Toronto's Housing Market Confronts a Reckoning - October 2025

New construction collapses as economic headwinds mount.

Toronto's residential property market is facing a significant downturn that goes beyond typical cyclical fluctuations. In August 2025, new home sales (detached house and apartments) fell to just 300 units, which is 42% lower than the previous year and 81% below the average over the past decade. This decline signifies not just a slowdown, but a fundamental breakdown in the new construction sector, where historical trends would typically see nearly 1,600 transactions in a normal August.

The decline in sales is hiding a more serious issue regarding development capacity. Over the past year, the number of high-rise project launches has dropped to historically low levels, while project completions have reached record highs. This mismatch poses a risk of dismantling the construction workforce entirely. As projects are completed without new ones being started, many tradespeople may face unemployment, which could worsen the overall deterioration of Canada’s labour market.

Inventory metrics highlight a paradox at the heart of the market. Currently, there are 22,000 units available, which represents 20 months of supply based on recent sales velocity, the highest level recorded. However, this figure indicates a collapse in demand rather than an oversupply. Inventory levels in the 2010s surpassed current totals without causing similar price corrections, emphasizing that it is sales volume, not inventory, that drives the current market distress.

Employment weakness compounds housing pressures.

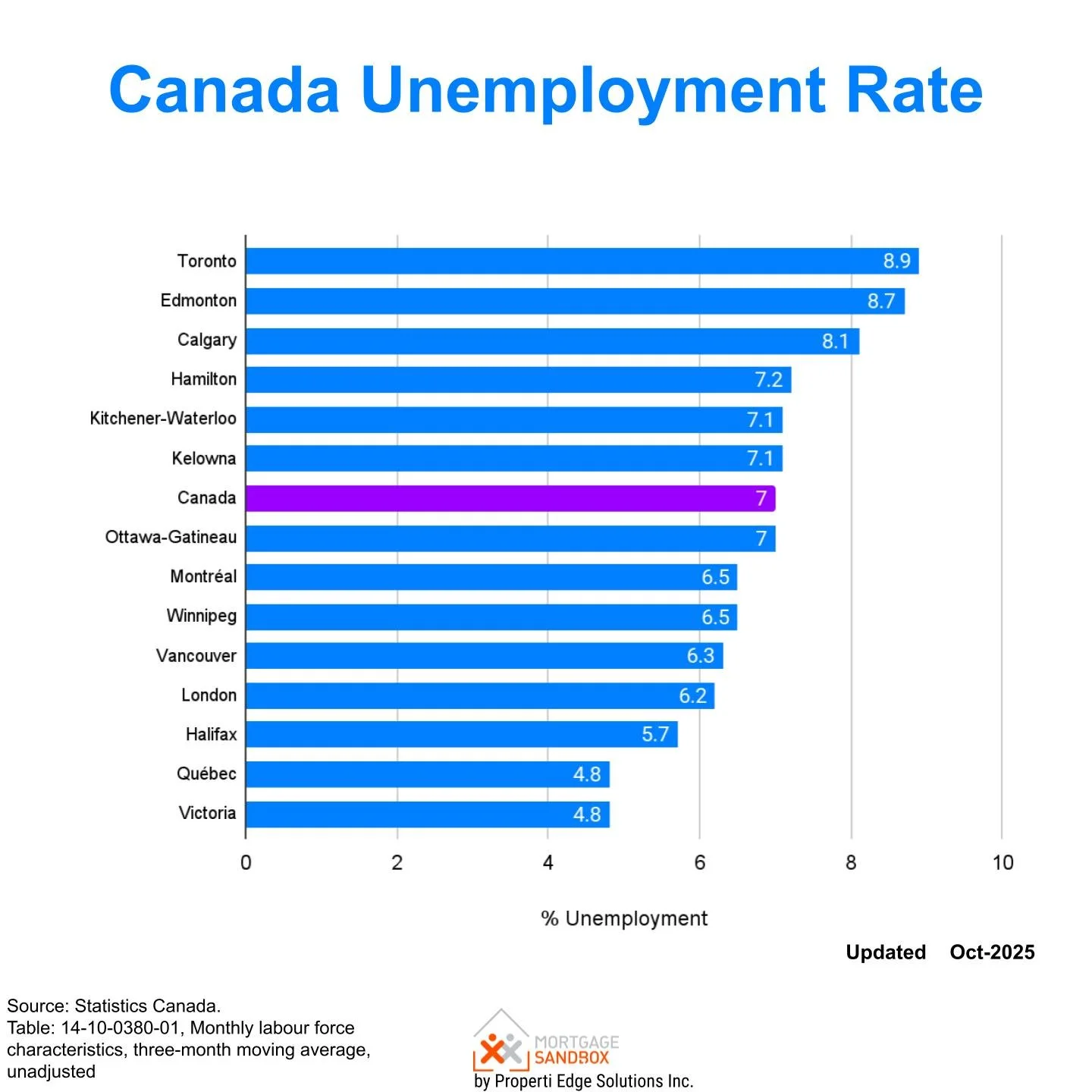

Additionally, weaknesses in employment are exacerbating housing pressures. In September 2025, Toronto's unemployment rate was 8.9%, the highest among major Canadian cities, significantly exceeding both national averages and historical figures. This fragility in the labour market directly undermines housing demand, as job security remains the primary factor influencing mortgage qualification and buyer confidence.

The combination of high borrowing costs and declining employment is creating a vicious cycle. Although the Bank of Canada has made modest rate reductions, mortgage rates are still significantly higher than the norms seen between 2010 and 2020. Recently, fixed-rate mortgages have increased, and since qualification calculations are based on five-year fixed rates, the decline in variable rates does not help improve purchasing capacity. While variable rates dropped by 0.3 percentage points following the policy adjustment in September, this change does little to enhance affordability for potential buyers.

Resale markets are divided between property types.

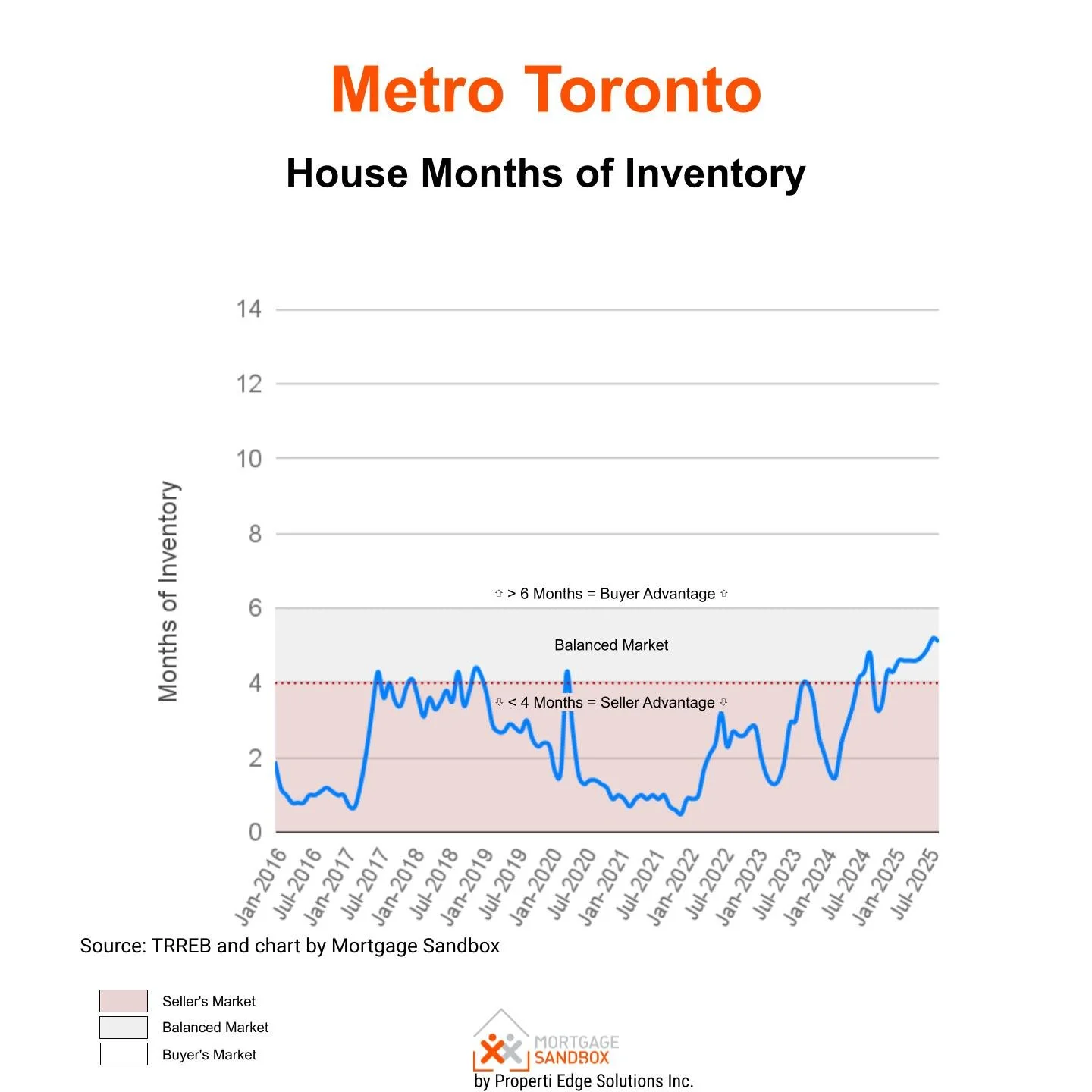

In the detached house segment, there is a balance between buyers and sellers, although the trend is shifting more in favor of buyers. Inventory has grown moderately year-over-year, with the increase in supply outpacing the rise in demand. Over the past three months, benchmark prices have seen a slight decline, which strengthens the advantage for buyers without leading to significant price drops.

Condominium apartments sellers are currently in a weaker position in the market. Buyers have significant negotiating power and prices continue to decline for both benchmark and median measures. Most purchasing activity is happening in lower-priced units, while larger floor plans and luxury properties are struggling to attract competitive offers. Although inventory has decreased slightly compared to the previous year, this reduction has not stabilized pricing or encouraged bidding activity.

Sentiment indicators signal further deterioration.

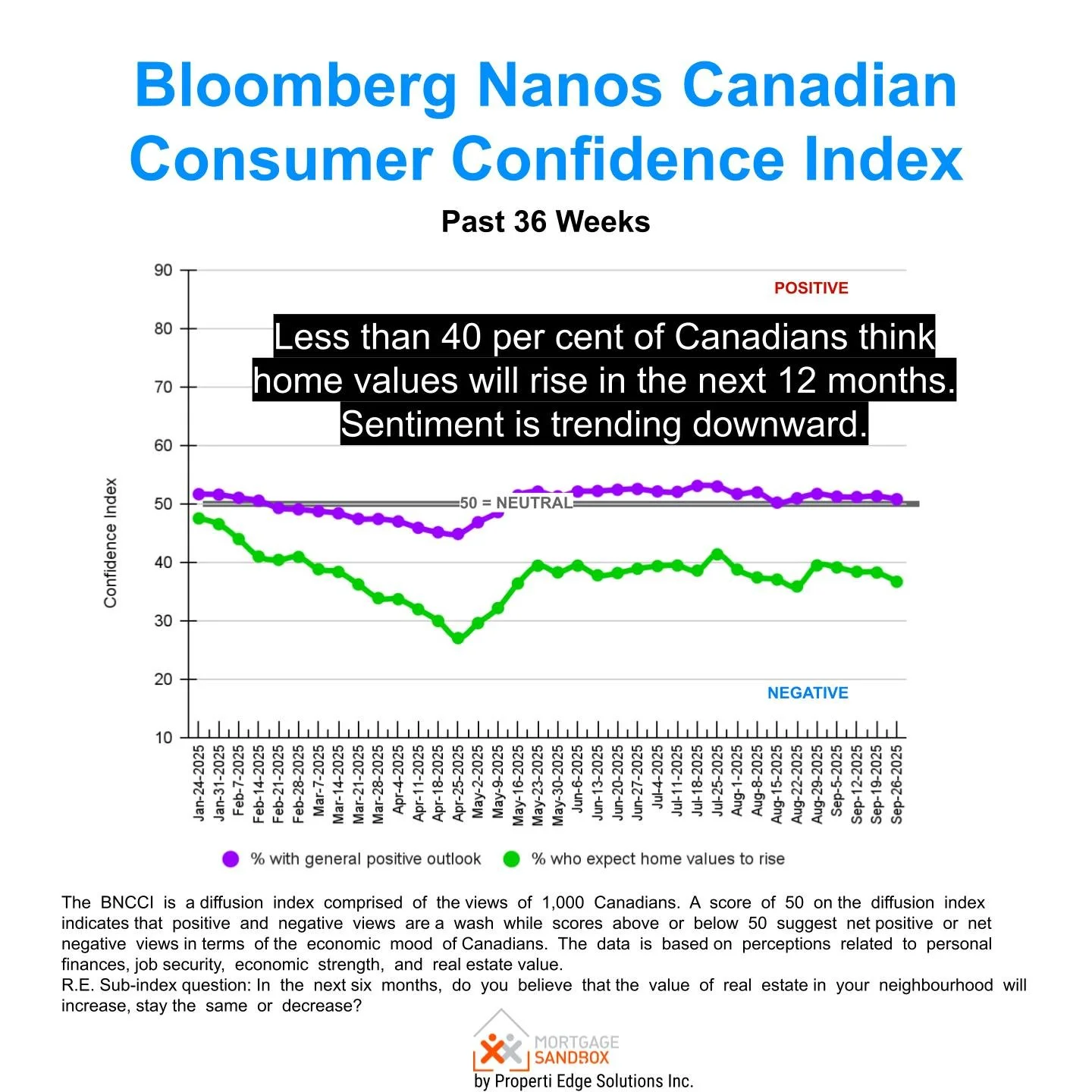

Sentiment indicators suggest a further decline in prices. Less than 40% of Canadians expect home prices to rise within the next 12 months. This prevailing pessimism often becomes a self-fulfilling prophecy as potential buyers postpone their purchases in hopes of better terms, leading to decreased transaction volumes and reinforcing negative expectations about prices. This psychological effect is compounded by practical factors such as mortgage qualification constraints and uncertainty in employment.

Two wild cards could disrupt the negative trajectory.

First, inflation remains volatile. Core measures continue running elevated, raising the possibility that the Bank of Canada could slow, pause, or theoretically reverse its easing cycle. While rate increases appear unlikely, even a hiatus in cuts would prolong affordability constraints. Tariffs on imported goods inject additional upward price pressure.

Second, trade relations with the United States are crucial for Canada, as American tariffs on Canadian exports hinder economic growth and may lead to contraction. Prime Minister Mark Carney's ongoing negotiations in Washington could potentially result in a compromise that bolsters employment and stabilizes housing sentiment, although the likelihood of success is uncertain.

Strategic implications diverge by market position

For sellers, particularly in the condominium sector, taking immediate action could yield better financial outcomes. Market forces are currently pushing prices down, and further declines seem more likely than a turnaround. While the spring selling season usually benefits sellers, this pattern will occur within an overall declining trend.

On the other hand, buyers with stable jobs and strong financial standing may find tactical opportunities, especially in the condominium market. Aggressive negotiation can lead to concessions, as sellers face rising carrying costs and dwindling alternatives. However, buyers should remain cautious with leverage assumptions. Waiting until late 2025 or even into 2026 may offer additional price reductions, but this strategy carries the risk of missing crucial turning points if policies or trade conditions change.

The fundamental challenge facing Toronto's housing market is multifaceted, involving restrictive monetary policy, declining employment, negative consumer sentiment, adjustments in federal immigration policy, and trade disruptions.

The impacts of the current situation are uneven across different property types and regions. However, the collapse of the new construction sector and persistently high unemployment indicate that recovery is still far off unless significant policy interventions or external shocks occur.