Vancouver's Condo Prices Descending Gently, For Now

Vancouver’s apartment market is cooling. But it is not collapsing. While Calgary’s market remains Canada’s strongest, and Toronto's the weakest, Greater Vancouver sits in the middle, steady but softening. Buyers have the upper hand for the first time in years.

A Market in Balance

Apartments make up half of all home sales in Greater Vancouver. The benchmark condo price has dipped 2% over the past three months to $748,400. Months of inventory has jumped 47% year-on-year, from 4.7 to 6.9 months of supply. The apartment market recently crossed from balanced into a buyer’s market. Demand has slipped 5%. This is not a fire sale. But it is a shift in power from seller to buyer, similar to what was seen in 2018.

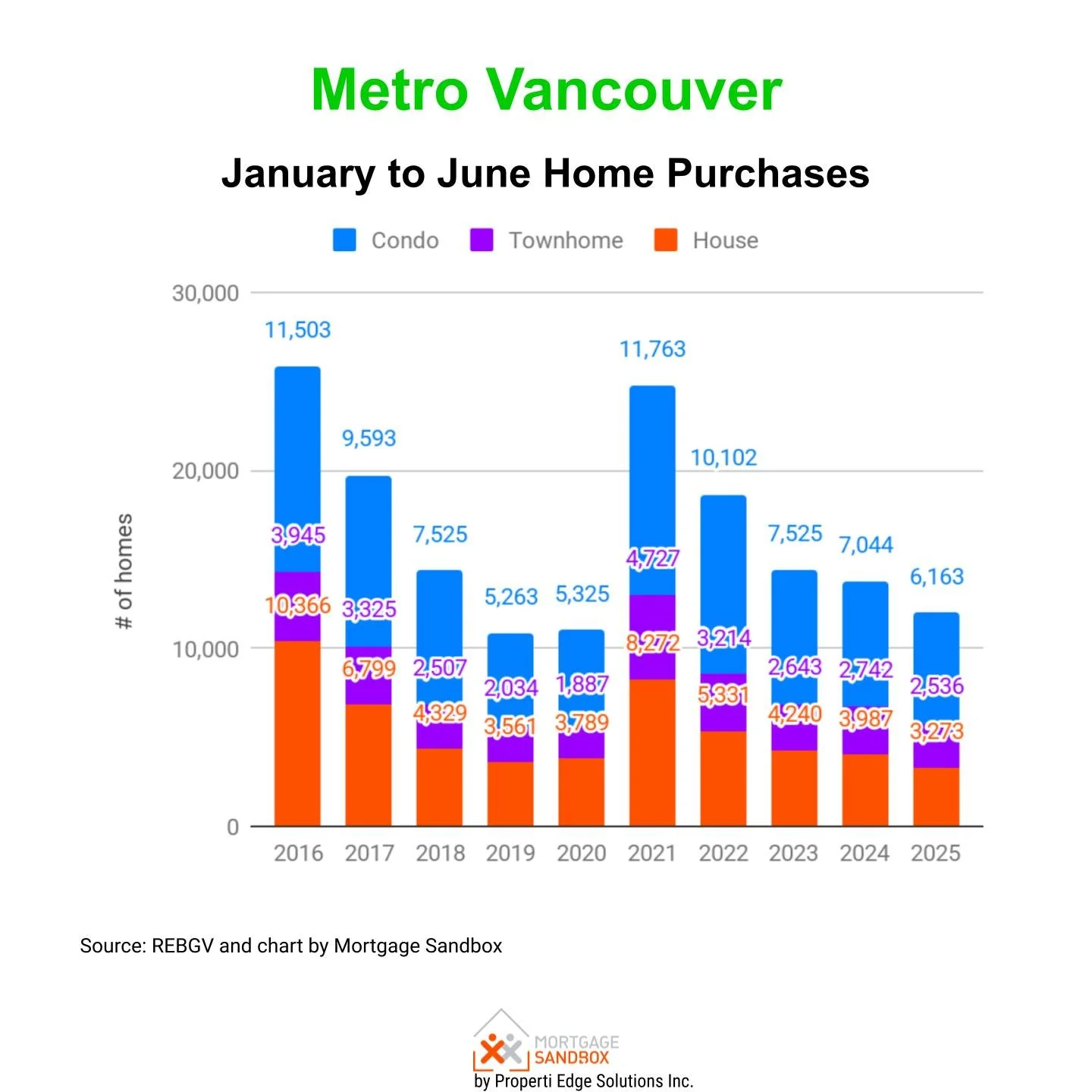

That shift matters. In 2016, houses made up nearly 40% of the market. Today they make up about 30%. Apartments are the dominant form of housing and are growing in political importance. Policy makers will take note.

Presales Lose Their Shine

Before the pandemic, buyers snapped up off-plan apartments, often paying a premium in the belief that prices would keep rising. They rarely questioned the risks: construction delays, poorly designed floor plans, financing gaps, or falling resale values. Today, that’s changed.

Presale volumes are down. Developers released an average of 575 units per month in the first five months of 2025, well below the 1,000-unit monthly average before COVID. The pricing model is under pressure. Buyers now expect incentives and discounts, as they should, for taking on risk. That’s how markets are meant to work.

Developers, squeezed by rising costs and slower sales, want government help. But that plea is awkward. Why should developers be shielded from falling property prices while individual sellers, who often have heavy mortgage burdens, are not?

Supply, Demand, and Caution

There are now 57,000 apartments under construction in Vancouver, up from 36,000 in 2022. As these units complete, they will hit the market at a time of weaker demand. That means more supply, more options for buyers, and likely further price declines. Yes, many of these homes have already been pre-sold. However, the new occupants of pre-sold apartments will be moving out of another home or a rental, indirectly releasing supply to the market.

Investors, who own more than a third of condos in the city, are pulling back. Rents are falling, making it less attractive to hold property. One-bedroom rents in Vancouver are down 4.8% from last year; in Burnaby, they are down over 8%. Two-bedroom rents have fallen even more.

Add higher mortgage rates, and it is no wonder many investors are sitting out for now, or cashing in their equity.

A Return to Fundamentals

This is a correction, not a crisis. Prices are still well above pre-pandemic levels. The current softness likely reflects a return to fundamentals, including higher rates, slower population growth, increased new unit construction, and more cautious buyers.

The resale market is still functioning. Deals are closing. Prices are adjusting. Buyers are negotiating. That’s what a healthy market looks like. Presales, on the other hand, are a different story. More cautious developers are proceeding with construction according to plan. Risk-taking developers who assumed prices would rise forever are now learning the limits of that bet. Bailing out the riskier outfits will encourage them to take risks again, at the expense of the more astute developers.

The Road Ahead

The apartment market in Greater Vancouver is likely to stay cool through 2025, and possibly into 2026. Prices may keep sliding. But affordability is improving, and more supply is coming.

In time, that may be good news for buyers and for the city.