Bank of Canada Holds Steady Amidst Trade Winds: A Cautious Calm for Mortgages

In a move widely anticipated by economists, the Bank of Canada today opted to maintain its policy interest rate at 2.75%. This decision, the third consecutive hold, signals the central bank's cautious navigation of a resilient domestic economy amidst the persistent headwinds of a global trade war, instigated by the United States.

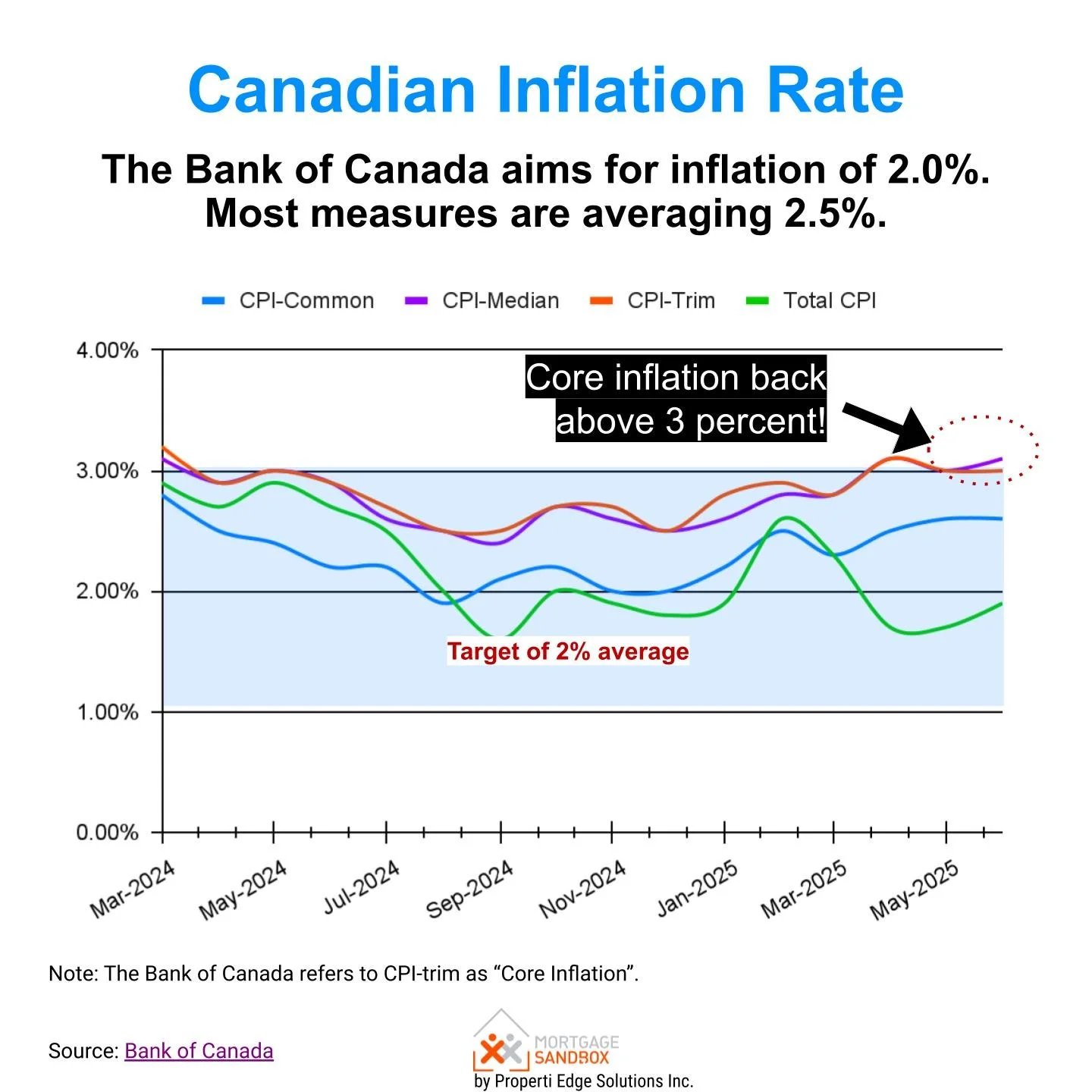

Governor Tiff Macklem, in his prepared remarks, underscored the "clear consensus" within the governing council for this pause. The Canadian economy has demonstrated a surprising fortitude, resisting a sharp deterioration despite the imposition of U.S. tariffs. Furthermore, underlying inflation, a perennial concern for central bankers, has shown a degree of stubbornness, complicating any immediate inclination towards monetary easing. This echoes the Bank's previous decisions in April and June, both similarly influenced by the prevailing global trade uncertainties.

While recent trade agreements struck by the U.S. with Japan and the European Union have somewhat assuaged fears of a "severe and escalating" global trade war, Governor Macklem was quick to temper expectations of a return to unfettered global commerce. The nature of these deals, he noted, suggests that "the United States is not returning to open trade," implying that a degree of protectionism will remain a fixture of the international economic landscape.

The Bank's monetary policymakers are keenly observing the impact of these tariffs on business activity and demand for Canadian exports, as well as the extent to which higher import duties are being passed on to consumers. With the effective U.S. tariff rate on Canada currently estimated at seven or eight percent—a five-percentage-point increase since the year's outset—the vigilance is warranted. However, the Bank also assumes that the vast majority of Canadian goods will ultimately be exempt from these duties, thanks to compliance with the Canada-U.S.-Mexico Agreement (CUSMA), as businesses adapt to the new trade realities.

Notably, the central bank's accompanying Monetary Policy Report once again refrained from offering a single, definitive economic forecast, reflecting the continued opacity of the global trade environment. Instead, it presented various scenarios, each acknowledging the enduring presence of tariffs, ranging from a persistent status quo to potential de-escalation or further escalation. In the baseline "status quo" scenario, the Bank anticipates a rebound in the Canadian economy through the remainder of the year, following an estimated annualized real gross domestic product decline of 1.5% last quarter.

Implications for Canadian Mortgages

For Canadian homeowners, particularly those with variable-rate mortgages, today's decision brings a welcome period of stability. As the Bank of Canada's policy rate directly influences the prime rates offered by commercial banks, variable mortgage payments are expected to remain relatively unchanged until at least the autumn. This provides a valuable window for households to assess their financial positions and plan for future renewals without the immediate pressure of fluctuating payments.

Conversely, the decision will have very little direct impact on five-year fixed mortgage rates. These rates are primarily influenced by the bond market, which tends to price in longer-term expectations for interest rates and economic growth, rather than immediate central bank adjustments. While the overall economic outlook and inflation trajectory can indirectly affect bond yields, the Bank of Canada's current hold, driven by a desire for stability amidst trade uncertainty, is unlikely to cause significant short-term shifts in fixed-rate offerings. Borrowers approaching renewal on fixed-rate mortgages should continue to monitor bond market movements and consult with their lenders to secure the most favourable terms.