An update on the Real Estate Crisis in the City of Vancouver.

All in Real Estate

Interest Rate Forecast to End of 2019

There have been some updates to interest rate forecasts since our last review of rates in March. The overall trend is upward but there are differing opinions on how high rates will rise.

Modernizing the Real Estate Exchange Process

There are many arguments blaming supply or demand for the Canadian housing crisis. We need to look at the role of the exchange process and modernize it to support our current real estate market.

Things You Might Not Know About These Metro Vancouver Neighbourhoods

Discover what you might not have known about these growing Metro Vancouver Cities. Why Brentwood, Lonsdale or King George could be the next place you call home.

BoC leaves key interest rate unchanged. Why is this important?

The Bank of Canada just kept the overnight rate at 1.25% but leading economists expect hikes throughout the course of the year. Why is this the case and why does it matter?

Will the Bank of Canada raise rates next Wednesday?

A look at what leading economists and the Big 6 banks are predicting ahead of next Wednesday’s Bank Rate announcement .

5 Tips For Seeing Through Home Staging

Home sellers go to great pains to show their home in the best light so buyers will pay the highest possible price. This is a guide to understanding what they’ve changed, so you can imagine what the home looks like when someone isn’t trying to sell it.

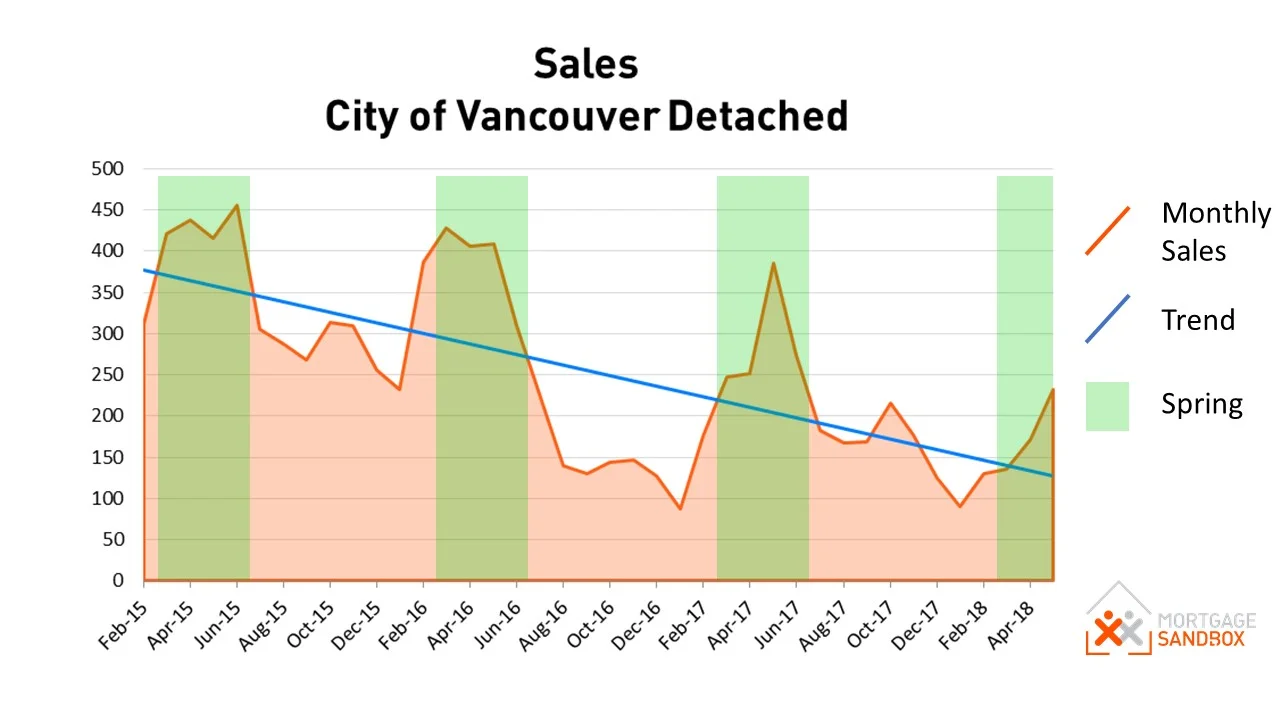

Key factors at play in the Vancouver housing market

An examination of the factors at play in the Vancouver Real Estate market reveals a definitive strengthening in the factors influencing the market downward.

Prices could continue to rise but the risk of a correction has risen significantly. There is still a critical supply issue so, regardless of home prices, many more homes need to be built in Vancouver.