Metro Vancouver

Real Estate Trends and Price Forecast

HIGHLIGHTS

The Metro Vancouver housing market is sending clear signals: home values are trending downward, breaking through a psychological price-floor that once seemed solid. While industry experts glimpsed hope in late 2025, reality has set in, and conditions have deteriorated, leaving buyers with newfound negotiating power.

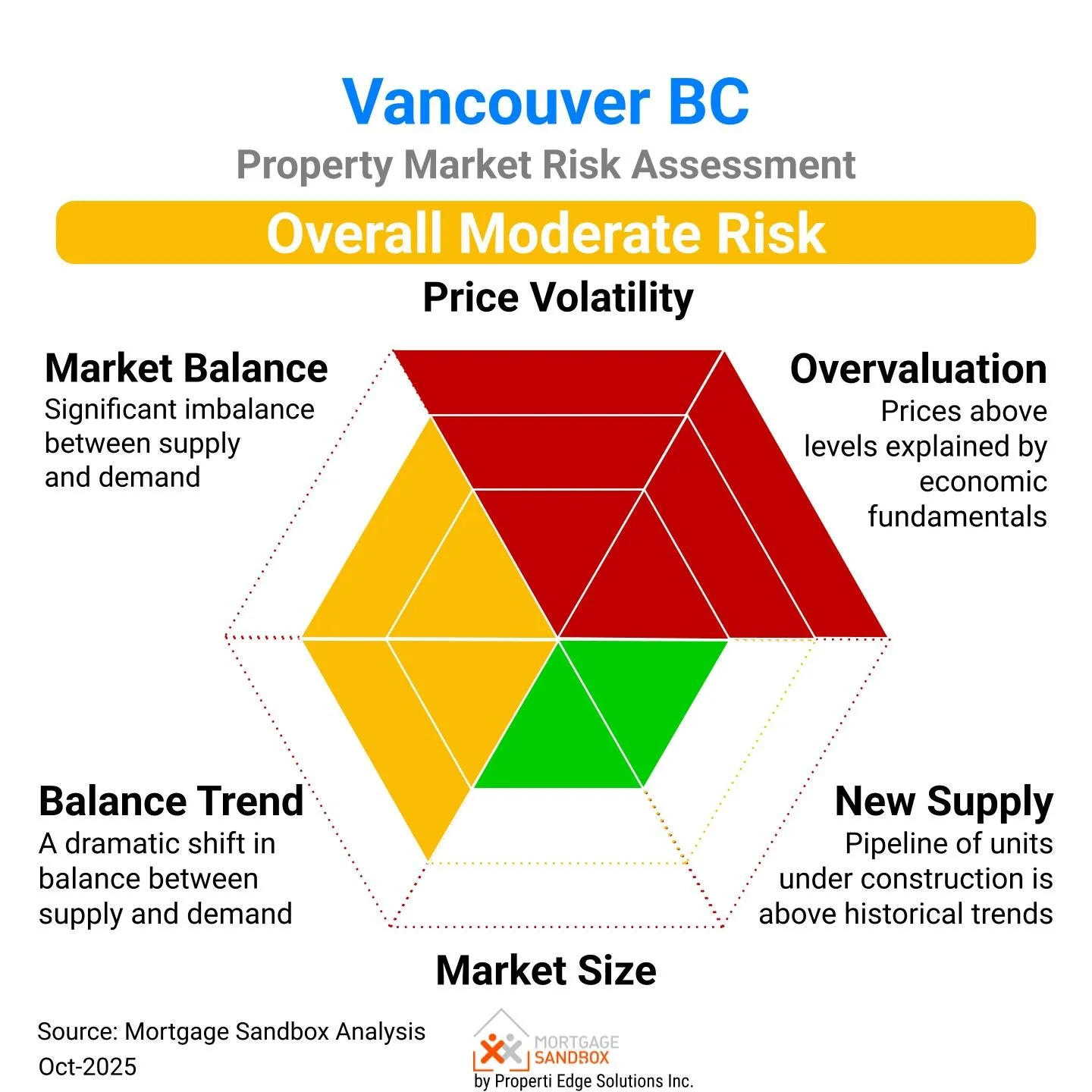

Multi-factor analysis identifies Metro Vancouver as a moderate-risk real estate market.

Mortgage rates have eased from their peak but remain stubbornly high compared to the average rates of 2010–2020.

Economic uncertainty is mounting due to Canada's shift in immigration policy and the Trump administration's tariffs.

Detached house prices have broken below the January 2024 floor of $1.94 million.

This article covers:

What is the state of the Vancouver real estate market?

Which way are prices going?

Should I sell?

Is now a wise time to purchase?

1. Has the Vancouver Housing Market Been Going Up or Down?

Overview of the Vancouver Property Market

Metro Vancouver remains one of the world's most livable cities, ranking 22nd globally among the top 100. With 3 million residents nestled between the Pacific Ocean and North Shore Mountains, it's easy to see why people are drawn here:

What Makes Vancouver Special:

Stunning Scenery: Ski in the morning, kayak in the afternoon, all within the same day.

Green Oases: Stanley Park and countless urban forests offer respite from city life.

Mild Climate: Warm summers and wet (but manageable) winters beat the rest of Canada's harsh conditions.

Global Village: A multicultural tapestry that creates vibrant, welcoming neighbourhoods.

Foodie Paradise: With a bustling restaurant scene, you have world cuisines at your doorstep.

The Reality Check: Vancouver's housing market is notoriously expensive, and affordability continues to challenge residents at all income levels.

Overall, Vancouver is a great place for people of all ages and backgrounds to live. It offers a high quality of life, a vibrant culture, and a strong economy.

Supply levels have been higher than in previous years at this time of year. Buyers have a greater advantage, and sellers have less power in negotiations.

Metro Vancouver Detached House Prices

As autumn 2025 approaches, detached house prices have plunged below the $1.94 million psychological barrier set in January 2024.

Since the Spring 2022 peak, Vancouver house prices have resembled a white-knuckle roller coaster ride, with values swinging tens of thousands of dollars up and down. But this latest drop is different because it breaks a critical psychological support level.

While many dream of owning a Vancouver house, affordability has sidelined potential buyers. High interest rates have created a double whammy; new homebuyers can't enter the market, and existing homeowners can't move up. Fewer households qualify for mortgages at current rates.

The days of limited listings driving prices skyward are over. Inventory levels have risen to their highest point in three years. It is a strong buyer’s market.

Are you interested in specific areas of Metro Vancouver? Try these reports!

Metro Vancouver New Construction Home Prices

Prices of new homes have been falling. Based on economic fundamentals and slow pre-sales, they are unlikely to rise in the medium term. In fact, some developer projects have been cancelled. In September, Wesgroup cancelled its 204-unit luxury development in the River District.

New home prices are falling, and the presale market has hit a wall. Here's a shocking statistic: no new presale projects launched in January or August 2025. Contrast this with 2018, when 750 units typically released in January and 800 in August.

Developers are watching and waiting, trying to gauge demand and test incentive strategies before committing to new launches. The pain is real. Developer profits are being squeezed between falling prices and rising construction costs.

What This Means for Buyers:

Can you negotiate with developers? Ye, but don't expect direct price cuts. Developers will emphasize location, amenities, and quality first. If concessions are offered, expect extras such as additional parking spots, storage lockers, or premium fixtures, rather than reduced sale prices.

Does this concern you? Read the Pros and Cons of Buying Pre-sale Homes

Vancouver Property Market Risk

Based on Mortgage Sandbox Analysis, multiple warning signs are flashing.

The current property market is classified as a Buyer's Market, primarily due to higher resale inventory levels and inventory levels have remained stable compared to the previous year.

Prices have been volatile and are currently elevated, creating potential Bubble Risk since prices appear disconnected from local income levels. Nevertheless, the large size of the market and the substantial number of buyers mean that sellers should still be able to find interested purchasers, even if there is a slowdown.

Construction activity is consistent with recent years, and the market is likely capable of absorbing the completed units.

The market is also being boosted by decreasing interest rates, as the Bank of Canada is in an easing phase. Lower interest rates generally increase property buying budgets, although the full impact of this easing may take up to 18 months to become evident.

Given the current trends and economic imbalances, Vancouver faces a Moderate Risk of experiencing a market correction.

|

Not sure about your bank's renewal offer?Try our mortgage offer evaluator Powered by Properti Edge |

Metro Vancouver Condo Apartment Prices

The apartment market mirrors the trend in detached houses. Prices are trending downward, and momentum is building.

Current Snapshot:

The benchmark apartment price has been falling since spring 2024.

Prices have fallen below the autumn 2022 floor. How low could prices go?

Greater Vancouver has high resale inventory levels, and is a buyer’s market trending in favour of buyers (against sellers).

The Demand Problem: While purchases have increased a little, active listings have jumped significantly. Buyers are in no rush. Last month, the benchmark apartment price dropped approximately $5,000 in a single month. Enough for a living room makeover or sunny vacation. So why rush to buy?

Rental Market Pressure: The average asking rent for one-bedroom apartments has dropped 7% over the past year. For investors holding rental condos, this creates a painful squeeze from falling property values combined with rising mortgage payments as 2020/21 mortgages renew at higher rates.

The Math: A benchmark condo is worth approximately $50,000 less than it was a year and a half ago. For investors, the question looms: Should they sell now, despite transaction costs, or wait for market stabilization?

Supply varies greatly between Vancouver sub-regions. You can use this information to avoid the most brutal bidding wars.

Looking Ahead: With remote and hybrid work becoming permanent, expect developers to shift toward larger floor plans (2 and 3 bedrooms). This could further depress the value of compact condos.

What We'd Like to See: At Mortgage Sandbox, we're advocating for 4 and 5 bedroom condos because:

Not every family can afford a house.

Remote workers need a dedicated workspace separate from living areas.

Many professionals prefer to skip house maintenance (lawns, eaves, sidewalks).

High-density neighbourhoods with walkable amenities appeal to modern lifestyles.

Metro Vancouver Townhouse Prices

The Affordability Crisis Persists

Despite falling prices, Vancouver remains unaffordable for most residents. Consider this sobering calculation:

A first-time homebuyer household earning $75,000 (the median income in Metro Vancouver) can secure only a $300,000 mortgage. To buy a benchmark $680,000 condo, they need $380,000 cash for a down payment.

For most people, that's not realistic without substantial financial support from parents and family.

|

How much can you afford?Our mortgage calculator takes uses up-to-date mortgage rates and estimates the price of a home you can afford. Powered by Properti Edge |

What about the rest of BC?

Read the Victoria Forecast and Okanagan Forecast.

2. Where are Metro Vancouver home prices headed?

Factors Affecting Vancouver Real Estate

Forecasting Vancouver's market through 2027 involves navigating significant uncertainty. Experts disagree on critical questions:

Will Canada's immigration policy reversal shrink the population?

Will mortgage rates drop to the 2-3% range Canadians grew accustomed to?

Will trade wars with China and the United States trigger recession?

Our Forecast Methodology

At Mortgage Sandbox, we provide a price range rather than a single prediction because real estate risks are inherently unpredictable. We review forecasts from leading lenders and real estate firms, then present:

Most optimistic estimates

Most pessimistic predictions

Average forecasts

Our forecast inputs:

3. Is it a good time to sell a home in Vancouver?

From a seller’s perspective, more changes in the market influence prices downward, so this year may be a better time to sell than in two years.

The annual real estate cycle usually favours sellers in the first half of the year.

Sellers should always consult a mortgage broker early to prioritize flexible loan conditions and reduce the risk of mortgage cancellation penalties. Find out more about the benefits of a mortgage broker.

Planning to Sell? Check out our Complete Home Seller’s Guide.

|

Need an estimated home buying budget?We will tell you what you can afford with transaction fees and taxes baked in, and fewer surprises. Powered by Properti Edge |

4. Is this a good time to buy a Vancouver property?

Prices have been falling, and supply is high, so prices could fall further. Mortgage rates are relatively high and falling. Also, the annual real estate cycle usually favours buyers in late summer and autumn.

These factors would lead buyers to conclude that later in 2025 or 2026 will be a better time to buy than now.

It's almost impossible to time the market perfectly. However, if you are buying your forever home and don't plan to sell for ten years, the risks of buying now are lower than a year ago.

If you are considering buying, be sure to drive a hard bargain and pay as close to market value as possible. Also, don't bite off more than you can chew when it comes to financing.

Planning to Buy? Check out our Complete Home Buyer’s Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

|

Do you have a financing strategy?Try our strategy assessment to maximize your risk-adjusted investment returns. Powered by Properti Edge |

Here are some recent headlines you might be interested in:

Over 80% of Metro Vancouver homes sold below final asking price in 2025 (Daily Hive | Jan 19)

What's in store for Canada's housing market in 2026? (CBC | Jan 15)

What experts advise for buyers, sellers as Vancouver-area home sales hit 25-year low (CBC | Jan 07)

Ottawa pushes for policy changes to boost first-time homeownership (BNN Bloomberg | Jan 06)

Vancouver area home sales hit lowest level in more than two decades in 2025 (CBC | Jan 05)

2026 Lower Mainland property assessments fall as housing market cools (BIV | Jan 02)

Like this report? Like us on Facebook.