Why the Bank of Canada Rate Fell, But Your New Mortgage Rate Looks High

How falling variable rates, sticky 5‑year fixed rates, and the mortgage stress test are capping what home buyers can afford in today’s market.

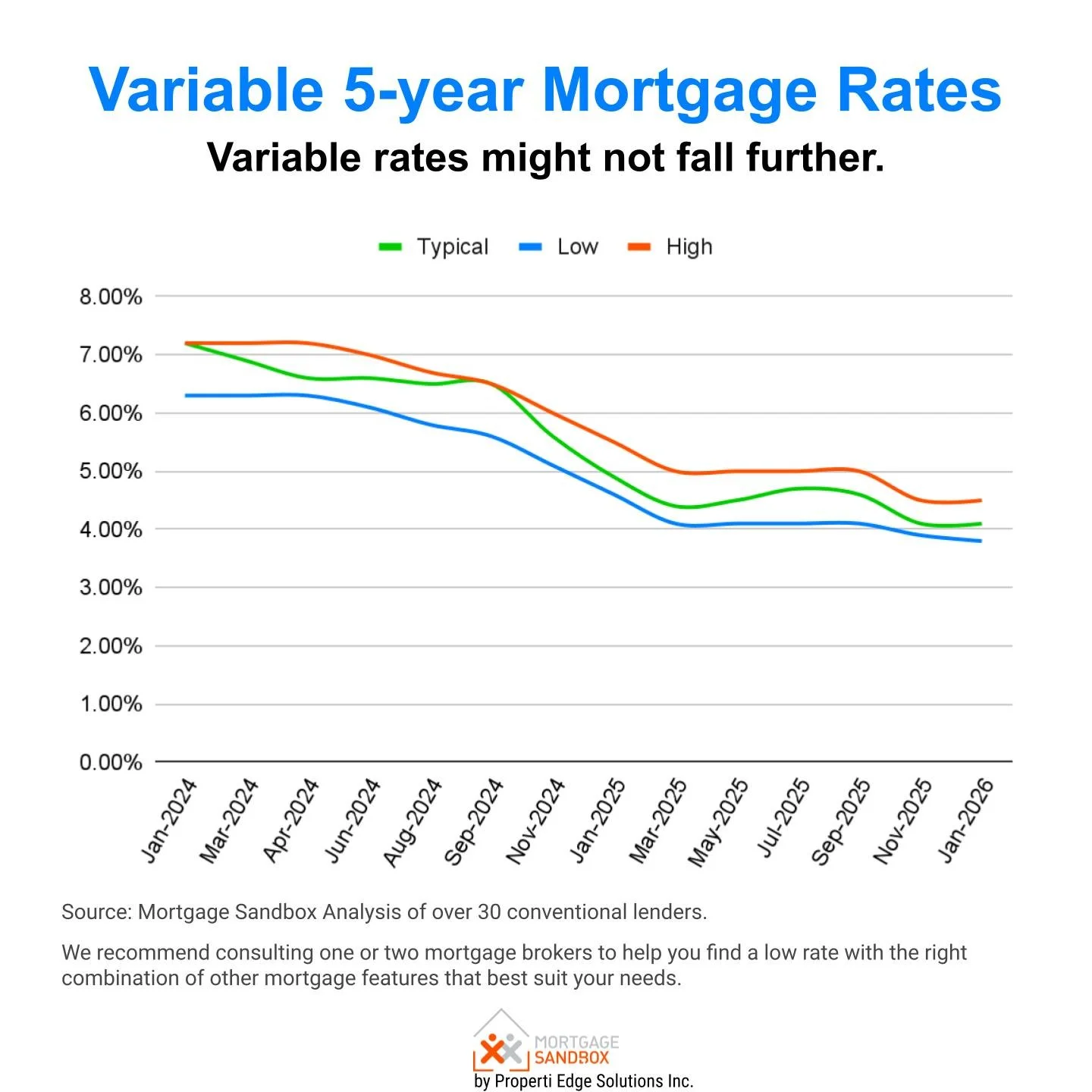

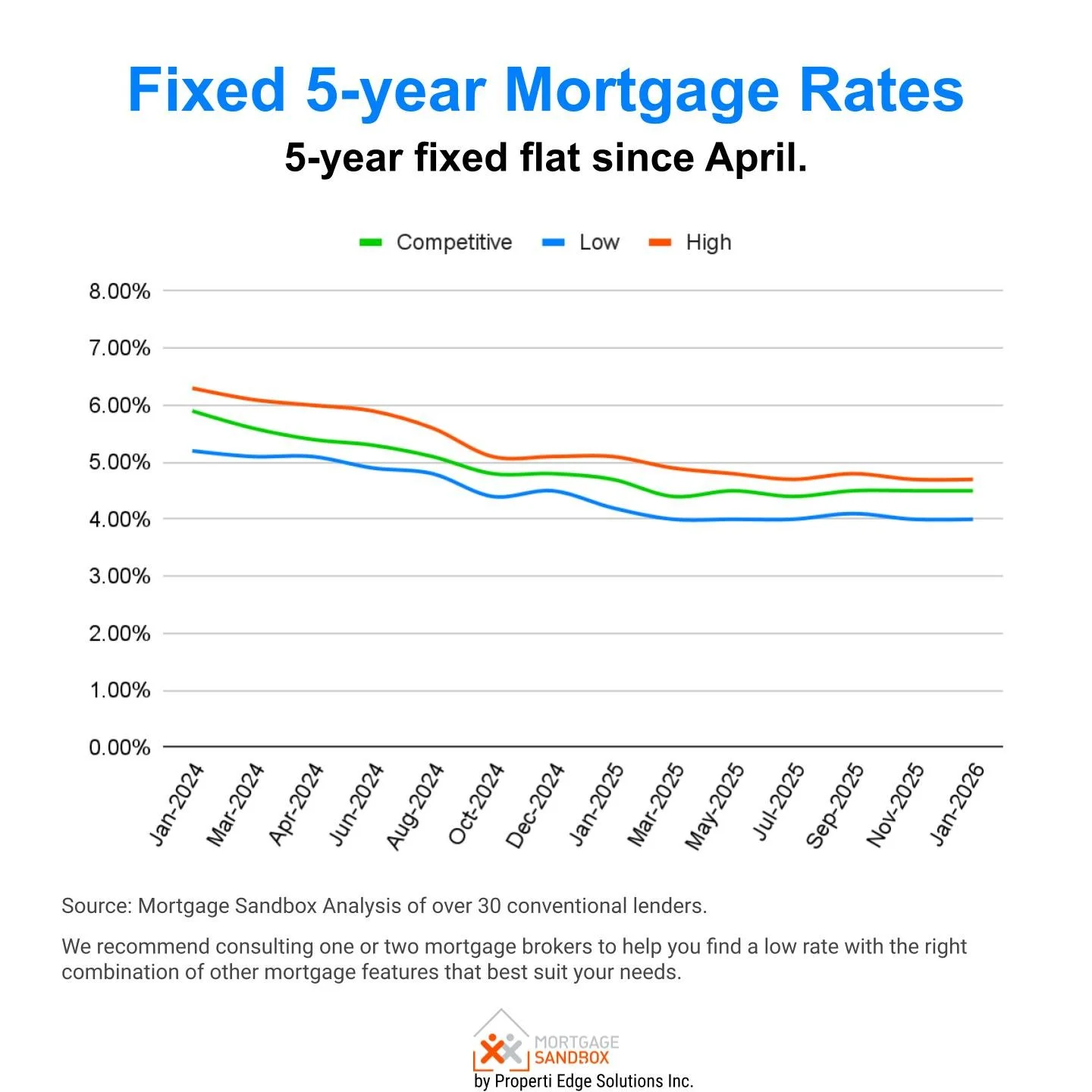

Mortgage rates are falling, but not all in the same way. Variable rates have dropped quickly with Bank of Canada cuts, while 5‑year fixed rates are still being held up by pressure in the bond market and are starting to edge higher again.

Why variable rates dropped so much

Variable mortgages are tied to your lender’s prime rate, which moves almost lock‑step with the Bank of Canada’s policy rate.

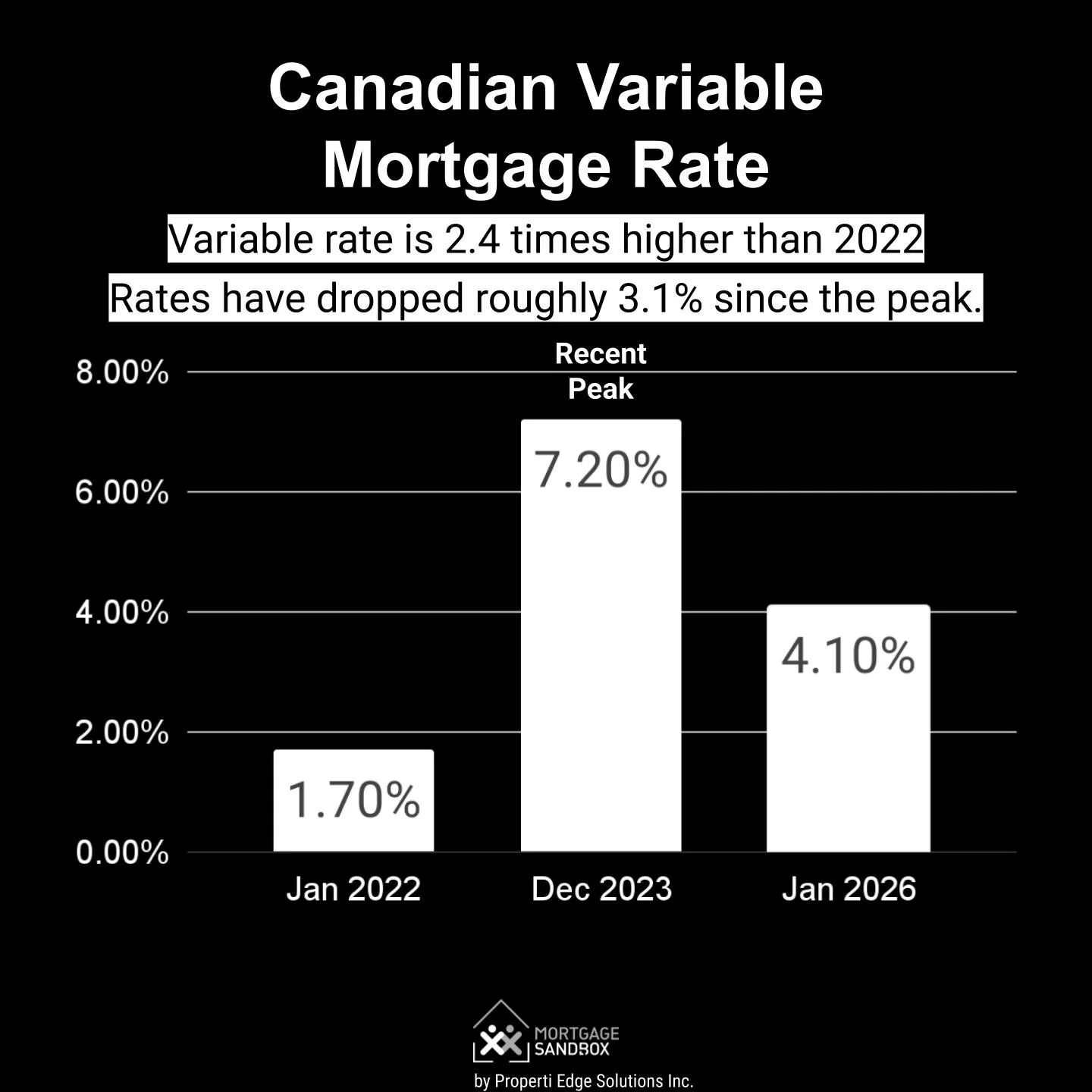

When the Bank of Canada cuts its rate, banks pass that through, so it is completely normal to see variable mortgage rates fall. The Bank of Canada cut its rate from 5% to 2.25%, and so variable mortgage rates have dropped from about 7.2% to 4.1%.

In simple terms, when the central bank steps off the brake, your variable rate usually comes down by roughly the same amount over time.

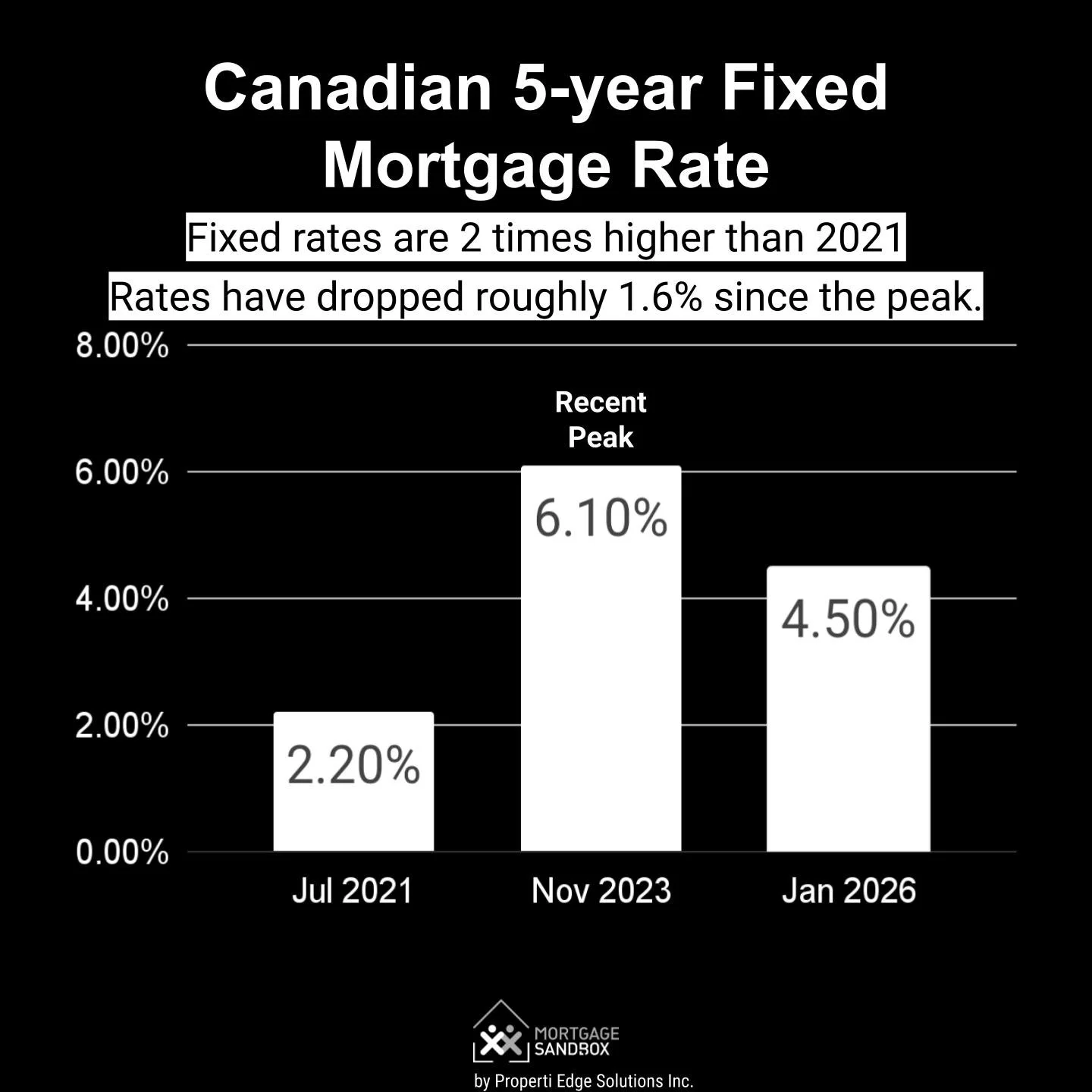

Why 5‑year fixed hasn’t fallen as far

Five‑year fixed rates are priced off the 5‑year Government of Canada bond yield, not directly off the Bank of Canada rate.

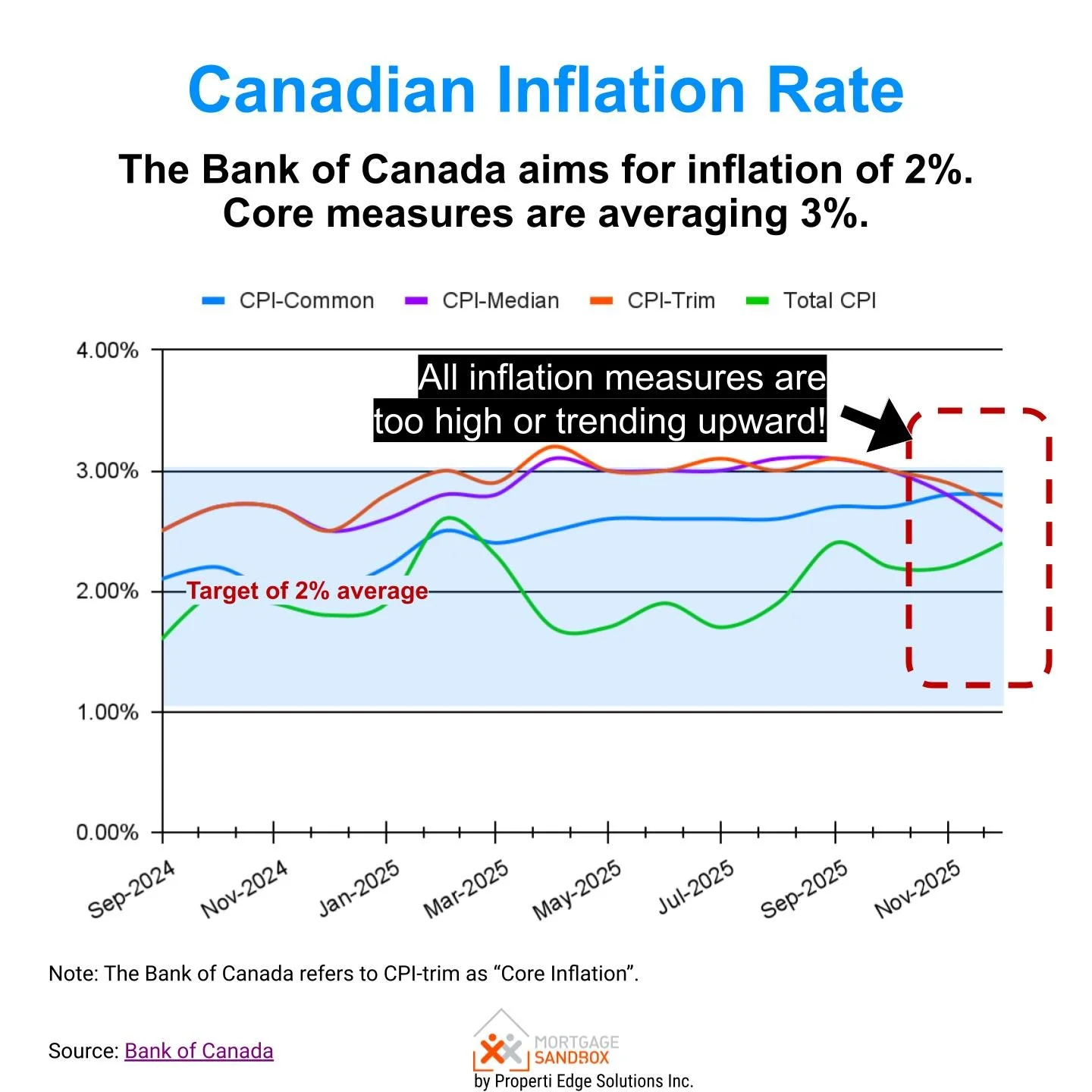

Those bond yields are still under upward pressure from factors such as large government deficits, global trade tensions, and geopolitical uncertainty in oil-producing countries. With all these risky activities going on, investors are demanding extra compensation (a higher “rate”) to lend for longer.

That is why your 5‑year fixed may have only dropped from roughly 6.1% to around 4.5%, about 1.6%, and has even been drifting up slightly over the past six months as 5‑year bond yields moved sideways to slightly higher.

Why this matters for your buying power

The 5‑year fixed rate is the key input for Canada’s mortgage “stress test”: most buyers must prove they can afford payments at the higher of 5.25% or their actual rate plus 2%.

With a 5‑year fixed contract at around 4.5%, the bank tests you at roughly 6.5% (4.5% + 2%), which sharply limits how big a mortgage you qualify for.

This also explains why buyers aren’t flooding the market to take advantage of the huge price concessions in B.C. and Ontario. With the 5-year fixed rate still relatively high, people still can’t afford to buy a home even with the lower prices.

During the pandemic, when 5‑year fixed rates were in the 1–2% range, borrowers were tested at much lower rates, so the same income could support a much larger mortgage and a higher home price.

What this means for a typical first time homebuyer

Cheaper variable rates help with monthly payments, but they do not solve the stress‑test problem, because your approval is still capped by the higher qualifying rate linked to 5‑year fixed levels.

As long as investors keep demanding higher returns on 5‑year Government of Canada bonds, banks will keep 5‑year fixed mortgage rates higher than many people expect, and that keeps a lid on how much you can borrow.

Practically, this means: even if rates “feel” lower than a couple of years ago, you may still qualify for less than friends who bought in the ultra‑low‑rate pandemic years, unless your income or down payment is higher.