What's Next for Inflation and What it Means for Canadian Mortgage Borrowers in 2026

Canada’s inflation story in 2026 will be central to how much households pay on their mortgages, credit lines, and other loans.

The way prices move through the year will guide the Consumer Price Index (CPI), which in turn will help determine the Bank of Canada’s policy rate and the level of five‑year bond yields that drive fixed mortgage rates.

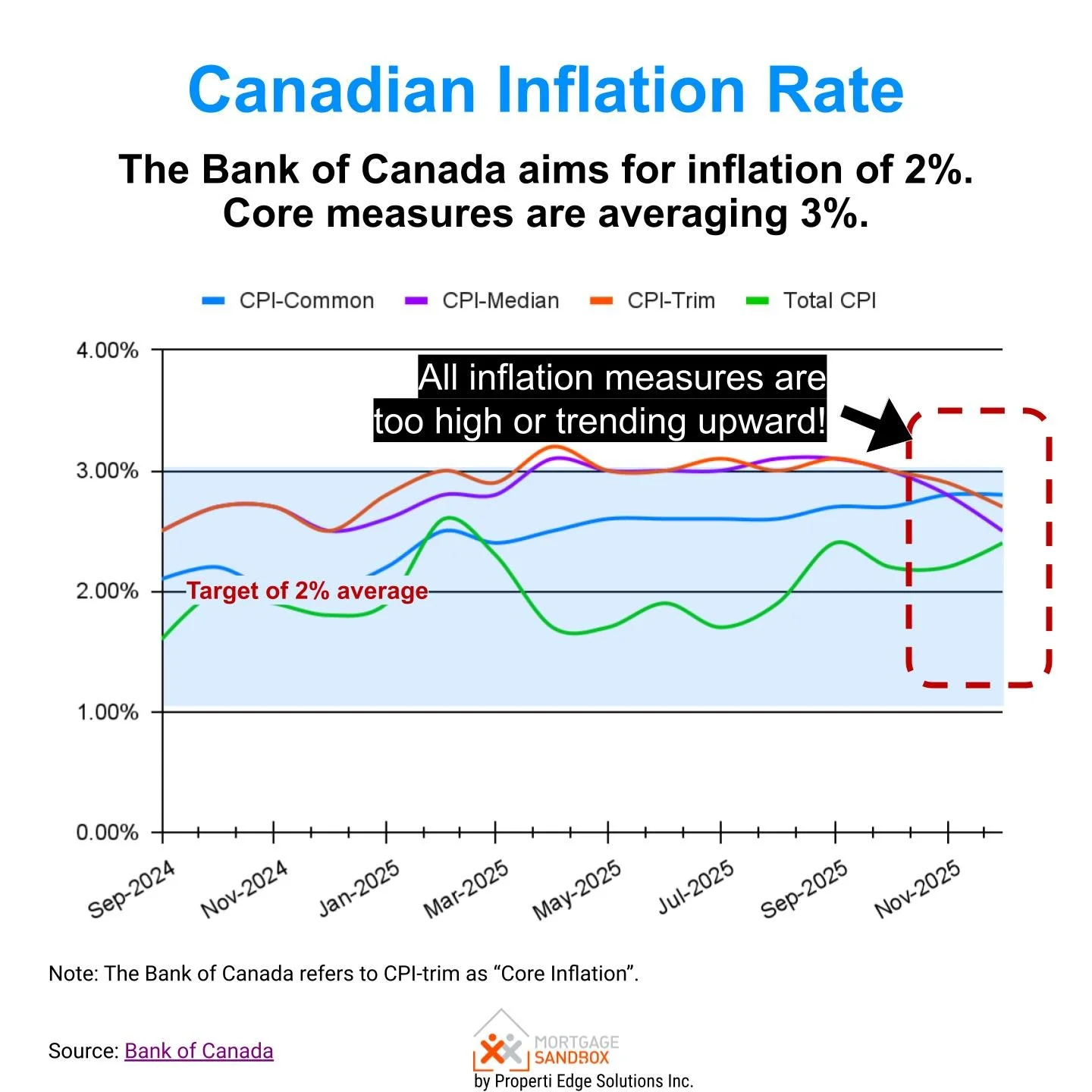

Inflation in 2026: Cooling, but not gone

Inflation is expected to continue easing toward the Bank of Canada’s 2% target in 2026, but the process will likely be uneven. Recent data show headline CPI a little above 2%, with some pressure still coming from services such as restaurants and parts of the food basket, even as shelter costs and some goods prices cool.

Several forces should help inflation drift lower:

Earlier spikes in supply‑chain costs, energy prices, and construction materials have faded, so businesses have less need to push through large price increases.

Labour markets have softened from their tightest point, which should limit wage growth and reduce pressure on companies to raise prices as quickly. Toronto's unemployment is currently 8.2%, Calgary’s is 7%, and Vancouver's is 6.4%.

However, some drivers will keep inflation from falling too fast:

Food inflation has been stubborn, with grocery and restaurant prices still rising faster than overall CPI after the temporary GST/HST holiday of late 2024.

Some service prices, including insurance and certain personal services, tend to adjust slowly and may stay above 2% for longer even as goods prices cool.

Rate reductions in 2024 and 2025 are still working their way through the economy, boosting housing demand and spending on big-ticket items.

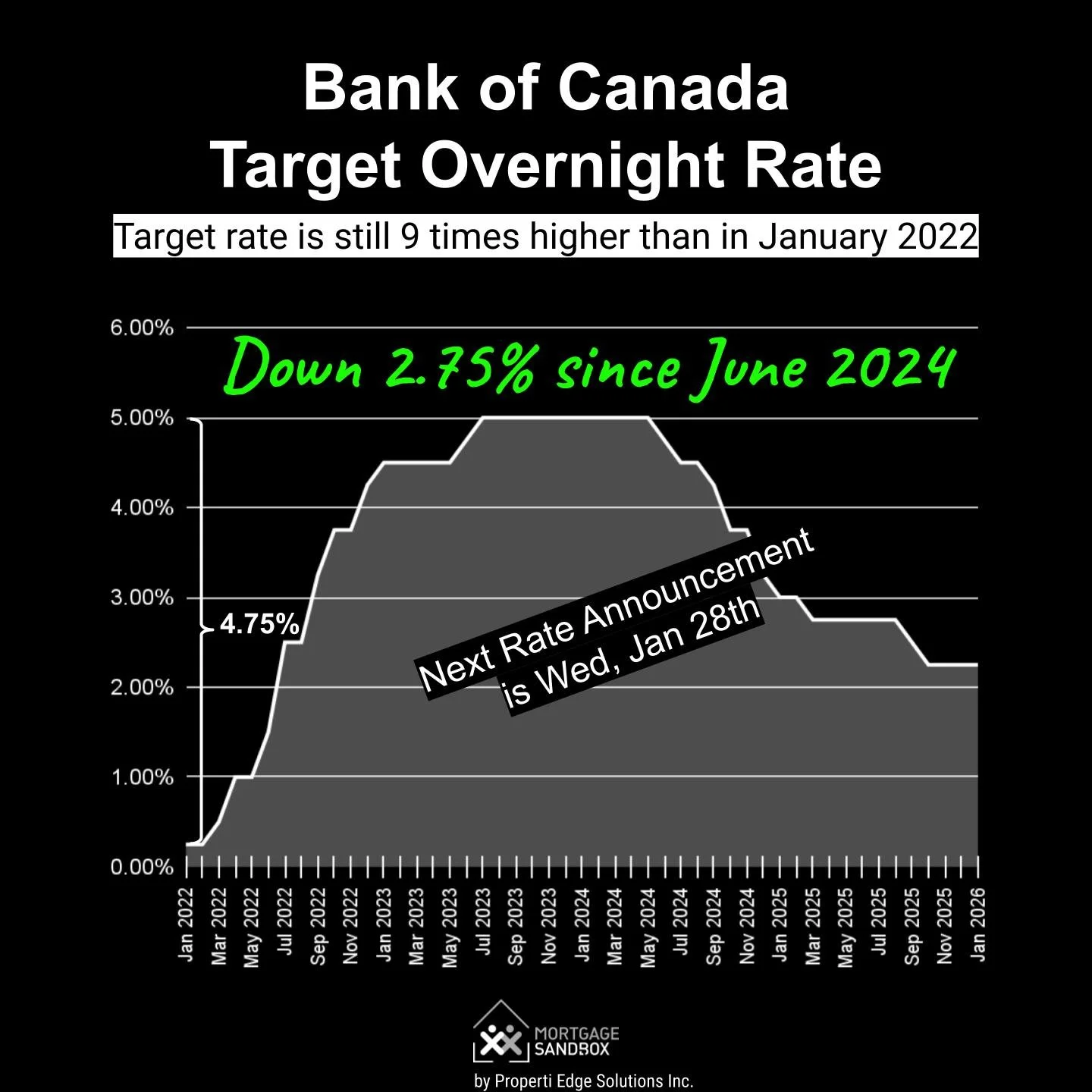

How CPI steers the Bank of Canada

The CPI is the main scoreboard the Bank of Canada watches to judge whether inflation is on track. The Bank focuses not only on headline inflation, but also on “core” measures that strip out volatile items such as energy and some food components. When these underlying measures run above 2%, the Bank tends to keep interest rates higher for longer; when they move below target, it can justify cuts.

Given inflation’s expected behaviour in 2026:

If CPI and core inflation stay close to but slightly above 2%, the Bank is likely to keep its overnight rate on hold through most or all of the year, waiting for clear evidence that price growth is durably at target.

If inflation unexpectedly re‑accelerates, especially in services and wages, the Bank could signal future hikes in 2027, or even bring them forward, to prevent inflation from becoming entrenched.

In short, CPI does not just describe what has happened to prices; it shapes the Bank’s decisions about the future path of short‑term interest rates.

From policy rate to five‑year bond yields

Financial markets translate the Bank of Canada’s inflation and rate outlook into the price of government bonds. The five‑year Government of Canada bond yield is especially important because it reflects what investors expect the overnight rate and inflation to average over the next five years.

When CPI data suggest inflation is easing and the Bank will eventually cut or hold rates, investors demand slightly lower yields on five‑year bonds.

When CPI surprises on the upside, markets may price in higher future policy rates, pushing five‑year yields higher almost immediately—even if the Bank does not move its rate that day.

As a result, bond yields can change quickly after monthly CPI releases, because investors update their expectations for inflation over the years ahead.

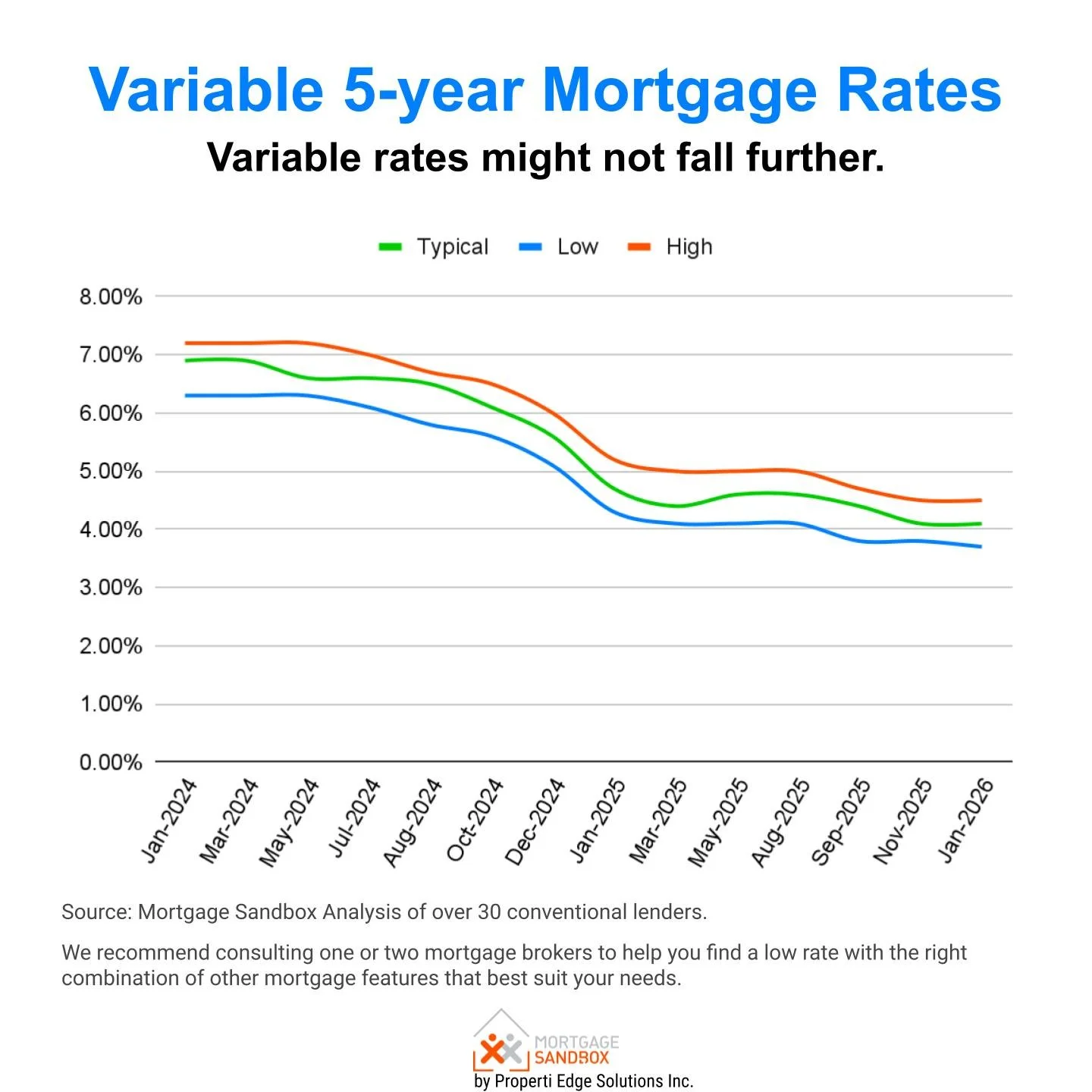

What this means for variable mortgage rates

Variable mortgage rates in Canada are closely tied to the Bank of Canada’s overnight rate, usually through lenders’ prime rate. When the Bank raises or cuts its rate, variable mortgage payments tend to move in the same direction.

With inflation expected to hover near the 2% target in 2026:

Variable rates are unlikely to fall much further if the Bank holds its policy rate steady, because the major easing cycle from earlier years has already happened.

If CPI data come in hotter than expected and core inflation stays sticky, markets could anticipate future hikes, and lenders may respond by nudging variable mortgage discounts less aggressively or even raising effective borrowing costs.

For borrowers, this means variable‑rate mortgages in 2026 may offer limited additional savings compared with today, but they carry the risk of higher payments later if inflation picks up again.

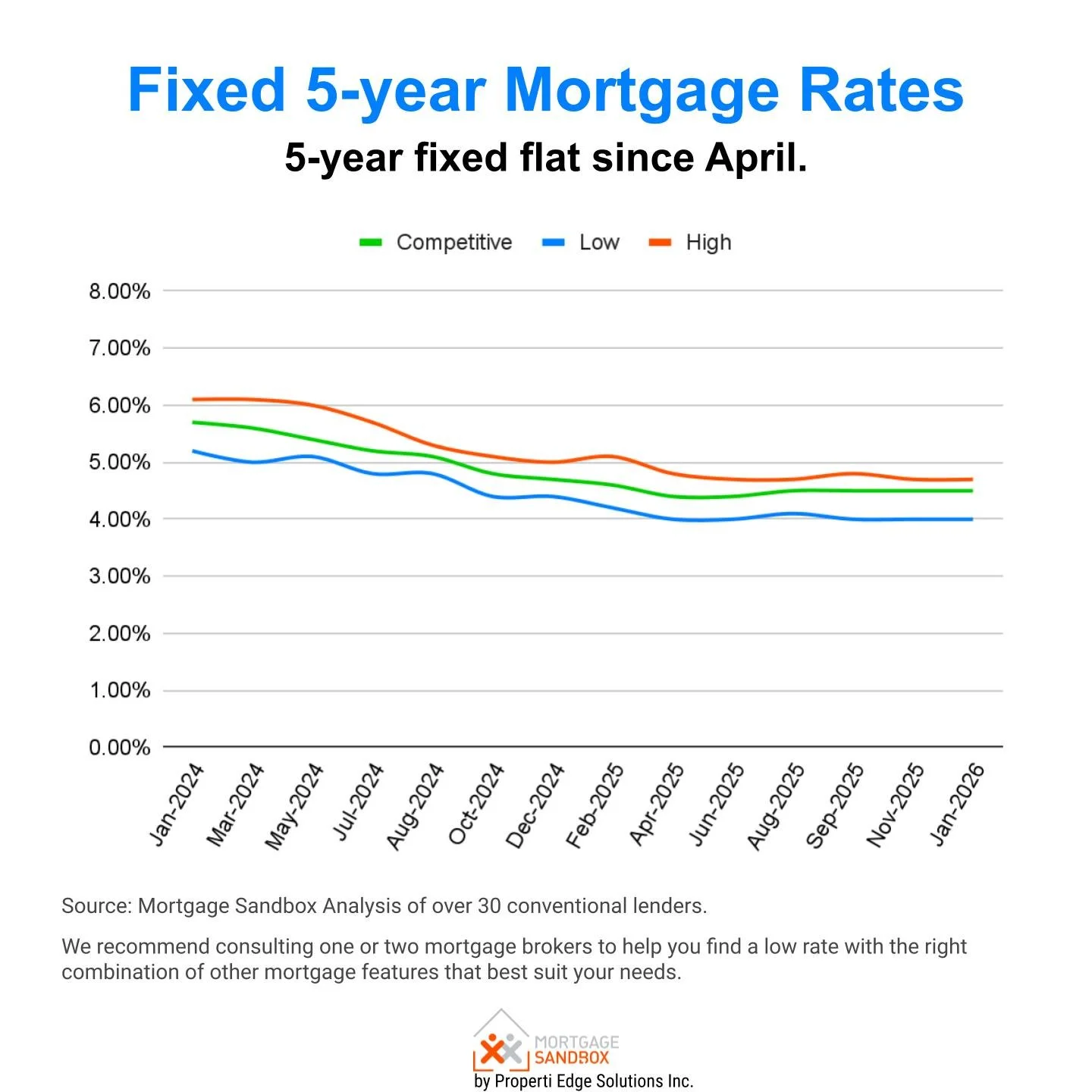

What this means for five‑year fixed mortgage rates

Five‑year fixed mortgage rates are set using five‑year Government of Canada bond yields as a benchmark, plus a spread for lender costs and profit. Because bond yields are driven by expectations about future inflation and Bank of Canada policy, CPI data have a powerful indirect effect on fixed rates.

In a scenario where inflation continues to cool but stays near target:

Five‑year bond yields, and therefore fixed mortgage rates, are likely to trade in a relatively narrow range, rather than falling sharply as they did when inflation first turned downward.

Stronger‑than‑expected CPI readings could quickly push bond yields higher, causing lenders to raise fixed rates even without an immediate move by the Bank of Canada. Conversely, a clear downside surprise in inflation could open the door to modest declines in fixed rates.

For many households, this makes the five‑year fixed option a way to lock in today’s real (inflation‑adjusted) borrowing costs at a time when inflation risk is moving lower but has not yet fully receded.

The bottom line for Canadian borrowers

In 2026, inflation is expected to edge closer to the 2% target, but the Bank of Canada will still be watching CPI and core inflation very carefully. That data will guide not only its overnight interest rate, but also the five‑year bond yields that anchor fixed mortgage rates.

If inflation behaves as expected—cooling but not collapsing—variable rates are likely to remain broadly stable, while five‑year fixed rates hover around current levels with modest moves up or down after major data releases.

If inflation surprises in either direction, the ripple effects will move from CPI to the Bank of Canada’s decisions, into bond markets, and finally into the borrowing costs Canadians pay on both variable and fixed mortgages. Understanding that chain helps households make clearer choices about which mortgage type best fits their risk tolerance and financial plans.