Toronto Real Estate Market: Review of 2025 and Future Outlook

The Toronto real estate market in 2025 was defined by a continued, painful adjustment. While some metrics suggest a tentative stabilization, the overarching narrative is one of significant price correction and weak underlying demand. The market remains mired in a state of balanced-but-fragile equilibrium, with considerable new supply on the horizon and profound affordability challenges capping a sustainable recovery.

The 2025 Market: A Year of Contradictory Signals

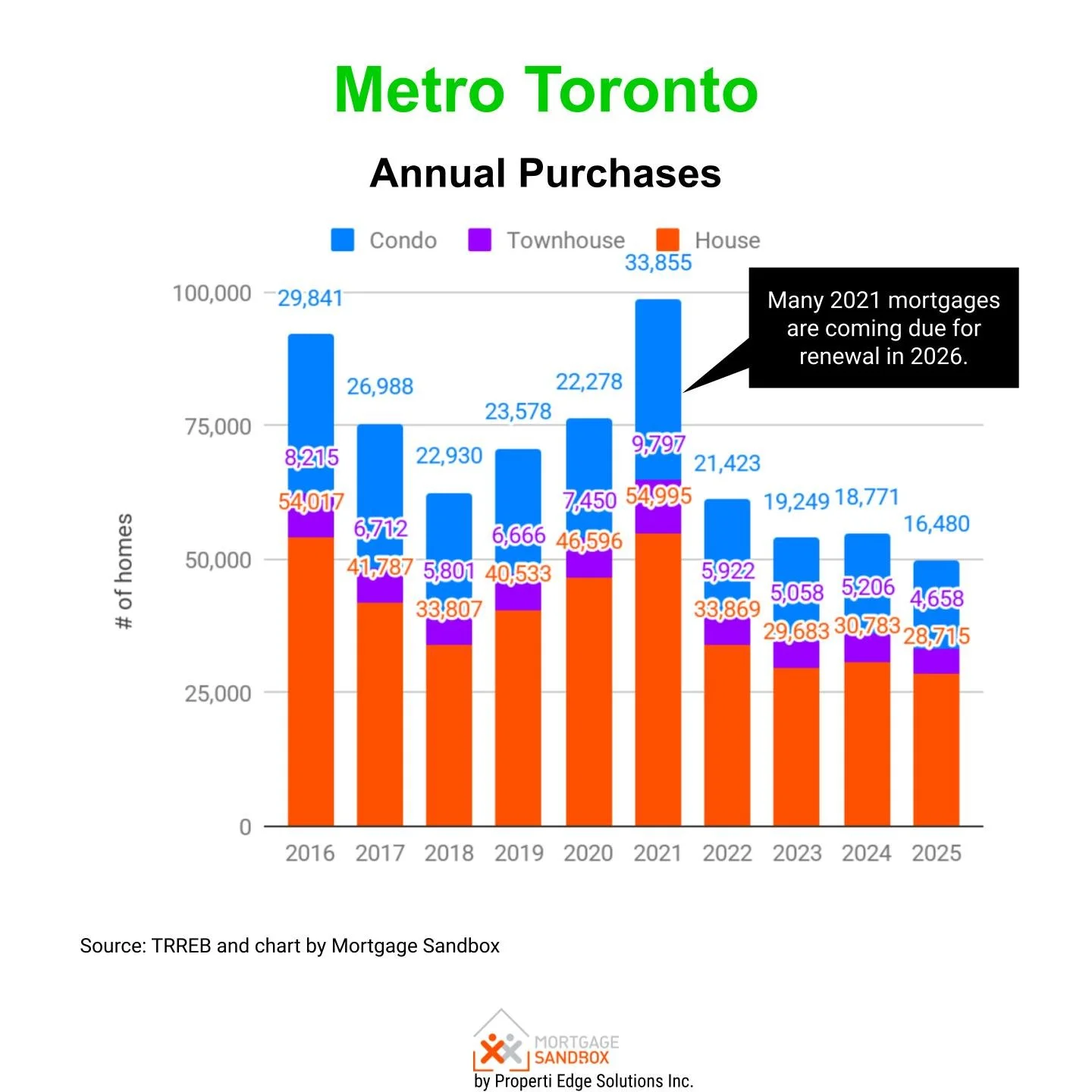

On the surface, 2025 showed signs of life: purchase demand for detached homes rose 19%, and condo demand increased 7%. However, this activity occurred at drastically lower price points and against a backdrop of deeply concerning macro trends.

Key Market Metrics (Year-over-Year):

| Segment | Market Status | YoY Market Trend | Benchmark Price | 3-month Price Trend* | 1-year Price Trend* |

|---|---|---|---|---|---|

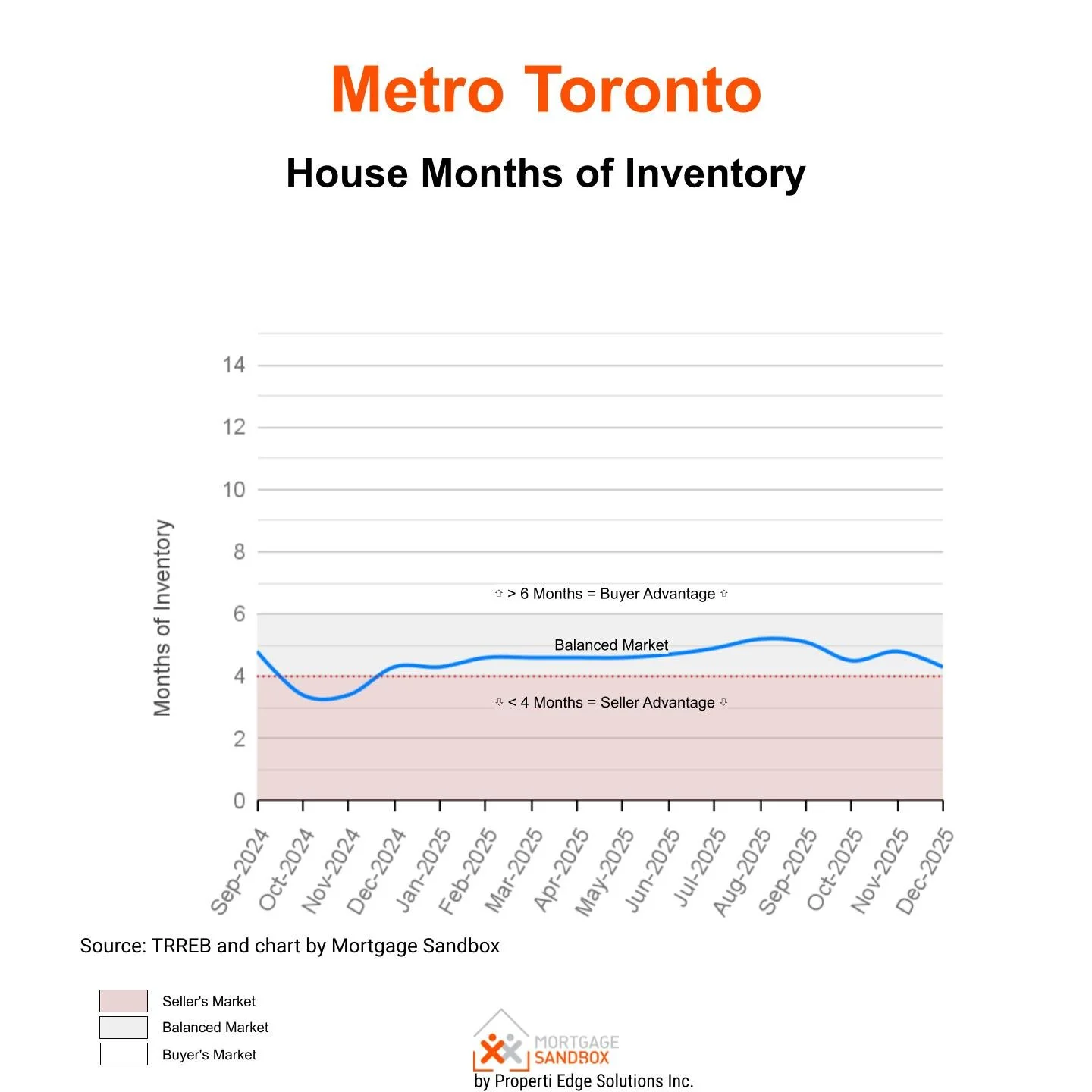

| Detached House | Balanced | Months of Inventory unchanged YoY at 4.3 | $1,229,200 | -2% | -10% |

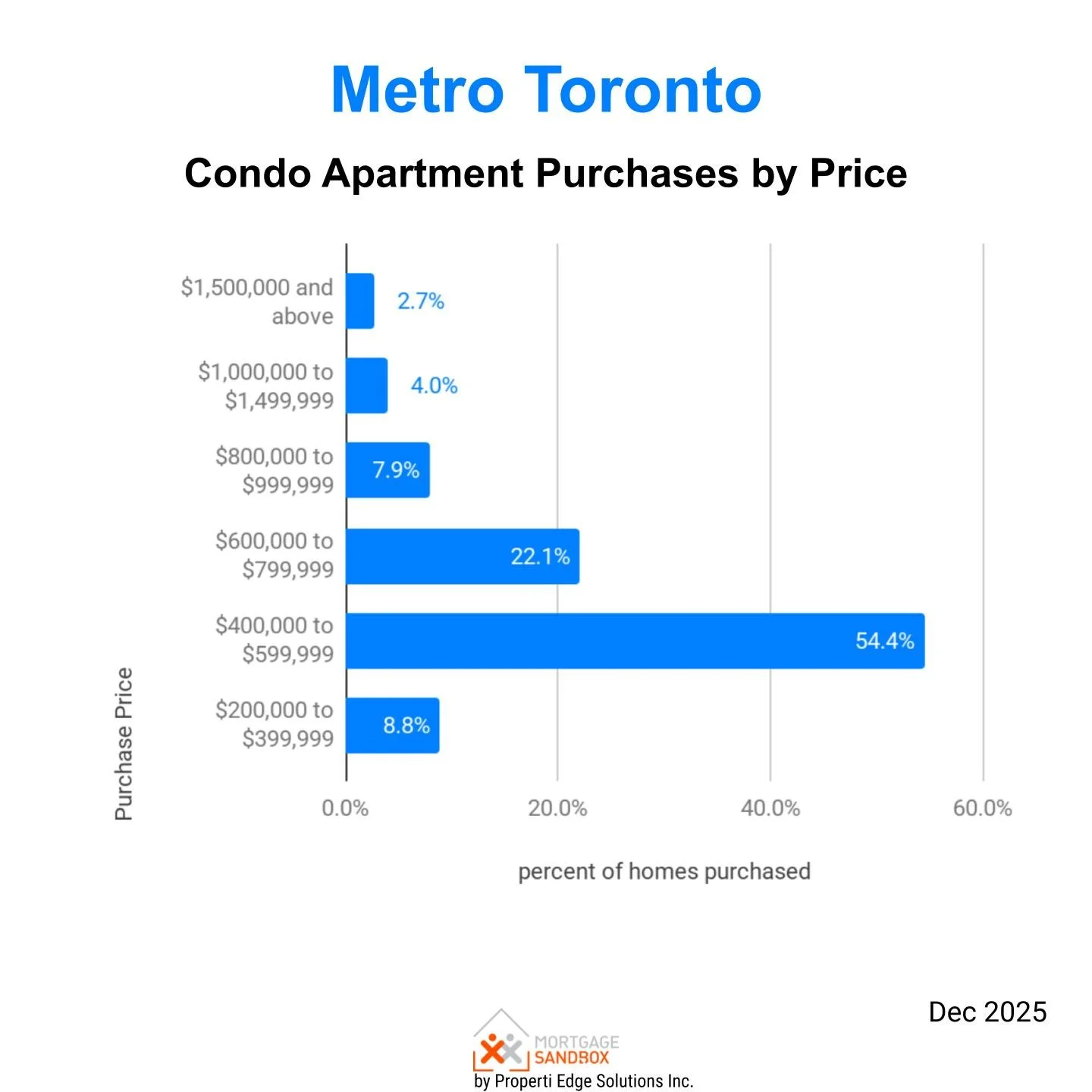

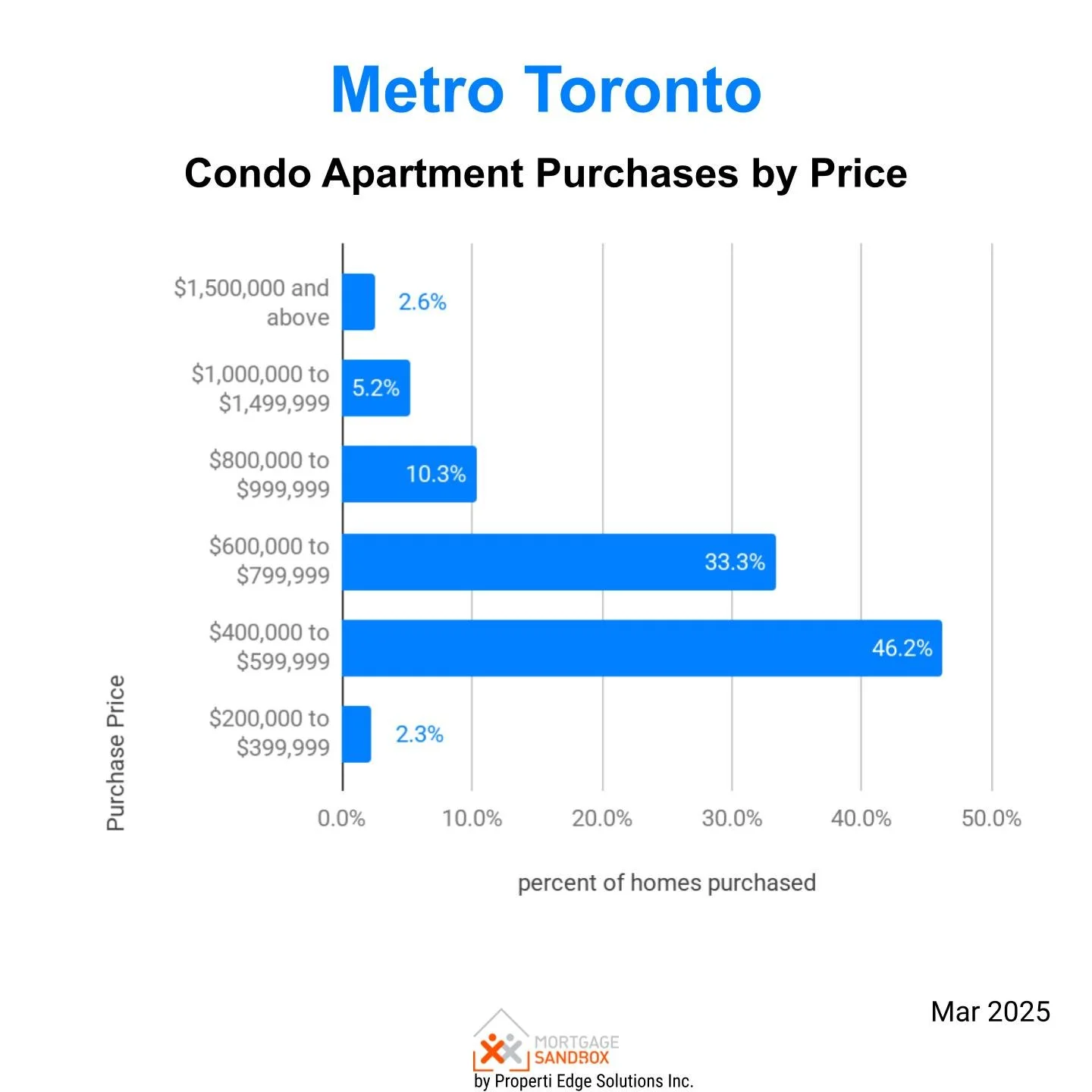

| Condo Apartment | Balanced | Months of Inventory down YoY from 6.5 to 6.0 | $553,500 | -2% | -7% |

The Volume Collapse

The most significant evidence lies in the sales volume. As shown in the accompanying chart, the total number of property transactions in the Greater Toronto Area has sharply declined from its peak. In 2025, there were approximately 50,000 transactions, a stark drop from the nearly 100,000 sales recorded at the market's height. This return to pre-2016 levels of activity highlights the challenges of affordability and illustrates how much the market had exceeded sustainable valuations supported by economic fundamentals.

Note: This data includes detached houses, condo townhouses, and condo apartments.

The Macroeconomic Squeeze: Population and Employment

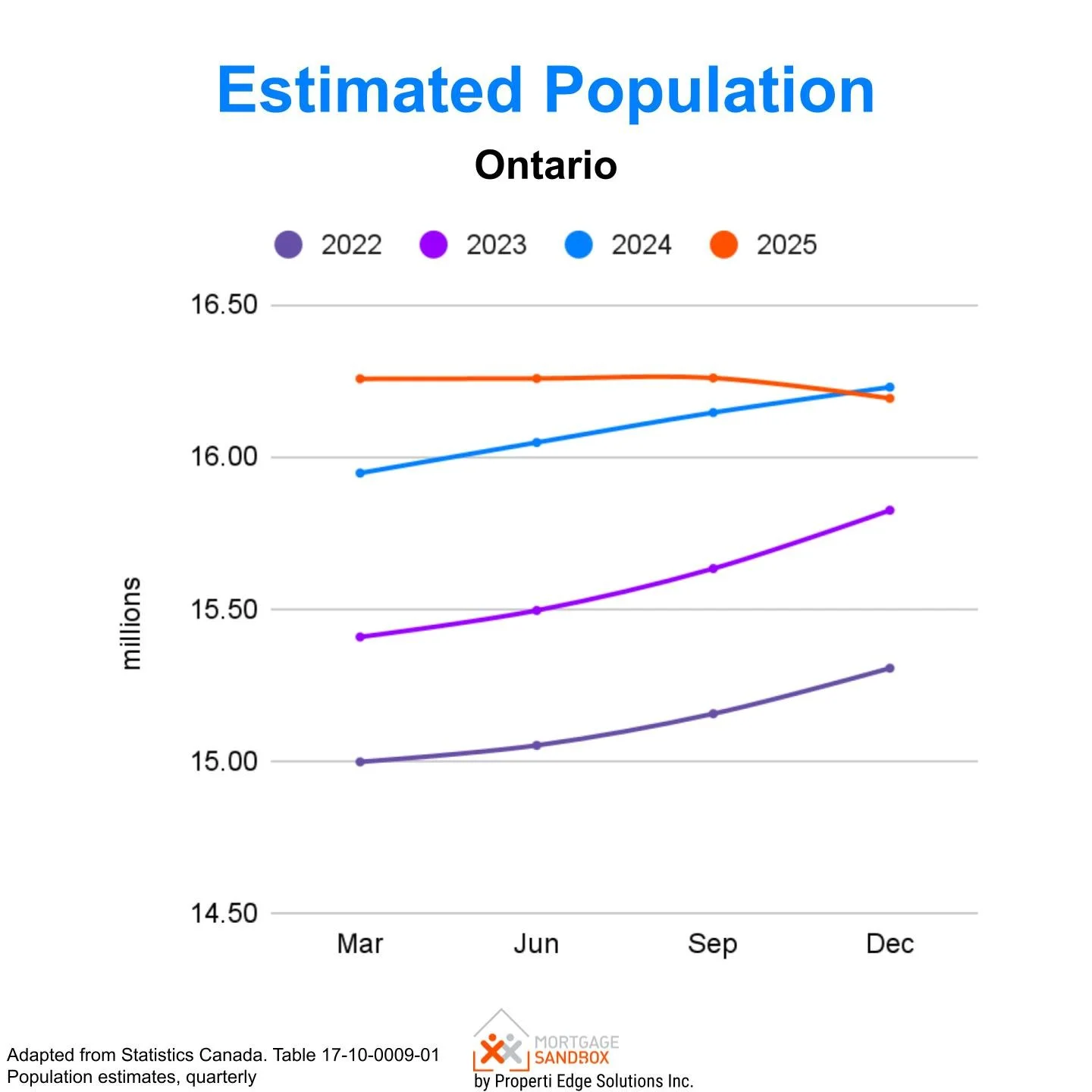

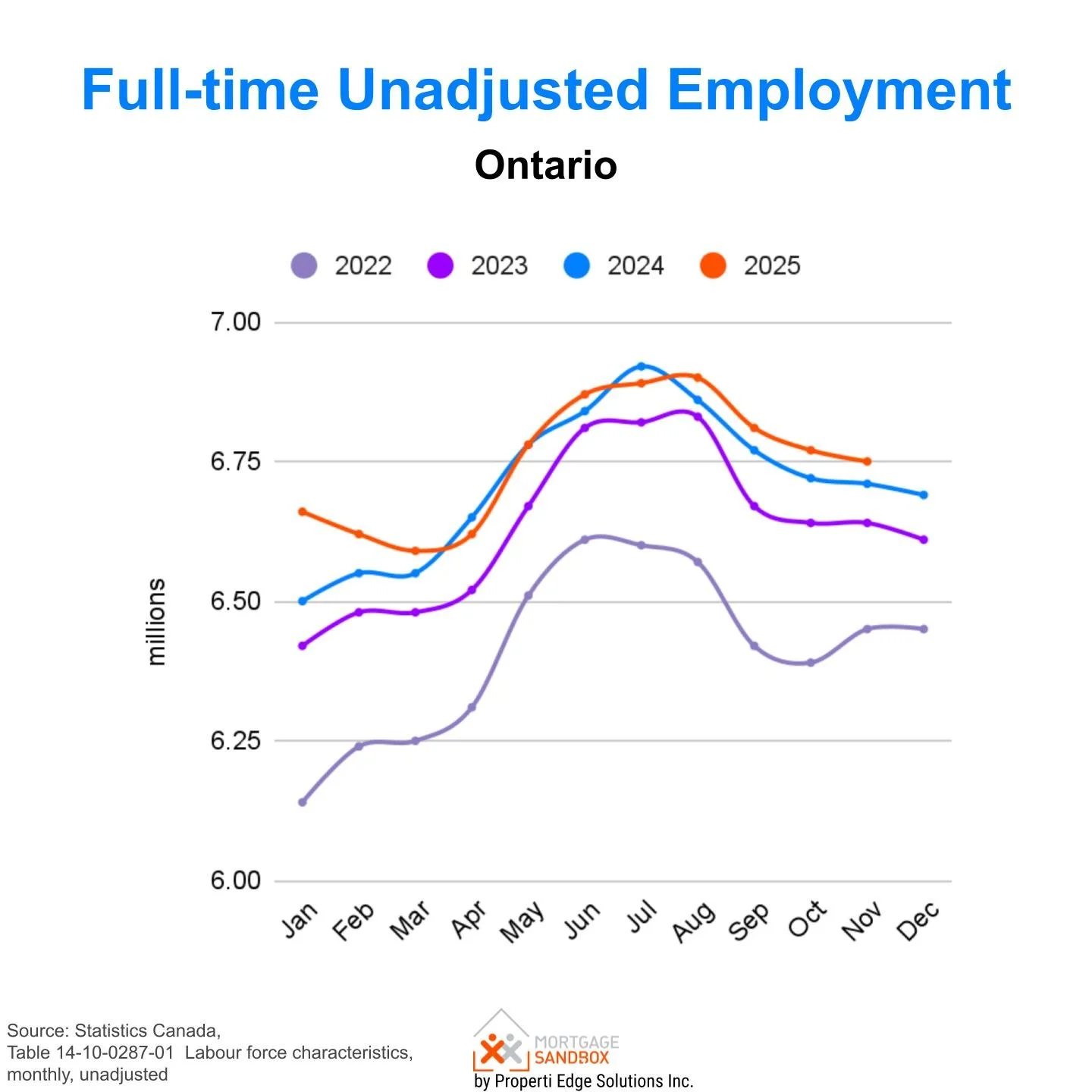

Two critical charts reveal the fundamental weaknesses underpinning the market:

1. Shrinking Population: Ontario's population growth turned negative by the end of 2025. A declining or stagnant population directly erodes the pool of potential buyers and renters.

2. Stagnant Employment: Full-time employment in Ontario has shown no meaningful growth through 2024-2025, indicating weak income growth and economic pressure on households.

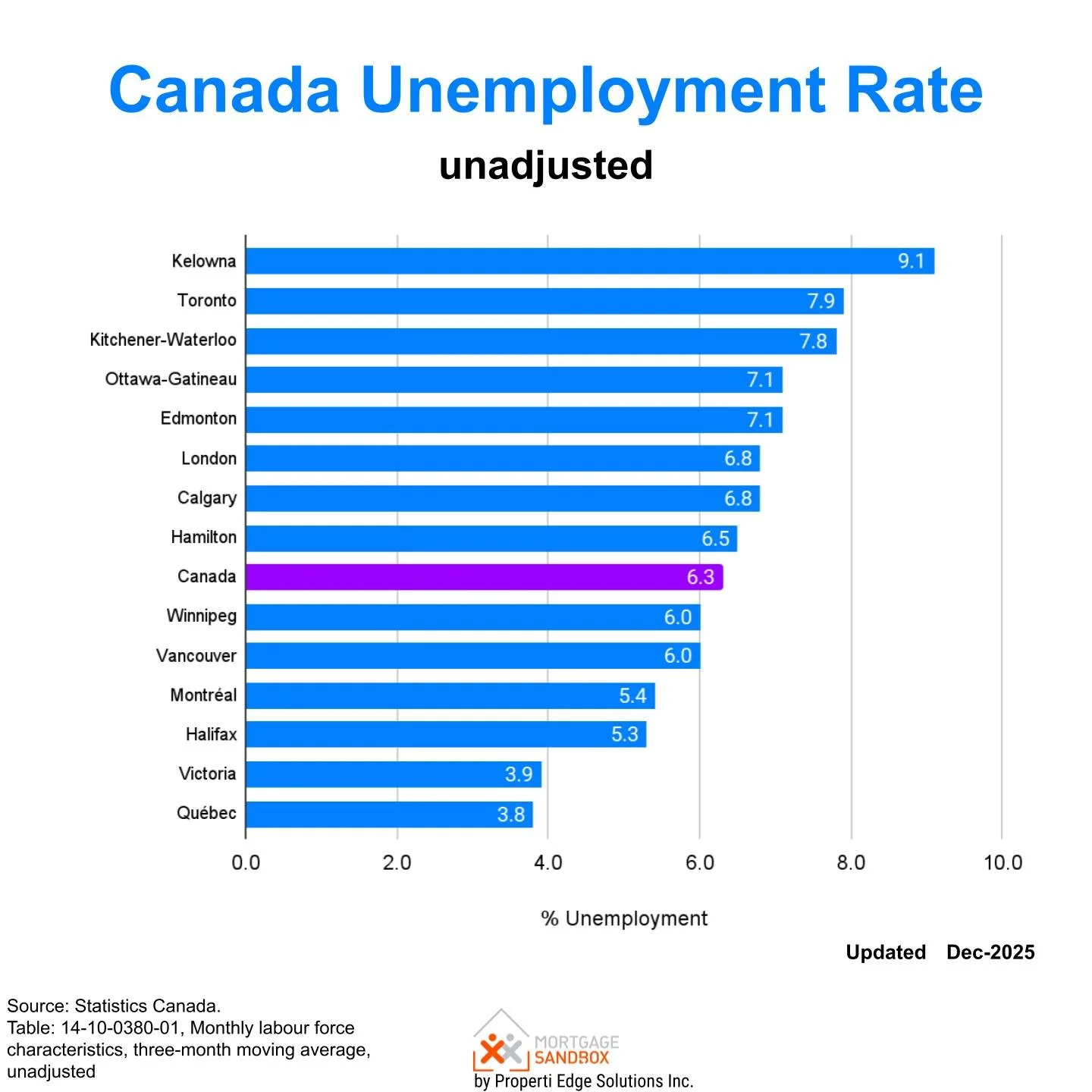

These factors create a significant headwind that even lower mortgage rates have struggled to overcome. Particularly, Metro Toronto has the highest unemployment rate among major urban centers in Canada.

Market Outlook & Risk Assessment for 2026: A Precarious Balance

The normalization—or correction—observed in 2025 is expected to continue. The scale of downside risks currently outweighs potential upside catalysts.

Significant Downside Risks

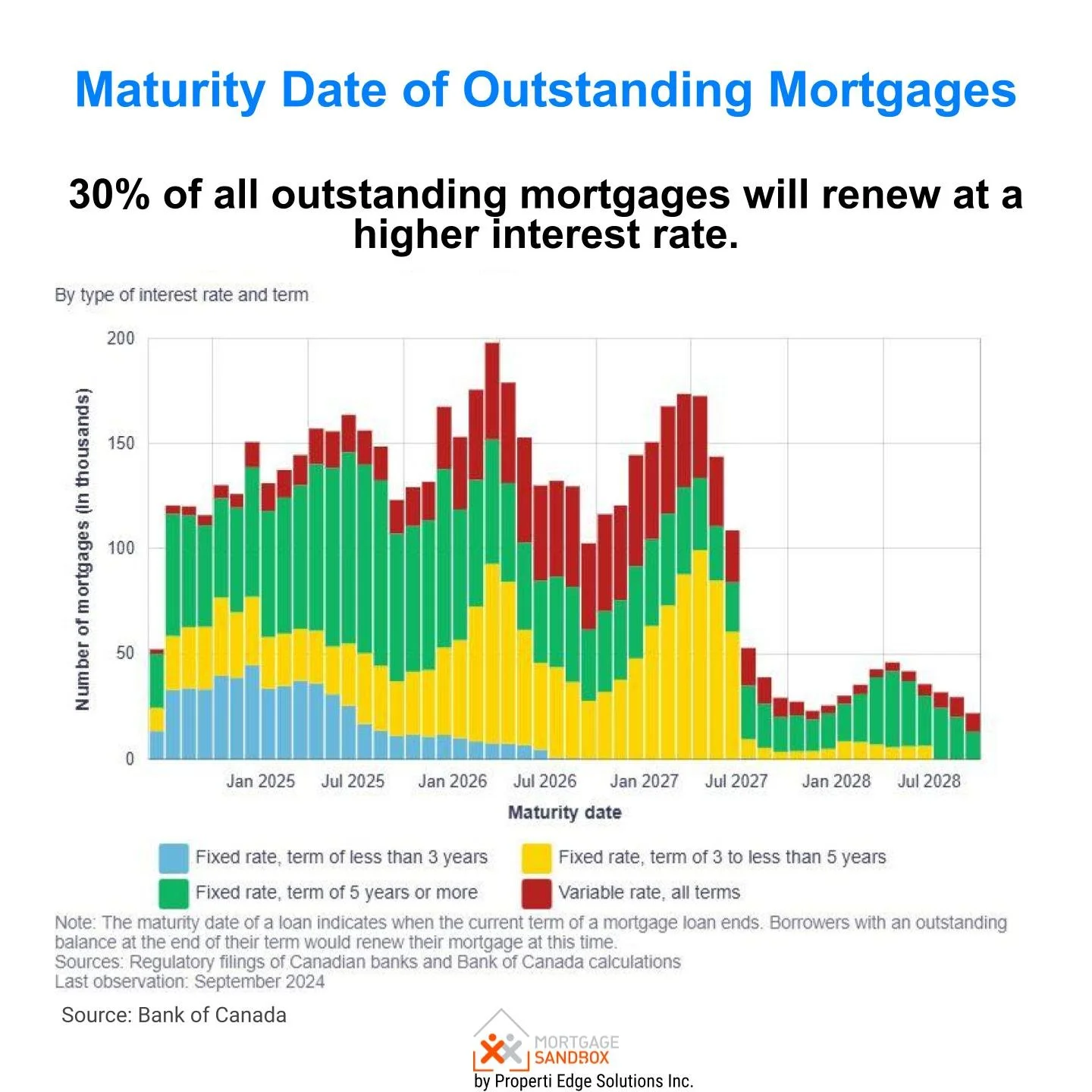

1. The Renewal Cliff: The most immediate threat is the 2026 mortgage renewal wave for buyers who purchased at peak prices with ultra-low rates in 2021. Payment increases of 20-40% could trigger a surge in power of sales and forced listings, flooding the market with motivated sellers. Distressed home sales have already surged in Toronto in 2025, and the trend will continue into 2027.

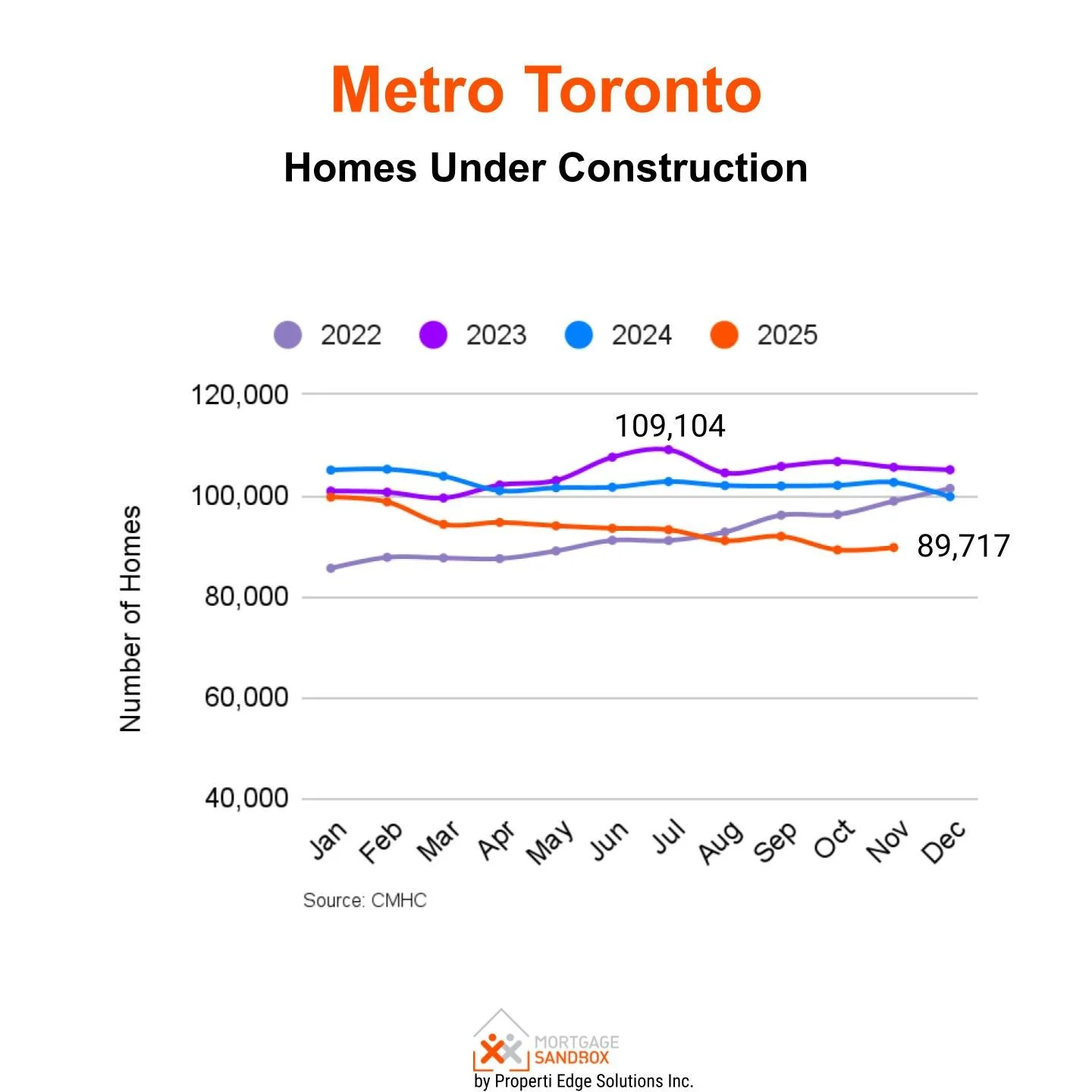

2. A Tsunami of Supply: With nearly 80,000 condo apartments under construction—completions that will far outpace 2025's total condo sales of 16,500—the market faces an overwhelming influx of new units. This will pressure prices further and compete directly with the resale market.

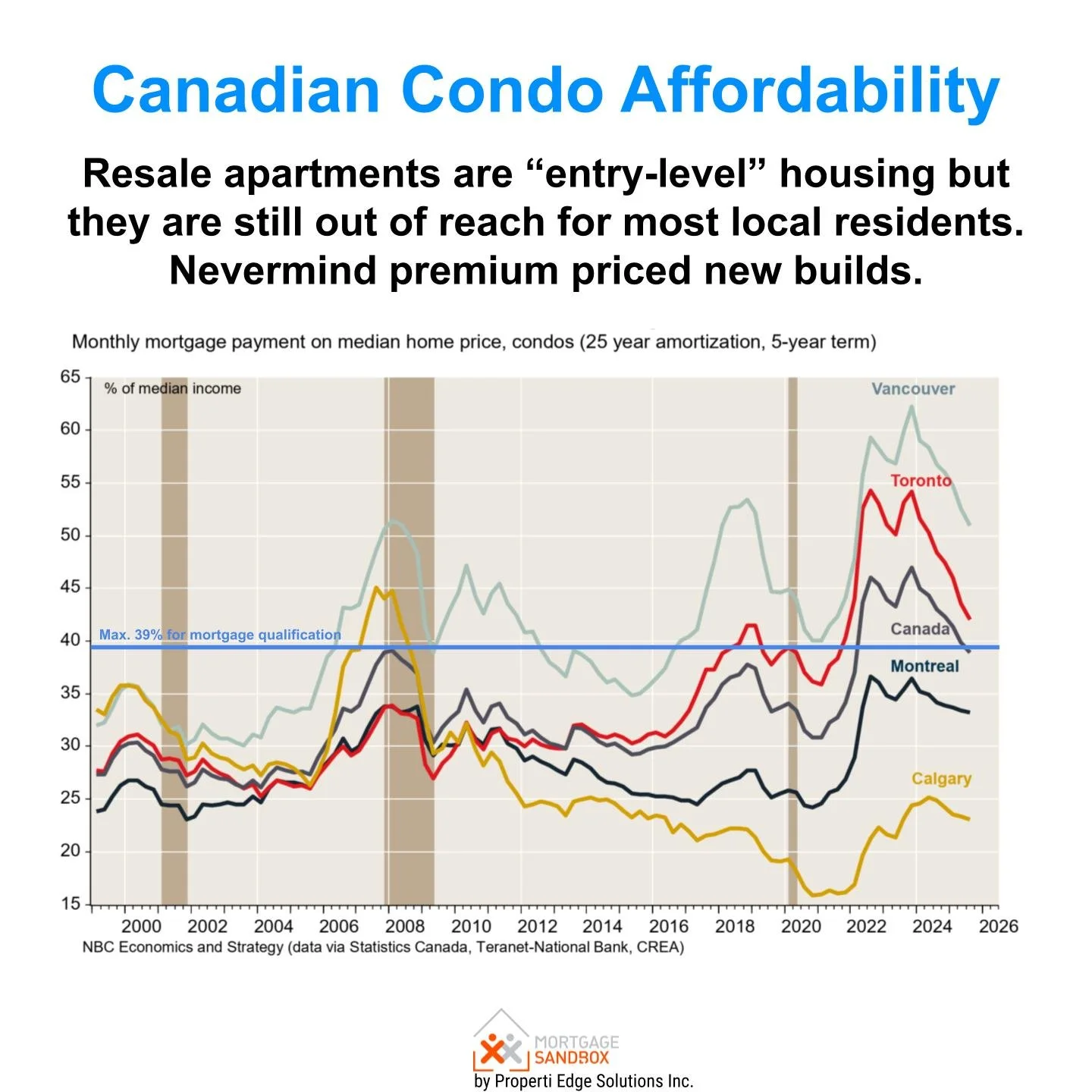

3. Persistent Affordability Crisis: Even after price declines, the math remains broken. Financing a typical entry-level condo still requires ~42% of median household income, above the 39% bank qualification threshold. This locks out most first-time buyers and stifles people trying to “move up the property ladder”.

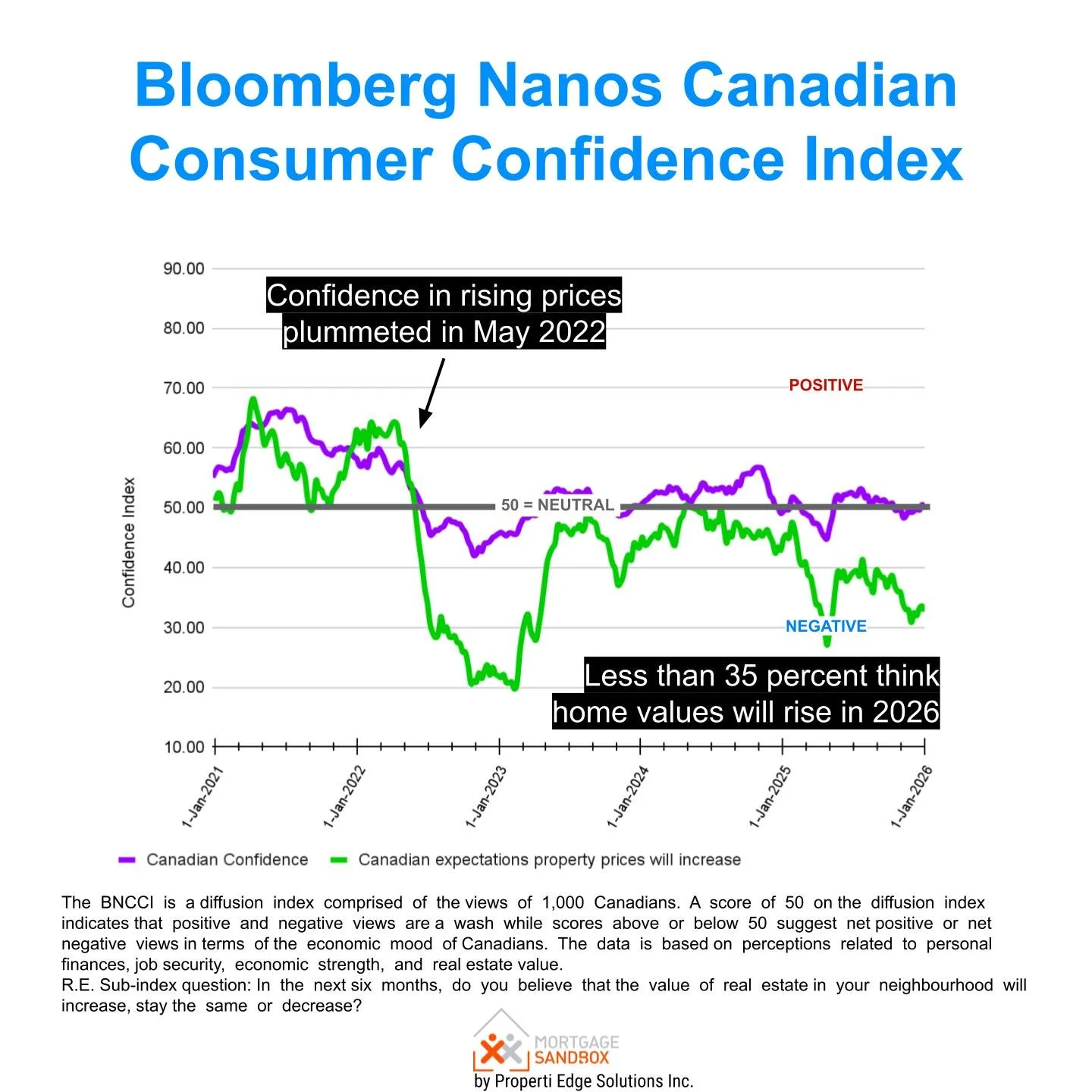

4. Negative Sentiment & Developer Distress: Headlines of developer cancellations and bankruptcies, particularly in the pre-construction sector, will continue to dampen buyer confidence and question the perceived safety of real estate as an investment.

Limited Upside Risks

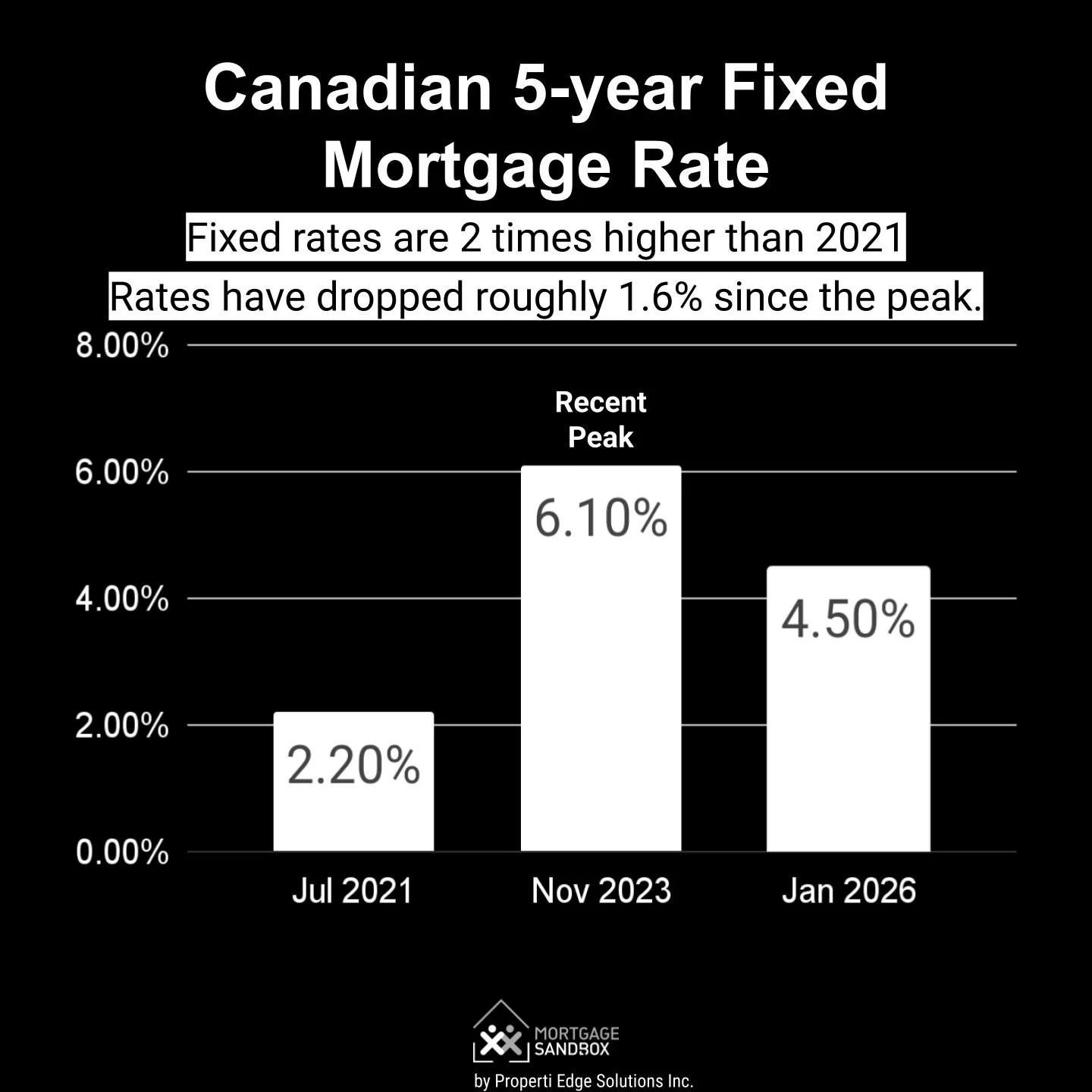

1. Rate Relief Priced In: While mortgage rates near ~4.5% (fixed) are below the 2023 peak, their stimulative effect appears largely exhausted, as evidenced by still-weak sales volumes. They provide a floor but not a catalyst for significant price growth.

2. Psychological Price Points: Some segments may see increased activity at specific, lower price points, but this is likely to represent a churn within the affordable tier rather than a broad market uplift.

A Market in Search of a Bottom

The Toronto real estate market in 2025 was a market in transition, but not towards a renewed boom. It transitioned further into an era defined by higher supply, strained affordability, and demographic stagnation. Prices have been falling throughout 2025 in balanced supply conditions. It would seem that the market is still finding the appropriate price range for a balanced market, after years of critically low supply.

For 2026, the largest variables are the toll of the mortgage renewal cliff and the impact of record construction completions.

The most likely outcomes are continued price softness, particularly in the condo segment, and a market that will favour patient, well-qualified buyers with significant equity.

Sellers must be prepared for their home to sit on the market longer, and they will need to price it to reflect the new reality of strained affordability. This is a market where you might want to undercut neighbouring sellers (your competition), rather than listing at a price above fair market value and potentially having to drop your list price later. In this environment, cautious, data-informed decision-making is essential.