The Bank of Canada’s Next Move Is Likely a Pause

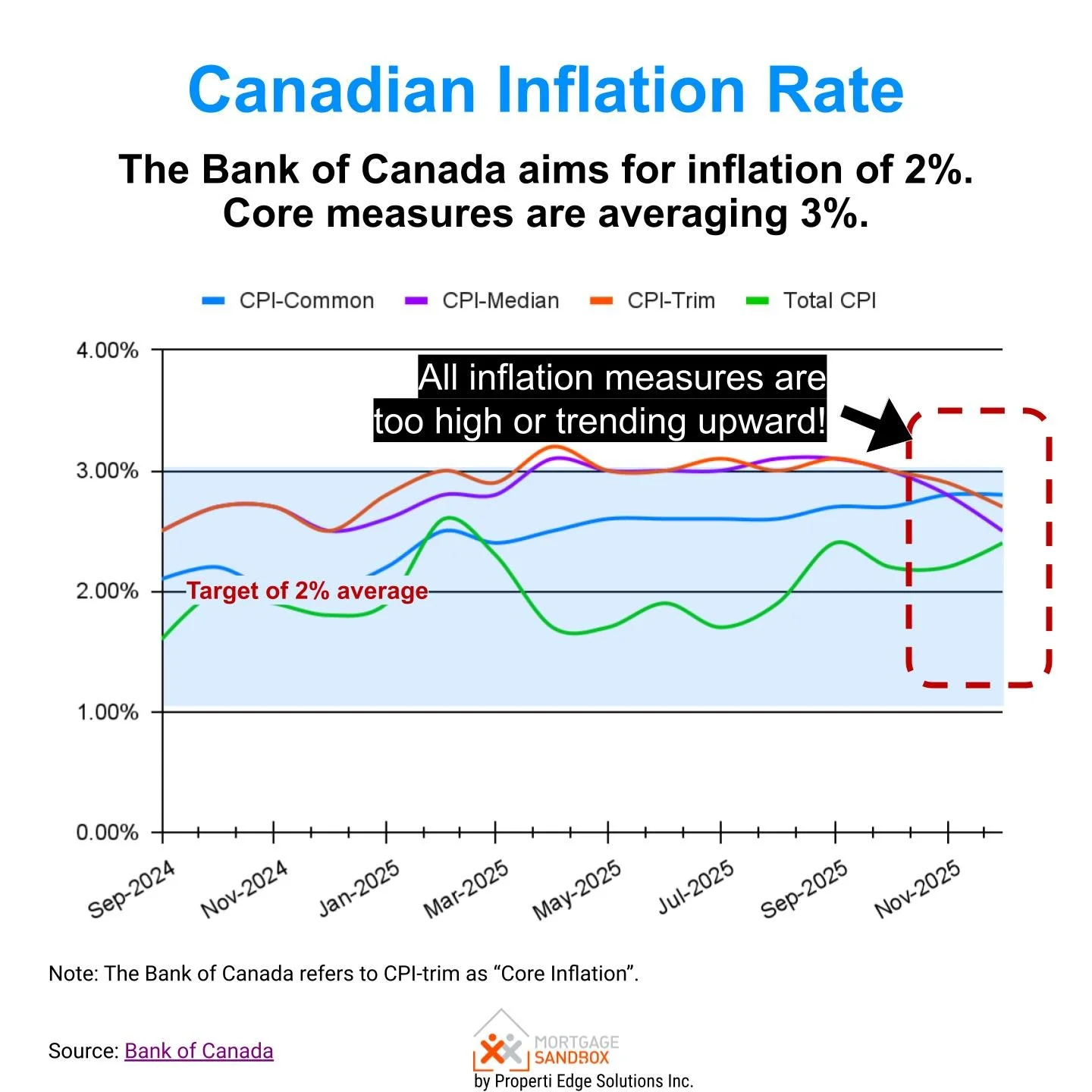

Going forward, The Bank of Canada (BoC) is more likely to raise interest rates than to cut them, despite some progress in addressing inflation. Recent Consumer Price Index (CPI) data indicates that headline inflation is in the mid-2% range, while core inflation measures, those that exclude volatile items, remain slightly above the target of 2% and have been slow to decline.

The economy has managed to avoid a significant recession as a result of the trade wars between the US and China, and output is expected to gradually increase through 2026 and 2027. Since the economy has already been weakened and is starting from a low point, it is more likely to improve. This reduces the need for additional stimulus and raises the risk that inflation could accelerate again if monetary policy remains too loose.

Next Wednesday’s Announcement

Looking ahead to next Wednesday’s announcement (January 28, 2026), the most likely outcome is that the BoC holds the overnight rate steady while reinforcing a “bias” toward future hikes rather than cuts. With markets already pricing in an extended pause and several forecasts showing the policy rate bottoming at 2.25 in 2025–26, the BoC has little incentive to signal further easing when inflation is still slightly above target.

If anything, stronger‑than‑expected growth or sticky core CPI prints could prompt policymakers to warn that rates may need to move higher in 2027, preparing households and businesses for a gradual tightening cycle once the output gap closes.

The Long Term Outlook

The long-term forecasts from major Canadian banks present a consistent outlook. On average, economists anticipate that the Bank of Canada (BoC) interest rate will remain around 2.25% for most of 2026, before gradually increasing to the mid-2% range in 2027. Some banks even project that the rate could exceed 3% by late 2027. Variable mortgage rates, which move with the BoC rate, are forecast to hold near the low‑4% range in 2026 and then climb gradually as policy tightens, leaving little room for further downside and increasing the odds of higher payments later in a new term.

Five‑year Government of Canada bond yields are projected to rise from roughly the low‑3% area toward the mid‑3% range over the same period, which supports a five‑year fixed mortgage rate path that edges up from around 4.8–4.9% toward just above 5% on average by 2027.

Long Term Mortgage Rate Forecast

For a more detailed breakdown of how these policy, bond, and mortgage‑rate expectations play out quarter by quarter, readers can consult the Mortgage Sandbox Mortgage Rate Forecast, which compiles and updates these bank projections in a single, easy‑to‑read view.