Mortgage Interest Rate Forecast – How much will mortgage rates rise?

As we approach the new year, economics departments of the big banks and credit unions issue their latest interest rate forecasts for 2018 and 2019. They are focused more on the bond market yields and the Bank of Canada rate, but those rates are directly correlated with mortgage rates.

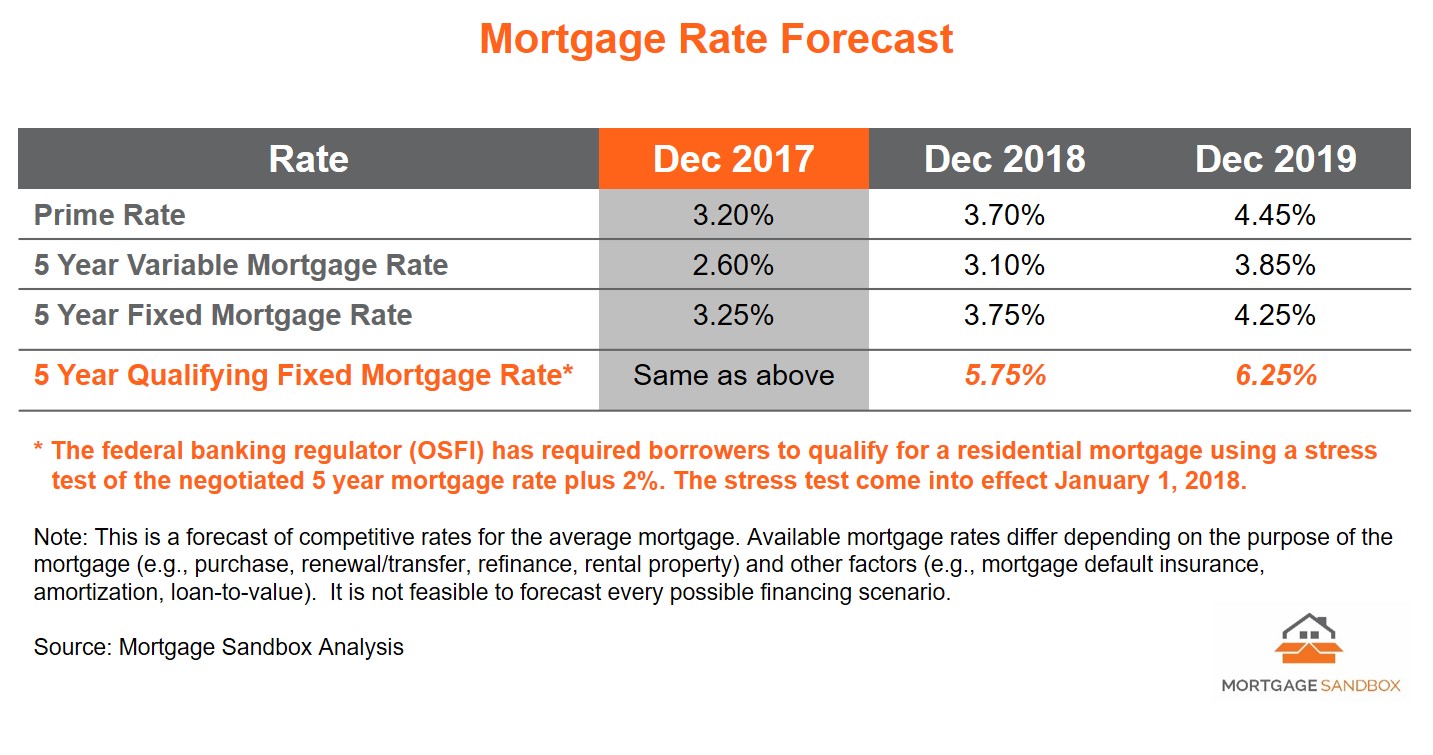

Mortgage Sandbox has analyzed the bank predictions and forecast mortgage rates through to 2019.

In this report you will learn:

1. How much rates will rise in 2018 and 2019

2. How to use this information to your advantage

How much will rates rise?

Prime Rate Forecast

The Prime Rate is used to calculate the interest rate on variable rate mortgages and home equity lines of credit (HELOC). The Prime Rate is a floating rate that changes monthly so that the interest charged on a variable rate mortgage or HELOC can vary from month-to-month.

Be careful with lenders quoting their Prime Rate because not all lenders use the same “Prime Rate” rate for all loans. Some lenders have a higher prime rate specifically for mortgages. For example, at the time of writing this article TD Prime Rate was 3.20% but TD Mortgage Prime was 3.35%. The difference between the two is small but significant. Over the course of a year the difference in rates could save you hundreds of dollars.

There aren’t a lot of forecasts of the Prime Rate but it is closely related to the Bank Rate (the rate at which banks can borrow from the Bank of Canada).

Mortgage Sandbox compiled the forecasts from 7 leading Canadian financial institutions and on average the Bank Rate is expected to increase by 1.25% by the end of 2019. Presently the Bank Rate is 1% and the Prime Rate is 3.2% so by the time the Bank rate hits 2.25%, we believe the Prime Rate will be approximately 4.45%.

If you have a closed 5-year variable rate mortgage set at Prime minus 0.6% then your rate today would be 2.60% but by the end of 2019 your mortgage interest rate could be 3.85%.

5-year Fixed Mortgage Rate Forecast

Forecasts of the 5-Year Fixed Mortgage Rate tend to predict the “benchmark” or “posted” mortgage rate, which isn’t helpful to home buyers. The “benchmark” or “posted” rate is the published rate from the Top Canadian Banks and is used by Statistics Canada, but most Canadians can get a much better rate.

For example, Bank of Montreal’s “posted” 5-year fixed rate is 4.99% but on the same webpage they advertise a special for a closed 5-year fixed rate of 3.49%. That’s a 1.5% difference between the posted rate and the actual rate.

Mortgage Sandbox developed its own forecast of the 5-year fixed mortgage rates by analyzing predicted increases in the 5-year Government of Canada Bond Rate. 5-year government bonds and 5-year mortgage rates move together so one is a good guide for the other.

Most economists expect 5-year rates to rise by approximately 1% by the end of 2019 which would translate into a 4.25% 5-year mortgage rate.

This rate is the cost to a home owner but anyone applying for a new mortgage or refinancing will need to qualify for a mortgage using a 2% stress test applied to their 5-year interest rate. This means that by 2019, in order to get a mortgage, new home buyers will need to show a bank they can qualify for a mortgage with a rate of 6.25%.

What you should do

1. Lock in a 5-year fixed rate

2. Buy a home now or wait for the next cycle

Lock in a 5-year fixed rate

The forecasts predict that variable rates will rise more than 1% over the next 2 years, and forecasts from TD and Scotiabank predict further rate increases in 2020 and 2021. Current rates are at the low end of the 10-year range so there is a good likelihood these forecasts are correct.

Although the forecast rate increases are not guaranteed to happen, if you are getting a new mortgage or renewing an existing mortgage, it would be prudent to lock in your mortgage rate for 5 years. You will be in good company because CMHC says 72% of home buyers in 2017 chose a fixed rate mortgage.

Buy a home now or wait for the next cycle

If you were planning to buy in the next 3 years, try to buy in 2018 because you will be able to afford less home in subsequent years as rate increases erode your home buying budget. This effect is amplified by the addition of the qualification stress tests in January 2018.

Provincially regulated Credit Unions and private lenders are not required to apply the stress test like the national banks, but they are unlikely to accept all of the applications declined by the big banks.

To get access to experts who know what every lender is doing, consult a mortgage broker. They have the broadest number of options to find you suitable financing.

If you’re not ready to buy a home, you can wait until rates begin to drop again but there is no guarantee they will ever be this low again. The previous low was in 1950 when it dropped to 1.5% which is still half a percent higher than today. During WWII when food was rationed the Bank Rate was 2.5%.

Like this post? Like us on Facebook for the next one in your feed.