Many Canadians Hope for Lower Rates, But Economists Say Don’t Count On It

A significant disconnect exists between consumer hopes and financial forecasts as a wave of mortgage renewals approaches.

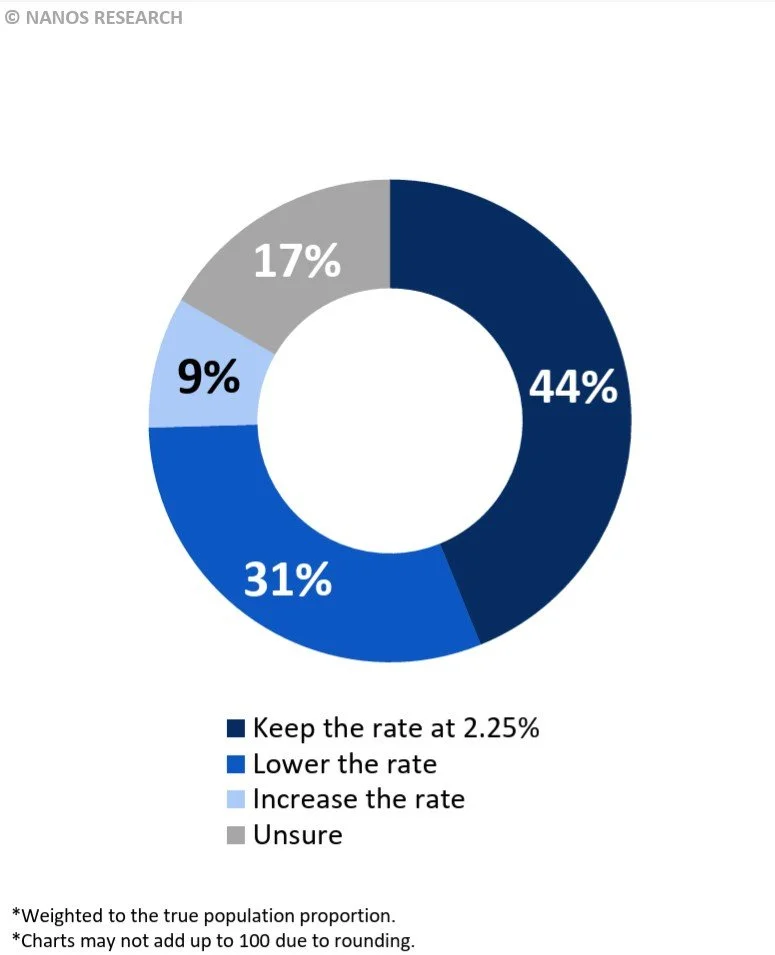

A new Nanos Poll reveals a stark divide: nearly 30 percent of Canadian consumers are hoping for and expecting further interest and mortgage rate drops in 2026, a view that puts them out of sync with most economists and likely sets them up for disappointment.

On the other side, over half of Canadians expect rates to either start rising or remain flat in the coming year, which aligns with the current consensus from economic forecasters.

The Bank of Canada’s Stance: Holding Steady

This disconnect comes as the Bank of Canada has signalled a pause in its rate-cutting cycle. On December 10th, the central bank held its key interest rate steady at 2.25%, following a cut in October. The bank stated the current rate is "about the right level" to keep inflation on target.

TD Economist Marc Ercolao echoed this sentiment, noting, “The Bank of Canada has reinforced that it feels comfortable with the current level of interest rates in the economy.” He and a majority of economists polled by Reuters believe the rate will be held steady throughout 2026 and potentially into 2027, barring unexpected economic turbulence.

Why the Disconnect? Confusion Over the Bank’s Role

Analysts suggest the gap between public hope and economic reality may stem from confusion about the Bank of Canada’s primary mandate. The bank’s first responsibility is to stabilize prices and keep inflation low, not to manage household debt or mortgage costs directly. While a slowing economy is a concern, it is secondary to the inflation target.

This focus explains why the bank is hesitant to cut rates further to ease consumer financial pressure, especially when recent economic data has been stronger than some perceive. Despite 45 percent of consumers feeling the economy is doing worse, Statistics Canada reported on November 28th that the economy grew at an annualized pace of 2.6 percent in the third quarter.

The Looming Mortgage Renewal Wave

The timing of this rate outlook is critical for a large segment of the population. Roughly 60% of outstanding mortgages, about 1.2 million loans, will renew by the end of 2026. Many homeowners who secured rates as low as 1-2% during the pandemic are now facing renewal at rates around 4-5%, leading to significant increases in monthly payments.

Surveys indicate about 22% of those renewing expect increases large enough to force major financial cuts. The widespread hope for lower rates to ease this burden is understandable, but the Bank of Canada is unlikely to intervene solely for this reason.

A Silver Lining for Housing

For 2026, economists are delivering a clear message: consumers should brace themselves for a year of stable interest rates rather than further reductions. The Bank of Canada will make its next decision on January 28, 2026, and currently, no changes are expected.

The housing industry had hoped that lower interest rates would revive the market, but in reality, price concessions have been the main factor driving improved affordability in most areas. Far more significant than the impact of lower rates. While lower rates can stimulate the housing market, the slow recovery has primarily been due to prices that exceed demand. During the pandemic, prices escalated beyond what the market fundamentals could support. For buyers to feel confident about re-entering the market in large numbers, prices must stabilize according to local economic fundamentals.