Vancouver's Housing Market: A Potential Recovery Amid Uncertainty

The city's property market shows tentative signs of life, but headwinds remain

Vancouver's property market is experiencing a curious contradiction: sales are recovering from their doldrums, yet buyers remain firmly in the driver's seat. After months of sluggish activity, July's figures suggest the market may be finding its footing, though the path forward remains anything but certain.

The Numbers Tell a Story

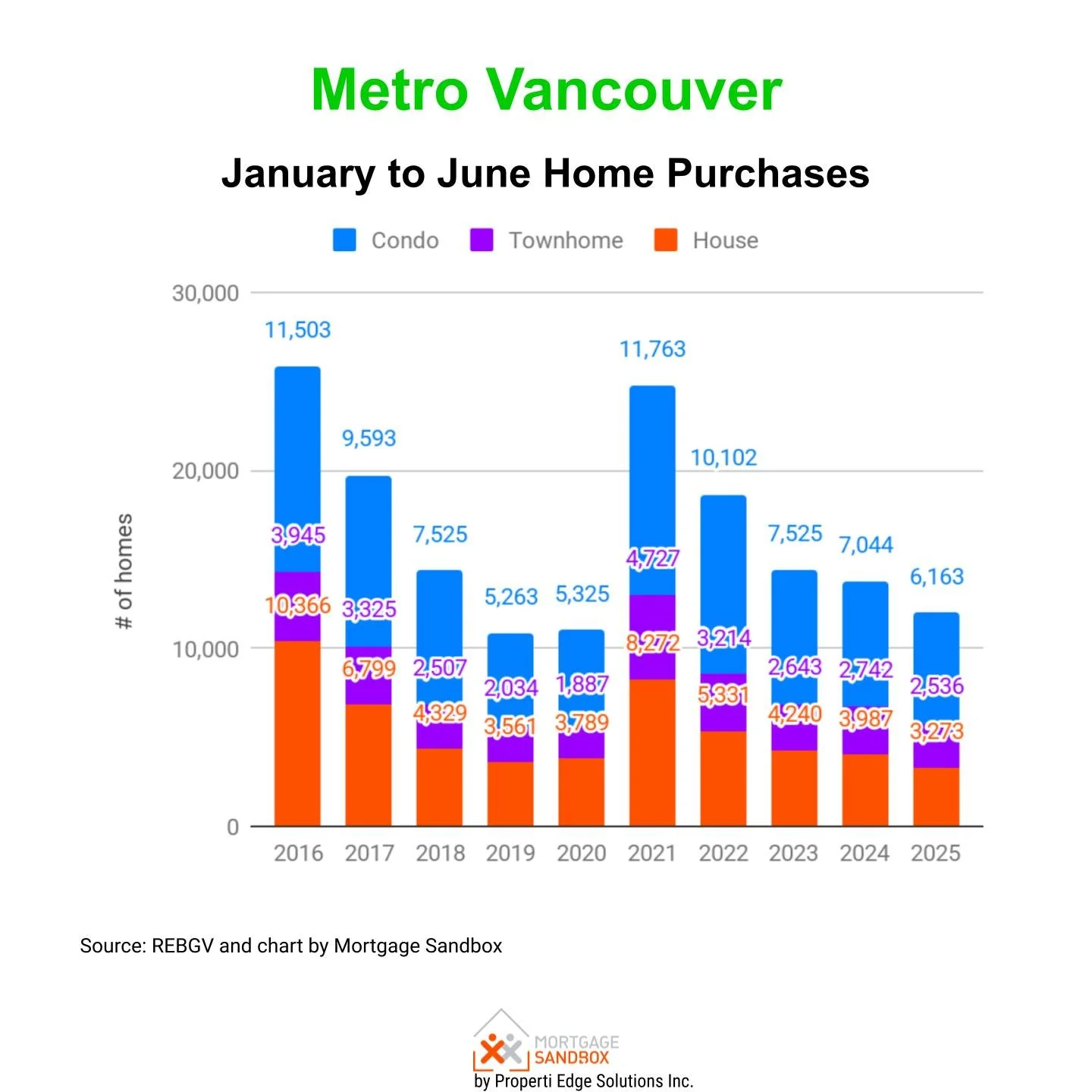

The Greater Vancouver Realtors reported 2,286 residential sales in July, a modest 2% drop from the same month last year. While this might sound underwhelming, it represents a significant improvement from the deeper declines witnessed earlier in the year. "The June data showed early signs of sales activity turning a corner, and these latest figures for July are confirming this emerging trend," noted Andrew Lis, the association's director of economics.

While purchases are down, the market balance, the ratio between purchases and sales listings, remains within a normal range.

A Market of Three Speeds

The Vancouver market isn't behaving uniformly. Different property types are dancing to their own tunes:

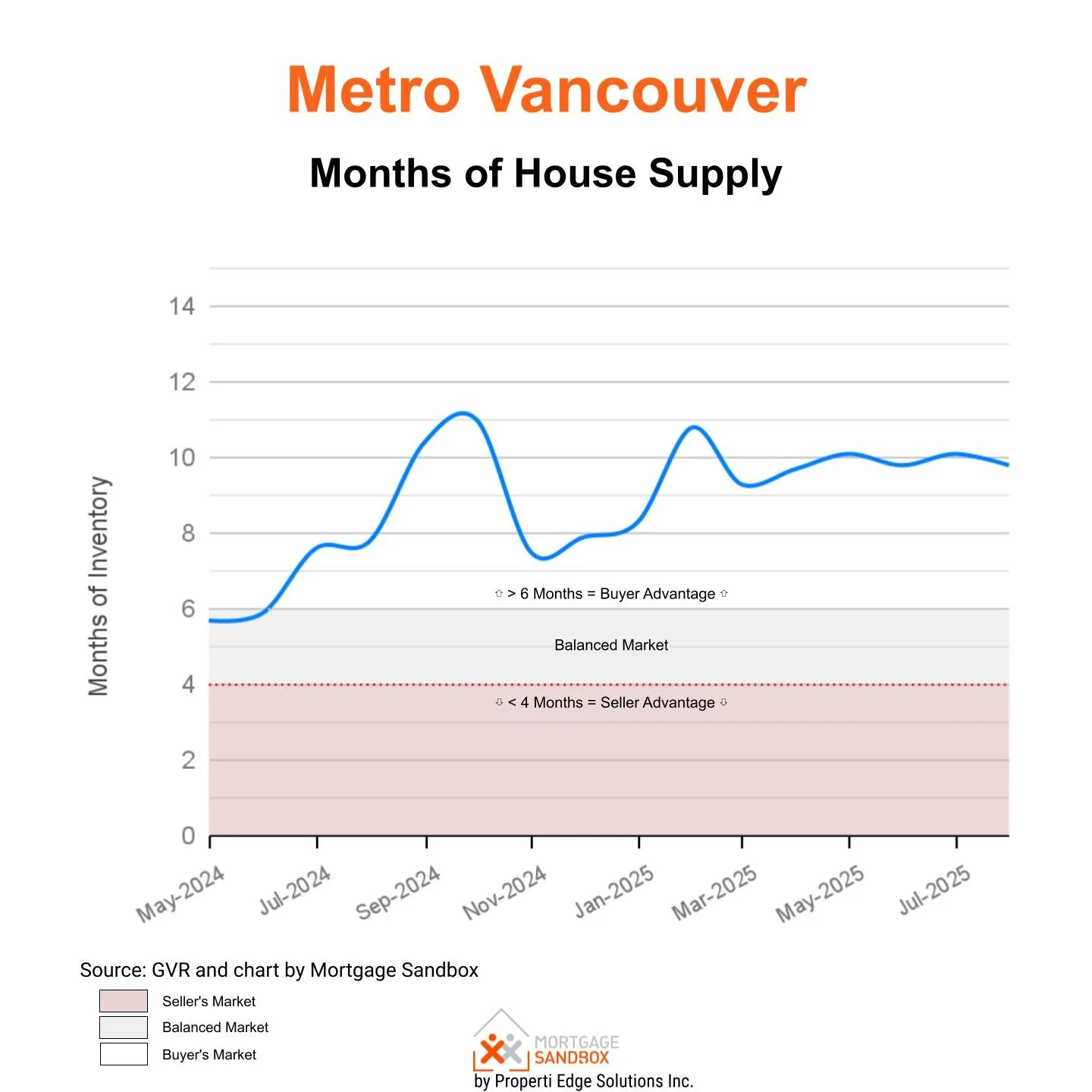

Detached Houses: Firmly in Buyers' Territory

The luxury end of the market remains decisively tilted toward buyers. With a benchmark price of nearly $2 million, detached homes have seen their months of inventory jump by 26% compared to last year. Buyers can afford to be choosy when inventory sits at 9.8 months, well above the 6-month threshold that typically signals a balanced market.

Townhouses: Walking the Tightrope

The townhouse segment occupies the middle ground, technically balanced but leaning toward buyers. At $1.1 million for a benchmark property, these represent something of a compromise between space and affordability, although "affordable" is relative in Vancouver's context.

Apartments: Buyers Still Rule

Even in the most accessible segment, with benchmark prices around $744,000, buyers maintain the upper hand. Inventory levels have increased by 21% year-over-year, giving purchasers plenty of options and negotiating power.

However, the apartment market is nearly balanced. This doesn’t qualify as a supply glut its’s demand that’s dried up.

The Broader Economic Picture

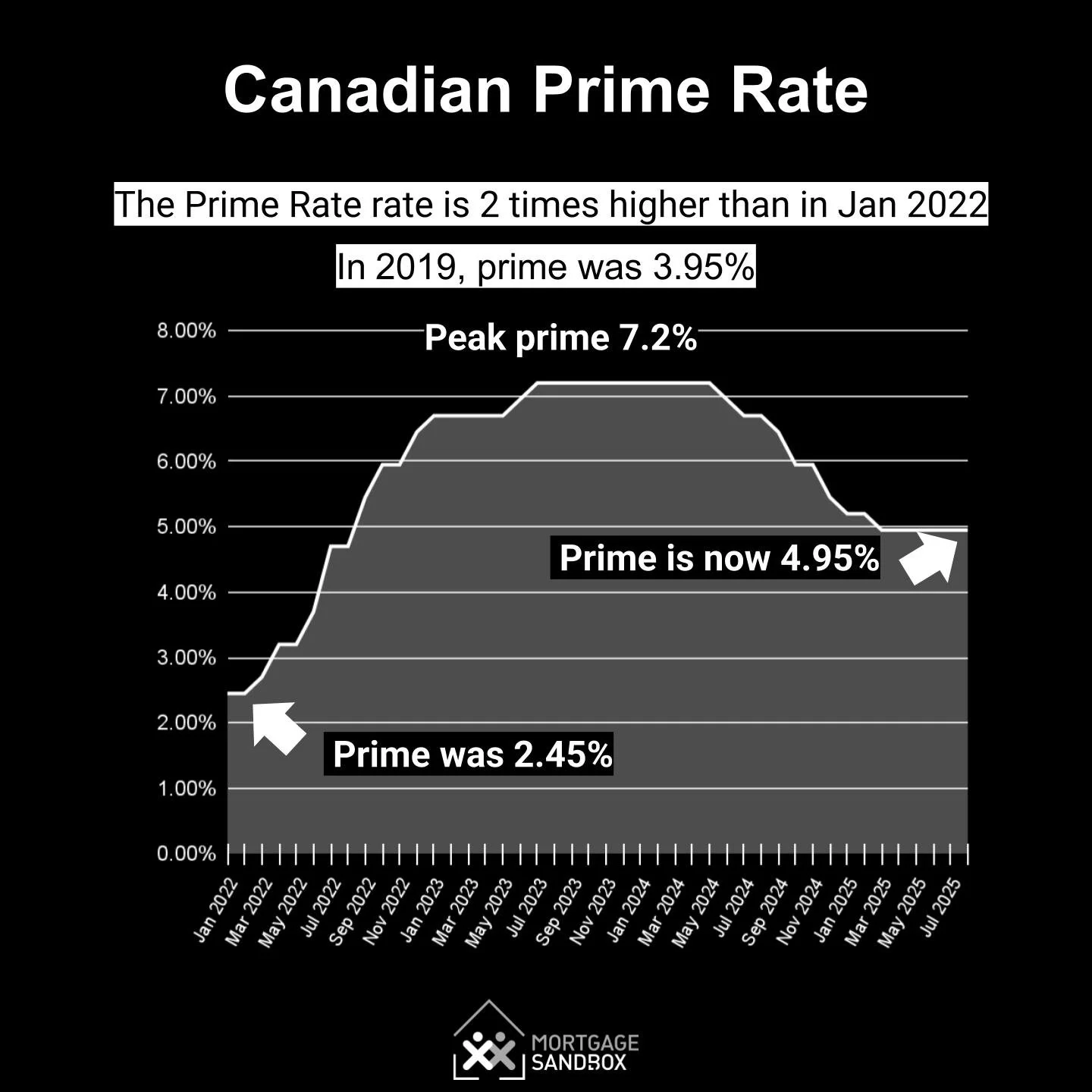

Several factors are shaping this cautious recovery. The Bank of Canada held its policy rate steady in July, providing some certainty in an otherwise uncertain landscape. However, ongoing trade negotiations with the United States and mortgage rates that remain elevated compared to the previous two decades are tempering enthusiasm.

Housing inventory across the region has stabilized around 17,000 properties, a level that provides buyers with abundant choice while keeping price pressures in check. As Lis observed, "This healthy level of inventory is sufficient to keep home prices trending sideways over the short term."

What Lies Ahead

The traditional autumn softening of demand looms ahead, and with economic headwinds still blowing, a dramatic price recovery appears unlikely. The market seems destined for a period of sideways movement, prices neither surging nor collapsing, but rather finding an uneasy equilibrium.

For buyers, conditions remain favourable across all property types, with ample inventory and negotiating power. Sellers, meanwhile, must adjust their expectations to a reality where properties may linger longer on the market and command prices below peak levels.

The Vancouver market's recovery is real but fragile, like a green shoot emerging from winter soil. Whether it blossoms into a full spring revival or withers under economic headwinds will depend on factors largely beyond local control: interest rates, trade relations, and the broader economic climate.

For now, the market appears to have steadied itself, offering a welcome respite from the volatility of recent years. In Vancouver's notoriously dramatic property landscape, sometimes stability is the most remarkable development of all.

Based on data from Greater Vancouver REALTORS®, July 2025