Calgary Real Estate Market: Year in Review and Outlook

The 2025 calendar year marked a definitive shift towards market normalization in Calgary.

Following the unprecedented volatility of the previous five years, the market is transitioning from a period of intense seller advantage to conditions increasingly favourable to buyers. This rebalancing is characterized by rising inventory, moderating demand, and softening prices across all property types.

While the market remains stable relative to national peers, the data indicates a clear cooling trend.

Detached House Market: Rebalancing from a Seller's Market

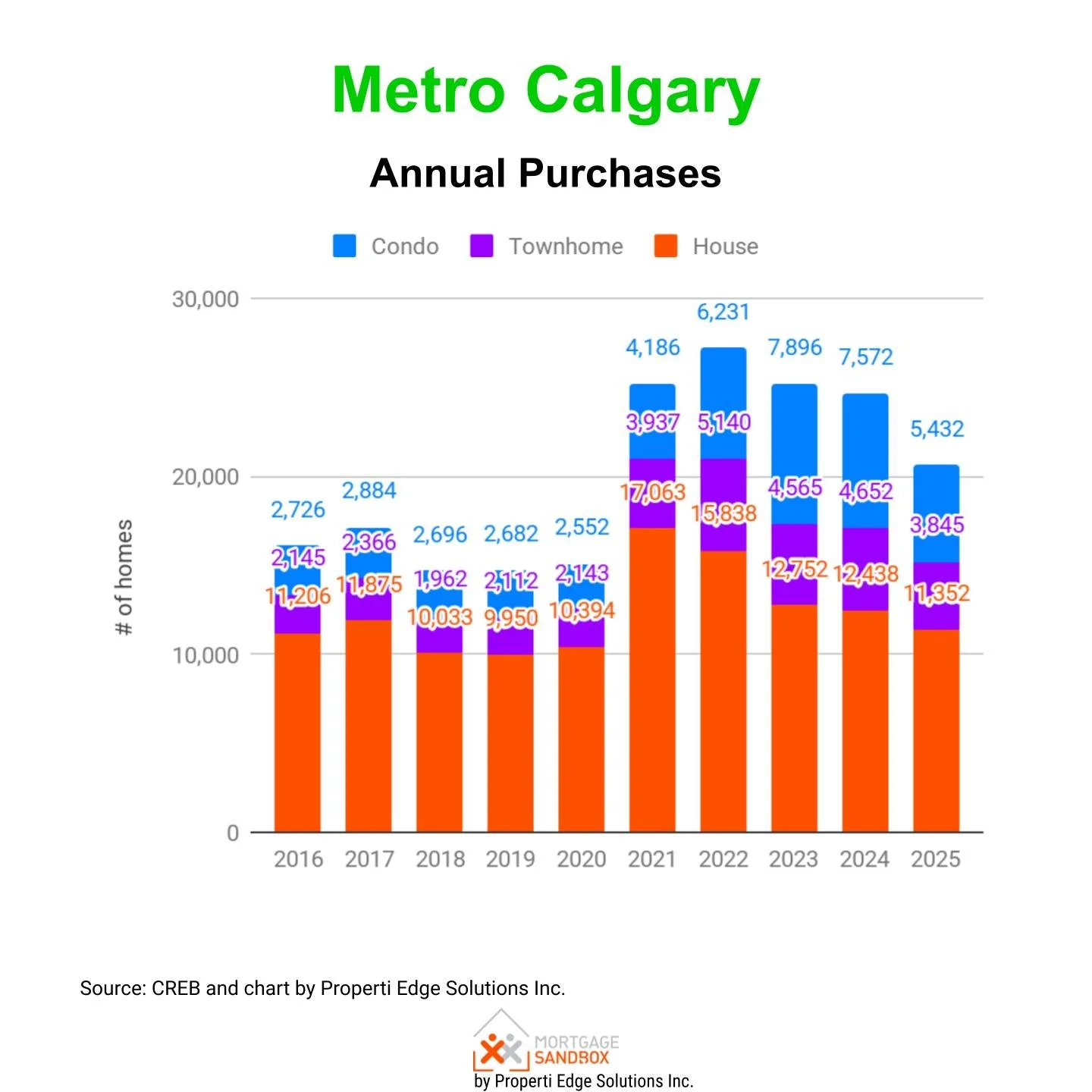

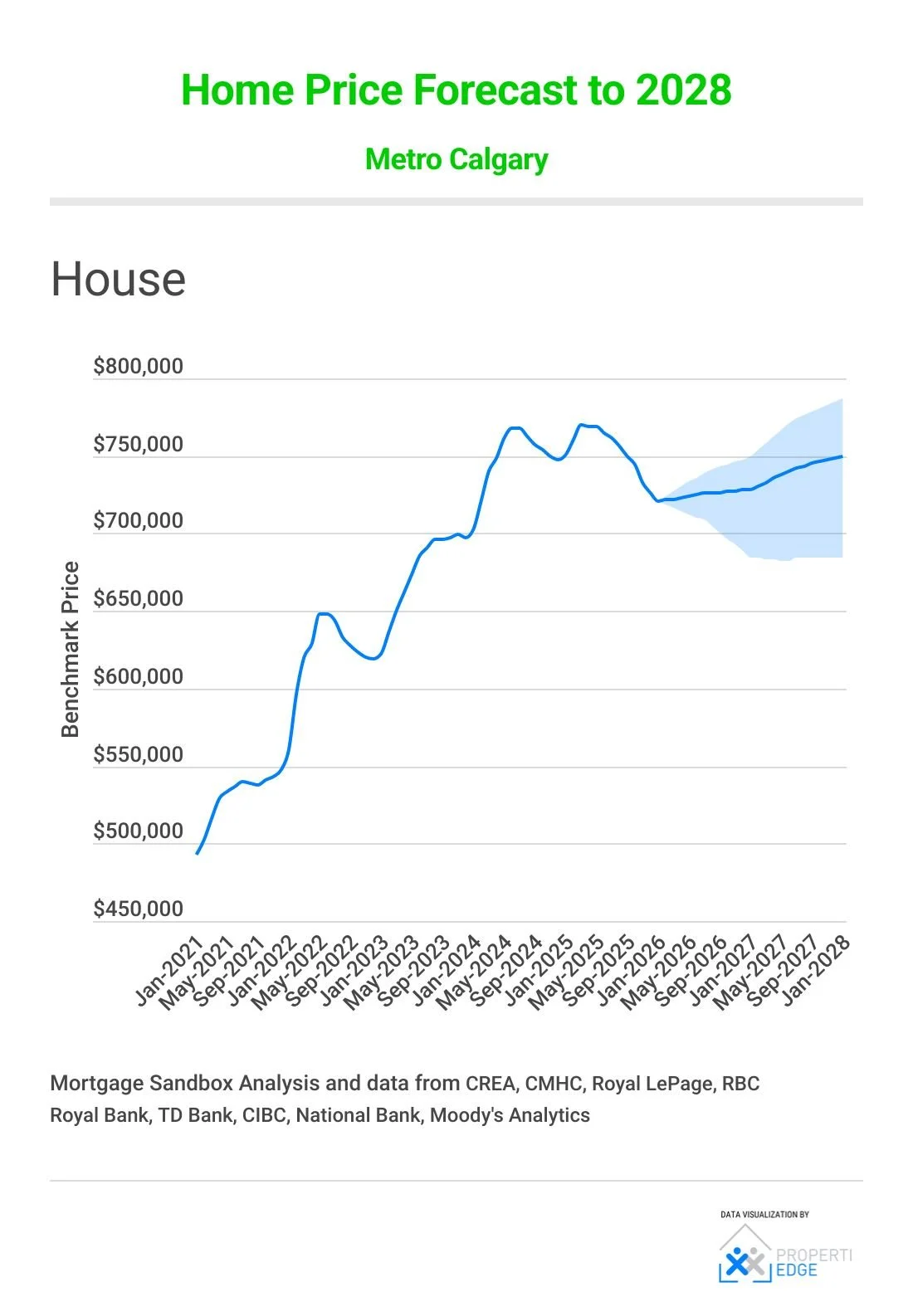

The detached segment, representing 55% of total market activity, has moved meaningfully toward equilibrium in 2025. With 11,352 sales, volume has returned to pre-pandemic (2016-2019) averages of approximately 11,000 units, signalling an end to the COVID-induced frenzy.

Key Metrics (Year-over-Year):

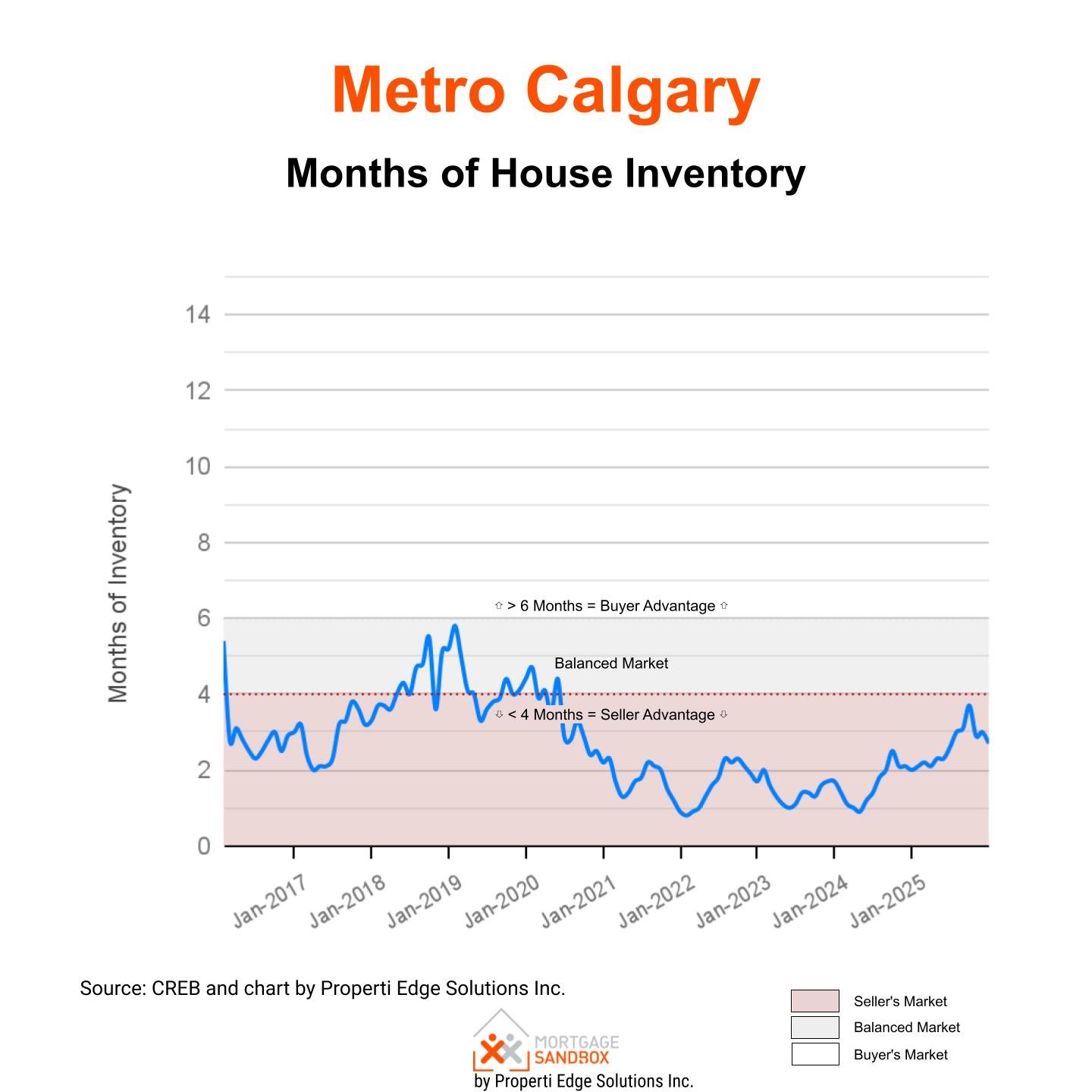

Market Balance: Seller's Market, trending towards buyers.

Months of Inventory: Increased 35% from 2.0 to 2.7 months.

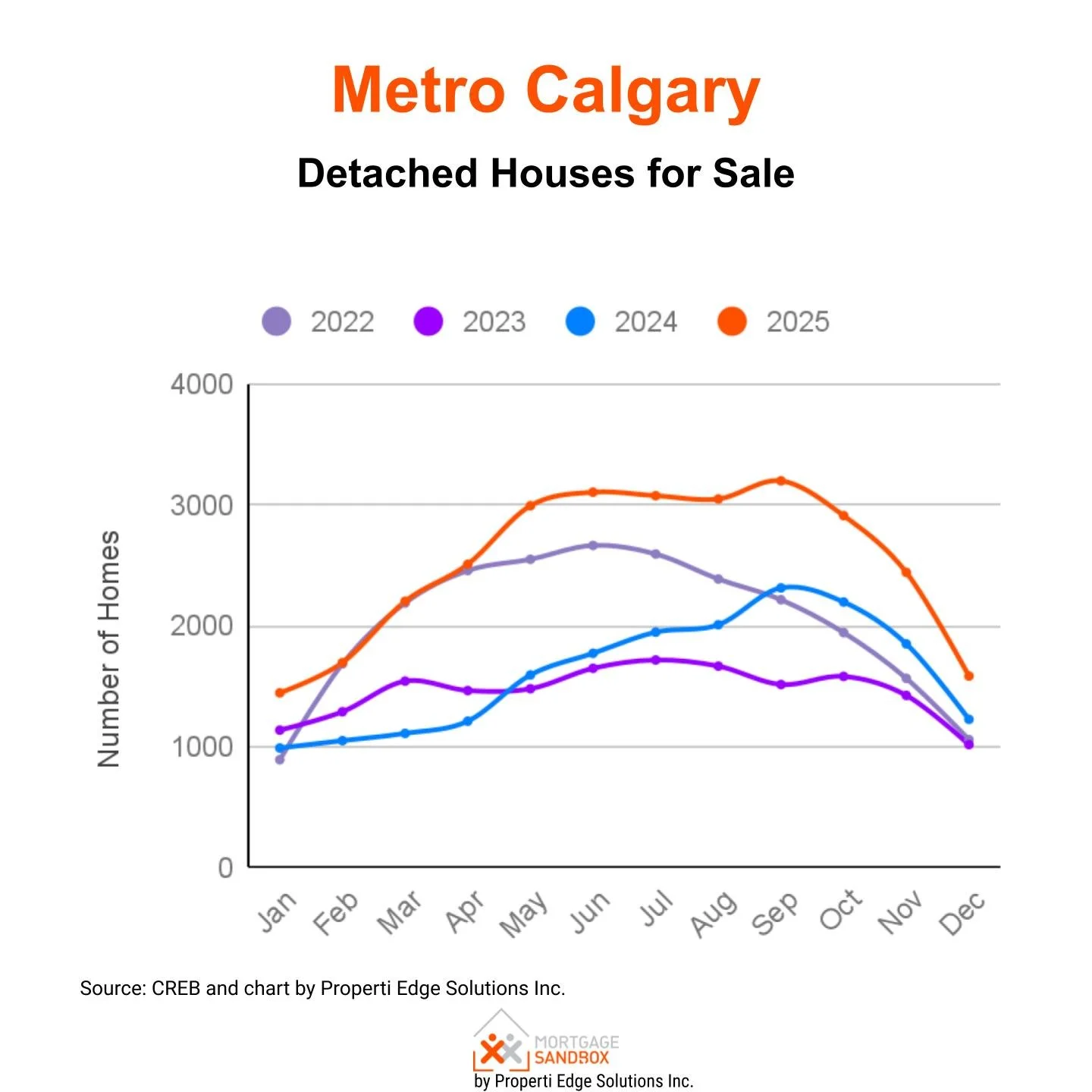

Supply & Demand: Active listings rose 29%, while purchase demand declined 4%.

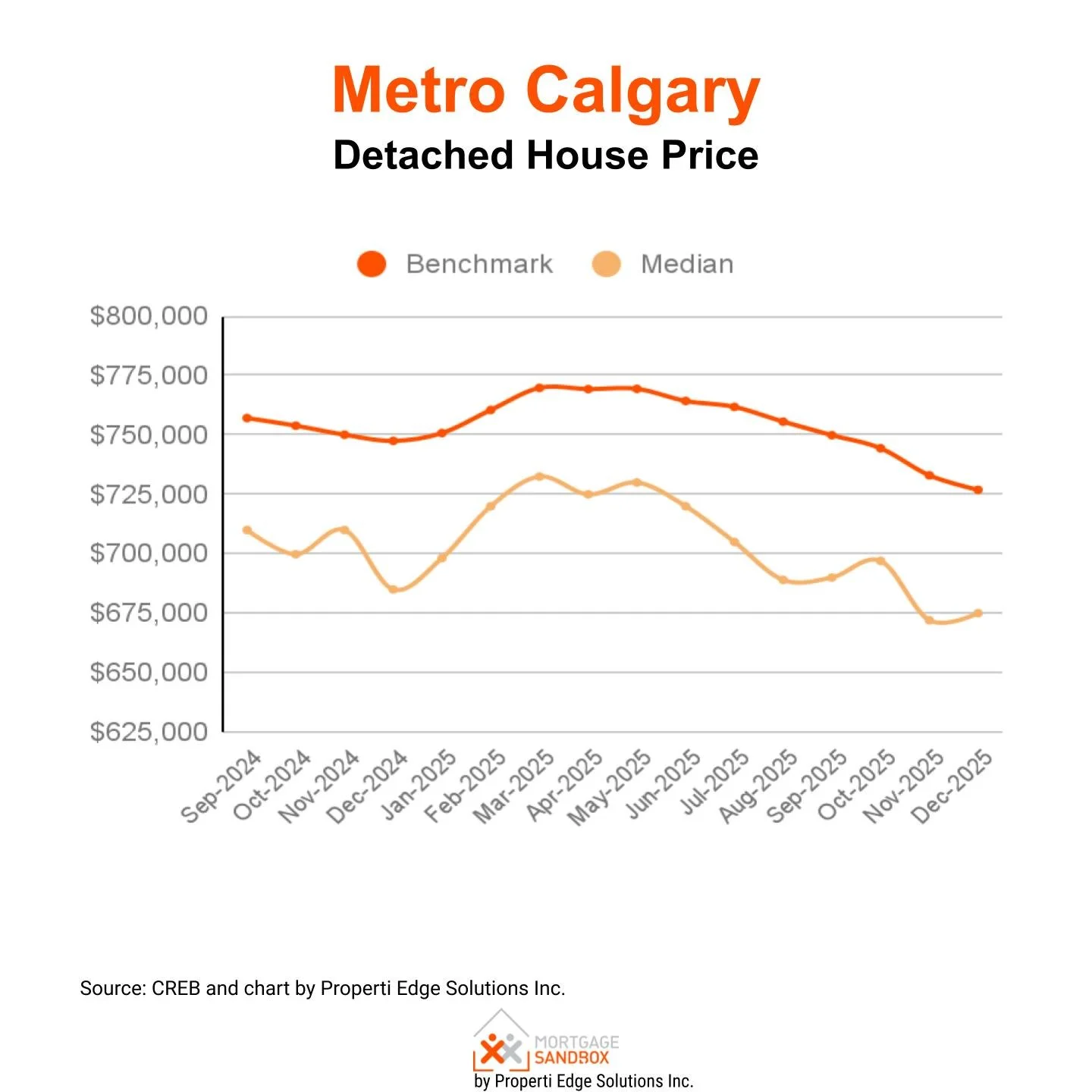

Pricing: The benchmark price closed the year at $726,900, reflecting a 3% decline over the final three months. The median price followed a similar trajectory, ending at $675,000 (down 2% over three months).

This combination of growing supply and easing demand has provided buyers with improved selection and slightly more negotiating power, though sellers retain an overall advantage.

Condominium Apartment Market: Shift to a Balanced Market

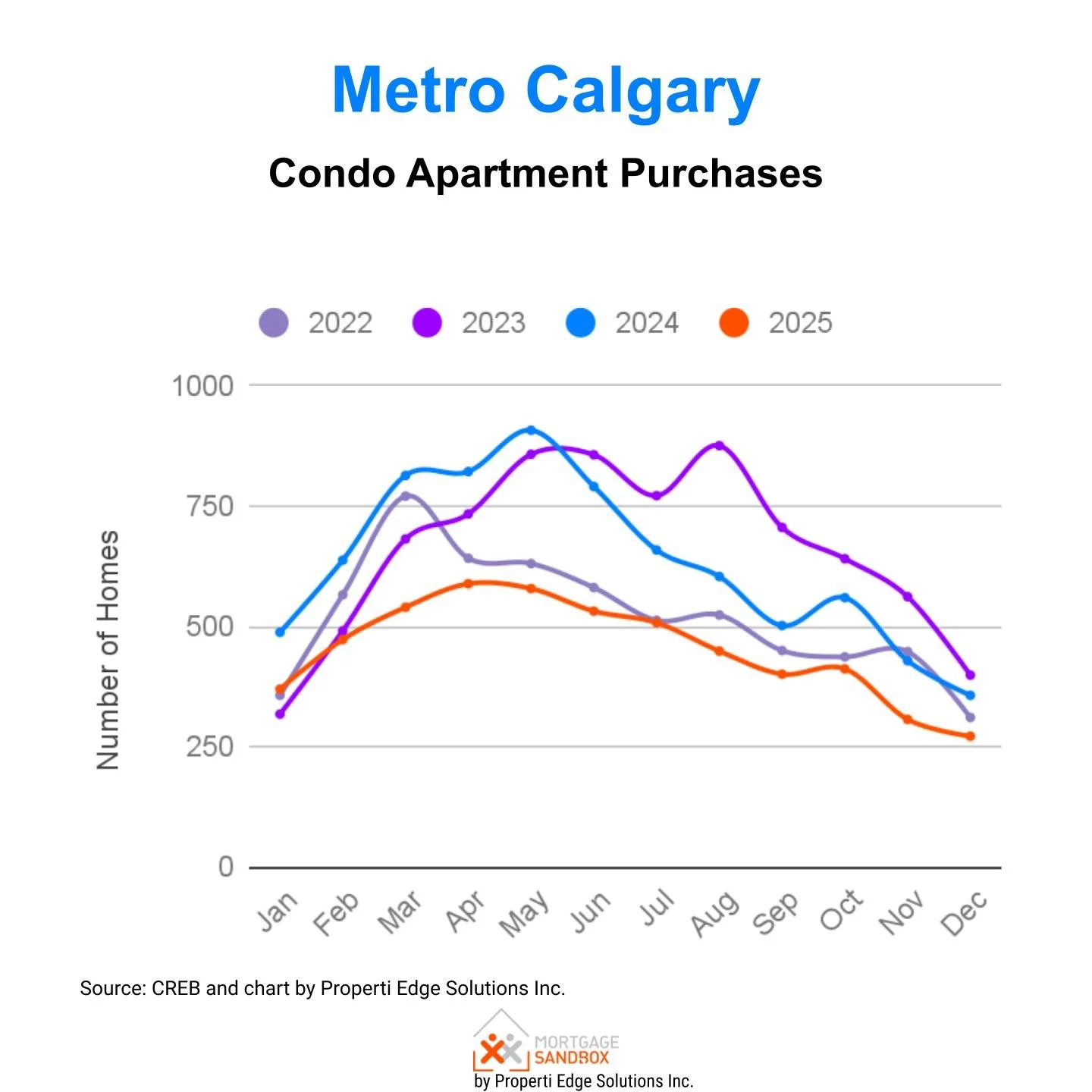

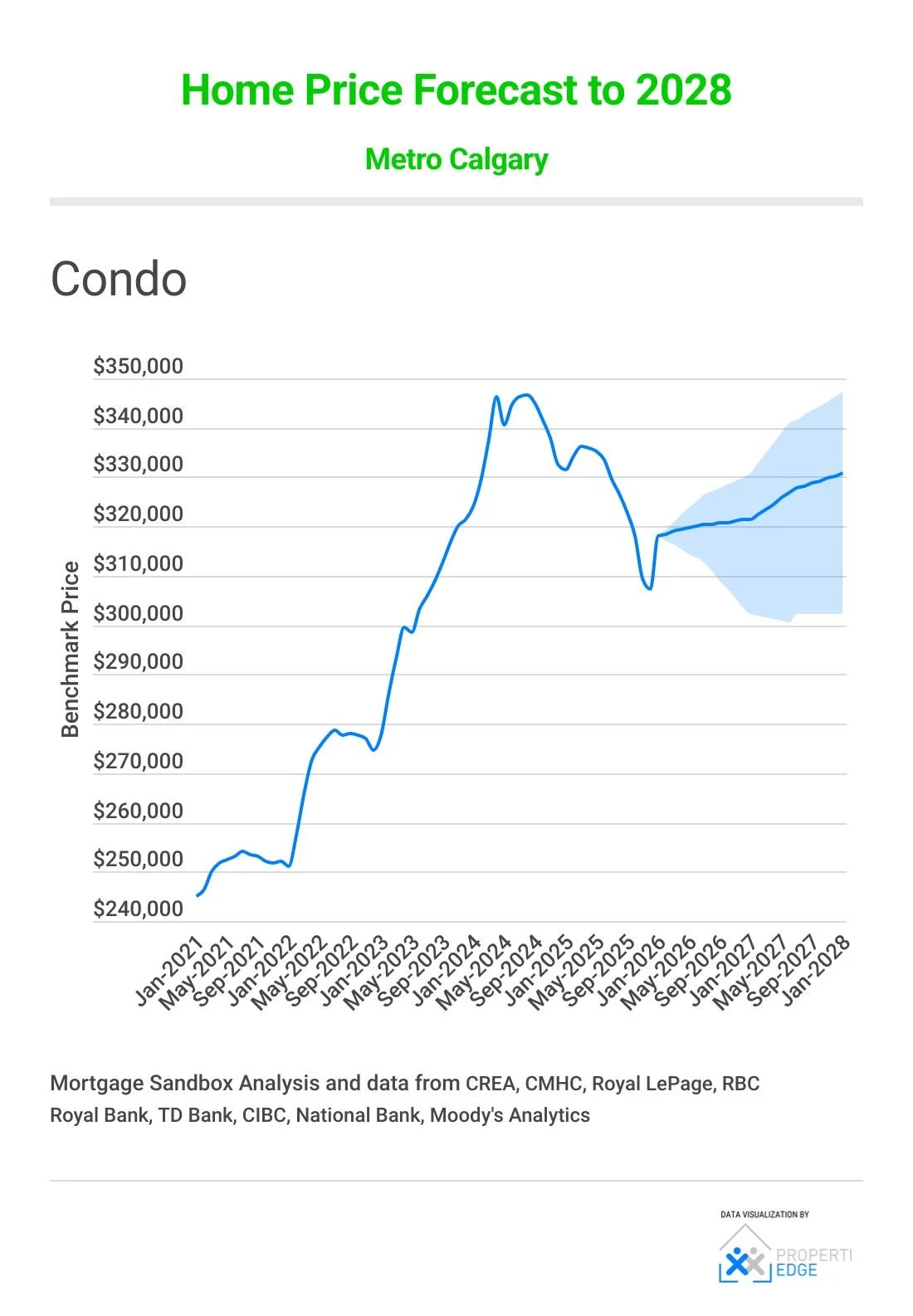

The apartment segment, accounting for 26% of activity, experienced the most pronounced adjustment in 2025. Sales of 5,400 units, while well above the pre-COVID average of 2,800, signify a sharp pullback from the 2023 peak of 7,900.

Key Metrics (Year-over-Year):

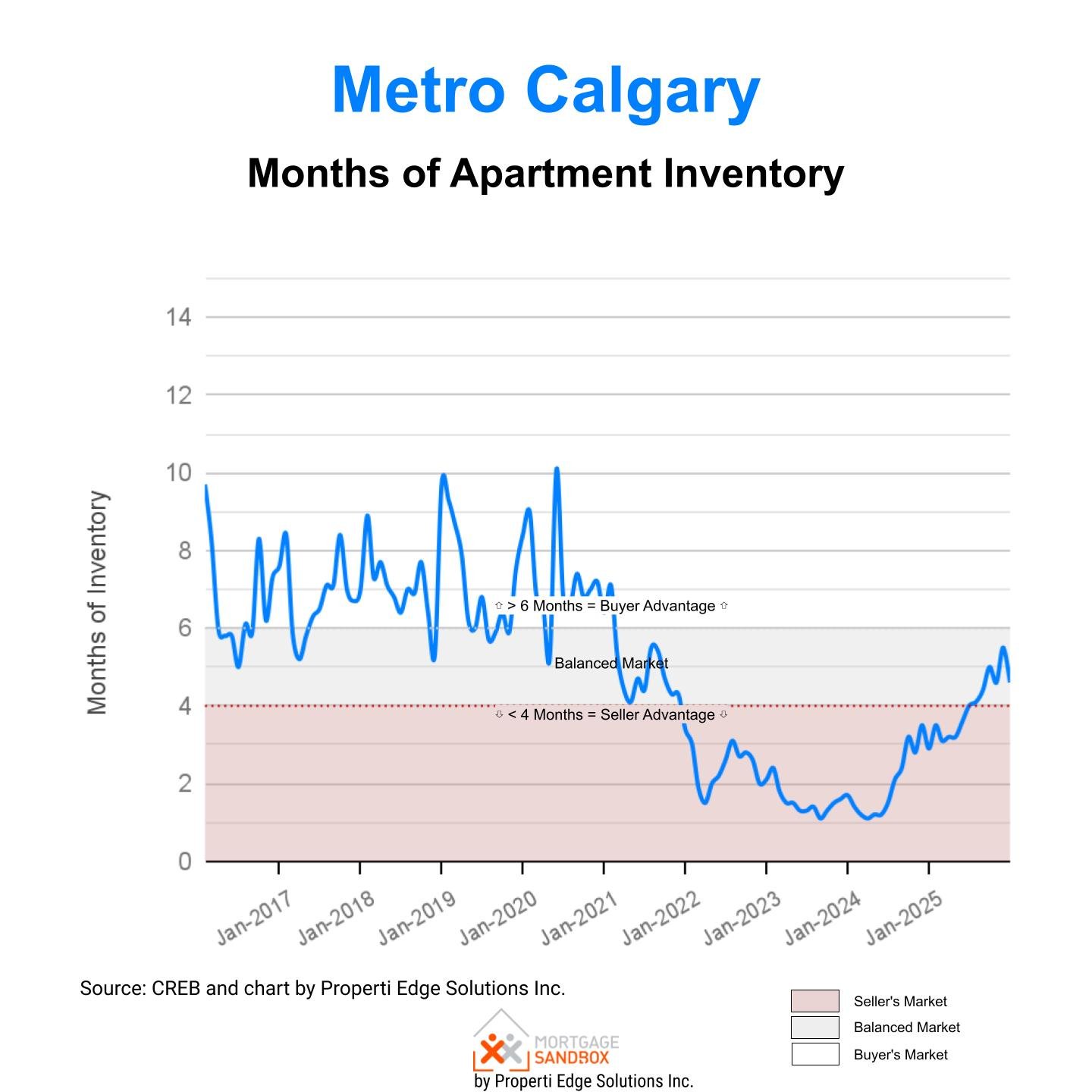

Market Status: Balanced Market, trending towards buyers.

Months of Inventory: Increased 59% from 2.9 to 4.6 months.

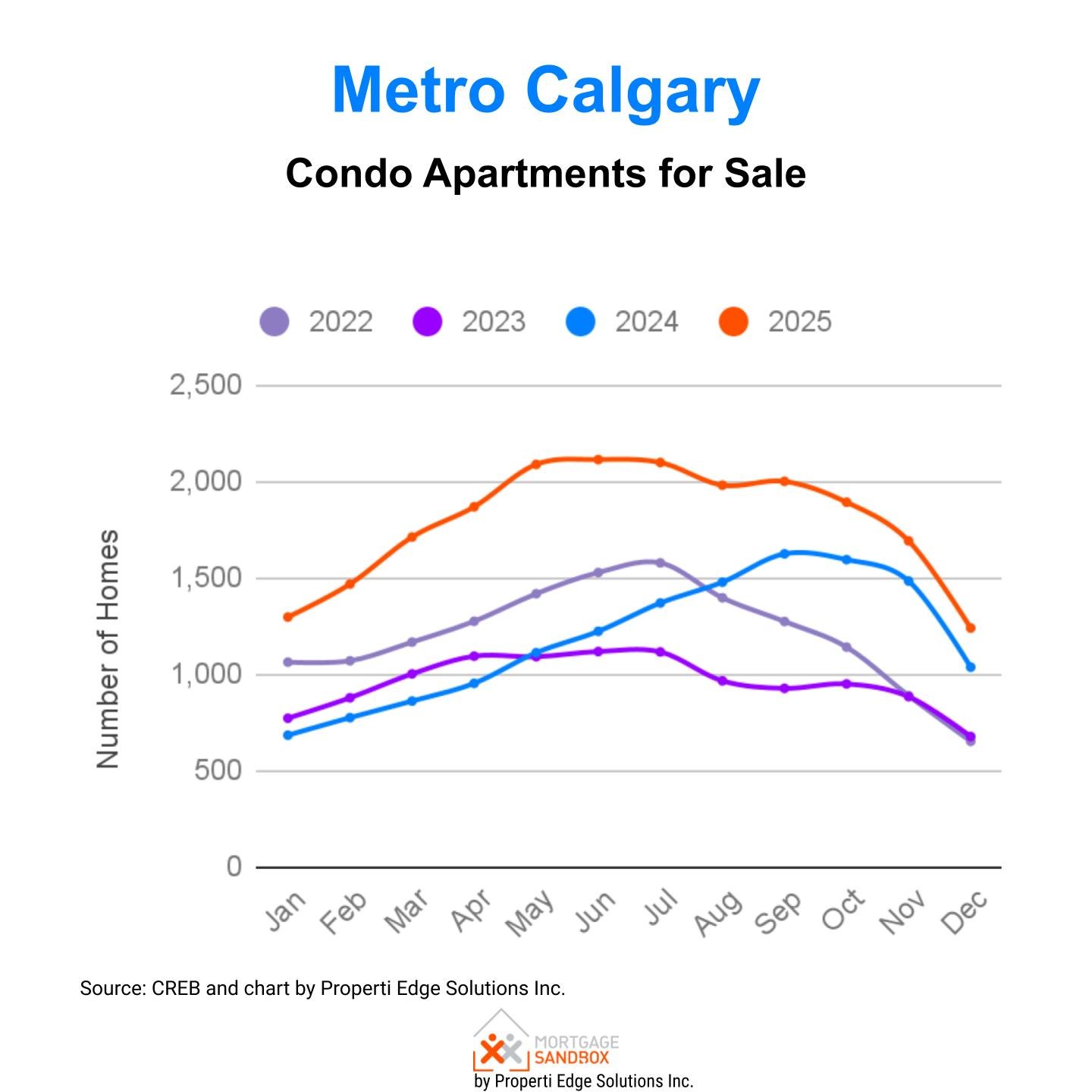

Supply & Demand: Active listings rose 20%, while purchase demand fell significantly by 24%.

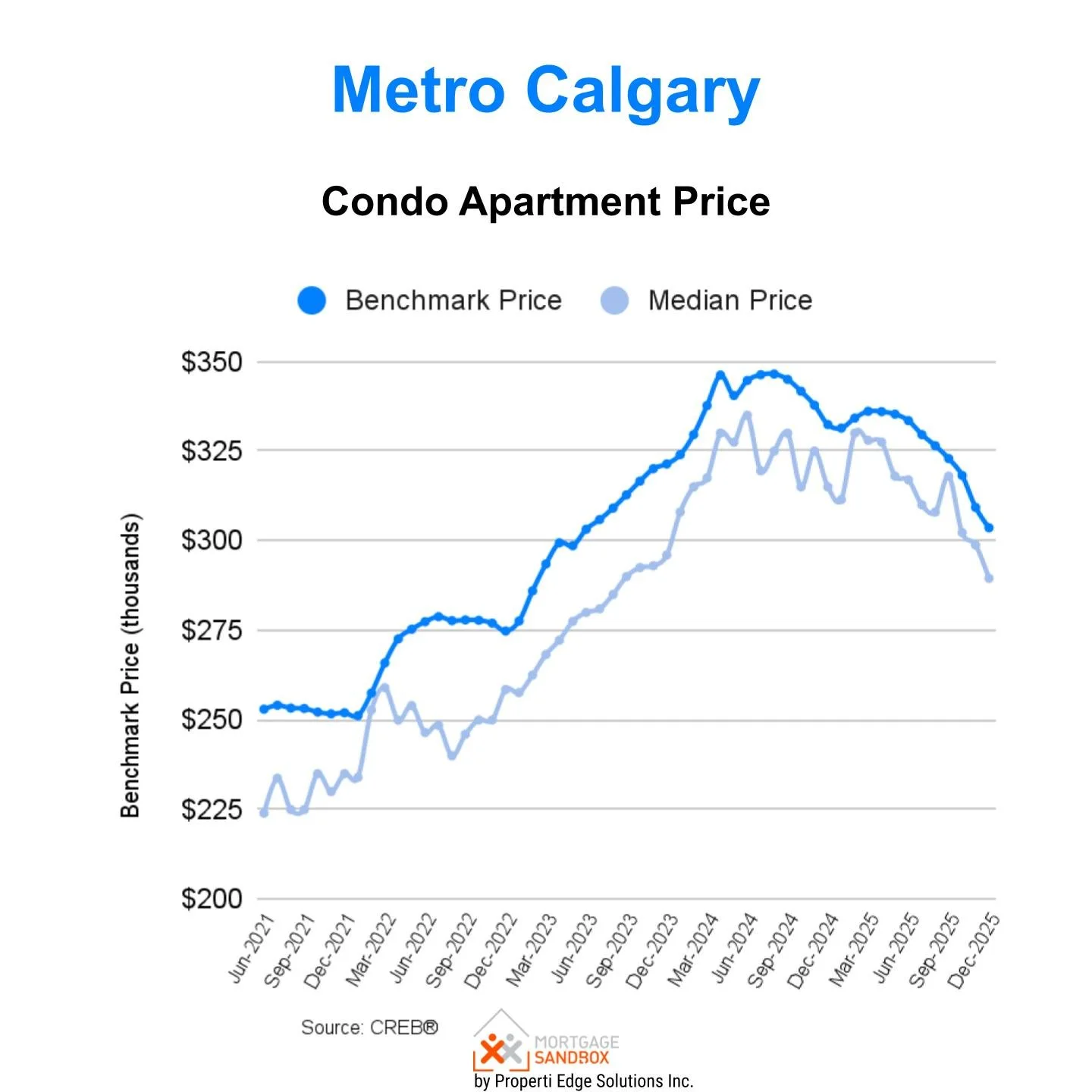

Pricing: The benchmark price fell to $303,600, a 6% decrease over the past three months. The median price saw a more substantial drop to $289,500 (down 9% over three months).

A primary driver of this shift is the strategic exit of rental investors. The proportion of rental-owned apartments in Metro Calgary has decreased from 37.6% (2019) to 34.7% (2025), coinciding with the completion of 44,000 new units. This investor sell-off, compounded by a rising rental vacancy rate (from 1.3% to 2.2%) and falling rents, has increased resale supply and applied downward pressure on prices.

Despite a 12% decline from the August 2024 peak of $346,000, Calgary's market stability contrasts sharply with major declines in Toronto and Vancouver.

Market Outlook & Risk Assessment for 2026

The normalization observed in 2025 is expected to continue, with several factors poised to influence the trajectory.

Downside Risks:

Economic & Sectoral Pressures:

Increased global oil competition from Venezuela and potential mortgage rate hikes in mid-2026 could impact local employment and purchasing power.

Supply Expansion:

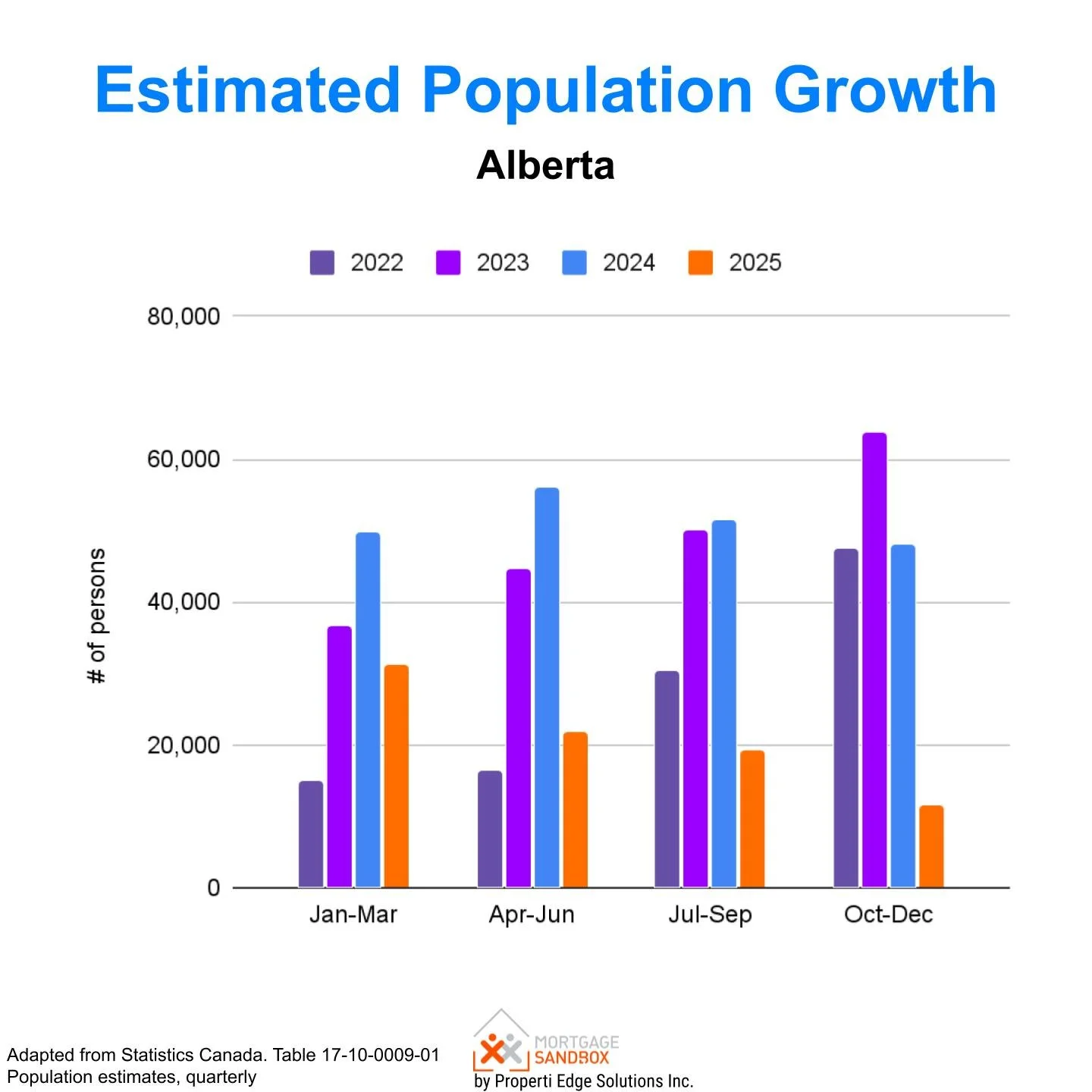

Continued weak population growth may allow housing supply to meet demand and balance the market. Furthermore, significant mortgage renewals with 20-40% payment increases could force sales, adding to inventory. Finally, Calgary has record construction levels, and these units will be added to a softening market.

Demographic Shifts:

The aging baby boomer population may begin to influence the detached segment as rightsizing accelerates. The oldest boomers turn 80 in 2026.

Sentiment Contagion:

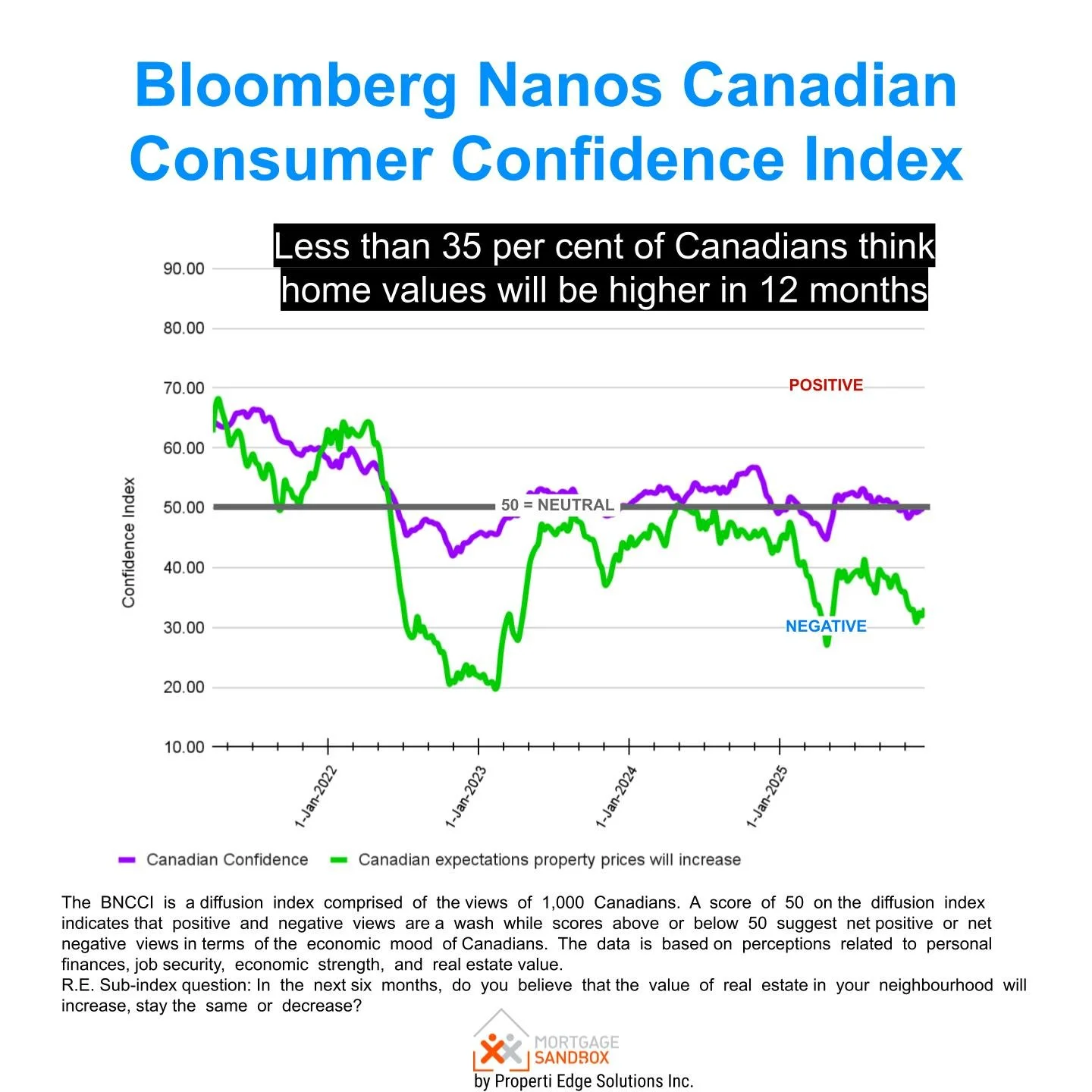

National headlines focusing on developer distress in BC and Ontario could negatively affect local buyer confidence.

Upside Risks:

Relative Affordability:

With detached prices down 6% and apartments down 12% from their peaks, Calgary's relative value may attract inter-provincial migration.

Mortgage Rate Relief:

Fixed rates (~4.5%) and variable rates (~4.1%) remain significantly below their 2023 peaks. The full stimulative effect of these cuts may still provide a floor for demand.

Outlook

The Calgary real estate market in 2025 demonstrated a clear transition into a post-frenzy phase. The data confirms a broad-based rebalancing, with the apartment segment leading the adjustment. While fundamental demand remains consistent with historical norms, increased supply and macroeconomic headwinds have tempered price growth.

Moving into 2026, market participants should anticipate continued moderation, with price stability contingent on the interplay between interest rates, economic conditions, and the materialization of the outlined risks. Calgary's market remains comparatively resilient but is not insulated from broader national cooling trends.