Toronto's Property Market Scales are Tipped in Buyers' Favour

A cautious optimism emerges as affordability improves, but challenges remain

After months of uncertainty, the scales continue to tip away from the seller-dominated market that has defined Canada's largest city for much of the past decade.

The numbers tell a compelling story. July 2025 marked the Greater Toronto Area's (GTA) best sales month since 2021, with 6,100 homes changing hands, a 10.9% increase from the previous year. Yet this apparent revival comes with an important caveat: it is being driven not by soaring demand, but by improved affordability as both prices and borrowing costs have declined.

A Market in Transition

Toronto's property landscape now presents three distinct pictures depending on what type of home you're considering. Detached houses and townhouses find themselves in "balanced markets," where buyers and sellers wield roughly equal negotiating power. Condominiums, however, have tilted decisively into buyer's market territory.

Detached House Market (Balanced)

Traditionally, the most sought-after property type, making up 56 to 55 percent of the market, is a Balanced Market, and is trending in favour of buyers

As a balanced market, buyers and sellers have equal negotiating power, and inventory levels have increased recently, disadvantaging sellers. Months of inventory increased from 4.1 to 4.9 compared to last year. Up 20 percent.

Purchase demand has increased 14 percent compared to last year, but the supply of active listings has increased even more, by 36 percent.

The benchmark detached house price is $1,278,400 and has dropped 3 percent in favour of buyers over the past three months. The median detached house is worth $1,180,000 and has fallen 4 percent in favour of buyers over the past three months.

Townhouse Market (Balanced)

The story is similar for townhouses. The townhouse market is balanced, and inventory levels have improved in favour of buyers. Months of inventory increased 28 percent from 3.9 to 5 compared to last year.

Purchase demand (sales) has increased 4 percent, and the supply of active listings has increased 32 percent.

Apartment Market (Buyer’s Advantage)

The condo apartment market is a buyer's market, and buyers have the upper hand in negotiations. Compared to a year ago, inventory levels have also improved in favour of buyers. Months of inventory increased from 6 to 6.4 compared to last year. Up 7 percent.

Purchase demand has increased 6 percent, and the supply of active listings has increased 13 percent.

The benchmark condo apartment price is $577,600 and has dropped 3 percent in favour of buyers over the past three months. The median condo apartment was worth $ 570,000 and has fallen 5 percent in favour of buyers over the past three months.

Broader Trend

The mechanics behind this shift are straightforward. Inventory levels have surged across all property types. Meanwhile, purchase demand has grown more modestly. This divergence between supply and demand has fundamentally altered the market's power dynamics. The same pattern has appeared across Canada, including Vancouver and Calgary.

The Affordability Factor

"Improved affordability, brought about by lower home prices and borrowing costs, is starting to translate into increased home sales," explains Elechia Barry-Sproule, president of the Toronto Regional Real Estate Board. Her observation captures the market's central dynamic: after years of being priced out, more households are finding viable paths to homeownership.

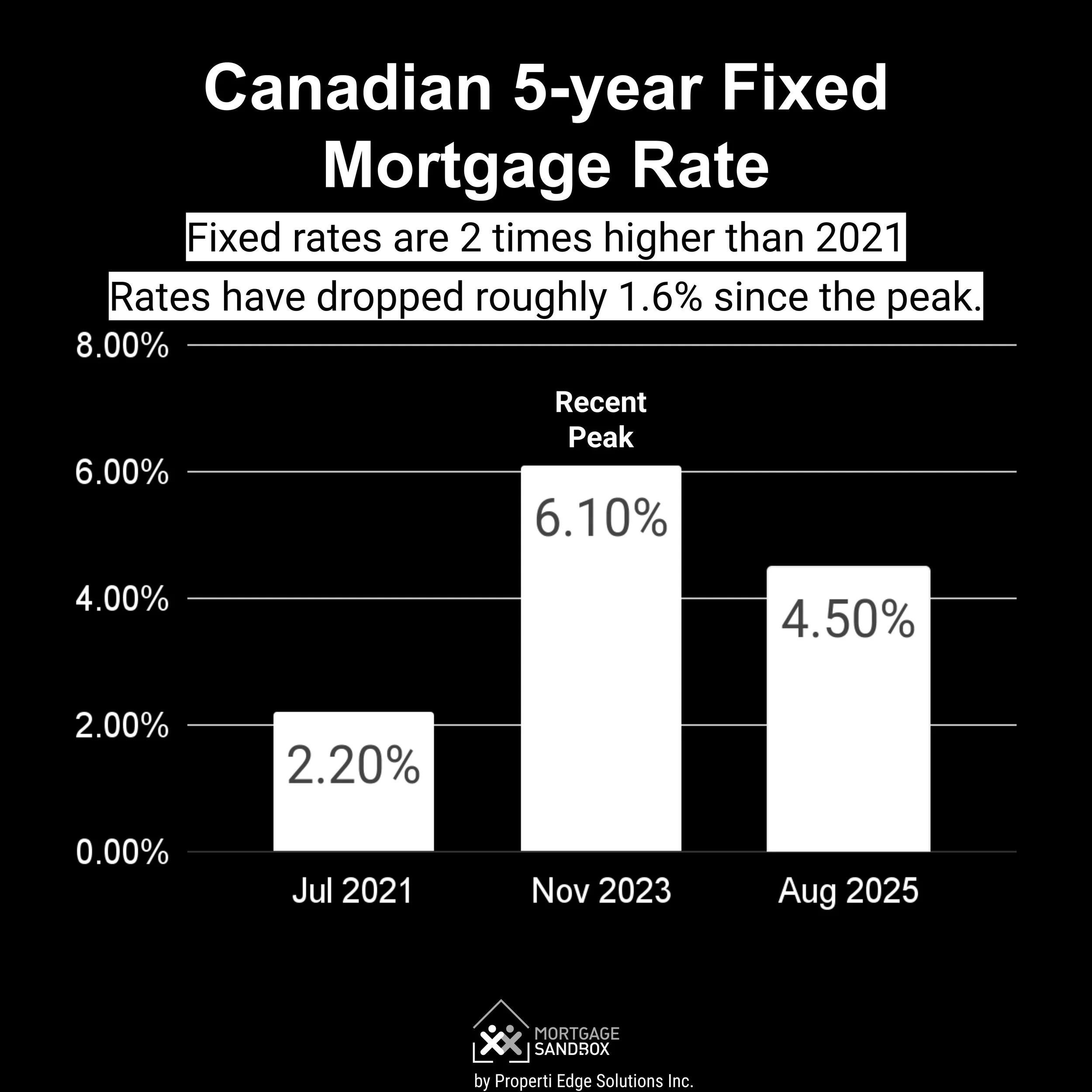

Interest rate cuts by the Bank of Canada in late 2024 and early 2025 have played a crucial role in this affordability improvement. Lower borrowing costs have expanded the pool of qualified buyers, even as prices have moderated. However, industry experts argue that further rate reductions are necessary to sustain this nascent recovery.

Economic Implications

The housing market's performance carries implications far beyond individual buyers and sellers. Jason Mercer, the Toronto board's chief information officer, points to housing's role as an economic catalyst. "The housing sector can be a catalyst for growth, with most spin-off expenditures accruing to regional economies," he notes, advocating for additional interest rate cuts to stimulate activity.

This perspective reflects a broader concern about Canada's economic trajectory. Recent data suggest the economy is "treading water" amid trade uncertainty with the United States. In this context, a revived housing market could provide much-needed domestic stimulus, creating jobs in construction, real estate, and related industries.

Foreign Investment: A Nuanced Picture

One factor often overlooked in discussions of Toronto's property market is foreign investment. Despite the federal government's foreign buyer ban, significant exemptions remain. Non-residents can still purchase multi-unit buildings with four or more units, vacant development land, and residential properties outside urban centres.

These exemptions ensure that foreign capital continues to flow into certain market segments, though the overall impact has diminished compared to the peak years of foreign investment in Toronto real estate.

Looking Ahead

The current market conditions present both opportunities and risks. For buyers, the improved negotiating position and enhanced affordability create the most favourable purchasing environment in years. First-time buyers, in particular, may find doors opening that seemed permanently closed during the market's frenzied peak.

Sellers, however, face a more challenging landscape. The days of multiple offers and bidding wars have largely passed, replaced by longer selling periods and the need for more competitive pricing. Properties that might have sold within days now sit on the market for weeks or months.

The sustainability of these trends depends largely on factors beyond Toronto's borders. Further interest rate cuts could accelerate the market's recovery, while economic uncertainty, particularly regarding Canada-US trade relations, could dampen enthusiasm.

For now, Toronto's property market appears to be finding a new equilibrium. After years of extremes, this more balanced state may prove healthier for all participants. The question is whether this moderation will persist or prove to be merely a pause before the next dramatic swing.

Markets rarely remain static. Toronto's property sector, having experienced both euphoric highs and anxious corrections, now enters a phase that demands careful observation. The winners and losers of this transition are still being determined, but one thing seems certain: the era of sellers calling all the shots has, for now, come to an end.