Greater Vancouver Property Market Report: January 2026

A Deepening Buyer's Market Takes Hold

The Greater Vancouver real estate market has opened 2026 with definitive data confirming a sustained and deepening shift in power toward buyers. Key metrics across all major property types (detached homes, townhouses, and condominium apartments) indicate rising inventory, softening demand, and measurable price declines, setting a clear tone for the year ahead.

Market Overview: A Pronounced Buyer's Advantage

The overarching theme for January 2026 is the establishment of a broad buyer's market. Both the detached home and condominium apartment segments now officially favour purchasers, with conditions trending further in their direction. This shift is driven by a fundamental imbalance: purchase demand has fallen sharply while the supply of available homes has increased.

Detached House Market: Significant Inventory Build-Up

The single-family detached market, a traditional bellwether for the region, shows the most pronounced changes.

Market Conditions:

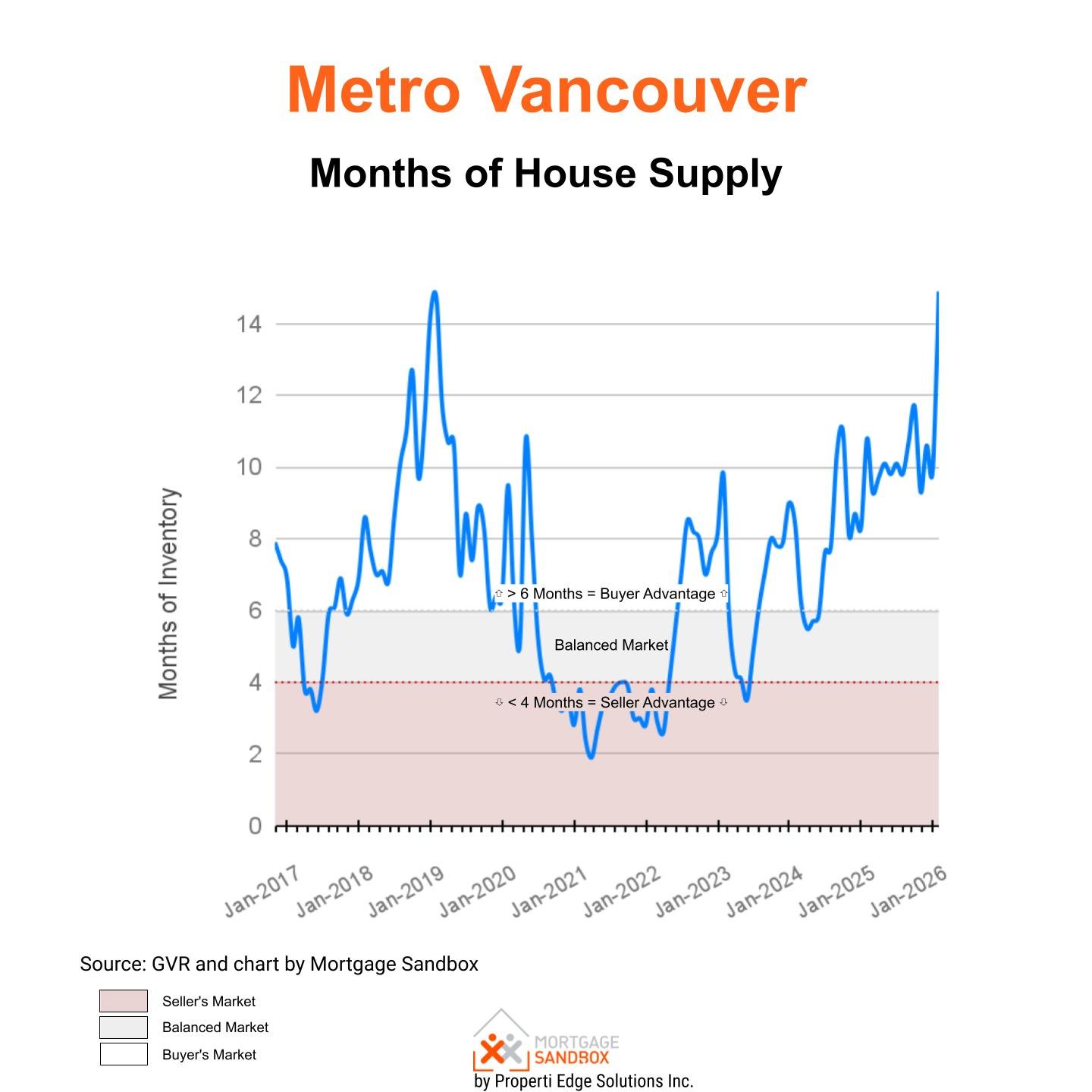

Solidified Buyer's Market. The critical "months of inventory" metric, which indicates how long it would take to sell all current listings, has surged to 14.9 months, up 38% year over year from 10.8 months.

Benchmark Price:

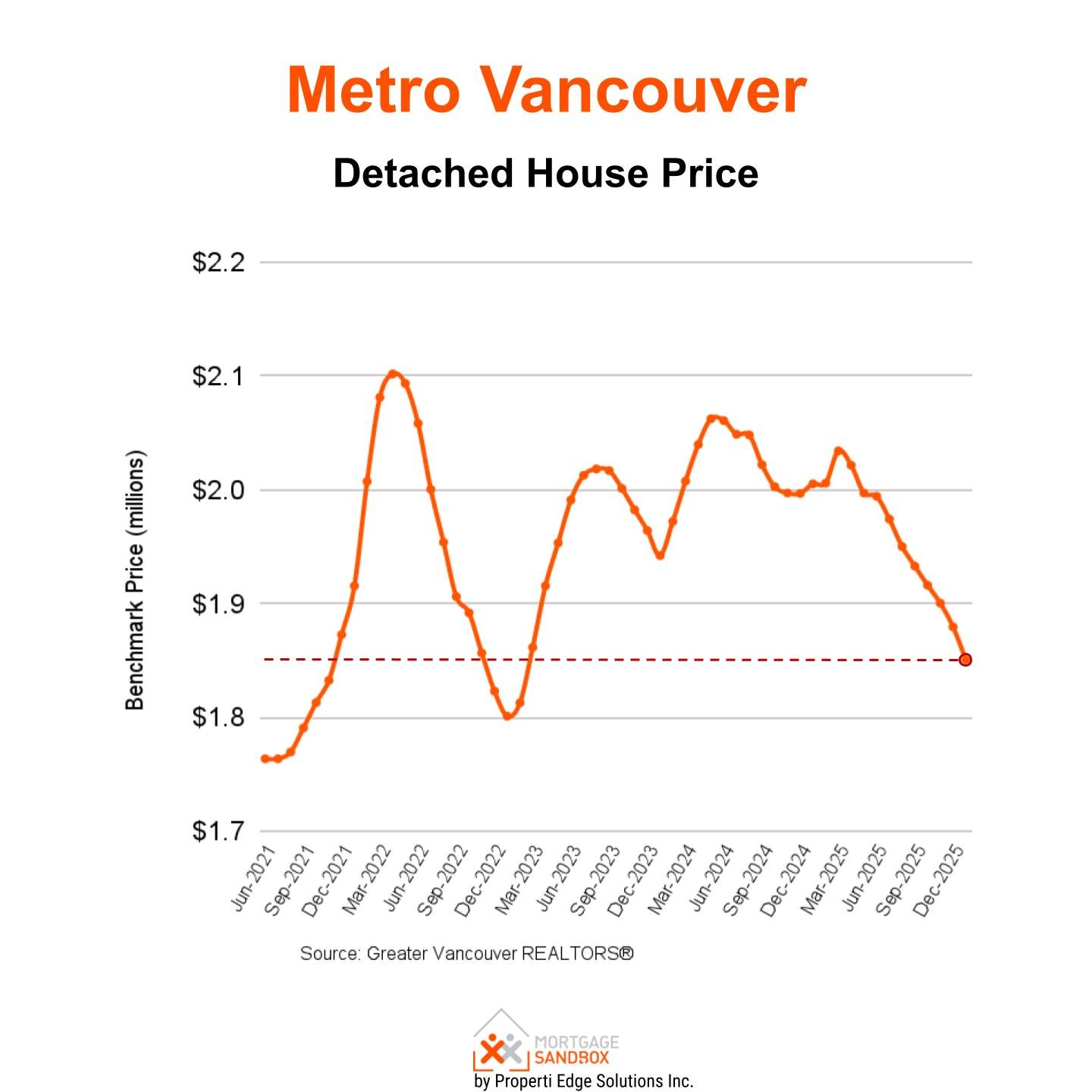

$1,850,800, reflecting a 3% decline over the past three months.

Active Listings & Purchase Demand:

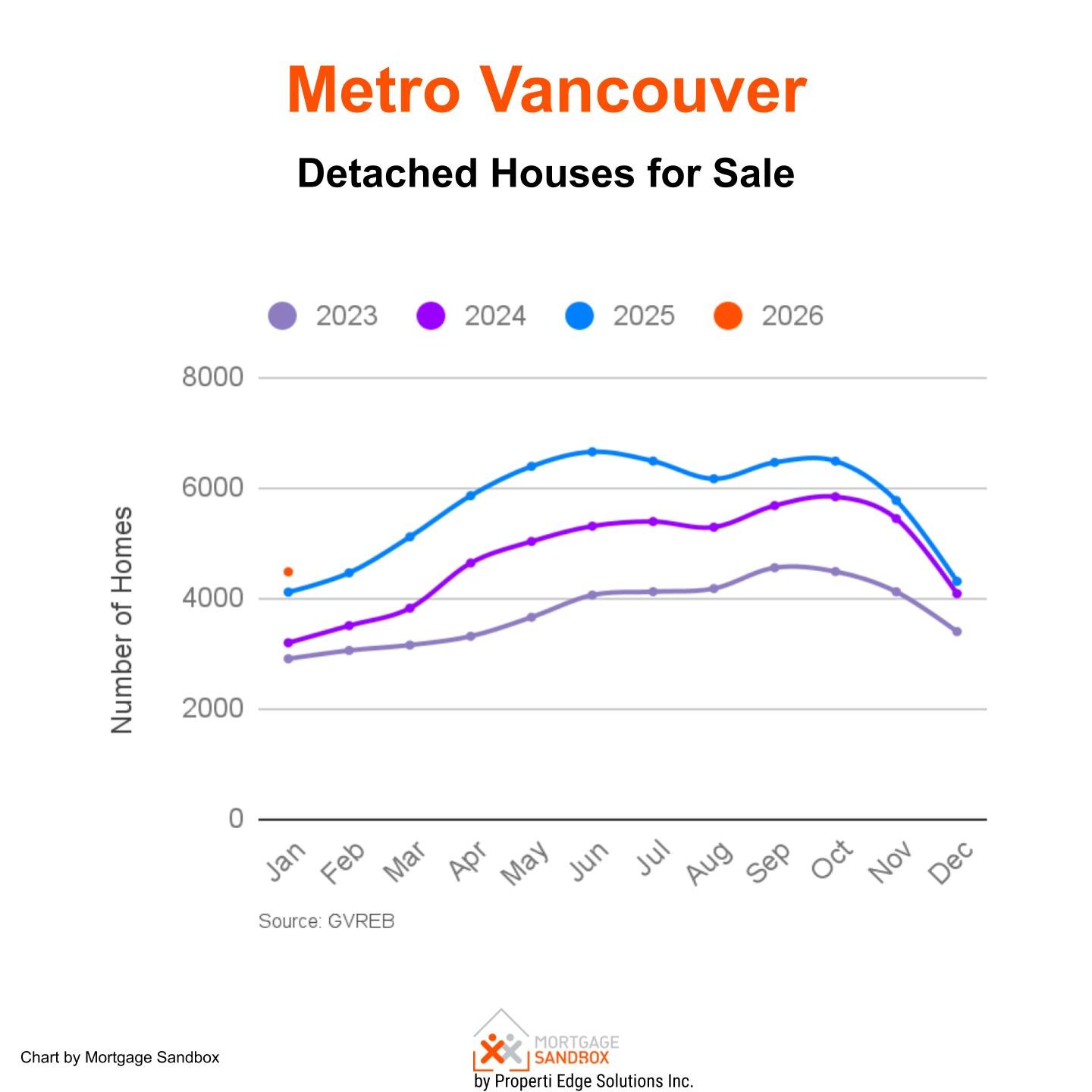

This dramatic rise in Months of Inventory (MoI) is fueled by a 21% drop in purchases, coupled with a 9% increase in active listings for sale.

Outlook:

The data from early 2026 suggests that significant downward pressure on prices will persist, as high inventory levels compete with a smaller pool of buyers. However, we are relying on one month of data. The outlook is expected to become clearer by March 2026, as spring is typically the most active time of the year for home purchases. Families generally prefer to move during the summer so that their children do not have to change schools in the middle of the year.

Townhouse Market: Demand Dries Up, Driving A Balance Shift

The townhouse segment mirrors the broader market trend, with falling demand being the primary catalyst for changing conditions.

Market Conditions:

Buyer's Market, trending further in favour of buyers. Months of inventory (MoI) have risen to 9.2 months, a 30% increase from 7.1 months one year ago. A buyer’s market is defined by months of inventory above 6, so the current conditions place townhomes deep in a buyer’s market.

Benchmark Price:

The current benchmark price of $1,043,400 is down $62,200 (6%) from a year ago and approximately $100,000 below the peak reached in May 2024.

Active Listings & Purchase Demand:

This shift in months of inventory is almost entirely driven by a sharp 30% drop in purchase demand, which has outpaced a 10% decrease in the supply of active listings. The decline in listings is overshadowed by the sharper pullback in buyer activity.

Outlook:

Drawing on trends over the last 3 months and given that the last interest rate cut was in October, the data suggests downward pressure on prices will likely persist.

Condominium Apartment Market: Accelerating Shift

The condo segment, often more active, is experiencing an even faster transition.

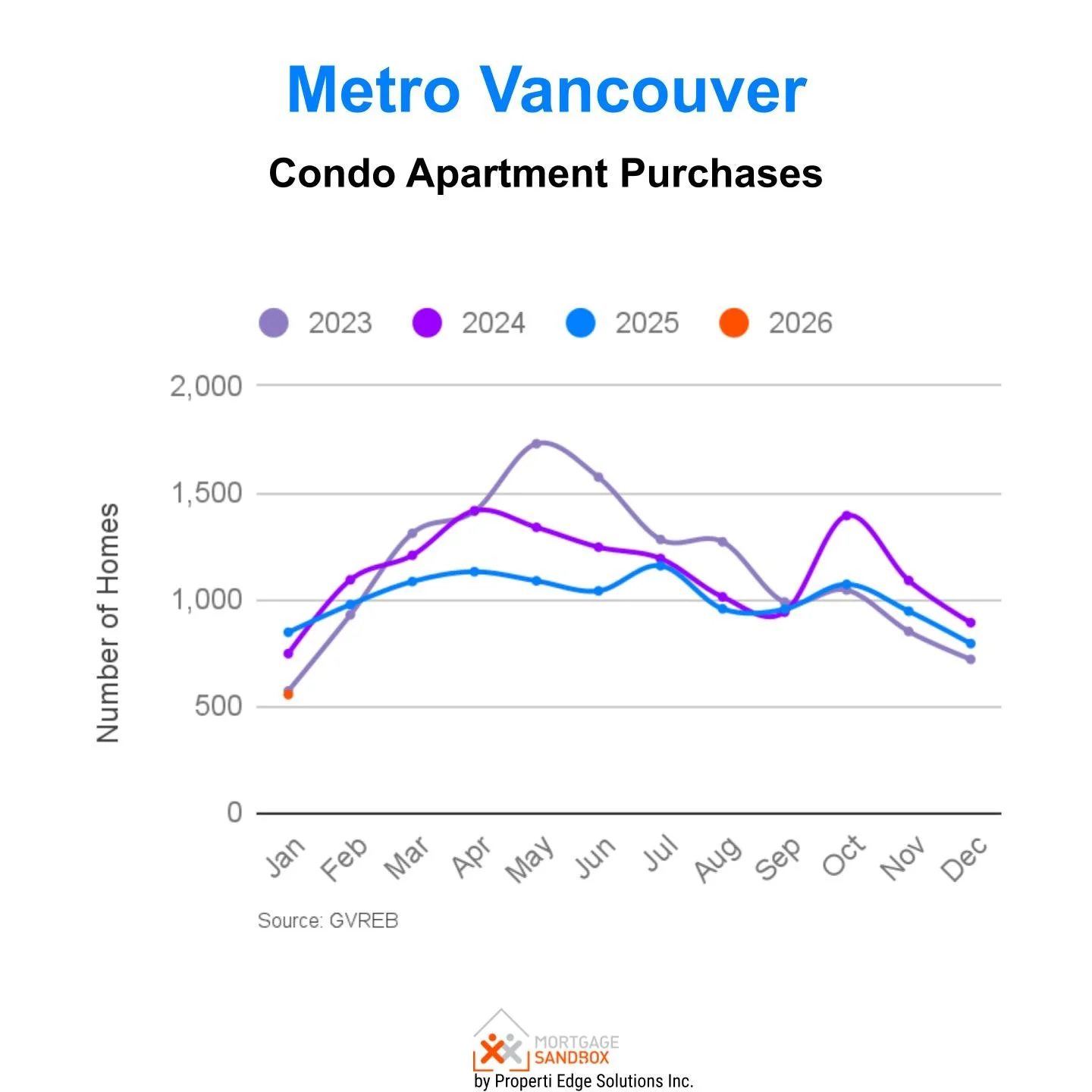

Market Conditions:

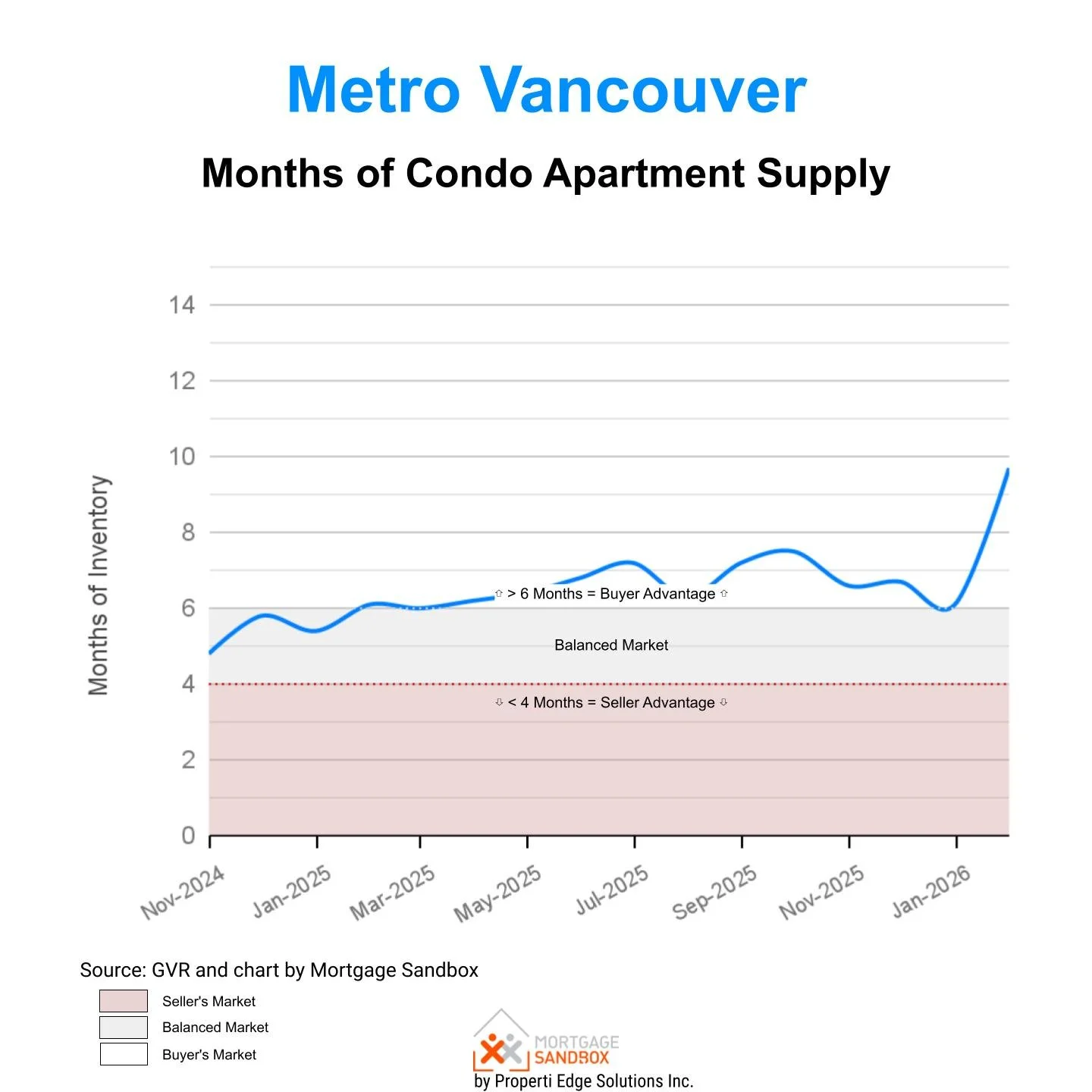

Accelerating Buyer's Market. Months of inventory have jumped to 9.7 months, a striking 59% increase from 6.1 months one year ago.

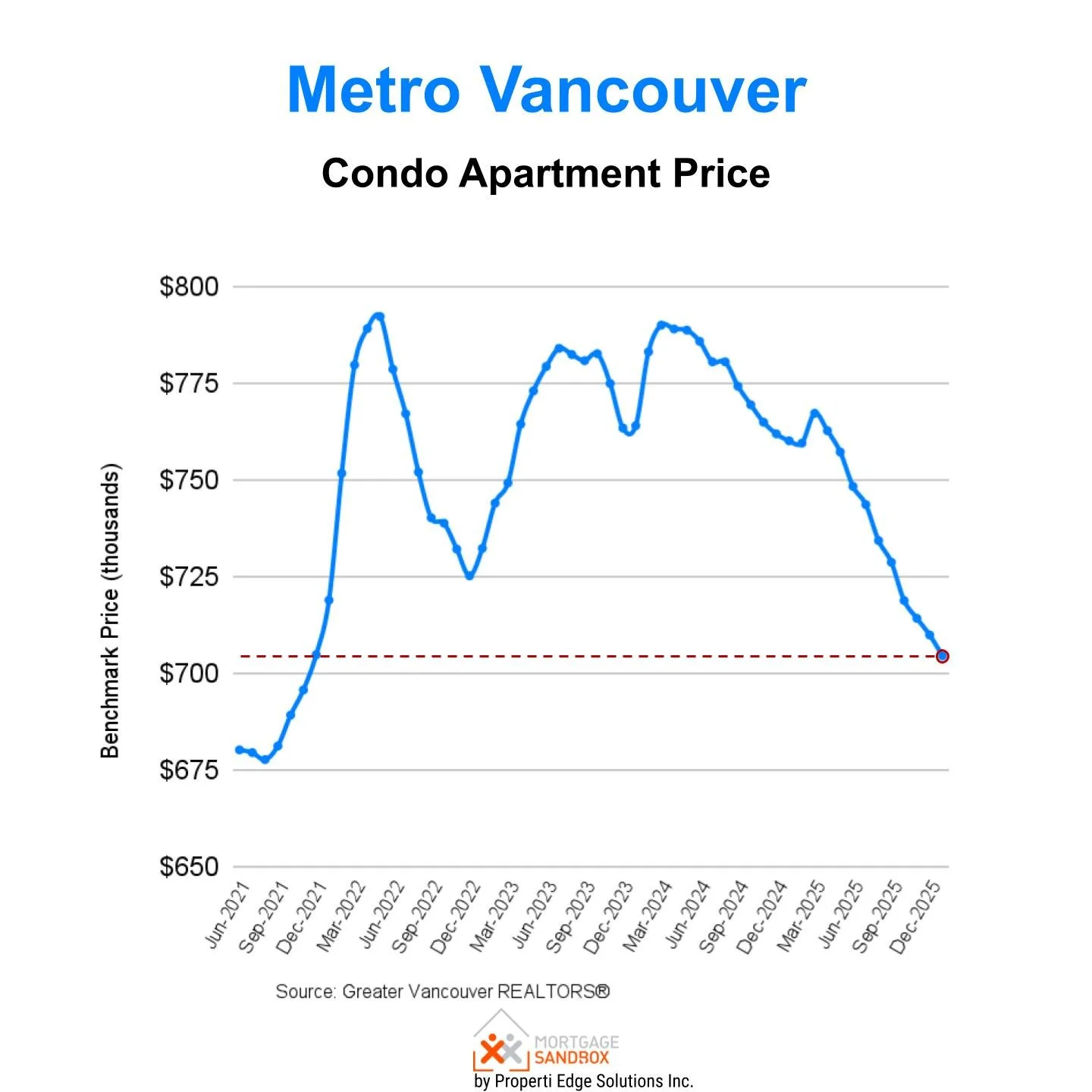

Benchmark Price:

The benchmark condo, priced at $704,600, has decreased by 7% over the past year and is down 11% from its peak of $792,300.

Active Listings & Purchase Demand:

This is the result of a 35% plummet in purchase demand against a 5% rise in listings.

Outlook:

The sharp drop in buyer interest relative to supply points to continued softness and likely further price adjustments in 2026.

Data-Driven Context: 2026 Forecasts Align with Early Trends

The January figures provide early validation for the cautious annual forecasts issued by major agencies. RE/MAX's projection of a balanced-to-buyer's market with prices falling 2% by year-end, and Royal LePage's forecast of a 5% decline for detached homes and a 3% decline for condos, align closely with the current trajectory. The median price forecasts from Royal LePage ($1,610,915 for detached, $712,853 for condos) sit marginally below current benchmark figures, suggesting a downward path.

Pragmatic Analysis & Outlook

The convergence of rising inventory, declining sales, and falling prices across the major housing categories presents a clear, data-supported narrative.

The market has been fluctuating since 2022. As we approach 2026, it appears that the Metro Vancouver market may have been affected by the significant correction taking place in Greater Toronto and Southern Ontario. Key factors contributing to this shift towards a buyers' market include sustained higher borrowing costs, declining rents, economic instability, negative consumer expectations regarding future property prices, and a decreased appetite for investment properties.

Strategic Implications

For Buyers, as prices decline, affordability is gradually improving, and more homes on the market mean buyers could find a more listings that meet their needs. More than one potential dream home within your budget. The high months of inventory provide significant negotiation leverage and the opportunity for a rigorous home inspection without the pressure of bidding wars. Patience is a good strategy in the current conditions.

For Sellers, realistic pricing, based on the most recent comparable sales and taking the price trajectory into account, is non-negotiable. Properties perceived as overpriced will stagnate. For those with a necessary sale horizon within the next 6-12 months, the data suggests acting sooner may be prudent to avoid "chasing the market down" as forecasts project further softening.

The January 2026 data solidifies Greater Vancouver's transition into a buyer's market. The trends of increasing supply and weakening demand are established and accelerating, setting a stage for continued price discovery and negotiation-driven transactions in the months to come.