Is Today the Best Time to Buy a Home?

Lately, homebuyers have been the victims of information overload. Most real estate agents will always advise you to buy as soon as possible because prices tend to rise in the long run. While that may be true, a homebuyer might like to know if waiting a few months could save them a few thousand dollars. The answers to these questions will surprise homebuyers!

Do low mortgage rates help me qualify for a bigger mortgage?

Will home prices drop in 2020?

Will the economy bounce back, or is there more trouble to come?

If prices will drop, should I wait to buy in 2021?

1. Do low mortgage rates help me qualify for a bigger mortgage?

The short answer is no. Lower interest rates will save you money on your mortgage, but they will not help you borrow more when compared to 2019 or 2016. How can this be? It's the result of two key changes put forward by the government to protect Canadians from taking on too much debt.

The mortgage stress test brought into effect on January 1, 2018

The change in the maximum allowable debt-to-income ratios effective July 1, 2020

Stress test

The stress test, implemented by the federal banking regulator, requires Canadians to qualify for a mortgage at an interest rate that is roughly 2% higher than the actual rate offered by the lender. For example, if your mortgage rate is 2.5%, the lender will qualify you for a rate of 4.5%. This reduces how much lower mortgage rates increase home buyer budgets. The effect of this change reduced homebuyer budgets by roughly 20%.

Debt-to-income ratios

CMHC, the federal home and mortgage agency, has changed the way it approves mortgages. They haven't added a stress test, but the effect of the change is similar. The change reduces the average homebuyer budget by close to 10%.

Low rates have not raised your buying power

In 2016, homebuyers could get a mortgage at 2.5% without the stress test or the new debt-to-income ratio. Today, mortgage rates are back down to the levels of 2016, but homebuyer budgets are 30% lower because of the two mortgage qualification rules.

This is good news for homebuyers because the rules don't discriminate. All Canadians have less purchasing power so that, in a bidding war, the same person will still win, but they will get to buy the home at a lower price and with less debt.

2. Will home prices drop in 2020?

Yes, it's likely that prices will drop in 2020 because of the recession caused by COVID-19.

Coronavirus Recession

We are in a recession, and Canada shed nearly two million jobs in April, as the novel coronavirus pandemic tore through the Canadian economy. The official unemployment rate soared to 13%, but it would have been 17.8% if the agency had included the 1.1 million Canadians who stopped looking for work — likely because the COVID-19 economic shutdown has limited job opportunities.

Job losses from Coronavirus containment efforts are a powerful force in real estate because, without income, you can not qualify for a mortgage. Most first-time homebuyers are Millennials, and job losses have hit Millennials hardest.

How Recessions Impact Home Prices

Brendan LaCerda, a Senior Economist with Moody's Analytics, has modelled the impact of a downturn on home prices. Moody's Model roughly translates a 1% rise in unemployment with a 4% drop in home prices. Based on this ratio, they must be looking at the lower unemployment scenarios. It is unlikely that Moody's calculation can fully take the social distancing measures into account. Banning open houses is unprecedented, so really, Moody's estimated impact is an intelligent guess.

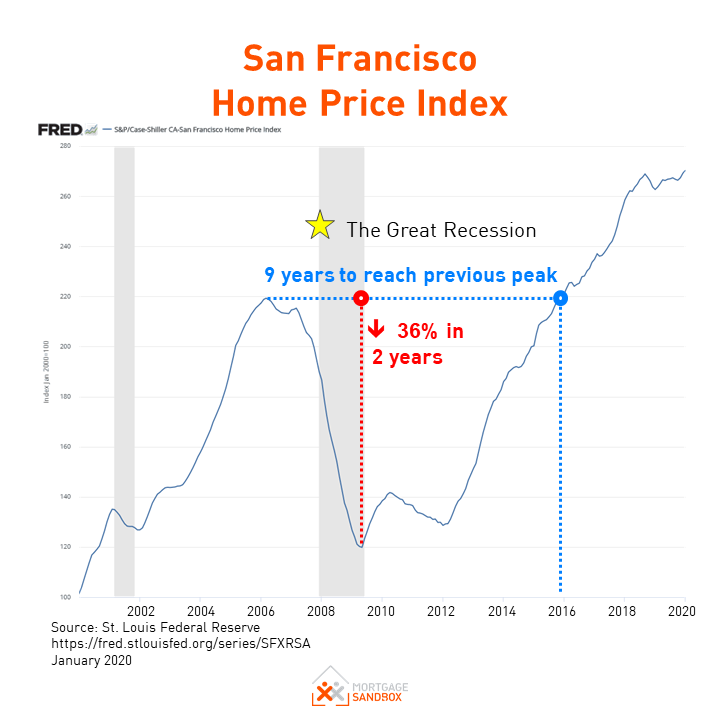

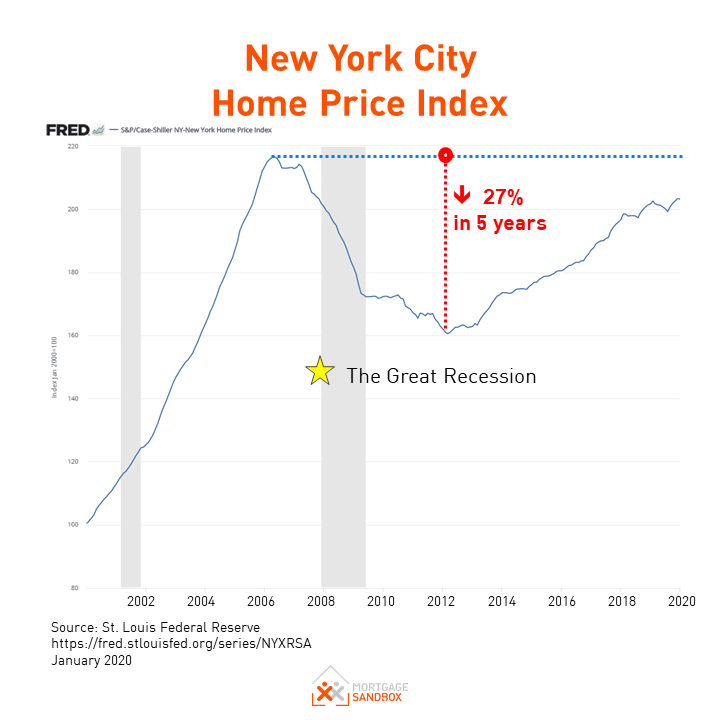

Past Recessions

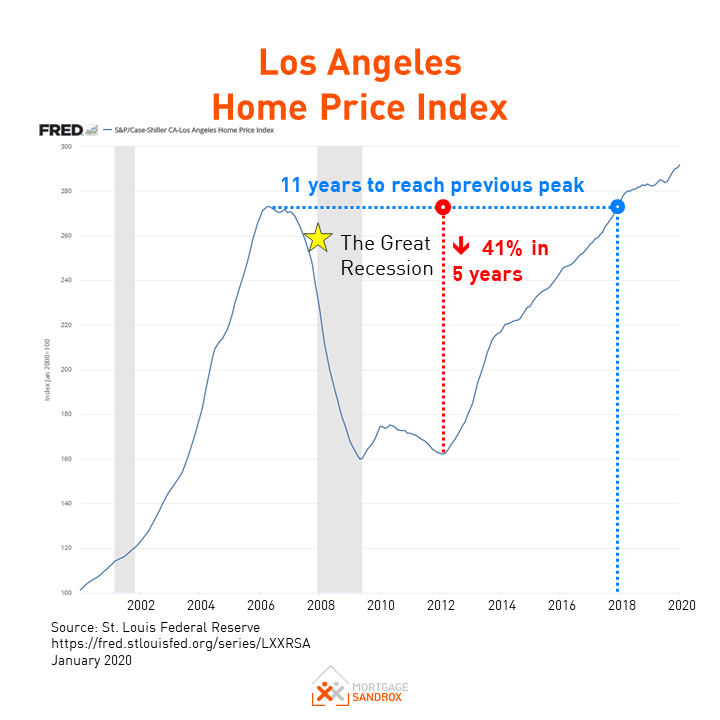

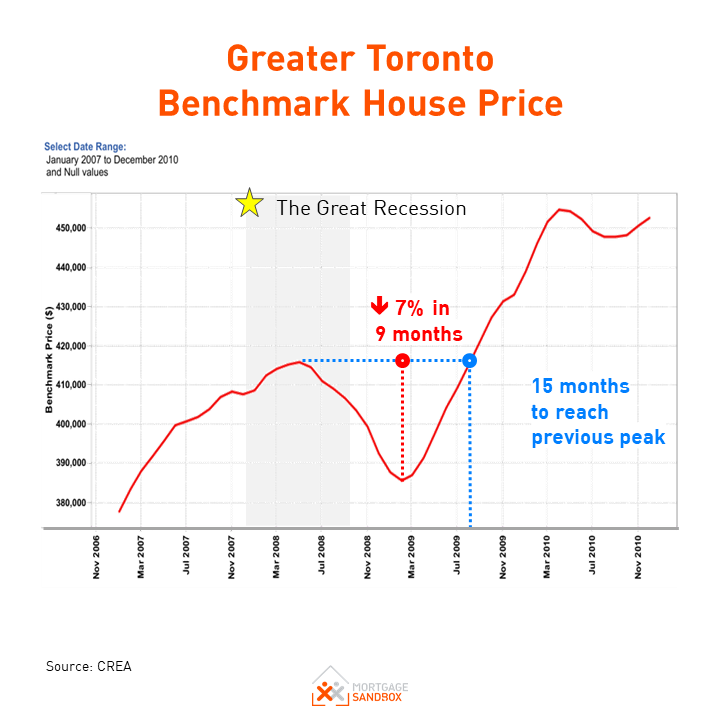

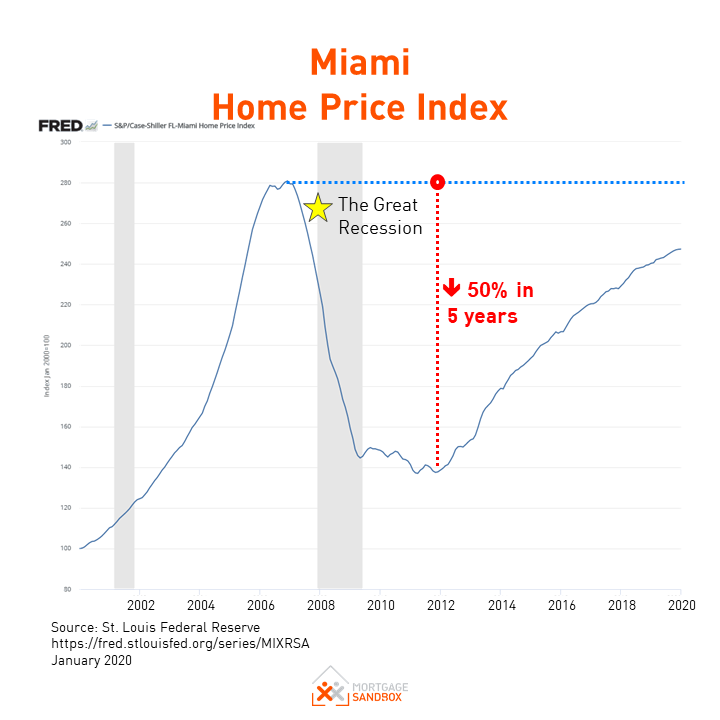

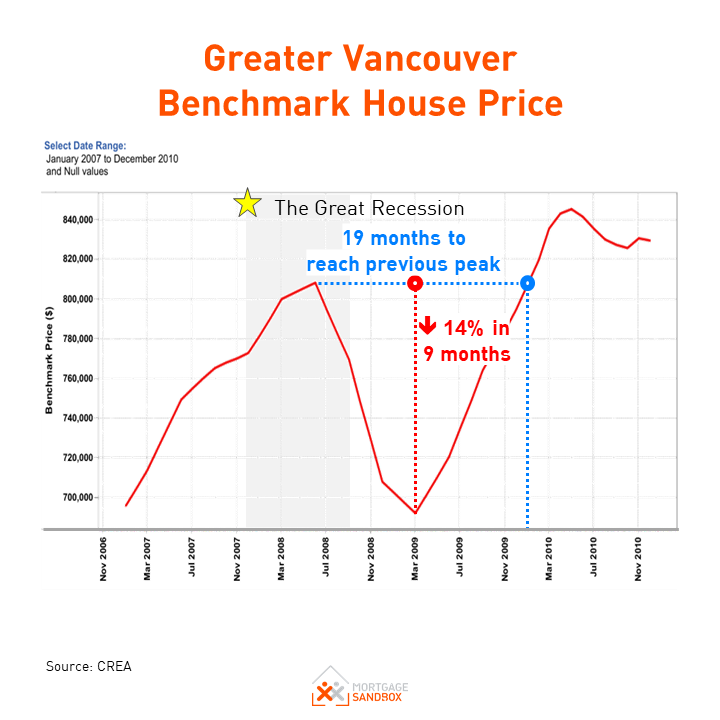

Prices will likely drop between 10% and 50%, depending on the local market, and values will probably not return to current levels for two years or even a decade.

3. Will the economy bounce back, or is there more trouble to come?

Two key assumptions underpin the more optimistic economic forecasts:

COVID-19 control measures in Canada will be gradually relaxed — but not eliminated entirely — over the remainder of 2020. There will not be a second or third "lockdown" in response to new waves of infection.

Unemployment will not exceed 15%.

At Mortgage Sandbox, we are placing greater emphasis on the forecasts that include a 'second wave" of infection because Dr. Anthony Fauci, director of the [U.S.] National Institute of Allergy and Infectious Diseases, believes a second wave of coronavirus infections is "inevitable."

A study headed by Dr. Kristine A. Moore, medical director at the University of Minnesota Center for Infectious Disease Research and Policy, warns that the pandemic will not be over soon and that people need to be prepared for possible periodic resurgences of disease. Optimistically, a vaccine will not be widely available until mid-2021, and 70% of the population would need to be infected to provide herd immunity. Unfortunately, more than 30% of the population have conditions that make them vulnerable.

4. If prices will drop, should I wait to buy in 2021?

Prices are still trending upward, but Coronavirus containment efforts pull prices down. Here are your key considerations:

Will you save money by waiting?

Current market conditions favour buyers

We don't know exactly how much local prices will drop or for how long

The annual real estate cycle often favours buyers in late summer

1. Will you save money by waiting?

Below is a simple cost-benefit approach to help you decide whether to wait or buy now. It's not an exact calculation, but it should give you a rough idea of how to proceed.

How much could you save by waiting 12 months for lower prices? Use our 'What can I afford' calculator to calculate your maximum home buying budget. Then calculate how by how many dollars the price would drop with a 10% correction and with a 20% correction.

For example, a $500,000 home would drop $50,000 with a 10% correction and $100,000 with a 20% correction.How much will it cost you to wait? Multiply your monthly rent by 12 to calculate your annual cost of waiting a year.

For example, the average rent for a 2-bedroom apartment in Vancouver or Toronto is $2,500, so the annual cost is $30,000.

In the example above, the cost of waiting is $30,000, or roughly 6% of the purchase price. If you feel prices in your area will only drop 10% from today's peak price to the bottom of this economic real estate cycle, then it would make sense to buy after prices have dropped 4% because the rent savings will offset the remaining potential home price savings.

This approach assumes that you want to buy and you're looking for timing advice, it is not intended to help with the long-term and more complex decision between renting and buying.

2. Current market conditions favour buyers

Ideally, a homebuyer should want to be looking for a home in a 'buyer's market' or 'balanced market' rather than a 'seller's market.'

In a buyer's market, there are enough homes for sale that it would take nine or more months to sell everything available. In this situation, the negotiating power lies with the buyer. Sellers will likely offer or accept discounts.

A seller's market has only enough homes for sale that it would take five or fewer months to sell everything available. Here, the negotiating power lies with the seller. A seller's market leads to bidding wars and increases in home prices.

In most Canadian markets, purchases have fallen more than listings, and that has shifted the market in favour of buyers. Locally, not all markets are in a full-blown buyer's market, but there has still been a movement toward a balanced or buyer's market.

3. We don't know exactly how much local prices will drop or for how long

It's very rare to time the market perfectly, and it is often impractical to wait until the market bottoms. It could take four years for the market to hit rock-bottom, and in the meantime, you're saddled with rental costs.

Instead of focussing exclusively on price, think about how a slower market will allow you to find a better home for the same price. Perhaps it will have more light, the building has 'better bones,' or it's closer to shopping and amenities.

When the market shifts to a buyer's advantage, it allows homebuyers to take their time and find a home that better fits their needs without having to feel FOMO (fear-of-missing-out).

4. The annual real estate cycle often favours buyers in late summer

In Canadian real estate, we observe two distinct cyclical patterns in real estate. The long-term real estate cycle is linked to the economic cycle and periodic recessions. This long-term cycle typically takes around a decade to complete and has a significant effect on the price of homes.

The other cycle is the annual real estate cycle, which is the effect that Candian winters and school vacations have on the market. The annual cycle has a less dramatic effect on prices, but a savvy buyer can save a significant amount of money by taking advantage of the seasonal fluctuations that occur every year.

Spring is when home buyers are most active. Between August and October, there are still plenty of homes listed for sale, but there is less buyer interest. This increased supply shifts negotiating power to the remaining homebuyers. A seller reviewing an offer needs to consider that turning-down an offer in the Fall, may mean that they will need to wait six months to re-list in the Spring.

Our Recommendation

The current market favours buyers, and it is likely to become more favourable in the Fall of 2020. If you are thinking of buying, be sure to drive a hard bargain and, since it is a falling market, try to pay slightly below the market value. For details on a specific market, you should read our local home price forecasts.

Buying a home is a big decision, so check out Mortgage Sandbox's Canadian Homebuyer Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

Before looking for a Realtor, you should get pre-approved for a mortgage so you can figure out your home buying budget. A Realtor will usually ask you for a homebuying budget before showing you any homes, so you may as well prepare yourself in advance.

Need a local Mortgage Broker?

We help Canadians find pre-screened, local Mortgage Brokers with whom they are predisposed to work well.

Like this post? Like us on Facebook for the next one in your feed.