Calgary Property Market Shifts as Supply Rises Across Segments

The Calgary real estate market is experiencing a significant rebalancing, with increasing inventory and declining prices creating unique opportunities and considerations for various types of buyers and sellers.

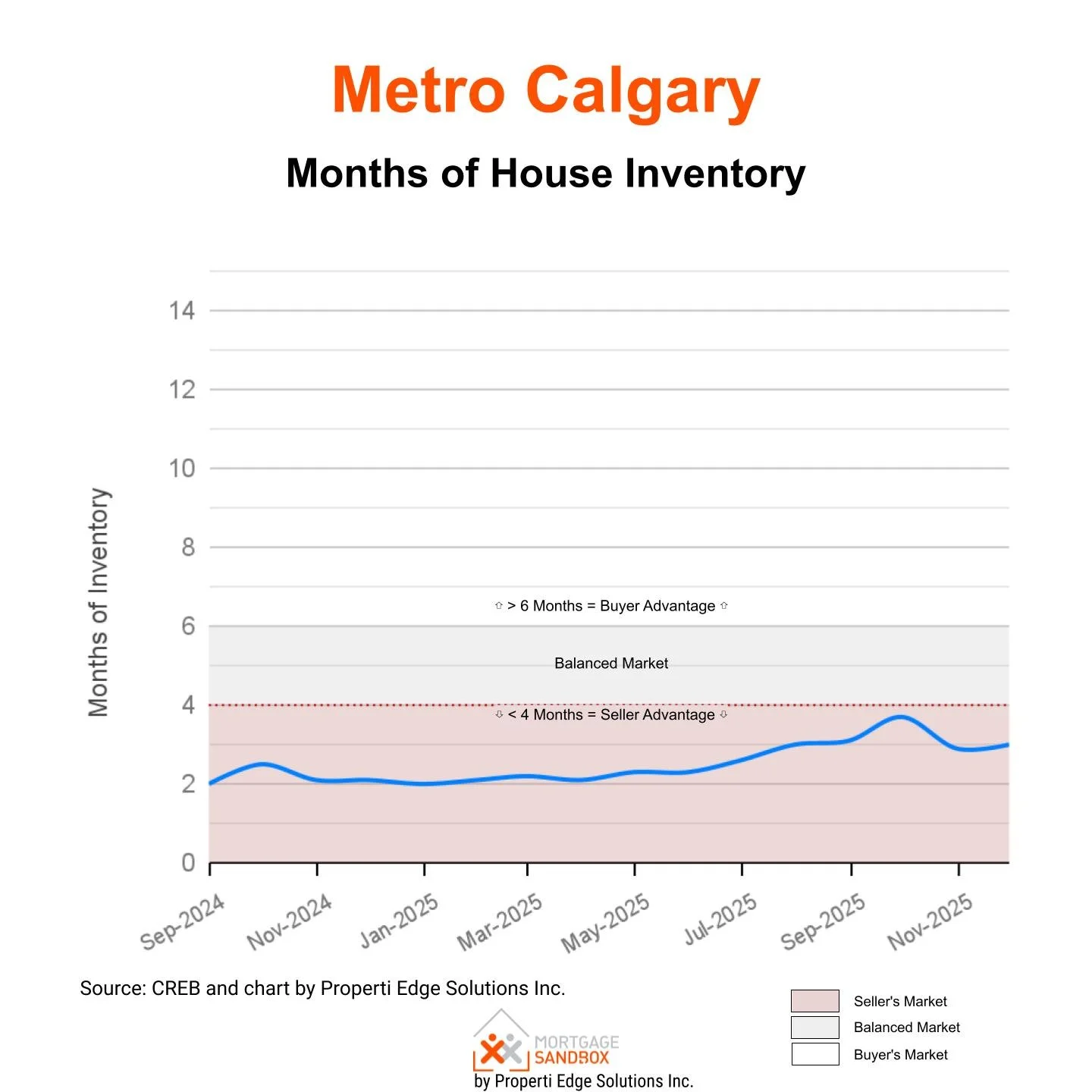

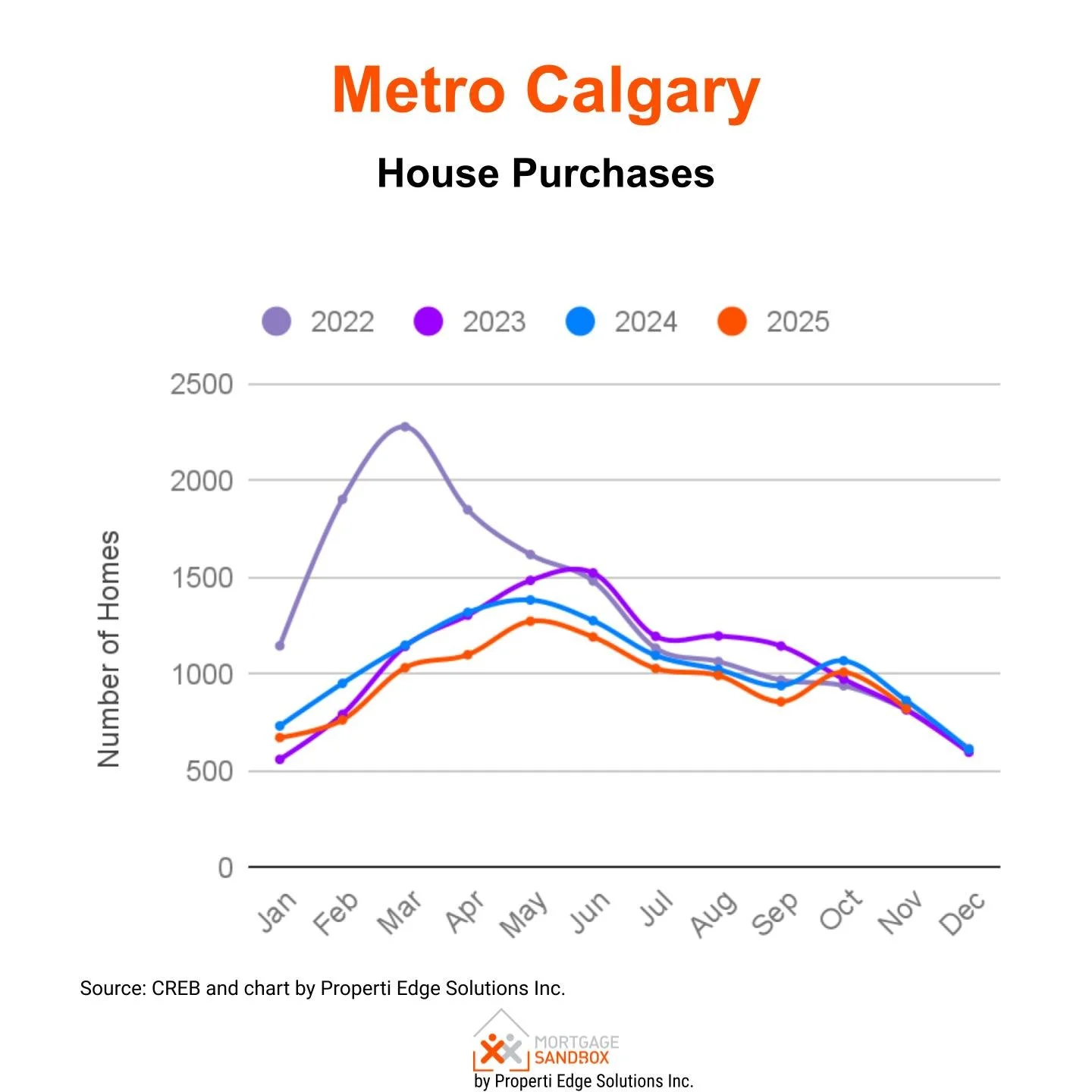

Detached Houses

Detached houses remain in seller’s market territory, but the advantage is moderating. Supply is trending toward a balanced market.

Buyer interest is currently stronger than during 2016 to 2020, but significantly lower than the levels seen from 2021 to 2024. Purchase demand has decreased by 5% since November 2024.

Active listings have risen by 32% compared to last year, leading to a 43% increase in months of inventory, which now totals three months.

This increased choice is applying downward pressure on prices, with the benchmark price falling 3% over the past three months and 2.3% year-over-year to $750,100.

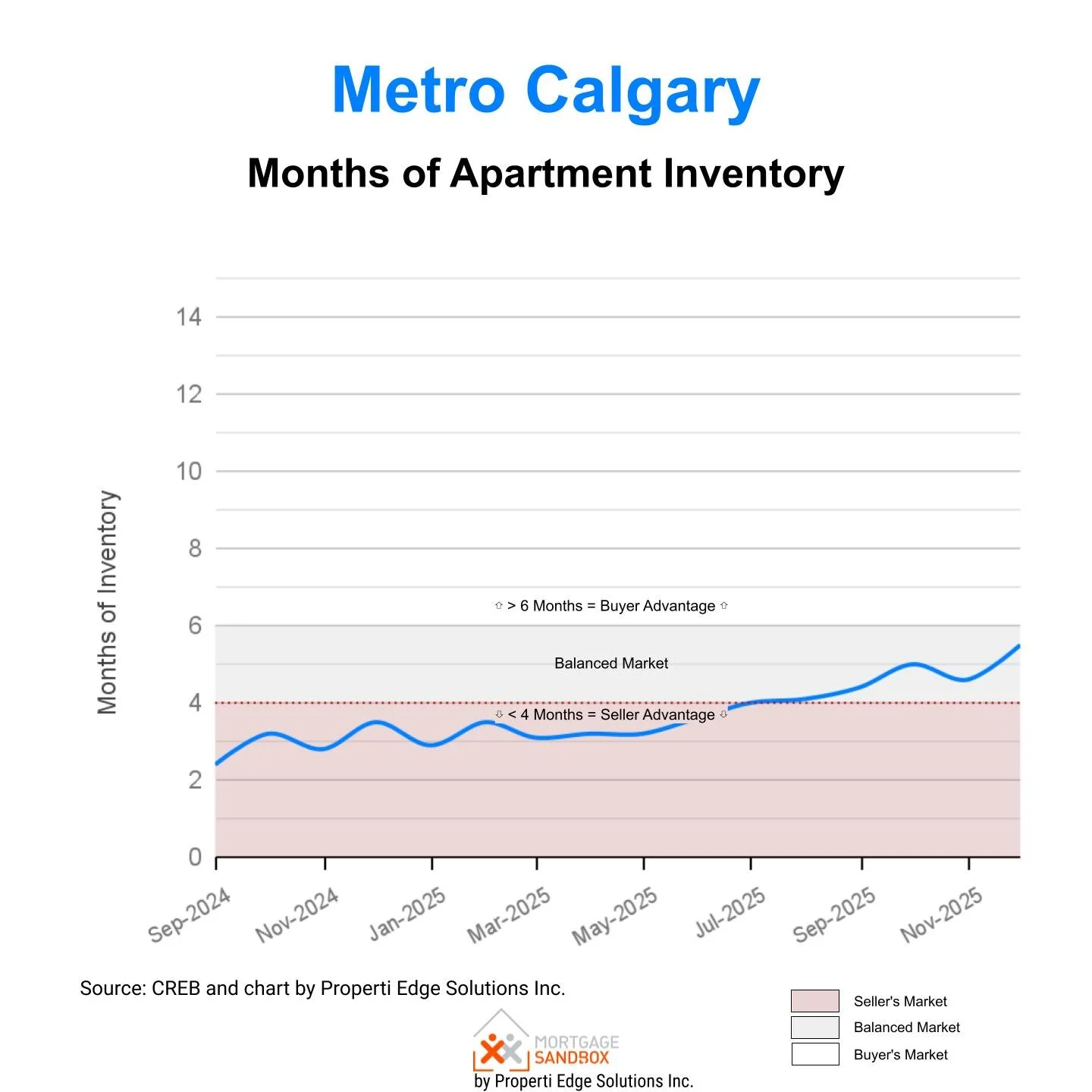

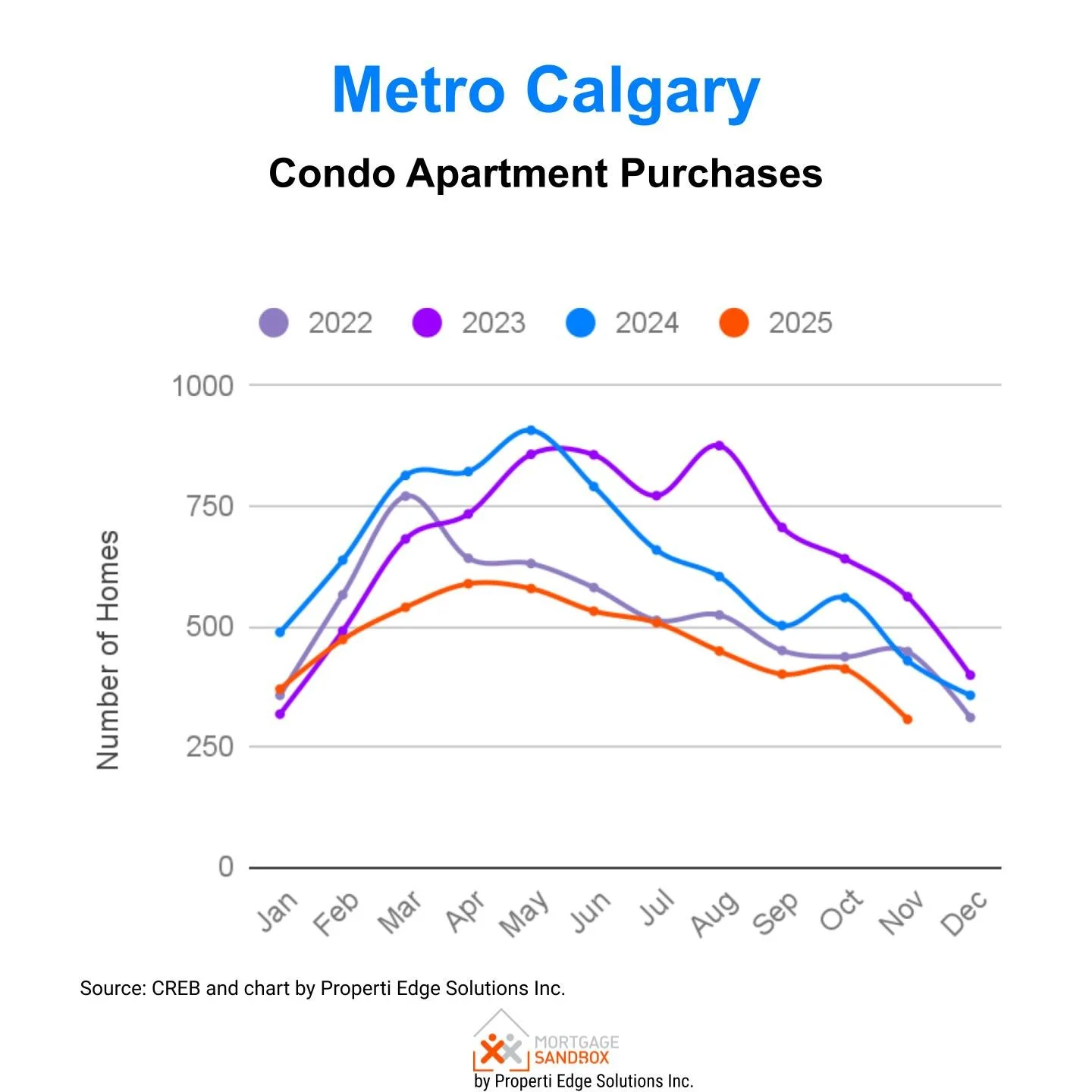

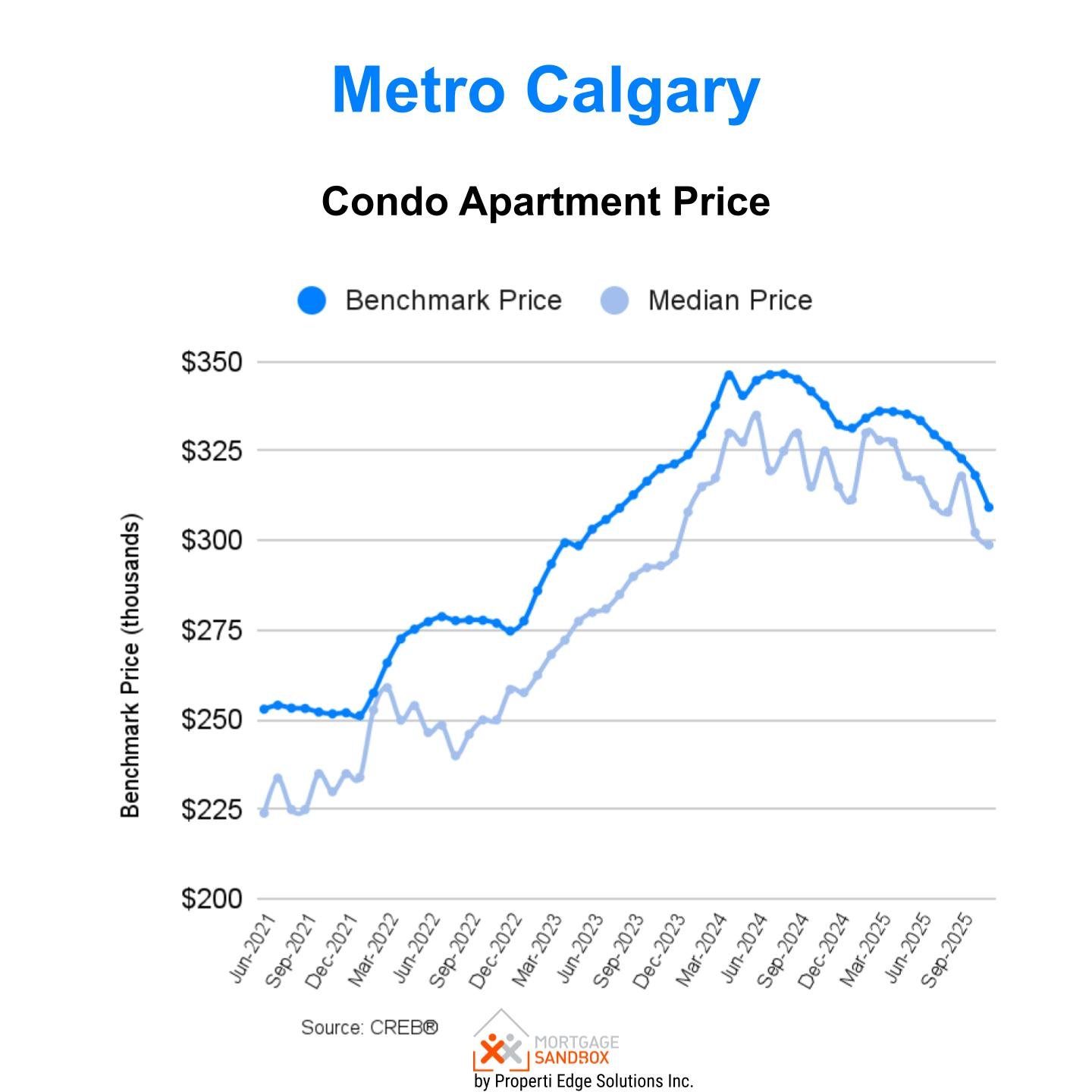

Condominium Apartments

The condo apartment sector has moved into balanced market conditions, tilting toward buyers.

The market has experienced a significant 57% increase in months of inventory, now totaling 5.5 months.

This shift has resulted from a 28% decline in purchase demand and a 14% increase in active listings.

Prices have responded, with the benchmark condo price declining 5% in the last quarter and 8.4% year-over-year to $337,800.

What These Conditions Mean for Market Participants

For first-time buyers looking to buy a condo:

For first-time buyers looking to purchase a condo, the current market presents a significant opportunity. You are entering a balanced market that favours buyers, featuring a notably larger selection of properties (inventory is up 14%) and much less competitive pressure, as demand has decreased by 28%.

This grants increased negotiating power and more time to make decisions. The steep year-over-year price correction of 8.4% also improves affordability, potentially allowing entry into the market at a lower price point.

For families looking to upsize from a condo to a house:

This may be an advantageous time to make your move.

The condo market is balanced, and prices are trending lower, which means the equity you’re counting on to help you buy a house is shrinking. There are no apparent signs that 2026 will be better for the condo market, so selling now and locking in your equity could be a good financial decision.

While the detached market still favours sellers, the conditions have improved for buyers, with more homes to choose from and prices softening.

Successfully navigating this transition will require careful pricing of your condo to sell in a cooler market, but the trade-off is a less frenetic and slightly more buyer-friendly environment for your house purchase.

For retirees considering right-sizing from a house to a condo:

For retirees considering right-sizing from a house to a condo, the current market data presents a distinct strategic advantage, characterized by a favourable sell-buy asymmetry.

Selling Your House: A Seller's Market Advantage

You will be selling your detached home in a seller's market, where you retain the upper hand in negotiations. Although inventory has grown, demand still outpaces supply for houses. This environment positions you to capitalize on your accrued home equity and achieve a strong sale price.

Buying a Condo: A Balanced Market with Buyer Leverage

You will be purchasing a condo in a balanced market that is trending in favour of buyers. With a 57% increase in inventory and prices down 8.4% year-over-year, you have significantly more choice, less competition, and increased negotiating power compared to the detached segment.

Net Result: A Potentially Advantageous Equity Event

This asymmetry, selling high in a seller's market and buying into a softer, balanced market, creates a clear opportunity to unlock more equity from your house. The conditions are conducive to a strategic downsizing that maximizes financial return while providing a greater selection of condo properties at more favourable prices.