Greater Toronto Area Property Market Report: January 2026

A Deepening Buyer's Market with Across-the-Board Declines

The Greater Toronto Area (GTA) housing market has opened 2026 firmly in buyer’s territory, with clear data indicating a continuation and intensification of the corrective trend that characterized much of 2025. Contrary to early forecasts of a potential upswing, January metrics reveal a market defined by weakened demand, rising inventory, and persistent price depreciation across all major housing segments.

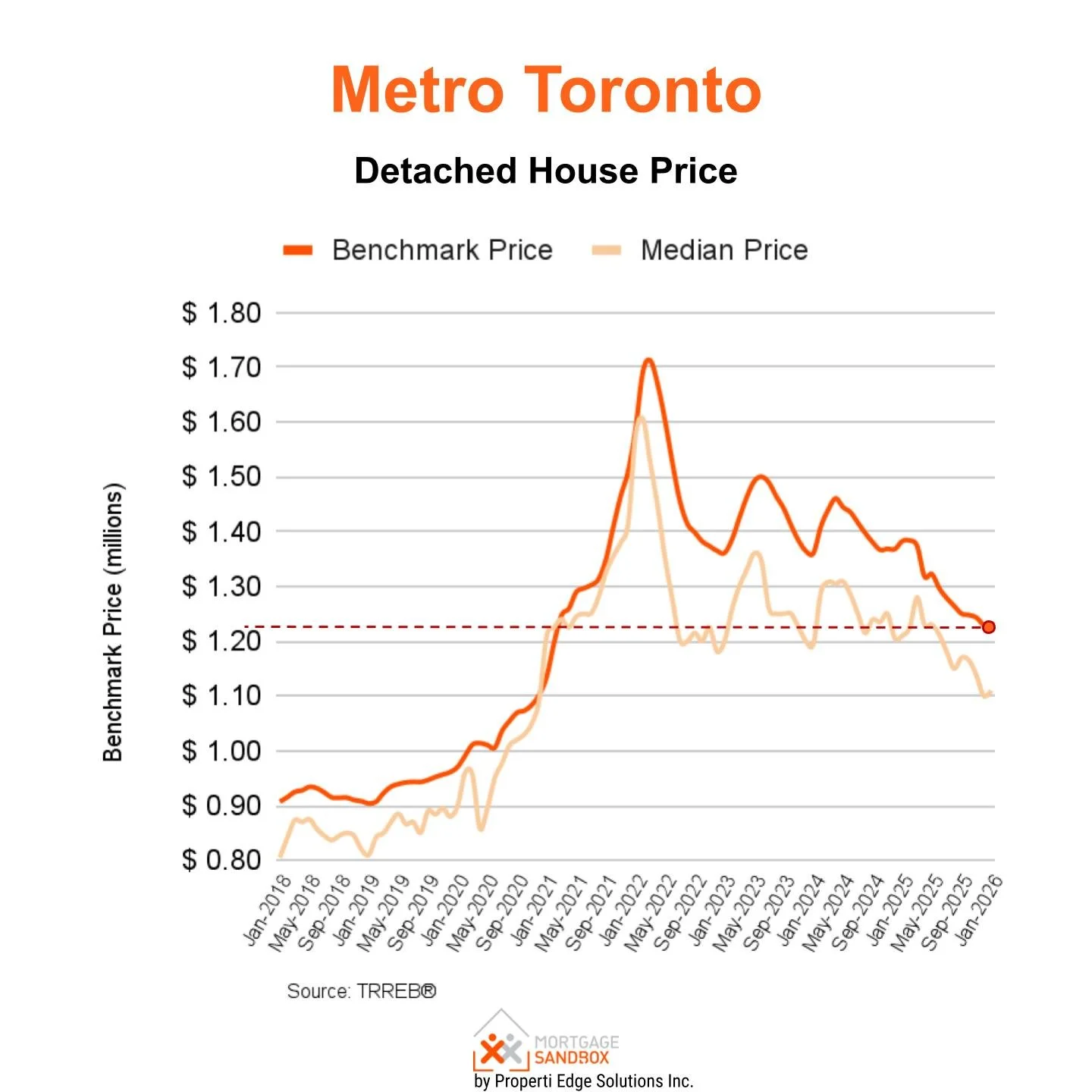

Detached Homes: Balanced Market Eroding, Prices in Steady Decline

The detached home segment, often considered the market’s bellwether, is now a balanced market trending towards buyers. Key indicators show a significant shift in fundamentals:

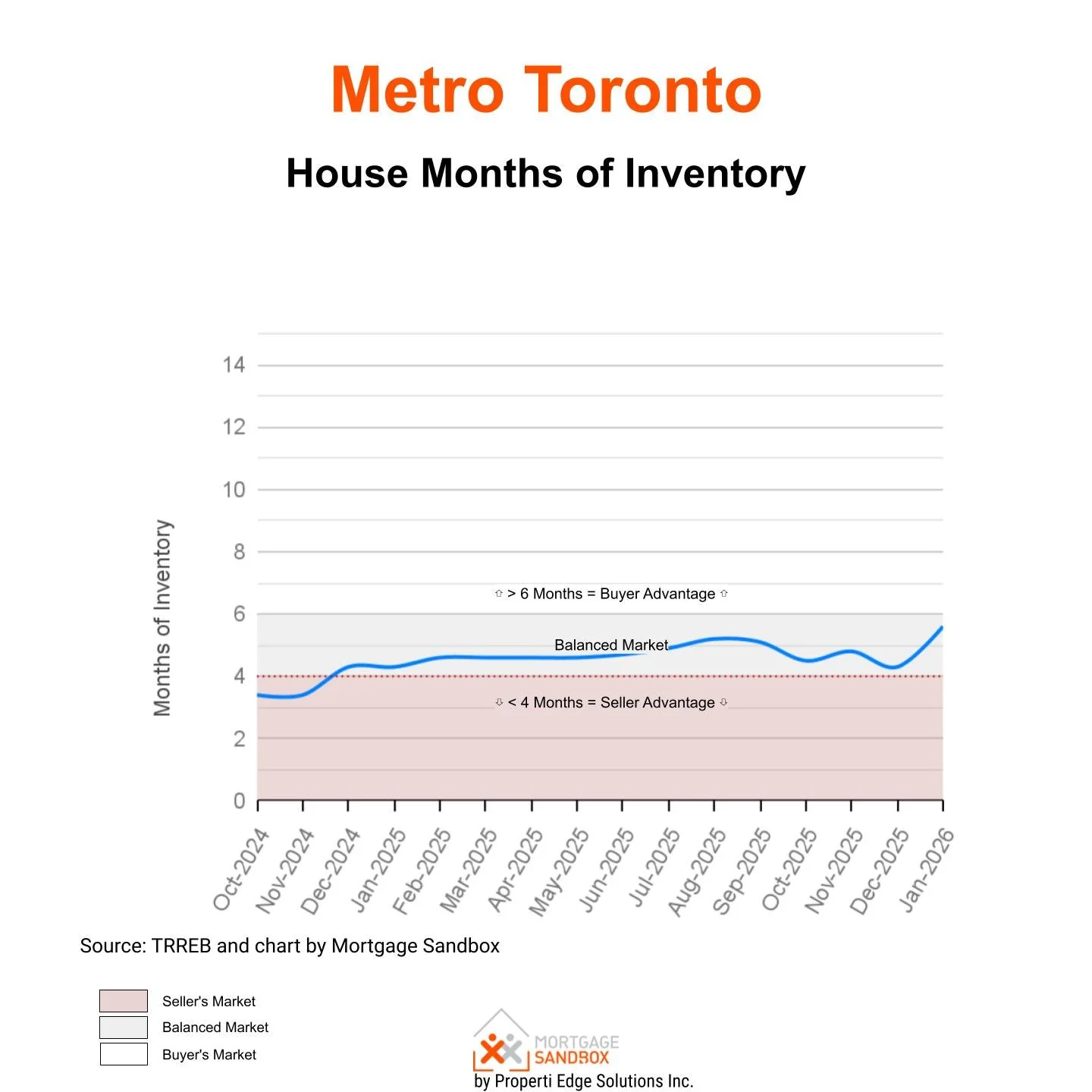

Inventory & Demand: Months of Inventory (MOI) has surged to 5.6, a 30% year-over-year increase, signalling a substantial rise in available supply relative to sales pace. This is driven by a 14% drop in purchase demand and a 10% increase in active listings.

Price Trajectory: The benchmark price of $1,224,300 reflects an 11% year-over-year decline from $1,382,500. The near-term trend is equally soft, with prices down 2% over the past three months. The median price has fallen 5% in the same period to $1,110,000, indicating the correction is affecting a broad range of properties.

Townhouse & Condo Apartment Segments: Firm Buyer’s Markets

The townhouse and condo apartment markets are exhibiting even stronger buyer advantages.

Townhouses: This segment is a definitive buyer’s market with MOI jumping 45% year-over-year to 6.1. A sharp 23% drop in demand, coupled with a 12% rise in listings, has drastically shifted the balance of power in negotiations.

Condominium Apartments: The condo market remains the most oversupplied, with an MOI of 7.8. While active listings have dipped 4%, purchase demand has collapsed by 26%, leading to increased market slack. The benchmark price of $542,600 is down 8% year-over-year and 3% in the last quarter, closely mirroring the median price decline of 4%.

Outlook for 2026: Ongoing Correction Seeking A Floor

The January 2026 data presents a coherent narrative: the market correction is ongoing. The projected 3.4% national sales increase for 2026, as suggested by some forecasts, is not yet materializing in the GTA. Instead, local data shows falling demand and rising supply are driving prices downward. Royal LePage’s forecast of a 6.5% annual decline in the median condo price aligns with the current trajectory, while even the more modest forecast for detached homes appears contingent on a demand recovery that has not begun.

A Market Requiring Patience and Pragmatism

Early evidence suggests 2026 will be more buyer-friendly than 2025, pointing to further potential price reductions.

For buyers, the data suggests a strategy of patience, thorough research, and a property inspection, as there are now many more listings and you’ll have more negotiating power. While it’s challenging to time the market perfectly, it tends to move slowly. Therefore, missing the absolute bottom by a few months can still result in a favorable outcome.

For sellers, particularly those who need to transact in the near term, the metrics underscore a challenging environment. Realistic pricing, based on current and projected rather than past comparable sales, and preparedness for your property to remain on the market for some time before a suitable buyer is found. There is an acute risk of “chasing the market down” by listing at aspirational prices, as all indicators point to a market where value is being methodically recalibrated downward every month by cautious buyers.

This report is based on available market data and analytics for January 2026.