Best Way to Buy a House for the First Time

Buying your first home is the largest and most important investment of your life. This is a big decision that should not be rushed; It takes a lot of time and patience to prepare, find your ideal home, and get it. We’ve compiled a crash course with the critical steps to successfully buy your home. Whatever point in the process you are at today, pick-up from that step in our guide and continue from there. Let’s set you on a path to home buying success!

Research Government Support Eligibility

A good real estate agent should be able to guide you toward the right government programs given your unique circumstances but it never hurts to do your own research. Support programs are offered depending on the type of property, where it is located, and your personal circumstances (mainly income). Grants are offered both federally and provincially.

Federal Support

There are 4 main grants that the Government of Canada offers. These are:

First-Time Home Buyer Incentive

First-Time Home Buyers’ Tax Credit

Home buyers’ plan

GST/HST New Housing Rebate

Each initiative offers different levels of support and has different eligibility requirements. Ultimately, the government wants to help you buy a home.

Provincial Support

Each province also has its own grants and home buying incentive programs. Mortgage Pal has a great breakdown of what each province offers. Generally, they offer support that complements the federal programs as well as other incentives for eco-friendly sustainable homes.

Set a Budget

You will want to leave yourself some breathing room, so don’t spend your maximum budget! No one wants to live paycheck to paycheck, and if you can help it, try to give yourself enough financial wiggle room to continue saving after your monthly mortgage payment.

Setting your budget is your first step in the home-buying process after deciding to buy a home, and it’s very important! Four major factors will determine your budget:

Your mortgage pre-approval.

Your down payment.

Closing costs.

Your moving costs.

Before finalizing your budget, make sure that you have consulted a mortgage broker and got a second opinion from a local bank or credit union. Then, talk to a lawyer and moving company for a closing and moving costs quote. Ask each professional to list out the detailed line items and carefully review their analysis to make sure they’ve truly understood your situation. To learn more about establishing your home-buying budget, look at our post on Mortgage Basics!

It’s hard to turn down your dream home when it’s just within reach, but if you’ve spent more than you’re comfortable with, that financial stress might stop you from enjoying your new home to the fullest.

Use the What Can I Afford calculator to find out your estimated homebuying budget

Pick Your Neighbourhood

When you’re searching for your ideal home, it doesn’t just involve finding the home itself, it also involves finding a neighbourhood that fits your lifestyle. There are many things to consider when picking your new neighbourhood. What kind of lifestyle do you hope to have? Are you looking for a quieter, family-oriented, and suburban neighborhood with schools nearby? Perhaps you want to be walking distance from shopping, restaurants, and theatres? Do you mind a long commute? How many cars do you want to own? These are just a few ideas of what to consider.

Make sure to write down a list of your neighbourhood requirements before visiting open houses so that you have a clear idea of what it is you’re looking for and what you’re willing to compromise on.

Meet with your real estate agent and agree in advance, before viewing a single property, which neighbourhoods and areas fit your lifestyle needs. The neighbourhood list is separate from your requirements in a specific home, something we will elaborate on in the next step!

Prioritize Your Needs Before Your Wants

You will want to be very clear with your real estate agent when you describe what it is that you really need in your new home, versus what you want but are willing to compromise. This is a very important step as the longer your list of requirements, the more difficult it will be for an agent to help you find a home, and the more expensive it will likely be. Don’t feel pressured to compromise on features that are very important to you but be mindful of things that you should consider as bonus features.

Requirements are often things that are expensive or difficult to add or change in a home. It is important to communicate the importance of your requirements to your real estate agent so that they can find the right homes for you to view.

At this point, you have narrowed your search to a few neighbourhoods and homes matching a specific profile. These lists will help you keep you and your real estate agent on track for success. When you’re spending this much money you don’t want to get emotionally attached to a beautiful home in the wrong neighbourhood or compromise on your ideal home just because it is in the right neighbourhood. Click here for more details on establishing your home buying requirements!

Establish Your Buying Strategy

Mortgage Sandbox has identified four common buying strategies that might help you decide what works best for your unique situation. These four strategies are:

Big Bang: Gather all of your money and resources to get the nicest home possible, taking advantage of an opportunity that may not be able to afford in a few years.

Baby Steps: Just get into the market with a starter home and a small mortgage that meet your requirements. You can upgrade your home every 5-10 years.

Lifestyle Protection: Balance your lifestyle expenses and your housing expenses. Find the nicest home possible for you that doesn’t compromise your lifestyle too much.

Strategic Leverage: Find a home that requires a small down payment, and target the largest possible mortgage amount.

Check out our detailed post on establishing your home buying strategy for more information!

Hire Your Own Professionals

Find yourself a real estate agent and mortgage broker that are aligned to your values! Why is this so important? Your values guide your objectives and your decisions. When you hire people that aren’t on the same page as you and don’t understand your needs and priorities, it can result in frustration, wasted time and, potentially, buyer’s remorse.

Mortgage Sandbox can save you a lot of time and stress in finding the right professionals with our MatchFinder app. Match Finder pre-screens mortgage brokers and agents and matches you with professionals that are aligned with your interests and values. All you have to do is answer a short survey and tell us a little bit about yourself.

Our platform matches you with local, pre-screened, values-aligned Realtors and Mortgage Brokers because shared values make better working relationships.

KEY TAKEAWAY

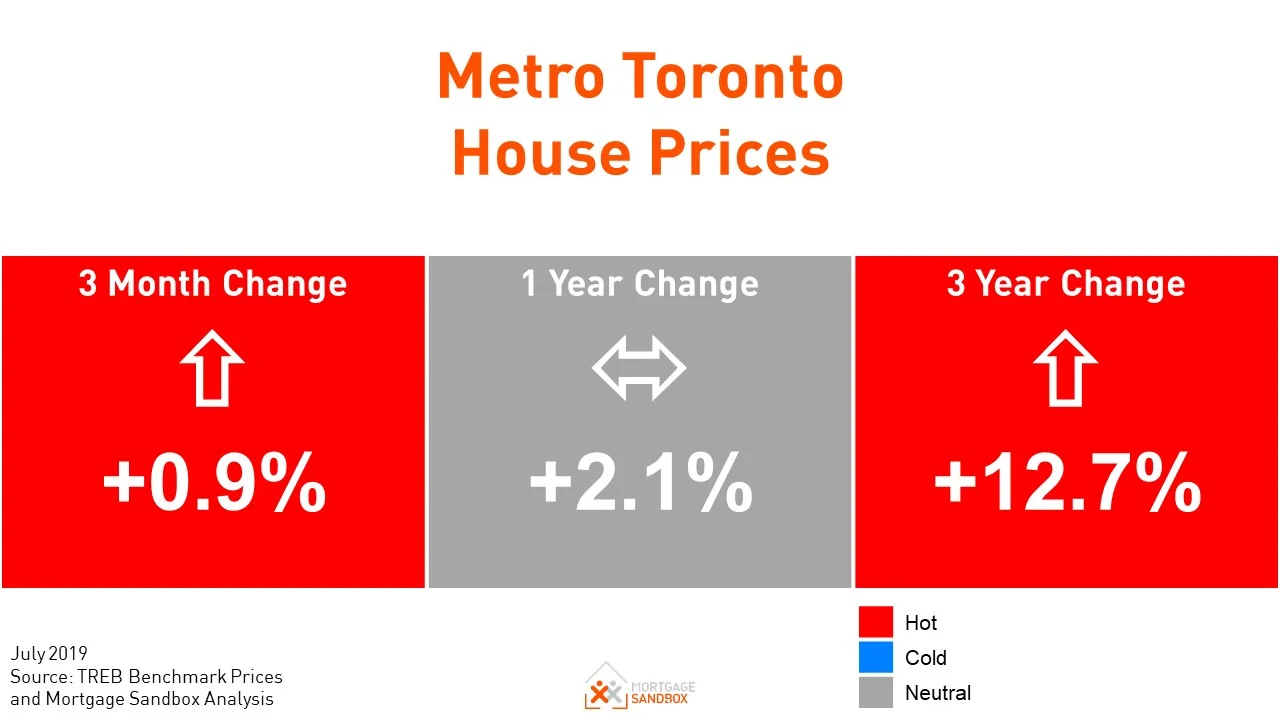

A large investment, like a home, requires a very thoughtful and strategic buying approach. Buying a home can be scary, but it doesn’t have to be as long as you’re prepared. For more in-depth information market conditions in your city, see our market reports and forecasts and feel free to contact us. We would love to hear from you!