Vancouver Real Estate Market: Review of 2025 and Future Outlook

A Market in Retreat: Anticipating Further Rebalancing

In 2025, the Vancouver real estate market officially transitioned into a buyer's market across all property types. This shift was characterized by declining demand, rising inventory, and ongoing price corrections, highlighting a significant change from the conditions that prevailed in the previous decade. Although the market is undergoing a necessary rebalancing, notable demographic and economic challenges indicate that this adjustment phase is far from complete.

The 2025 Market: A Broad-Based Buyer’s Advantage

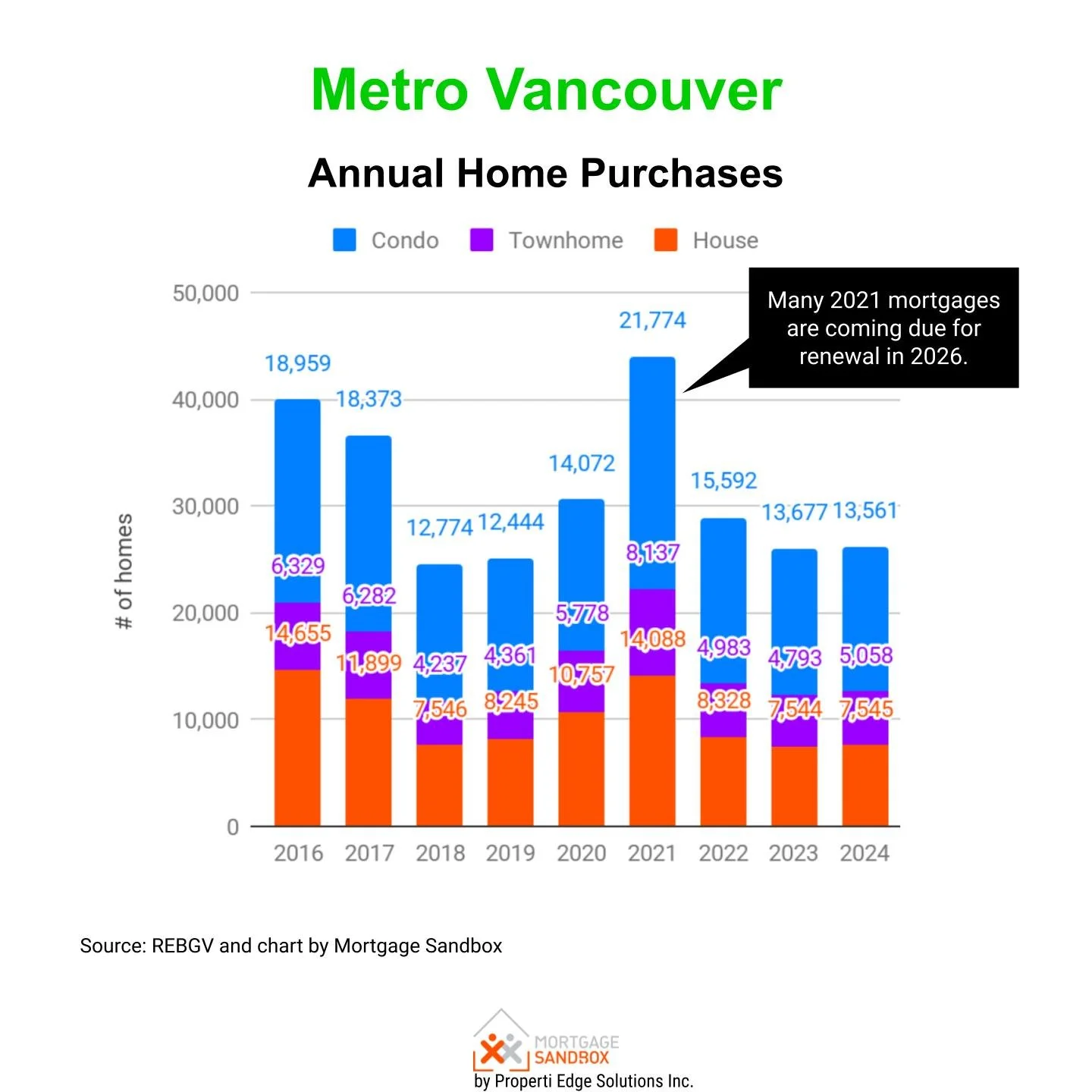

For the first time in years, buyers have consistent negotiating power in both the detached home and apartment segments. The data indicates that the market is in decline, with sales activity dropping to approximately 23,000 transactions in 2025, down from a peak of 44,000 in 2021. This sharp decrease serves as a clear sign of diminishing demand.

Key Market Metrics Year-over-Year (YoY)

| Segment | Market Status | YoY Market Trend | Benchmark Price | 3-month Price Trend* | 1-year Price Trend* |

|---|---|---|---|---|---|

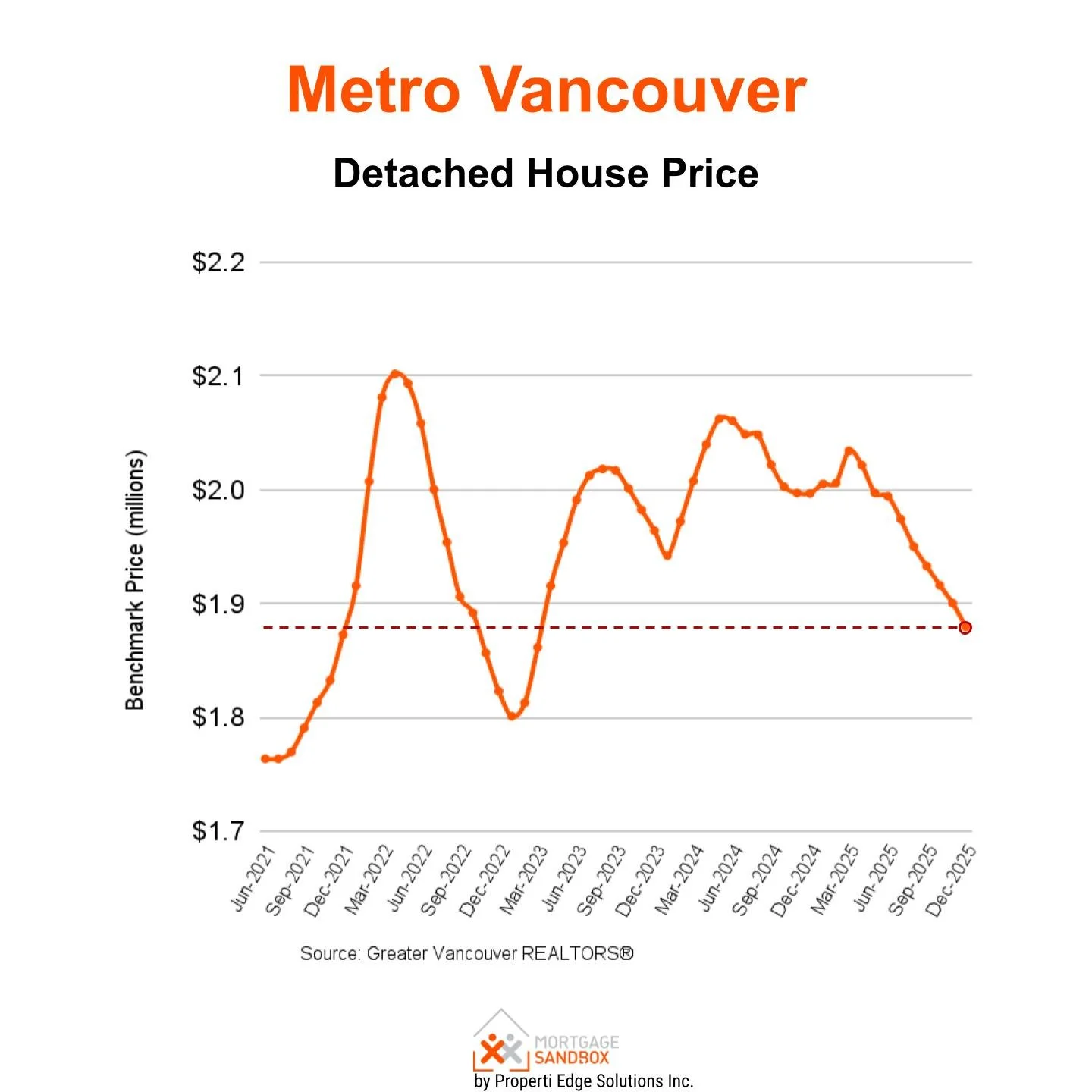

| Detached House | Buyer’s | Months of Inventory up YoY from 8.3 to 9.0 | $1,879,800 | -3% | -6% |

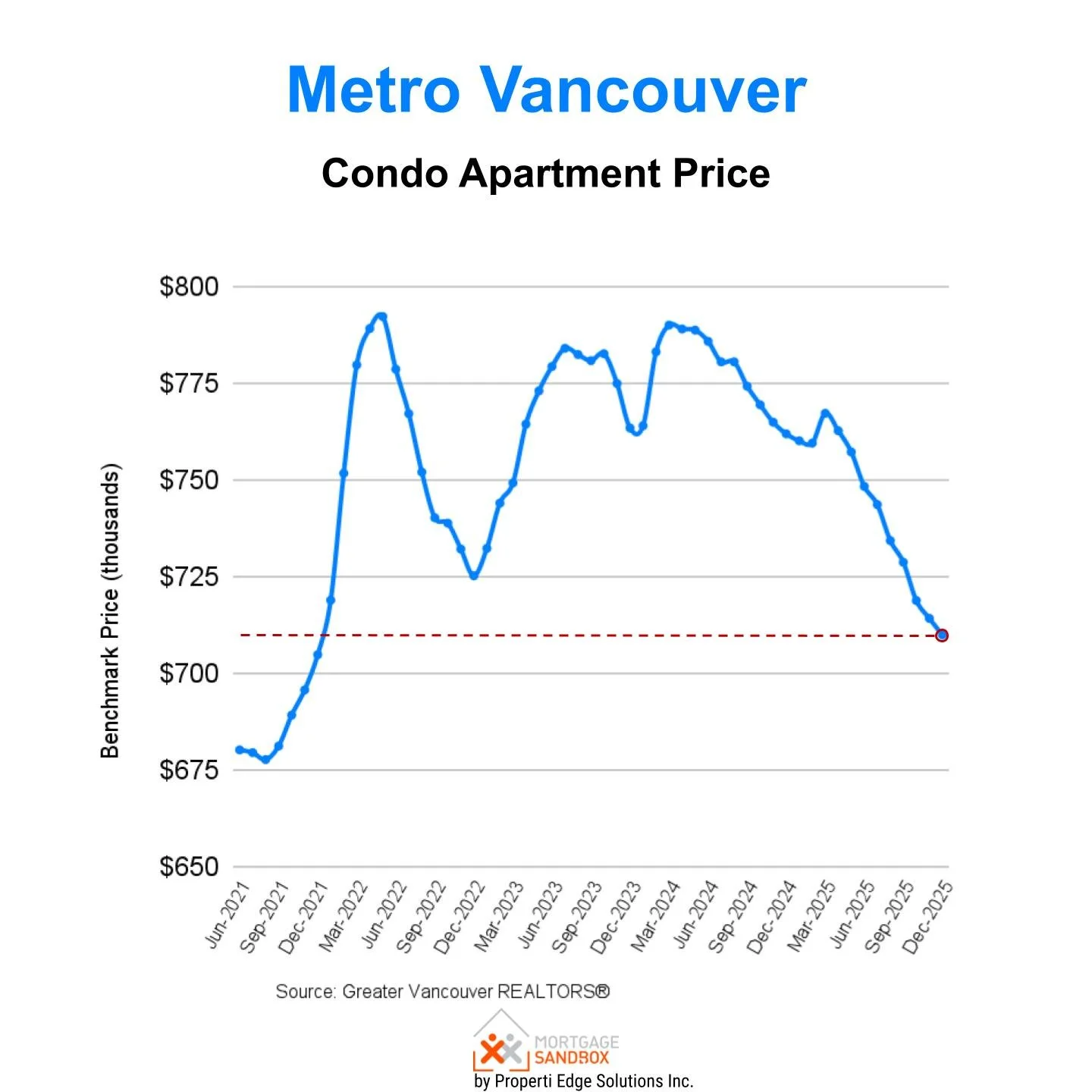

| Condo Apartment | Buyer’s | Months of Inventory up YoY from 5.4 to 6.1 | $710,000 | -3% | -7% |

The Demand Drought

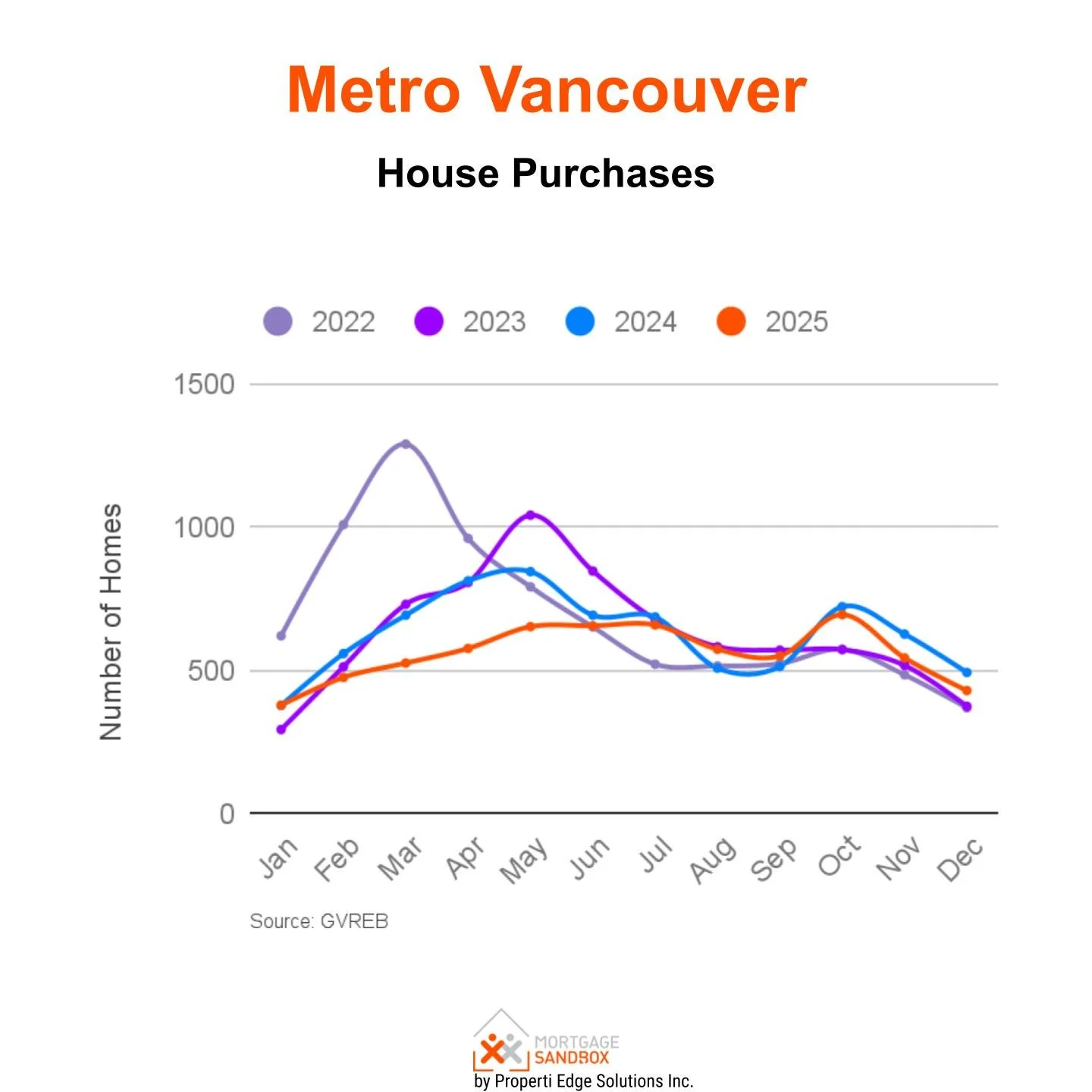

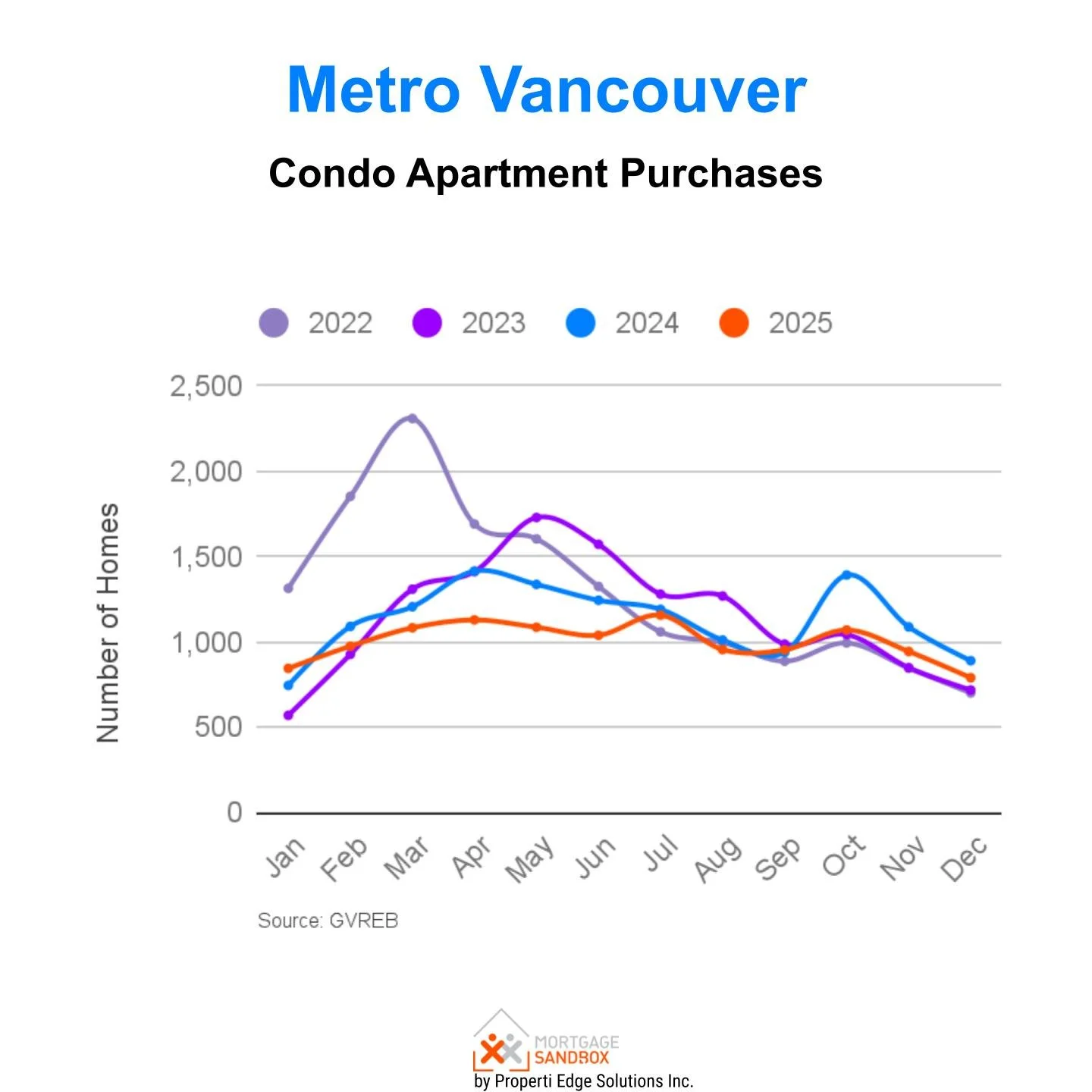

December purchase demand fell by 12% YoY for detached homes and 11% YoY for apartments. This decline is not merely a cyclical dip but reflects fundamental pressures: eroding affordability, higher carrying costs, and a reversal in population growth.

The Triple Threat: Demographics, Employment, and Rental Softness

Three interconnected macro-factors are driving the market’s recalibration:

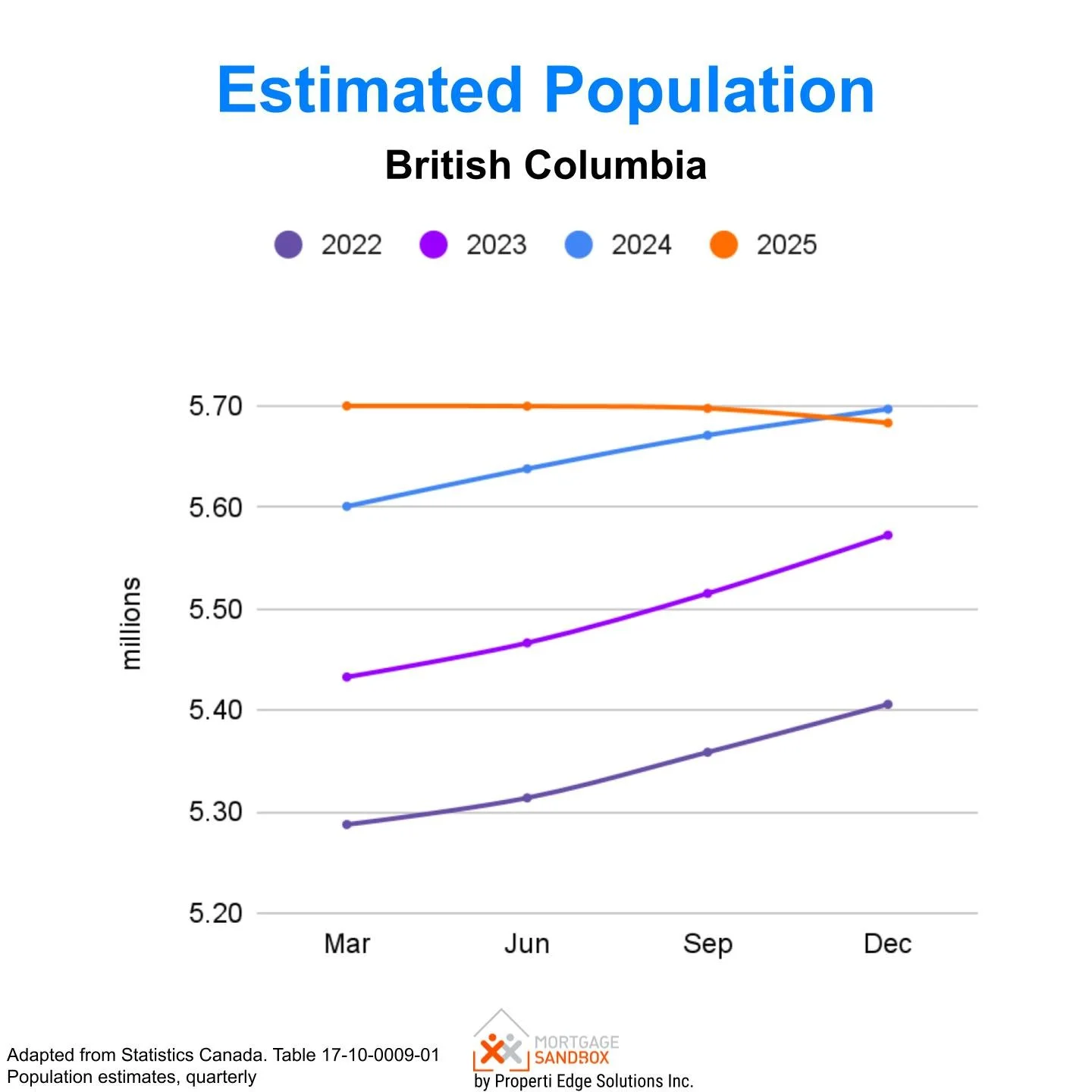

1. Population Reversal: For the first time in decades, British Columbia's population decreased by 12,000 people in 2025. This reduction directly impacts the number of potential buyers and renters, undermining the traditional "supply will never catch up with demand" narrative.

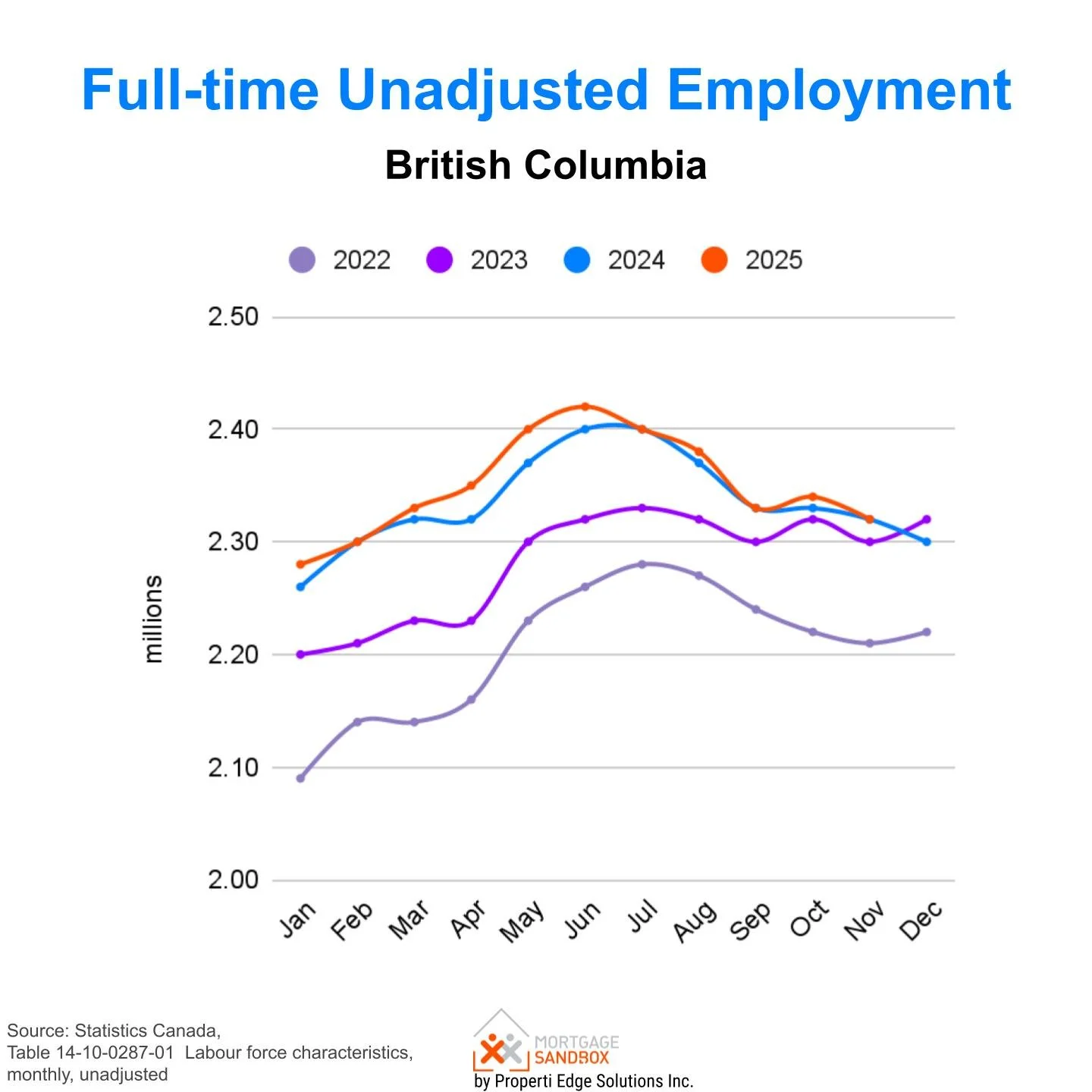

2. Economic Stagnation: Economic stagnation has caused full-time employment in the province to stagnate, hindering income growth and household formation. In an already unaffordable market, stagnant wages are making ownership increasingly unattainable.

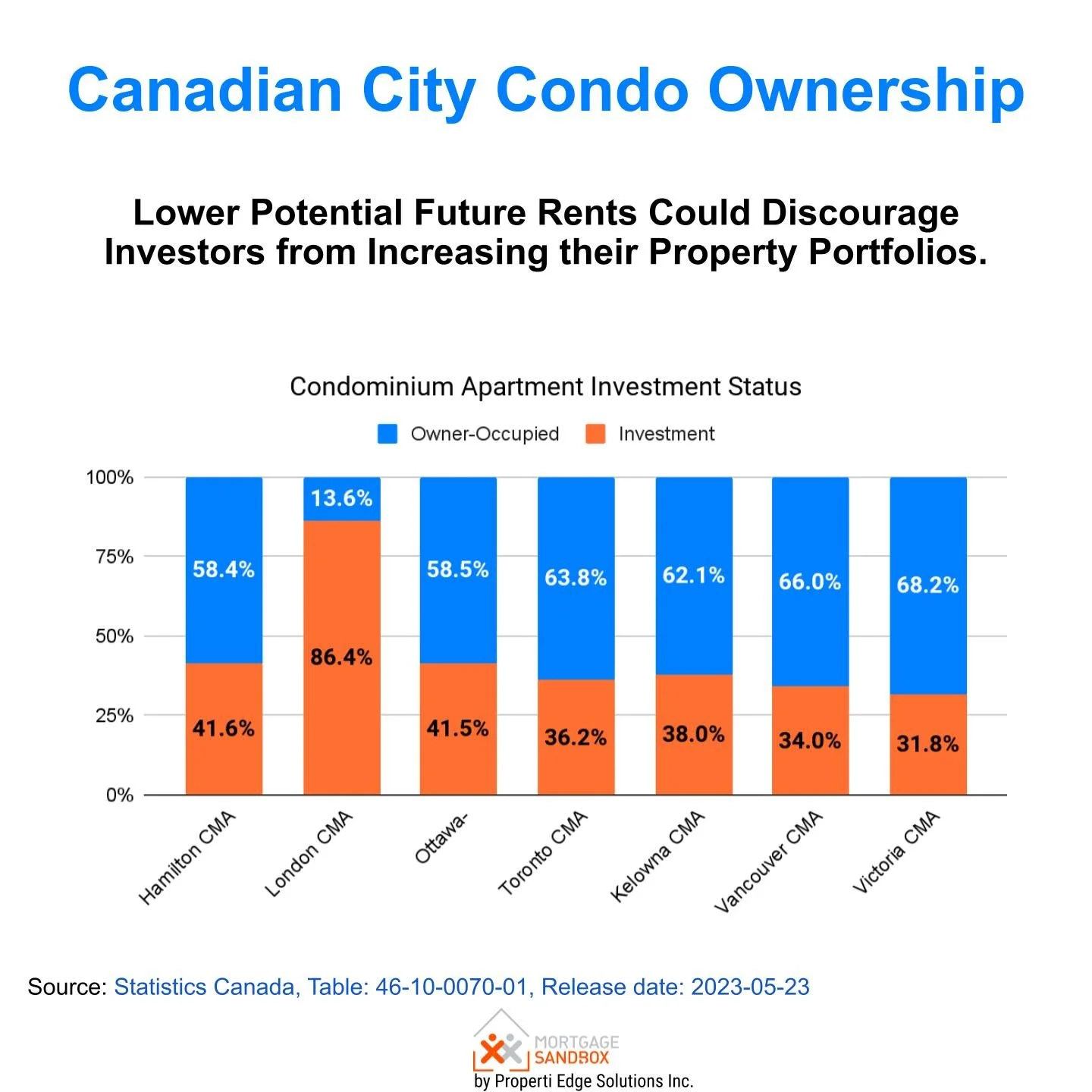

3. Investor Retreat: The rental market, a key pillar for investor demand, is softening. The condo vacancy rate has risen to 1.5% (from 0.3% in 2018), and 1-bedroom rents have fallen 12% over three years. With 34% of Metro Vancouver condos held as investments, falling yields and rising vacancies are prompting investor exits, adding to resale supply.

Market Outlook & Risk Assessment for 2026: The Rebalancing Continues

The current trends point toward a continued buyer's market in 2026, with the scale of further adjustment hinging on several critical factors.

Significant Downside Risks

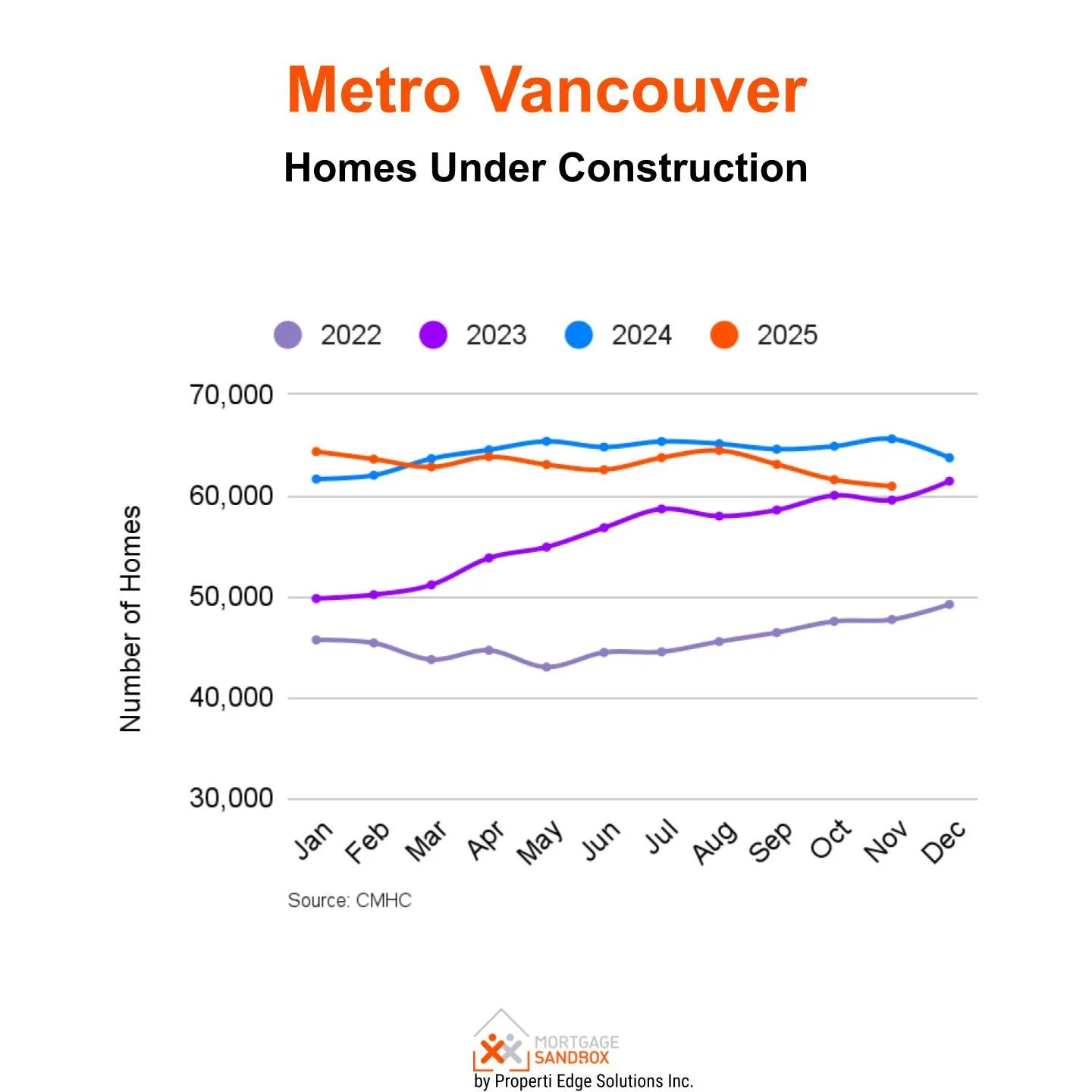

The Unprecedented Supply Pipeline: Vancouver has a staggering 61,000 homes under construction, exceeding the previous record. This wave of completions, particularly in the condo sector, will hit a market with already-high inventory and weak absorption rates, placing immense downward pressure on prices.

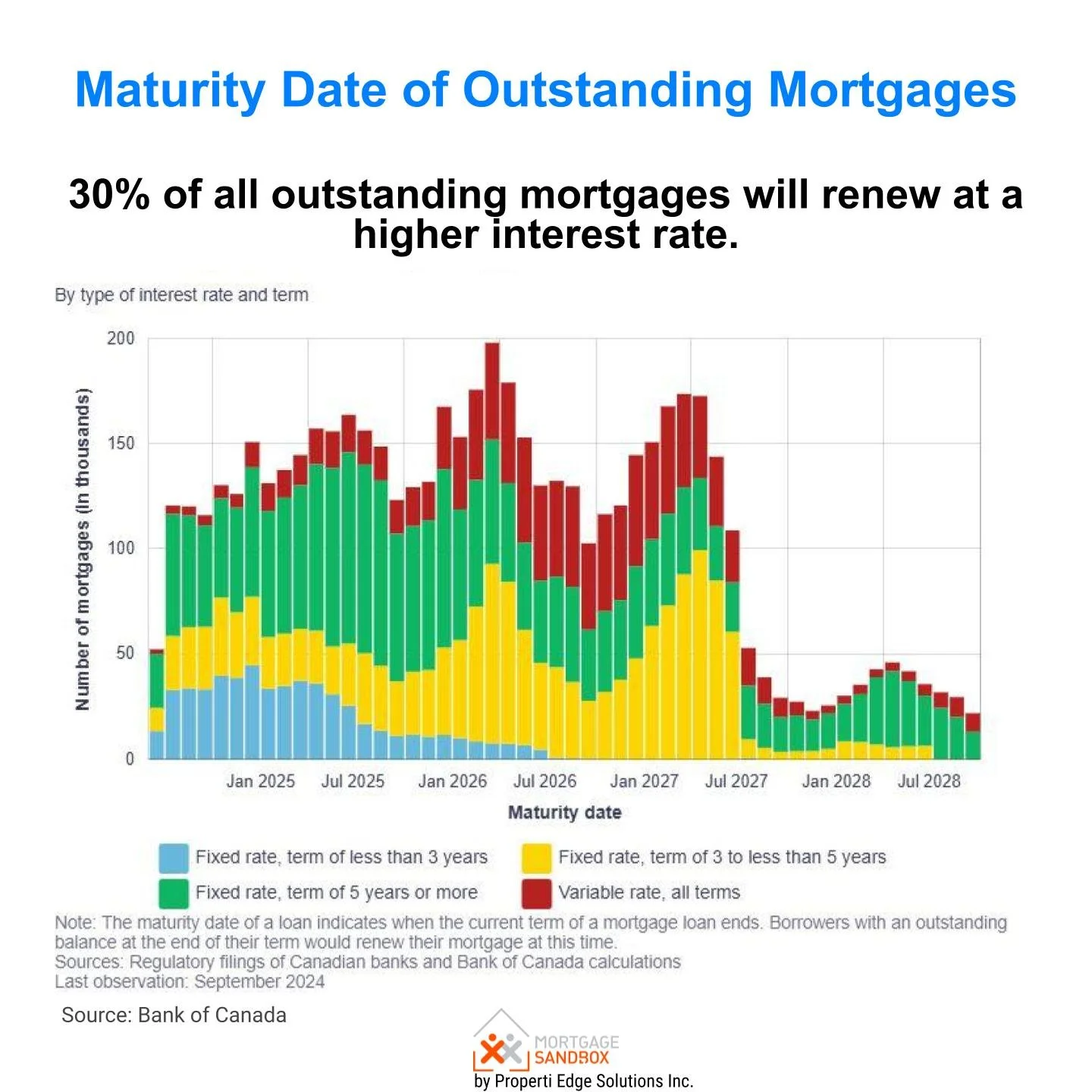

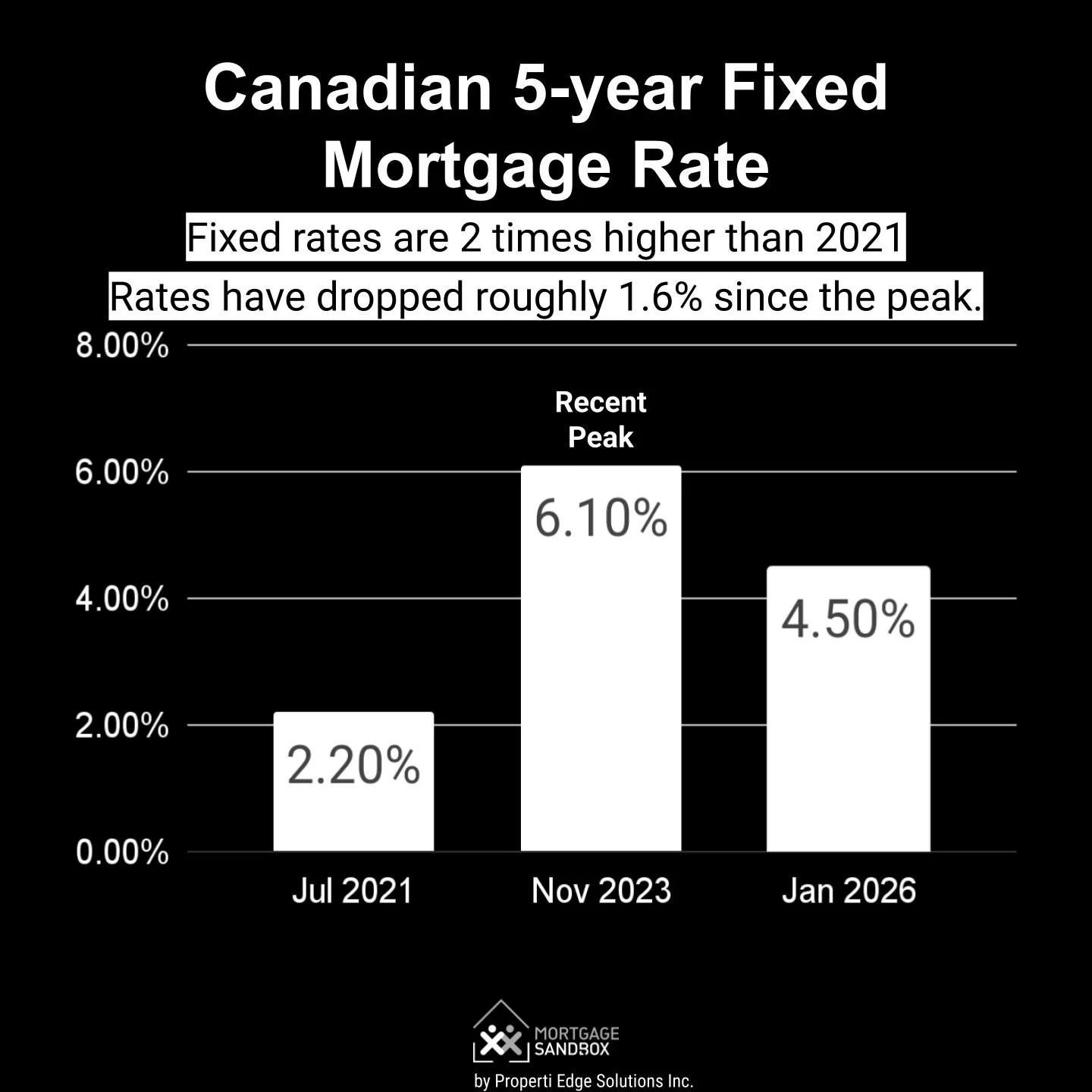

The Mortgage Renewal Shock: The 2021 cohort of buyers now faces renewal with rates drastically higher than their original sub-2% mortgages. The resulting payment shocks could force sales and increase the number of motivated sellers, accelerating price declines.

Demographic & Economic Erosion: Continued population stagnation or decline, coupled with weak job growth, would fundamentally undermine the demand required to stabilize prices at current levels.

The Investor Exodus: If falling rents and rising vacancies persist, the investor sell-off could intensify, transforming a steady trickle of new listings into a sustained flood of supply.

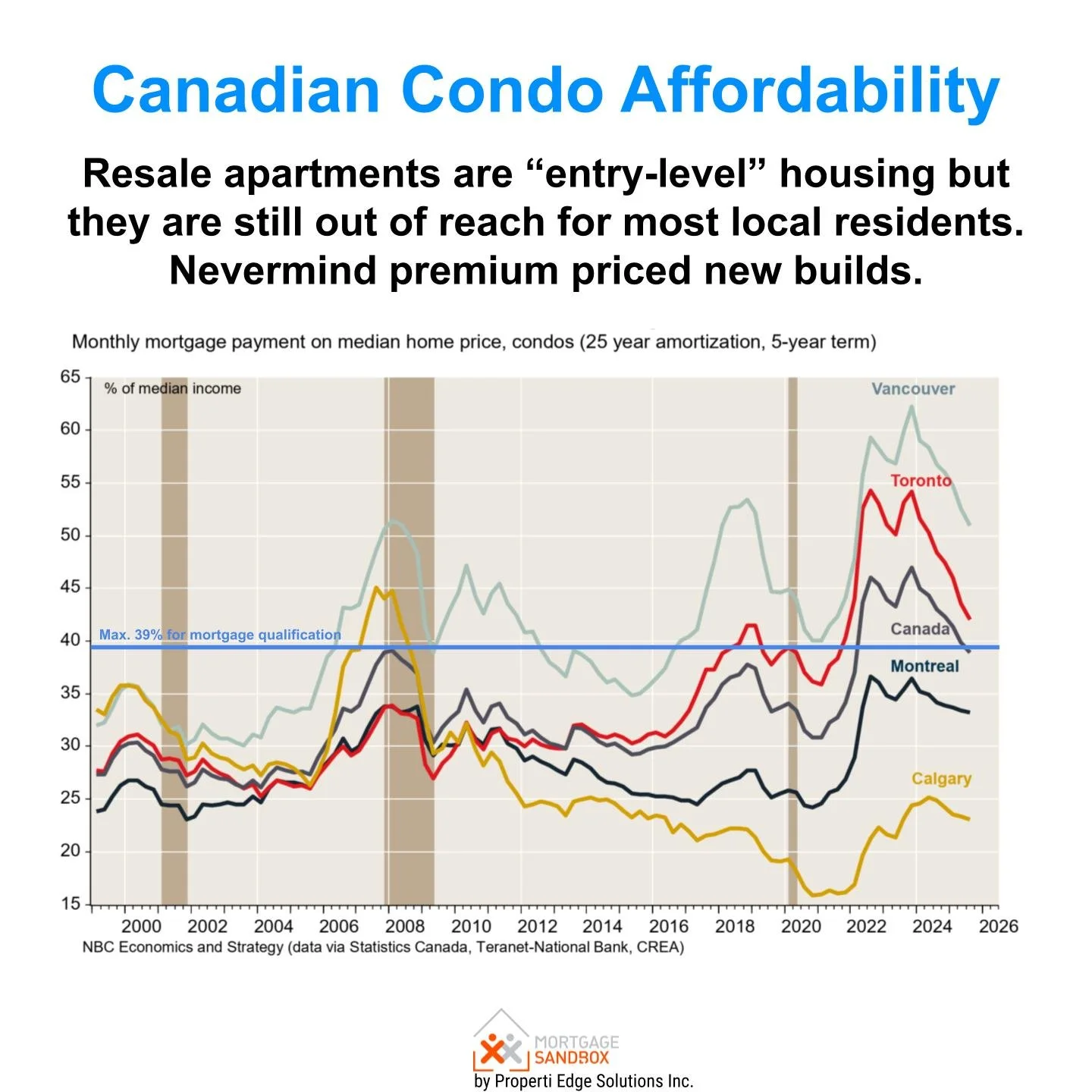

Poor Affordability: The monthly mortgage for a typical entry-level condo in Vancouver would still consume 51% of the median household income. The maximum allowable for bank financing is 39%. Buying is out of reach for most first-time buyers. Condo prices have also been dropping, squeezing owners' equity. This leaves upsizing off the table for most people in the Metro Vancouver.

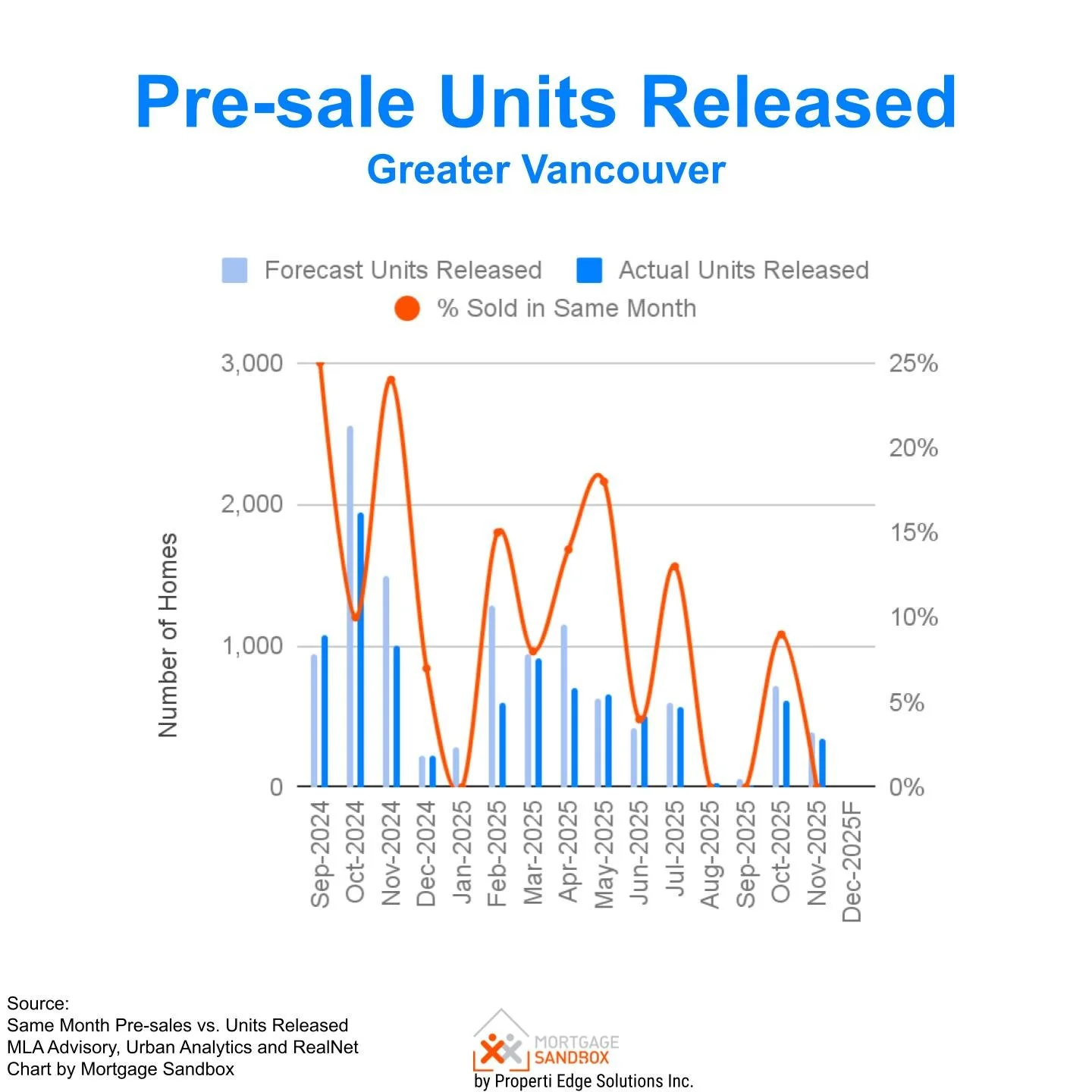

5. Pent-up Pre-sale Inventory: Current pre-sale activity is low because project economics require prices that exceed today’s market values. However, the land for these projects is already assembled and will eventually be developed. This could occur either through the original developer, as rental properties, or by a new owner after a restructuring. This situation represents a substantial shadow inventory. Once market sentiment improves, a significant wave of pre-sales will emerge, directly competing with resale listings and limiting price appreciation. Buyers are now more aware of the risks associated with pre-sales, which means they can no longer demand the premiums they once could.

Limited Upside Risks

Psychological Pricing Thresholds: As prices correct, certain segments may reach price points that attract renewed interest from long-term, equity-rich buyers who have been waiting on the sidelines. However, this is unlikely to constitute a broad-based recovery.

Interest Rate Stability: It is widely expected that the Bank o f Canada has finished lowing it policy rate for this cycle and the mortage rates 4-5% range, the reduction in rates is welcome relief.

A Market Redefining Its Foundation

The Vancouver real estate market in 2025 continued its correction. The pillars that once supported ever-rising prices are showing cracks.

Looking ahead to 2026, we can expect continued rebalancing in the market. Buyers will have greater leverage, a wider selection of properties, and more time to conduct due diligence. On the other hand, sellers will need to adjust their expectations to align with prices that reflect the current economic reality rather than speculative potential.

With a record-setting construction pipeline, supply will not be an issue for buyers, but it will pose a challenge for sellers.

The central question for 2026 will be whether meaningful demand can emerge to absorb that supply. In this environment, prudence, patience, and thorough financial analysis will be essential for all market participants.