.

Recessions traditionally happen every 7 years and they’re a normal part of life. They will continue to happen from time to time and the world will be fine.

The idea in this situation is simply to take big financial fewer risks when a recession seems imminent. For example, don’t buy a house with the intention of flipping it because you may have trouble finding buyers in a recession. If you’re buying it to live in, then it’s not as risky a financial transaction so long as you’re comfortable with the monthly payments.

Cause for optimism

A risk event is, by definition, never guaranteed to happen.

In July 2008, the benchmark price of a Greater Vancouver house was $800,000 and today it stands close to $1.4 million. The growth in Greater Toronto has been more dramatic rising from just $380,000 in July 2008 to $945,000 today.

Although the government’s intervention has succeeded in moderating house prices and mortgage debt, without its intervention over the past 10 years Canada would be in an even more precarious situation.

This article is important in the spirit of transparency because many in this industry avoid discussing the risks of home ownership, which we believe home buyers should be aware of. People should consider risks when borrowing money, but ultimately the only way to mitigate the risk of investing in a home is to buy it as a place to live. If you buy a condo and it drops in value between the purchase and the date when you want to trade-up to a townhome, the price of the townhome you’re hoping to buy next will have dropped in value too. If buying a home primarily as an investment, the short term market outlook is a much more important consideration.

Our platform matches you with local, pre-screened, values-aligned Realtors and Mortgage Brokers

Shared values lead to better working relationships.

Like this post? Like us on Facebook for the next one in your feed.

Sources:

CMHC Housing Market Assessment: Housing Market Assessment publications evaluate the extent to which there is evidence of problematic housing market conditions in selected Census Metropolitan Areas (CMAs). Results are updated on a quarterly basis.

RBC Canadian Housing Health Check (November 2019): A risk assessment of major Canadian housing markets.

Canadian Real Estate Association MLS® Home Price Index: The MLS® Home Price Index (HPI) comprises a set of software tools configured to provide time-related indices on residential markets within territories of participating real estate boards in Canada.

UBS Global Real Estate Bubble Index 2019: This annual assessment of real estate bubble risk concludes that the greatest in Munich, Toronto, Vancouver, Frankfurt, Paris and Amsterdam.

New York Fed: Probability of a Recession

Scotiabank Auto News Flash, January 7, 2020: Canadian auto sales fell back modestly in October.