Greater Calgary Property Market Report: January 2026

A Cooling Market Solidifies as Buyers Gain Leverage

The Greater Calgary real estate market has begun 2026 with clear data confirming a sustained cooling trend and a decisive shift in leverage toward buyers. Metrics across all major property types (detached homes, row/townhouses, and condominium apartments) show rising inventory, softening sales, and measurable price declines, establishing a cautious tone for the year ahead.

Market Overview: A Broad Shift to Balanced and More Buyer-Friendly Conditions

Total residential sales in January 2026 reached 1,234 units, a 14.8% year-over-year decline. Active listings to rose to 4,391 units. That’s the highest January level since 2020.

Detached House Market: Inventory Builds in a Balanced Setting

The detached market, while remaining the most stable segment, shows clear signs of easing from the strong seller's conditions of recent years.

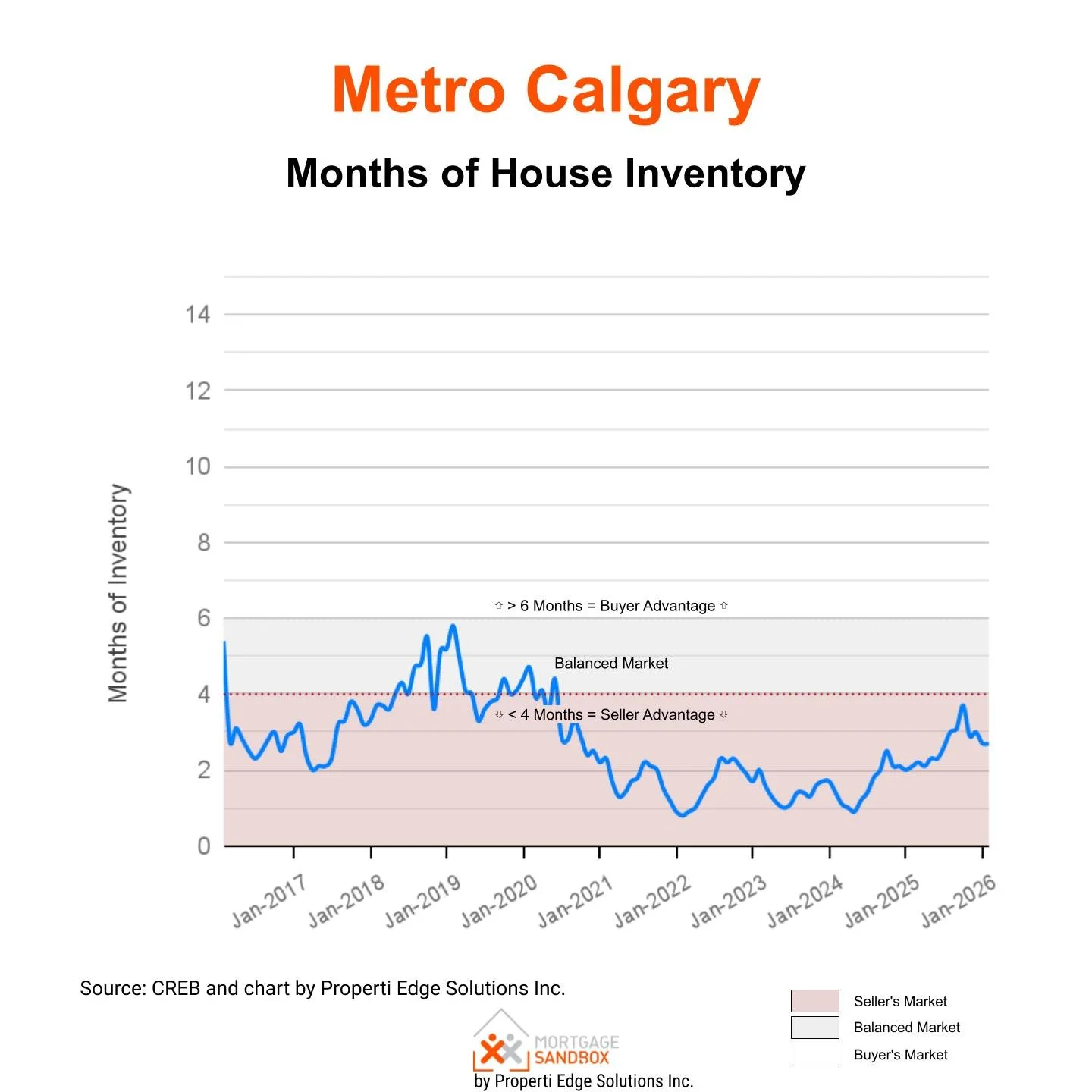

Market Conditions:

Sellers’ Market, trending in favour of buyers. The critical "months of inventory" metric has increased to 2.7 months, a 29% rise from 2.1 months one year ago. While this remains below the 4-month threshold that typically defines a balanced market, the trend indicates improving choice and negotiating power for purchasers.

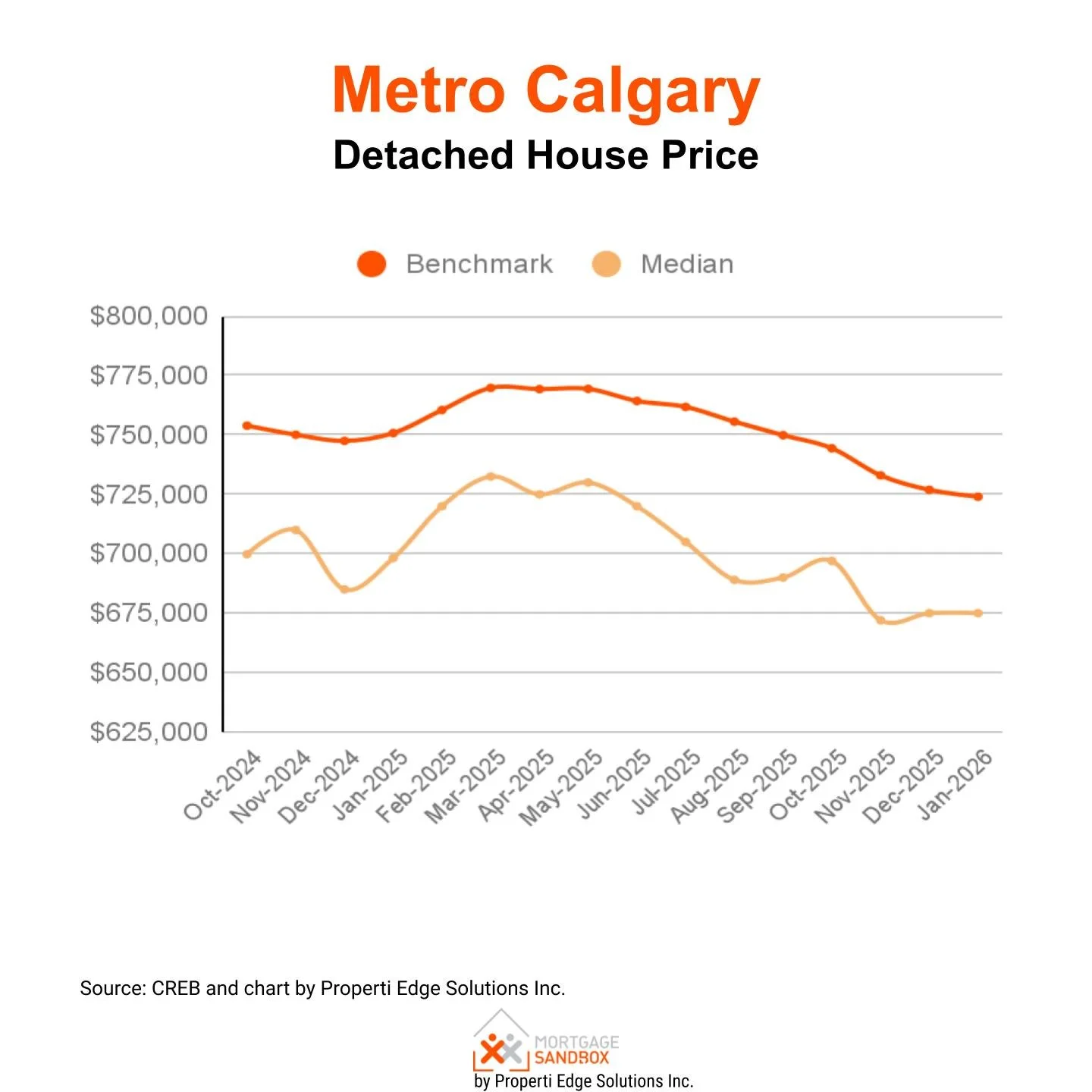

Benchmark Price:

The benchmark price is $724,000, reflecting a 3% decline compared to January 2025. This is down 6% from the peak in March 2025. The median price has decreased by 3.2% year-over-year and is down 8% from its peak.

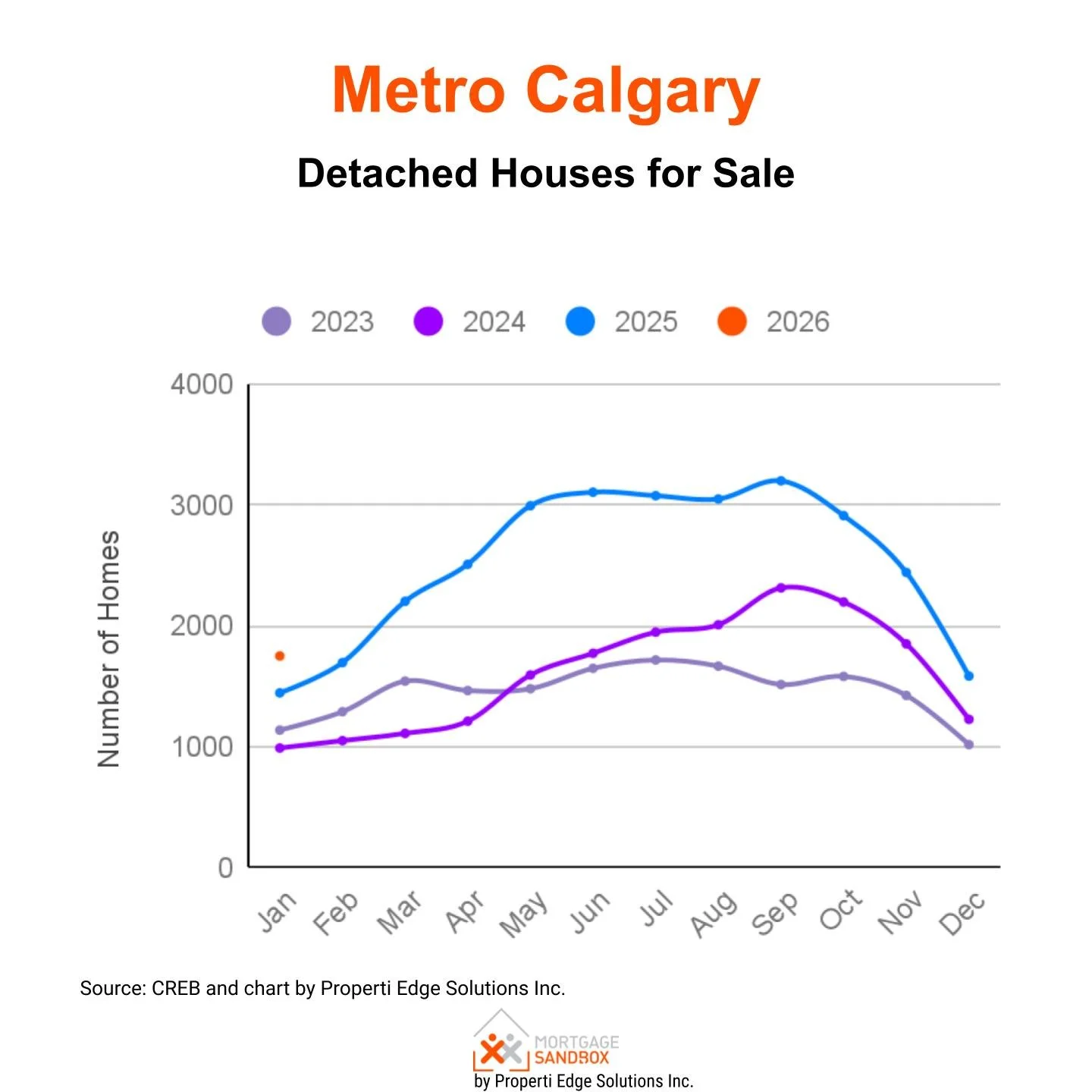

Active Listings & Purchase Demand:

This rise in months of inventory is fueled by a 21% year-over-year increase in active listings, which has outpaced a modest 2% decline in purchase demand.

Outlook:

The data suggests a continuation of stable-to-soft conditions. With inventory growing and demand easing, significant upward price pressure is absent. The spring market will be a key indicator of whether this balance holds or trends further toward buyers.

Row/Townhouse Market: Rising Supply Meets Weaker Demand

The row home segment is experiencing a faster transition toward buyer-friendly conditions due to a notable rise in supply.

Market Conditions:

Balanced Market, trending toward buyers. Months of inventory have risen to 4.2 months, a 76% increase from 2.4 months one year ago, moving this segment to the upper edge of balanced conditions.

Benchmark Price:

$420,800, down 5.2% from January 2025, down 9% from the peak in June 2024.

Active Listings & Purchase Demand:

The significant increase in active listings inventory by 32.6%, combined with a year-over-year decline in sales of 24.7%, has nearly doubled months of inventory, shifting the market from a sellers' market to a balanced market.

Outlook:

Increased supply, especially due to competition from new construction, is expected to continue exerting downward pressure on prices in this segment in the near term. As of December 2025, there are 2,845 townhomes under construction, while a total of 3,845 resale townhomes were purchased throughout 2025. This influx of new housing stock adds to a market that is already tilted in favour of buyers.

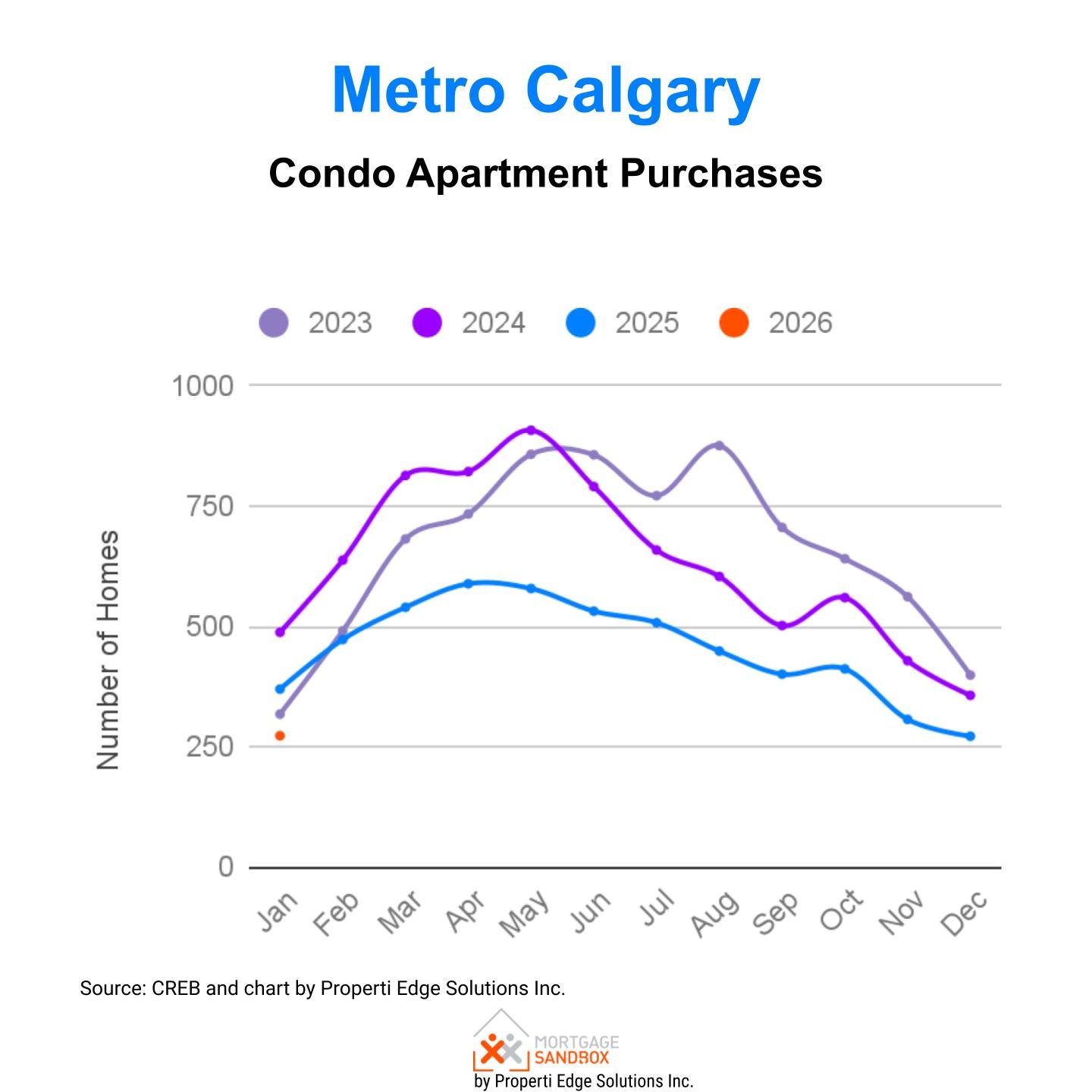

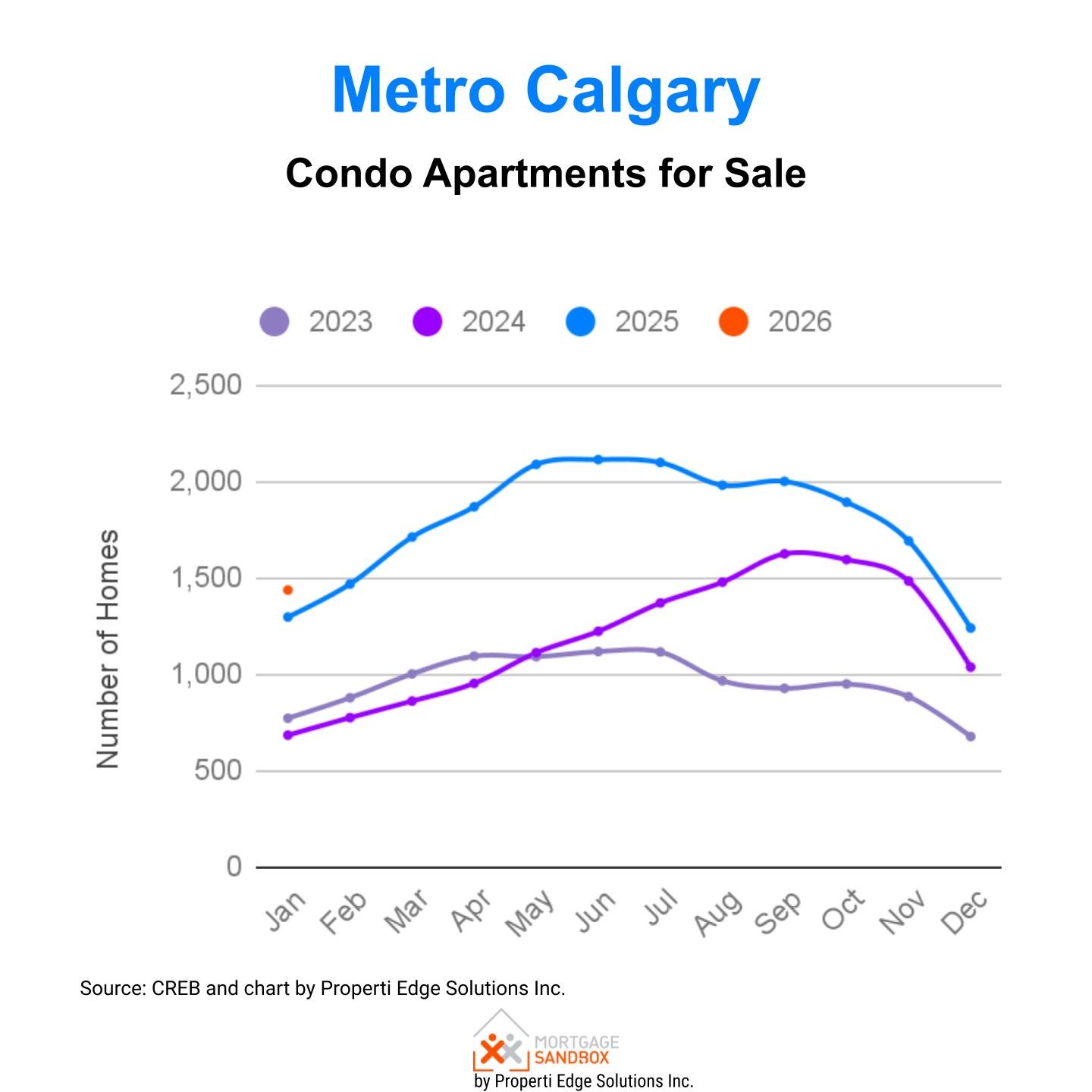

Condominium Apartment Market: Accelerating Buyer's Market Conditions

The apartment segment faces the most pronounced challenges, with conditions solidifying into a clear buyer's market.

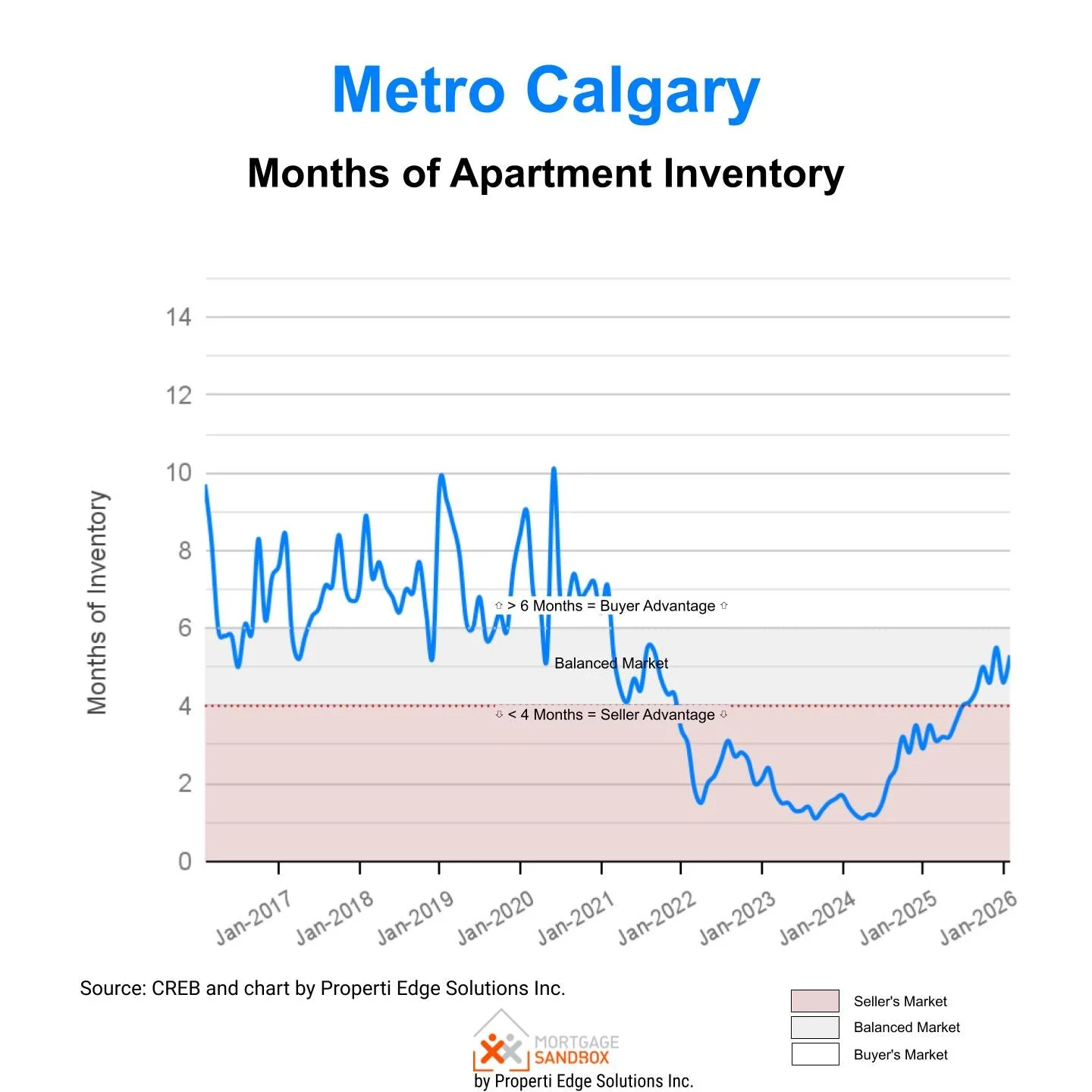

Market Conditions:

Buyer's Market, accelerating. Months of inventory have jumped to 5.3 months, a 51% increase from 3.5 months one year ago, firmly placing this segment in balanced market territory and trending toward a buyer’s market.

Benchmark Price:

The benchmark apartment price is $301,200, which reflects a year-over-year decline of 7.75%, marking the largest drop among all property types. Over the past three months, the benchmark apartment price has decreased by 5%, indicating a shift in favour of buyers. Meanwhile, the median apartment price is $297,000, having dropped 2% in the same timeframe, also in favour of buyers. Notably, prices have fallen 31% from their peak in August 2024.

Active Listings & Purchase Demand:

This is the result of a 26% decline in purchase demand occurring alongside an 11% increase in active listings. Inventory reached a record high for the month of January.

Outlook:

The significant supply and weaker demand fundamentals indicate that continued softness in home values is likely, with a high probability of further price correction in 2026. In the resale market, 5,432 apartments were purchased throughout 2025. As of December 2025, there were 17,930 apartments under construction in the metro Calgary area, which will compete for buyers over the next two years. There is a risk that the market may not be able to absorb this supply within such a short timeframe.

Data-Driven Context: Early 2026 Trends and Annual Forecasts

The January figures provide an early snapshot that aligns with cautious annual forecasts. RE/MAX's projection of a balanced-to-buyer's market with 0% price change by year-end appears consistent with current detached market stability but may prove optimistic for the apartment sector. Royal LePage's forecast of a modest 3% rise for detached homes seems at odds with the current data showing declining prices and rising inventory.

Pragmatic Analysis & Strategic Implications

The convergence of rising inventory, declining sales, and falling prices across most housing categories presents a clear, data-supported narrative for Calgary.

Key factors driving this shift include the exit of out-of-province investors, a decline in property flipping activity, sustained higher borrowing costs, and a growing supply in the attached and apartment segments.

Strategic Implications for Buyers:

Increased inventory provides more choice and negotiation leverage, particularly in the apartment and townhome segments. Patient negotiations and due diligence are advised, as the market trend suggests no immediate pressure to buy before prices rise.

Strategic Implications for Sellers:

Realistic pricing, grounded in the most recent comparable sales and acknowledging the current price trajectory, is essential. In the softening apartment segment, and for sellers with a sale deadlinewithin 6-12 months, acting sooner may be prudent to avoid chasing a declining market.

The January 2026 data solidifies Greater Calgary's transition from one of the hottest Canadian markets into a cooler, more balanced market with clear buyer advantages in specific segments. The trends of increasing supply and softening demand are established, setting the stage for continued price discovery and negotiation-driven transactions in the months to come.