Canada’s Mortgage Renewal Wave | Navigating Choppy Waters

A mortgage renewal “wave” is crashing over millions of Canadian households in 2025–26, most acutely in Toronto and Vancouver. After half a decade of record-low pandemic rates, those renewing now face steeper monthly payments, testing family budgets and investor nerves alike.

How We Got Here

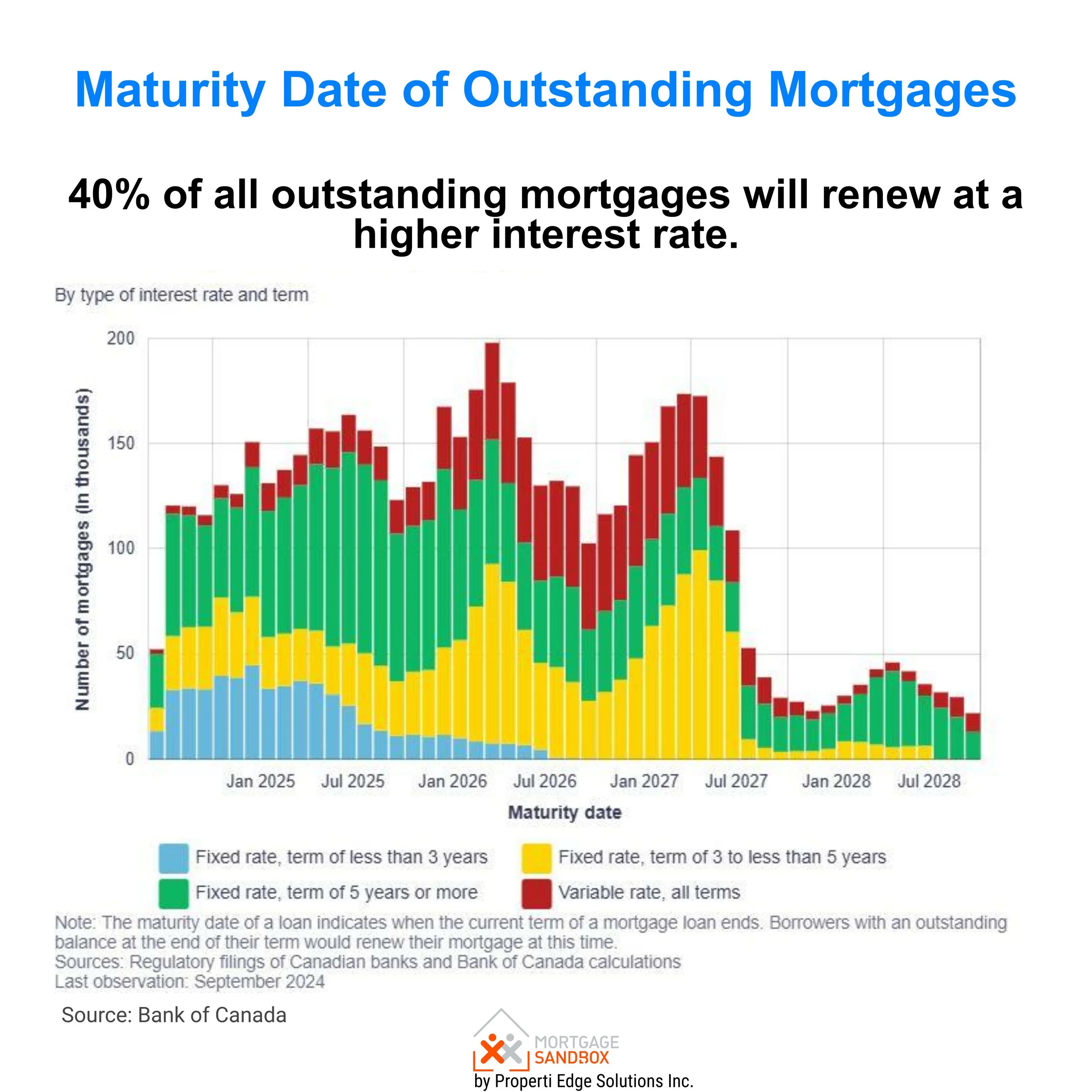

During the pandemic, many Canadians locked into 1–2% interest rates. Now, rates hover around 4–5% despite recent Bank of Canada cuts. Roughly 60% of outstanding mortgages, about 1.2 million loans, will be renewed by the end of 2026. Most borrowers are set to see a 10–20% increase in monthly costs, with five-year fixed-rate holders facing the steepest jump.

How Many Households Are Impacted?

The Bank of Canada estimates 60% of those renewing in 2025 and 2026 will see higher payments, and 40% of all mortgage holders will experience increased costs.

On average, monthly obligations will rise 10% in 2025. For a typical $500,000 mortgage, that means around $320 more per month. For many families, that’s the price of groceries or child care. Surveys show about 22% expect increases large enough to force major financial cuts, while a quarter expect their payments to decrease or remain unchanged.

Owner-Occupiers vs. Investors: Who Feels the Pinch?

Owner-occupiers

People living in their own homes have little practical flexibility to “sell and run” if costs surge; they always need a place to live. As a result, most opt to cut back discretionary spending, negotiate with lenders, or extend their amortization to buffer the shock, rather than move. Recent behaviour shows these borrowers are more likely to buckle down than panic sell—even if it means skipping a vacation or eating out less.

Investor owners

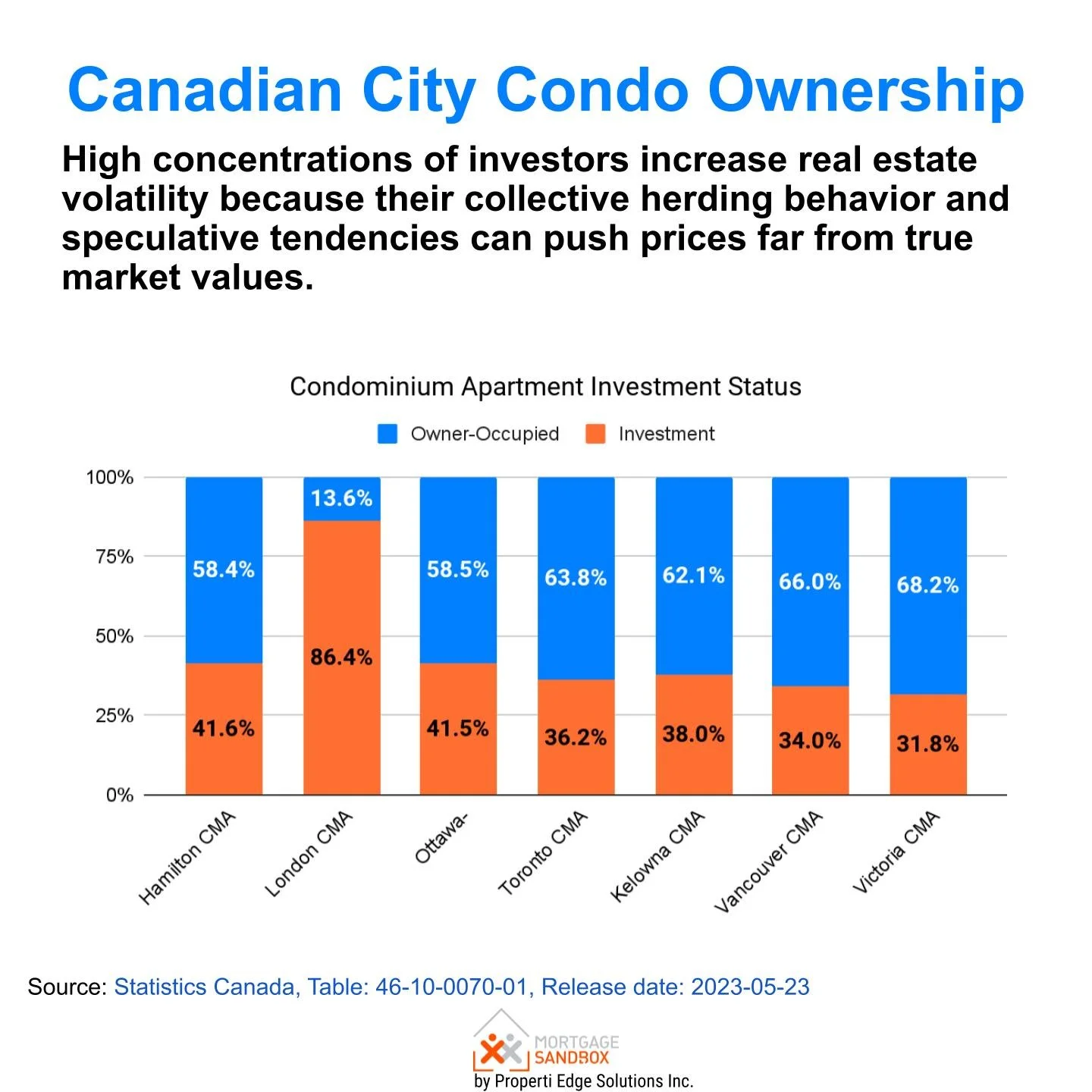

On the other hand, investors are more pragmatic. When mortgage costs rise and market rents stagnate or fall, as is happening in parts of Toronto and Vancouver, property investors may see their monthly cash flow turn negative. Unlike owner-occupiers, investors have less attachment to their properties: if the holding no longer yields a profit, many will list for sale or try to offload less profitable units. This is why some city landlords are now offering incentives like free rent or cash to attract tenants, especially where oversupply and affordability issues collide.

The impact of landlord behaviour debends on the concentration of investor owners in the local area. London, Hamilton and Ottawa have high investor concentrations, but because of the lower up-front cost of a rental property the mortgages might be more manageable. Toronto and Vancouver investors likley have the largest mortgages and 1 out of every 3 rental apartments is investor owned. That makes the Vancouver and Toronto markets acutely vulnerable to an investor exodus. Landlords cashing in their equity to avoid losing money every month with the intention to re-enter the market at more favourable conditions.

Will Renewals Crash the Market?

So far, the market has weathered the storm, albeit with a few leaks. Toronto has already experienced a significant double-digit correction. There’s been concern that a surge in forced selling, especially by leveraged investors, could trigger steep price drops in expensive cities like Toronto and Vancouver.

While home prices are expected to fall lightly in 2025 (about 2% nationally, with bigger drops in Ontario and B.C.), most analysts believe a crash is unlikely barring a major job market deterioration or surprise rate hikes (to fight resurgent inflation).

Their reasoning?

Strong household equity

Ongoing population growth, and

Robust employment.

But don’t expect a smooth ride. Stretched budgets will curb spending, investment properties may come up for sale, and credit stress could rise. In the next year or two, Toronto and Vancouver may see modest price declines, slightly higher rents, and slower new housing construction. A “crash” remains possible if unemployment unexpectedly spikes or the global outlook worsens.

Despite “the pain” of this renewal wave, most Canadian homeowners and the housing market are likely to muddle through, not collapse. For households, it will mean careful belt-tightening; for investors, renewed scrutiny of the bottom line.

For policymakers, a reminder: rate cycles are driven by economic fundamentals, and there are limits to how the government can interfere to lower borrowing costs, even with the best of intentions.

Sources:

Bank of Canada Staff Analytical Note 2025-21

Bank of Canada: Canada’s Mortgage Market – A Question of Balance

TD Economics: CA Mortgage Renewals

Bank of Canada Financial Stability Report 2025

Financial Post: Canada Mortgage Renewal Wave Cresting

Global News: Canadians’ Mortgage Renewal Anxiety, Monthly Payments Survey

Urbanation: Two-Thirds of Rental Buildings Offering Incentives in Q2

Financial Post: Toronto Landlords Chasing Tenants with Free Rent, Incentives