Mortgage Renewal Shock: What homeowners can do to soften the blow

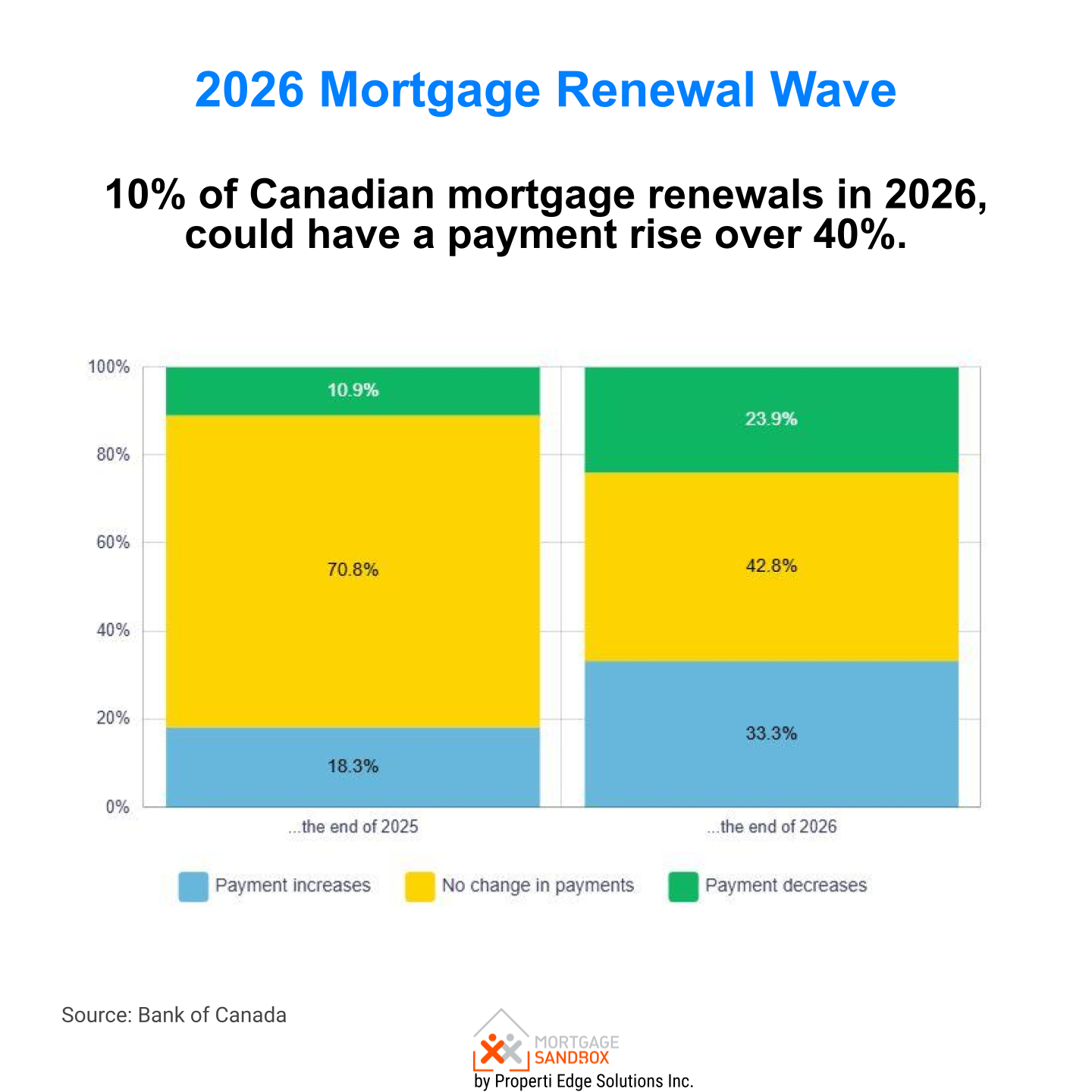

Many Canadians who took out mortgages in 2021 will feel significant financial strain in 2026. Rising rates, stretched amortizations, and tighter lending standards mean higher payments at renewal. Here is your guide to what homeowners can do to soften the blow.

The End of Ultra-Cheap Mortgages

In 2021, Canadian borrowers acted reasonably in a situation that now seems unreal.

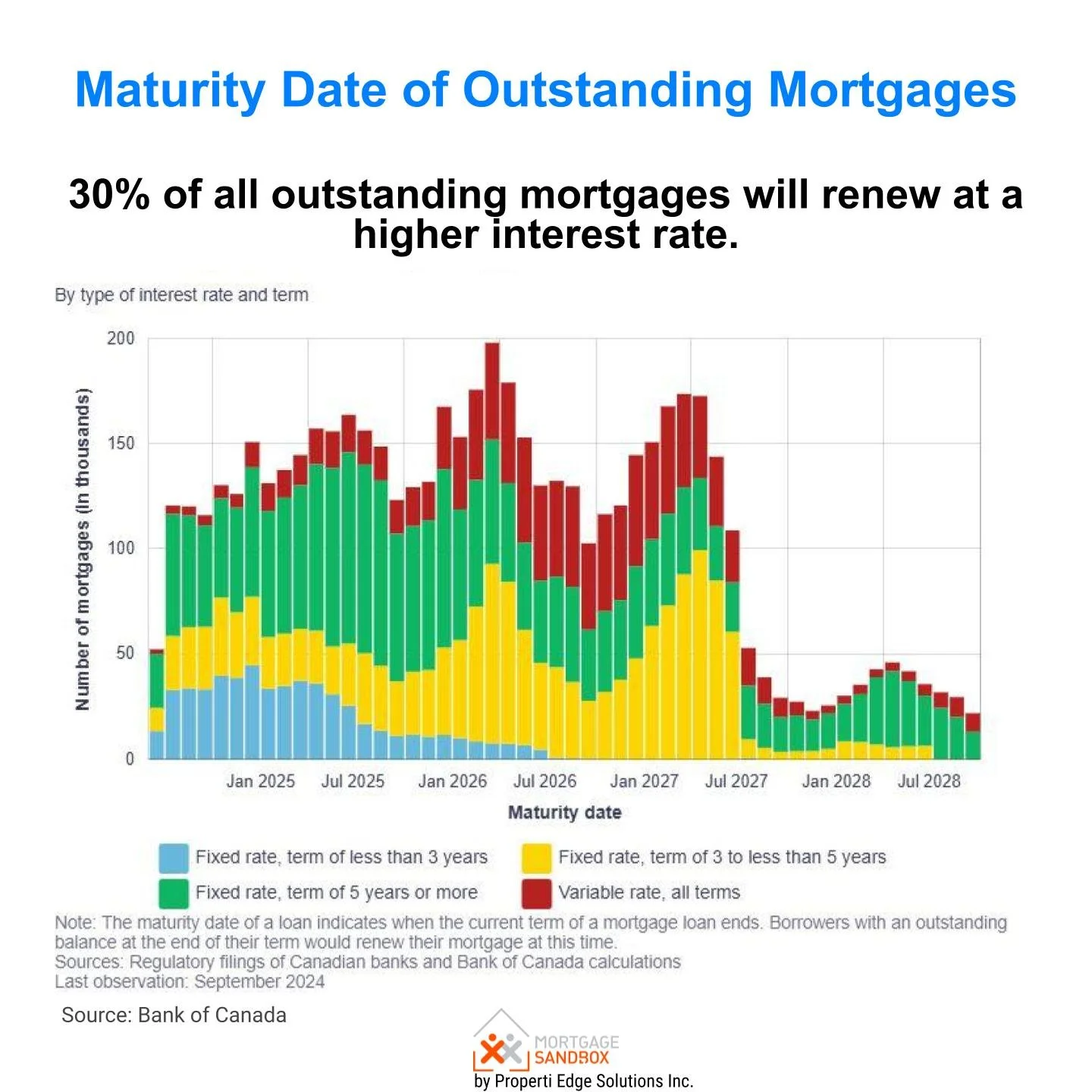

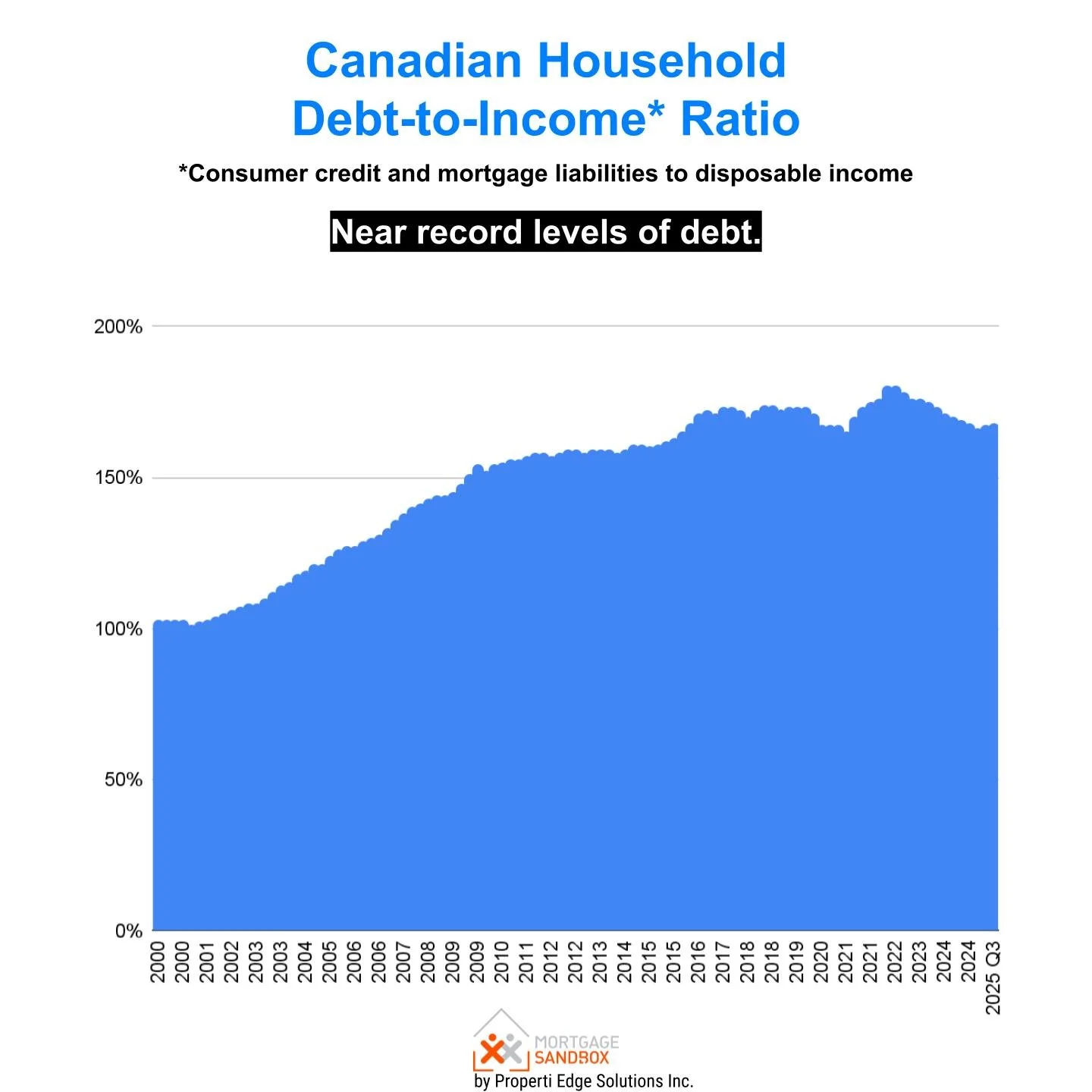

Extremely low interest rates, the increase in remote work arrangements, and a fear of missing out on rising home prices led many households to stretch their budgets for larger homes and bigger mortgages. These loans are set to renew in 2026 and 2027, marking the definitive end of the era of ultra-cheap money.

For a significant number of these borrowers, the calendar will bring about an effect that the market has not yet reflected and it will clearly highlight the impact of years of rising interest rates through a noticeable increase in monthly payments.

Economists refer to this phenomenon as "payment shock," while homeowners might express their frustration in more colourful language around the kitchen table.

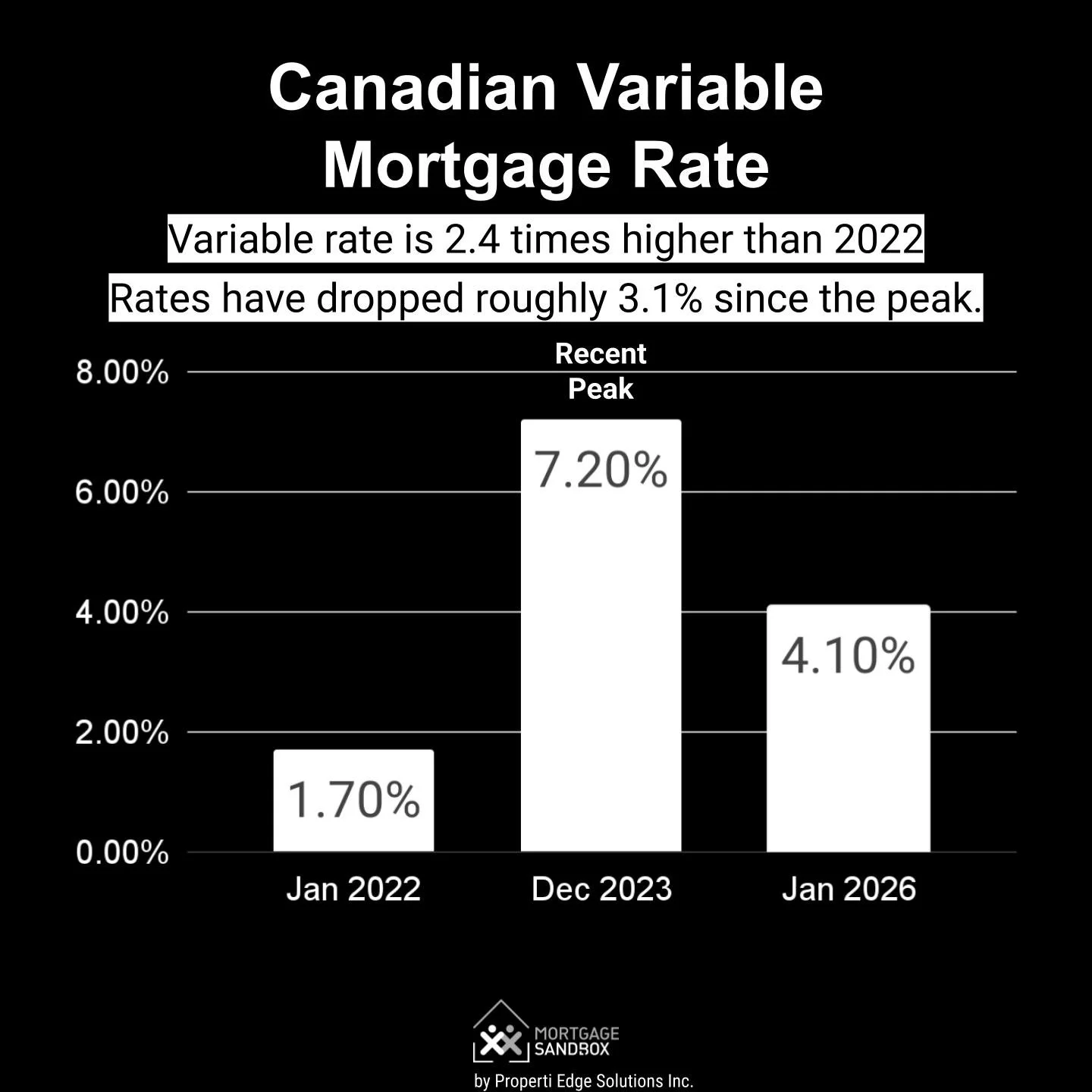

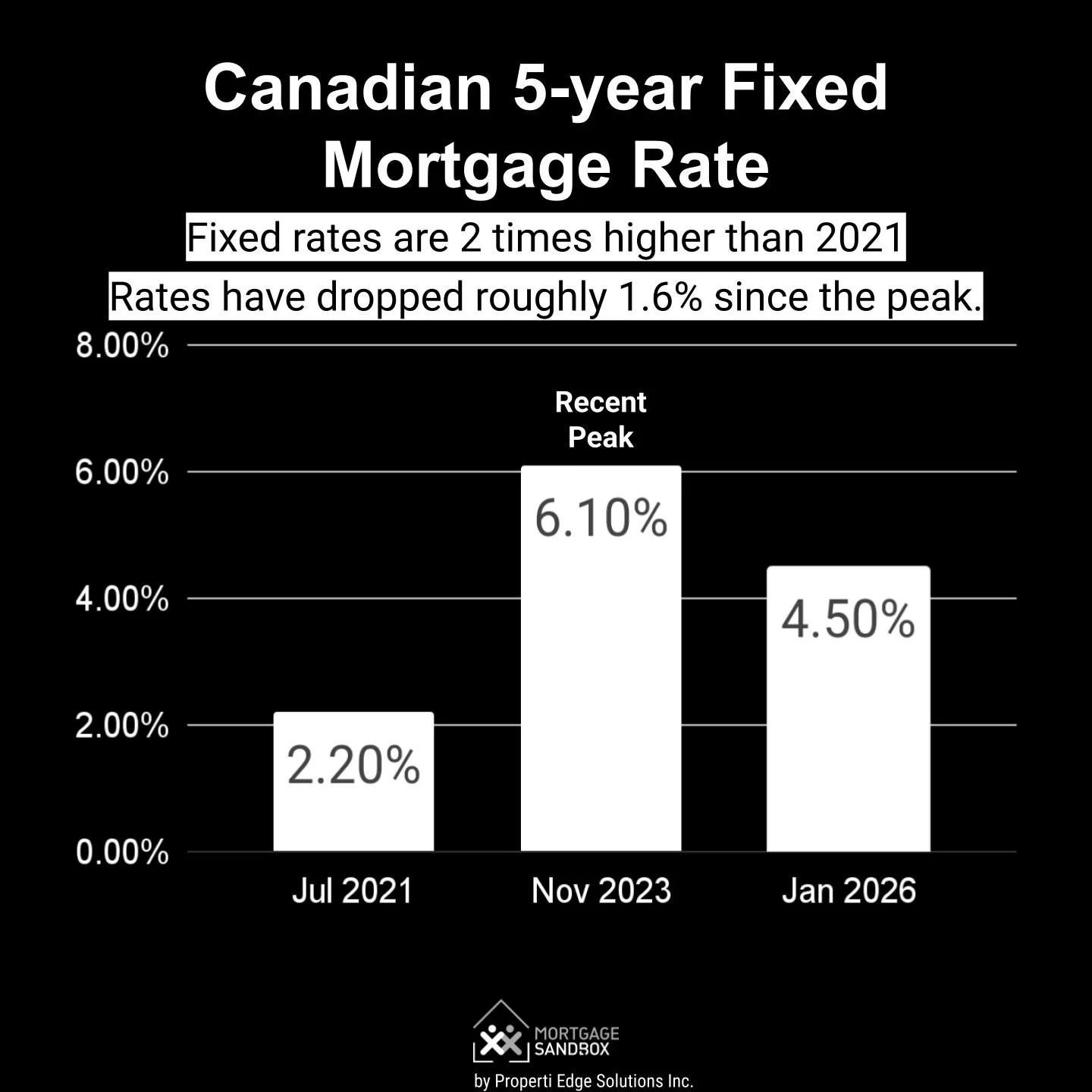

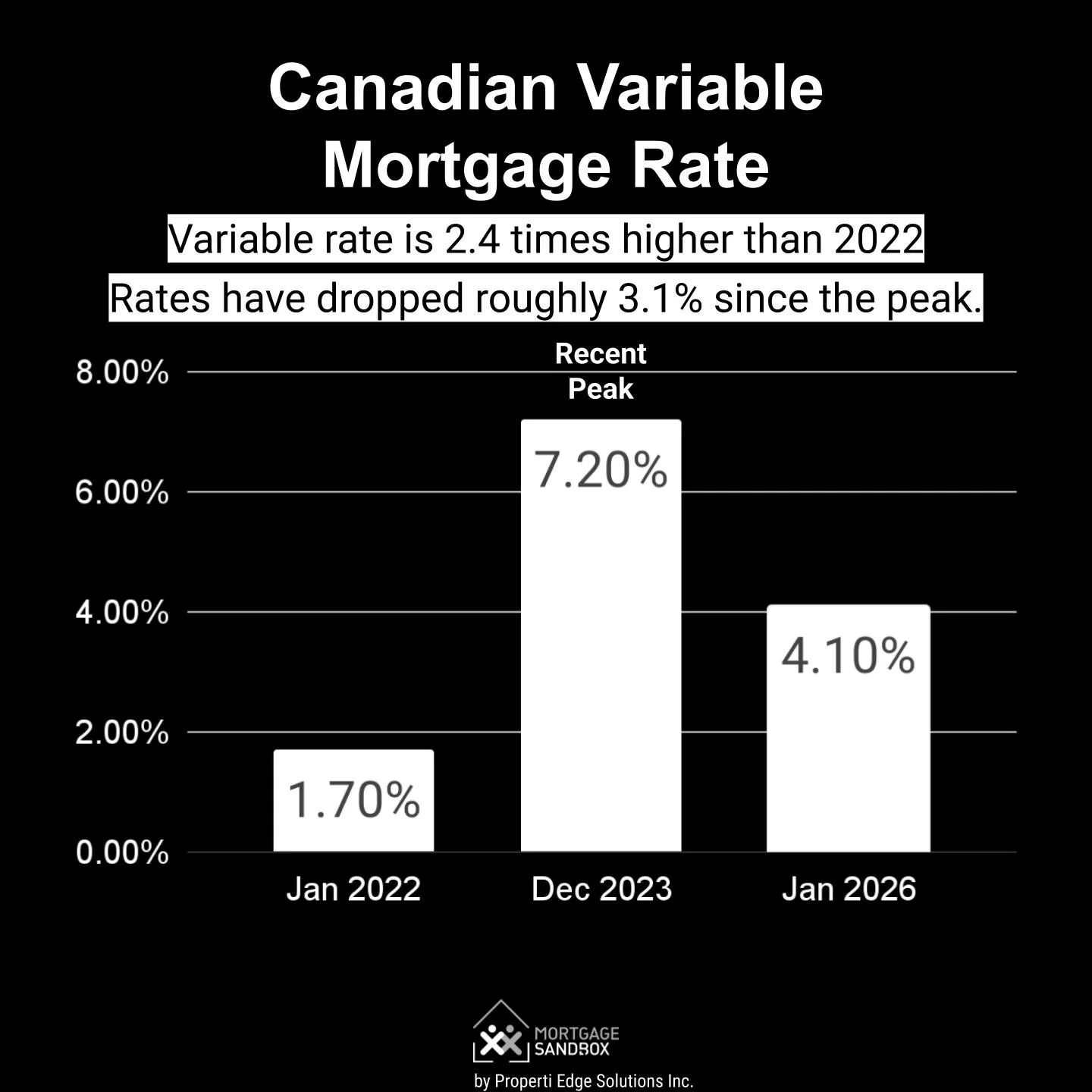

How payments rise at renewal

The first and most obvious reason payments will increase at renewal is that mortgage rates today are simply higher than the old rates. Many five‑year fixed mortgages originated in 2021 were priced around 2%. Even if the Bank of Canada lowers its policy rate by 0.25% again in 2026, renewal rates in 2026–27 are still expected to land several percentage points above those pandemic lows, translating into double‑digit percentage increases in monthly payments for borrowers who keep the same amortization and term type.

Variable‑rate borrowers face a more subtle problem. During the rate run‑up, many held “fixed‑payment variable” mortgages, where the monthly payment stayed constant even as rates rose.

Behind the scenes, however, more and more of that payment went toward interest costs, leaving less to pay down the loan balance.

When a borrower is repaying their mortgage more slowly than scheduled, the amortization period, the expected duration for full repayment, extends without notice. For instance, instead of staying on track to pay off the loan in 25 years, the borrower may end up on a much longer timeline. In some cases, negative amortization can occur, where the interest costs surpass the borrower's payment, resulting in unpaid interest being added to the mortgage balance.

When the repayment schedule is off track at the time of renewal, the lender must negotiate with the borrower to get them back onto a realistic payment plan. This often involves increasing payments so that the loan balance begins to decrease again.

Policy decisions can amplify these pressures. During the 2023 rate spike, some lenders provided temporary relief options, such as interest-only periods, extended amortization, or capitalized interest, which kept monthly payments low. However, as these concessions come to an end, borrowers will transition from these reduced payments to fully amortizing schedules at higher interest rates. This can create a sudden and challenging financial adjustment, especially when combined with other rising cost-of-living pressures.

Meanwhile, regulators have expressed concern about highly leveraged households, particularly among investors, prompting lenders to adopt a more conservative approach when renewing or restructuring risky loans.

Other forces drive up payments

In addition to interest rates and amortization periods, several other issues are influencing this trend.

Some borrowers may reach the maximum allowable amortization periods.

In cities like Toronto and Vancouver, where property values have decreased by 10 to 20 percent since Spring 2022, loan-to-value regulations may restrict borrowers' ability to extend their payments over a longer amortization.

In many cities, rental rates have been declining. Combined with the drop in property values, this means that investors may find their lenders less willing to provide favorable restructuring options.

Lender typically use renewal as an opportunity to normailize the mortgage. Households that accepted short-term payment deferrals or interest-only arrangements will likely face the removal of these concessions. As a result, they will not only experience an increase in payments from a “low rate to a higher rate,” but also transition from a “subsidized payment to a full payment at a higher rate.”

How to soften the blow with your current lender

Borrowers have options when it comes to dealing with renewal letters from lenders. Here are some strategies to negotiate with your existing lender:

Blend-and-extend the Term

A “blend-and-extend” arrangement combines your current mortgage rate with a new rate over a new term. This approach smooths out the increase in payments and can help you avoid any prepayment penalties associated with breaking your mortgage. While the blended rate may still be higher than your original rate from 2021, it can be lower than your lender's standard renewal offer.

Extend the Amortization

Another effective strategy is to extend the amortization period of your mortgage. For example, you can stretch the remaining term from 25 years to 30 or even 35 years, if allowed. This adjustment spreads the same mortgage balance over more payments, which reduces your monthly payment amount. Lenders may consider moderate extensions as straightforward administrative changes during renewal; however, extending beyond the original amortization limits might encounter regulatory or risk-related constraints.

Lump Sum Payment

Some borrowers can take a different approach by making a larger payment before renewal. A lump-sum prepayment using savings, bonuses, or other assets to reduce the outstanding principal on which the new, higher rate is applied. Even small early repayments can significantly decrease your recalculated monthly payment, especially when combined with an extension of the amortization period.

Lower Payment Frequency

For those utilizing accelerated bi-weekly payment options, consider changing how you make payments. Switching from accelerated bi-weekly to standard bi-weekly or monthly payments can lower each installment, although this may slow down the reduction of the principal. Additionally, if you have been making optional top-up payments (extra amounts added to each payment), reducing or eliminating these can improve your monthly cash flow while keeping the core mortgage intact.

When It Pays to Look Elsewhere

In the mortgage markets, loyalty often doesn’t pay off. About four months before your mortgage matures you can lock in a rate offer from a competing lender or mortgage broker. New lenders eager for business often lower their rates, especially for borrowers with solid incomes, good credit, and significant prime mortgages.

For some borrowers, switching lenders primarily hinges on the rate because a lower interest rate can help offset an increase in monthly payments.

Others might take this opportunity to change their mortgage type, opting for a shorter-term fixed rate if it's attractive, or a variable rate if they are willing to take the risk of potential future cuts.

It’s important to not become overly fixated on rates, be sure to investigate discharge fees, the ability to add a home equity line of credit, and how penalties are calculated.

In any case, it’s essential to weigh the paperwork and hassle against the potential savings over the next term. While Canada’s wave of mortgage renewals won’t threaten the financial system, it will challenge household budgets in a way that the low-rate era did not.

It’s crucial to treat renewal not as a simple formality, but as a strategic financial decision. Understand the reasons behind rising payments, know which options are available, and leverage the competition among lenders to your advantage.