Top 5 recession warning indicators

If you’re trying to figure out if the Canadian economy is going to go into a recession, you probably feel like you’re watching a game of ping pong.

One headline will tell you Canada has the economic equivalent of blue skies and sunshine; while the next news story predicts hurricane-force economic headwinds.

Most experts say there’s no need to panic just yet, but there are a number of reports you may want to watch to help anticipate future economic conditions. They’re referred to as “indicators,” and they’re what economists watch when checking the health of the economy.

In this article, we will identify the 5 key indicators, explain why they’re significant and also provide links to help you check up on them yourself in the future.

1. Inverted yield curve

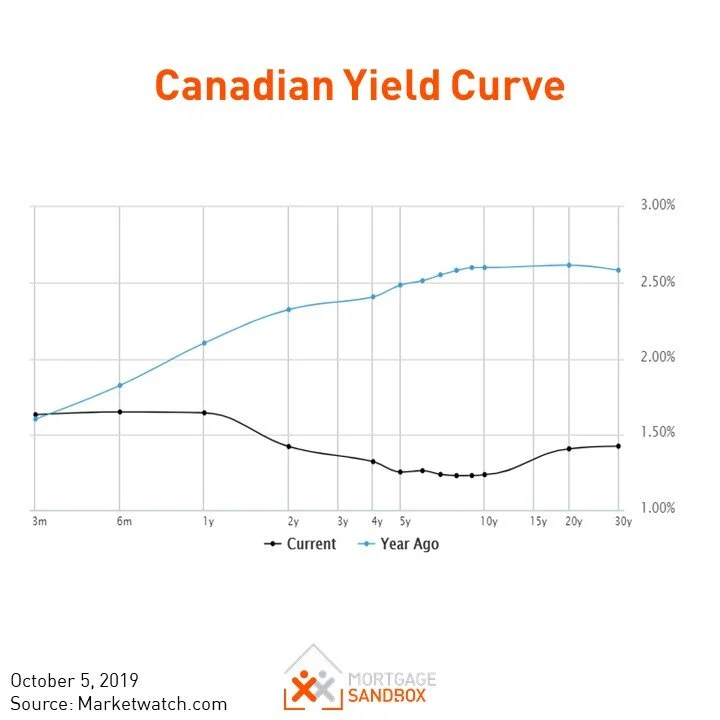

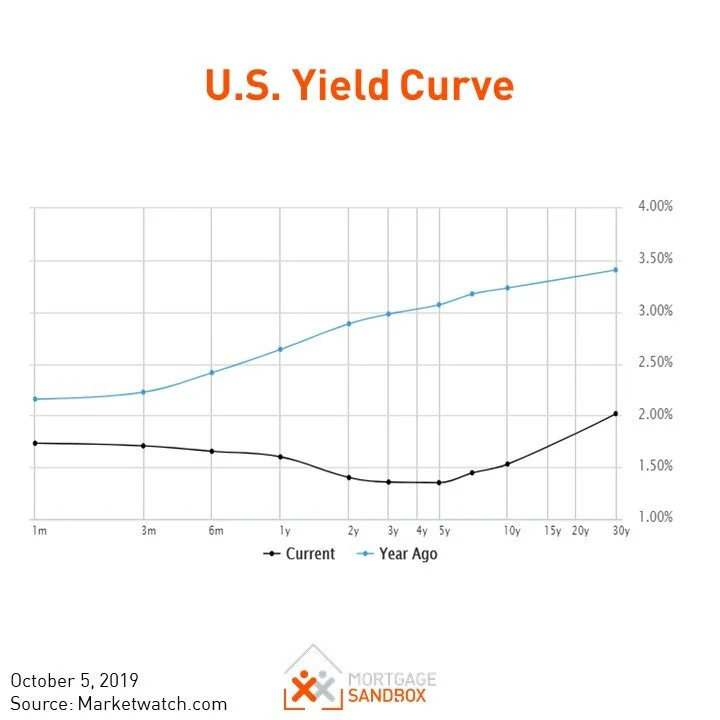

One of the most reliable indicators of an impending recession is an inverted “yield curve.” Canada has had an inverted yield curve since April of 2019 and the U.S. has had an inverted yield-curve since May 2019.

The “yield” is the interest rate paid to the owner of a bond or short-term debt investment. These investments ask investors to commit their money for differing lengths of time and that is referred to as their “maturity”. Some investments require a one-month commitment while others last 30 years. The yield-curve compares how must interest investors expect for different length maturities. Typically, when an investor commits their cash for a longer timeframe, they expect more interest in return. If you’re an investor, and you’re given the choice for investing for a month or investing for 10 years, you would say, ‘Hey, a lot more can change in 10 years than in 1 month. I’m going to demand a higher interest rate, a higher yield,” and that’s why the yield curve is positive sloping – most of the time.

An inverted yield curve, or downward sloping yield-curve, describes a situation where investors' expectations are opposite to what would be normal. They are buying long-term investments that pay less than short term investments. The only logical explanation for this behaviour is that they expect short-term rates to drop significantly in the future. They believe they will make more money accepting a lesser return on a long-term investment now because in the future the investment will pay more than a short-term investment.

There is a Canadian yield-curve and a U.S. yield-curve and since the Canadian economy is intertwined with the U.S., you should probably pay attention to both.

This article will explore other recession predicting indicators, however, research by the U.S. Federal Reserve has found that the yield curve—specifically between 3 months and 10 years—significantly outperforms other indicators in predicting recessions six to eighteen months in advance.

Every recession in the past 50 years has been preceded by an inverted yield-curve so it has a high correlation, but it is not necessarily a guarantee of a recession. This time could be different.

Nevertheless, if you believe the yield curve is an accurate indicator then a recession is very likely in 2020.

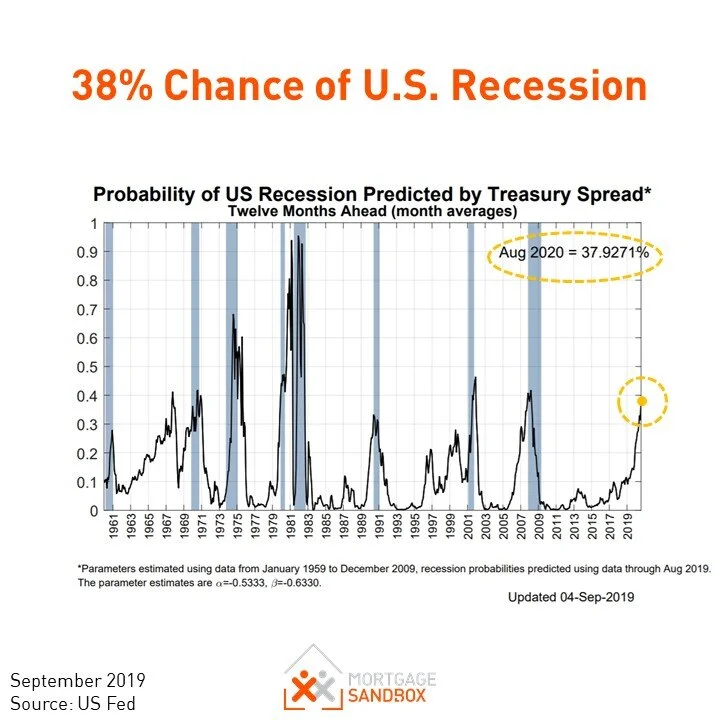

2. The Federal Reserve Bank of New York’s recession probability model

What happens to the U.S. economy usually spills over into Canada because the U.S. buys 80% of Canadian exports.

Based on the spread between the 10-year and three-month Treasury yields, the regional New York Fed compiles data about the likelihood of a recession in the year ahead. It’s updated typically at the beginning of each month.

To be honest, this indicator is calculated using the yield-curve so it would be misleading to imply this is a separate indicator from the yield-curve. However, it’s helpful that they use the yield curve to calculate the likelihood of a recession. In August 2019, the Federal Reserve’s model calculated a 38% chance of a U.S. recession by August 2020 and from the chart, we can observe that the likelihood of recession is rising quickly. Click here to see the latest Recession Probability Model by the U.S. Fed.

Even though it has only reached the 37 percent threshold, it in line with other economists’ estimates who are starting to forecast that a recession could happen in 2020.

3. Sales of New Homes

Real estate and rental and leasing contribute 13% to Ontario’s economy and 18% to British Columbia’s economy. Construction contributes 7% to Ontario and 9% to BC. When you combine the two, 20% of Ontario and 27% of BCs economies are dependent on real estate. Wow!

Therefore, we can extrapolate that a 5% slow down in real estate services and construction would translate roughly to a 1% drop in Canadian economic growth. With Canada only growing at 2% annually the relationship between real estate and economic growth is hard to ignore. So we want to monitor the sales of new homes to help anticipate an economic downturn.

At Mortgage Sandbox, we watch Metro Toronto and Metro Vancouver as weathervanes for the broader provincial real estate market because these two cities are each home to a large share of their provincial populations.

Vancouver is doing very poorly while Toronto has levelled off since taking a hit in 2017 and 2018. If Toronto, slows again while Vancouver continues to struggle then pre-sales and construction starts may be delayed and this will pull down industry earnings.

You can follow up to date home sales here for:

Toronto

Real Estate

Metro Vancouver

Real Estate

4. Auto Sales

Manufacturing accounts for accounting for 12% Ontario GDP and 7% of British Columbia’s. In Ontario, much of that is building cars destined for the U.S.

When auto sales in Canada and the U.S. drop then there are fewer orders to factories to replenish the dealership lots, so watching auto sales is a good leading indicator of whether factories will idle capacity or layoff workers.

Rebekah Young, Director, Fiscal & Provincial Economics, Scotiabank Economics is reporting that Canadian auto sales fell by 3.9% y/y (nsa) in September. #CanadianAutoJournal https://t.co/mhq3DB2IyG

— Autosphere.ca (@Autosphere_ca) October 4, 2019

Canadian Auto sales are not going well but the US has been resilient.

Looks like U.S. auto sales have been flat for some time, whereas Canadian year-over-year auto sales have declined for 18 out of the past 19 months.

— Mortgage Sandbox (@MortgageSandbox) October 5, 2019

.https://t.co/PFC4XdPi4d #FRED @stlouisfed pic.twitter.com/VJkX4p1x95

Auto sales are inconclusive for now. You can follow the US Fed interactive Auto Sales chart here.

5. TD’s Leading Economic Index

Most economic indicators are published with a lag, so it’s hard to find a forward-looking signal. TD Bank, Canada’s second-largest bank, has a leading index they use to anticipate a recession. They combine 6 indicators into a single index, and they say the index is flashing “yellow” like a traffic light.

If we look at their chart below, it becomes apparent that a “yellow” indicator only give you a three to six-month warning of a recession and that there hasn’t been a recession every time their indicator flashed yellow. However, if we take this indicator along with the others available we can form our own opinions on the likelihood of a recession.

Let’s explore what a “yellow” light means for a property developer. If you haven’t bought the land yet then perhaps hold off to see if things improve, but if you’ve already bought the land and are in the process of seeking a development permit then don’t split hairs. Take a good offer if the municipality is relatively cooperative and complete the pre-sales now because otherwise, you may have to wait a few years (or more) until prices return to pre-recession levels.

Indicators that are not helpful

The indicators below are often quoted in the news but are actually a waste of time.

Consumer confidence indexes: Although many people watch consumer confidence it is not clear that this is a good predictor. Many researchers argue that consumer confidence reflects past economic performance reported in the news; that is a lagging indicator. So, in that case, consumer confidence falls when they see headlines about job losses or learn at year-end that they won’t get a bonus.

Job losses: Hiring and training people is costly, so companies usually wait for a few months after business slows before they start letting people go. So once again the recession will have begun already when you start to see job losses.

In fact, unemployment is at such historical lows that it’s difficult to envision employment improving further. Yet an increase in unemployment at these lows would likely not be a good indicator of a broader economic issue because labour is so tight these days that any fluctuation could just as easily be attributed to seasonal fluctuation.

Mortgage Delinquencies: People will default on credit cards and car loans before they’ll fall behind on mortgage payments. As well, a mortgage isn’t considered delinquent until 3 months of payments have been missed. The U.S. financial crisis and the Great Recession began in 2007 but mortgage delinquencies didn’t begin to climb until the end of 2007, and they didn’t peak until 2010. Mortgage delinquencies are a terrible predictor of trouble on the horizon.

Gross Domestic Product: GDP is a direct measure of economic output that is published with a 3- month delay and the initial figure is often revised. If you hear in the news that the economy shrank 3-months ago it’s likely too late to do anything to mitigate your circumstances because you could already be 3 months into a recession. The irony, it that you can be in a recession, but economists will not “crown” an economic slowdown as a recession unless there have been 9 consecutive months of negative growth. Of course, we won't get the news until 12 months after it began. The key takeaway is that GDP will not help you predict a recession. It’s a historical account of economic events.

No need to panic

Predicting when a recession will arrive is nearly impossible. Pay attention to these indicators, but there will never be a clear-cut signal.

If a recession happens, your retirement savings should already be in a balanced investment portfolio that reduces your exposure to economic impacts. Your home is where you live and you likely won’t sell it for years. You may lose out on a raise or bonus but most people will come out on the other side in the same job they started.

Recessions traditionally happen every 7 years and they’re a normal part of life. They will continue to happen from time to time and the world will be fine.

The idea in this situation is simply to take big financial fewer risks when a recession seems imminent. For example, don’t buy a house with the intention of flipping it because you may have trouble finding buyers in a recession. If you’re buying it to live in, then it’s not as risky a financial transaction so long as you’re comfortable with the monthly payments.