Five Forces Driving Alberta Home Prices

Last updated:

At a fundamental level, house prices are determined by supply and demand, with various factors influencing either supply or demand. At Mortgage Sandbox, we have developed a five-factor framework for gathering information and conducting our market analysis. The five key factors include core demand, non-core demand, government policy, supply, and popular sentiment.

While the market is primarily driven by economic forces in the long run, short-term price fluctuations can be influenced by sentiment, often pushing prices beyond sustainable economic levels.

Summary

Alberta's major housing markets are showing clear signs of change, with both Calgary and Edmonton facing a moderate risk of a correction, despite currently favouring sellers. The combination of shifting supply dynamics and changing monetary policy is setting the stage for a significant transition.

Key indicators suggest that the market is moving decisively in favour of buyers. Although inventory remains below four months, which technically qualifies as a seller's market, the months of inventory are rising sharply, indicating a rapid loosening of conditions. This shift is occurring alongside a surge in new construction, with levels in Edmonton being "much higher than normal" and elevated in Calgary. This influx creates a clear risk of absorption challenges, likely prompting developers to offer discounts, incentives, and amenities to attract buyers.

Importantly, both markets are entering this period of increased supply from a position of relative strength. They are large, deep markets where sellers can still find buyers even during a slowdown, and prices remain affordable for most people, providing a crucial buffer that is lacking in smaller cities like Kelowna, Hamilton and London Ontario.

The primary countervailing force is mortgage rates. With interest rates currently low and likely to rise, the rpospect of rising borrowing costs and lower buyer budgets might dampen sentiment and demand. However, the full impact of the earlier rate cuts can take up to 18 months to materialize, resulting in a lag effect.

In the near term, the central challenge for 2026 will be absorbing the influx of new supply without causing significant disruption. While the affordable base and lower rates offer support, the rapid rise in inventory and high construction levels suggest that returning to a balanced market will require price stability or modest adjustments to clear the incoming inventory. This process sets the stage for a more balanced, but potentially volatile, year ahead.

1. Core Demand: Weakening

Core demand, driven by household formation for primary shelter, has weakened significantly due to policy shifts and economic strain.

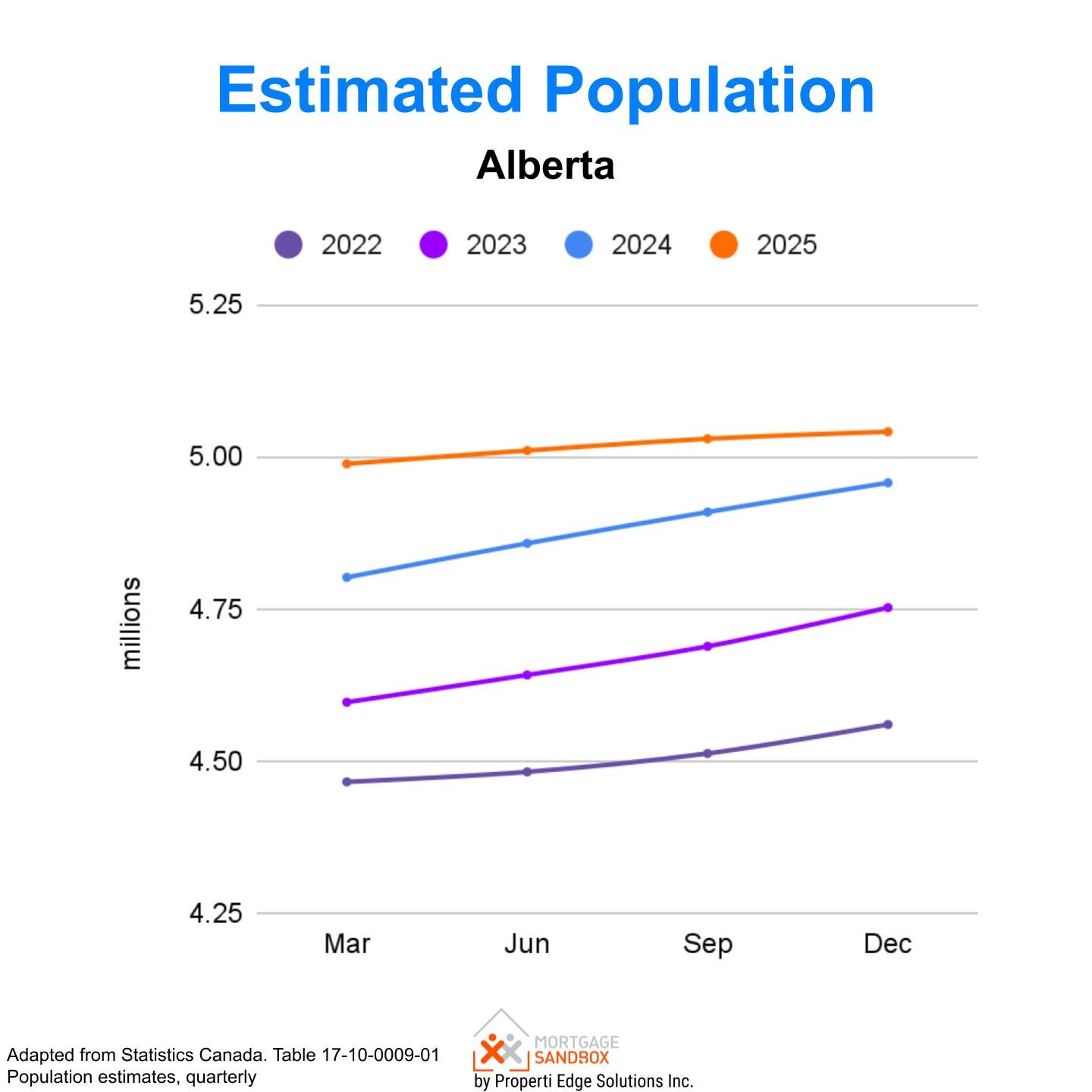

Population Growth

The federal government's study permit cap and adjustments to other immigration streams are having a measurable effect. Statistics Canada data for late 2025 confirms a net slowdown in population growth for Alberta, particularly in the key cohort of new non-permanent residents. This directly reduces the number of new households being formed.

Affordability & Prices

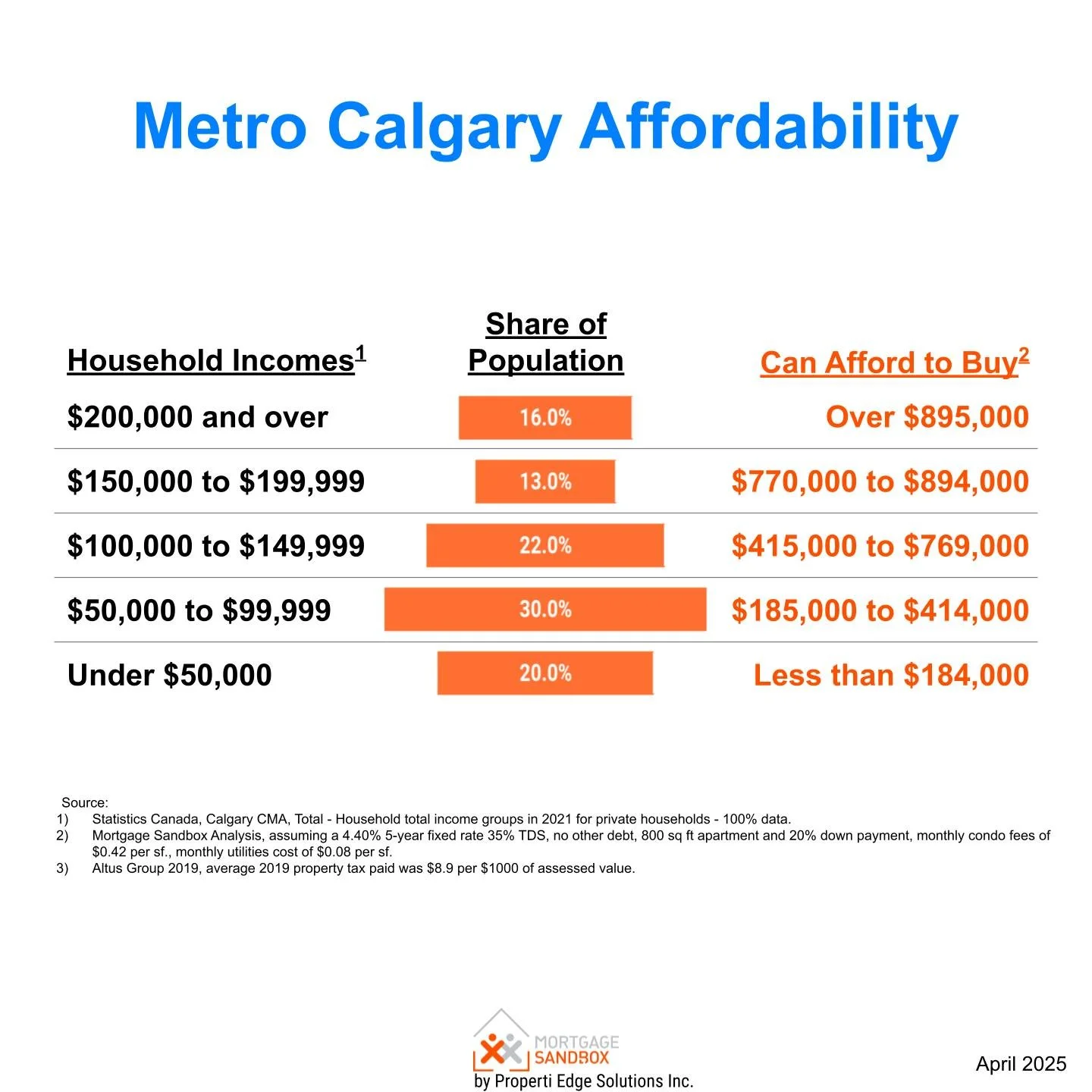

Although prices have decreased from their highest levels, the costs associated with homeownership are still close to historic highs in relation to income. Mortgage lending guidelines typically restrict borrowers to spending no more than 40% of their income on homeownership expenses. According to RBC Royal Bank, homeownership costs in Calgary were 41% of median household income, whereas in Edmonton, they were 32%. In simpler terms, Calgary is approaching a limit for sustainable house prices, while Edmonton remains more affordable but is still a challenge for many.

Condo owners need more savings and mortgage financing to upgrade to a house when the price gap is large. During the pandemic, house values in Alberta increased more rapidly than apartment prices. However, in recent months, the gap between house and condo prices has stabilized and is now starting to shrink. This narrowing price gap makes it easier for condo owners to consider upsizing to a house.

Financing Costs

People typically finance home purchases through their savings, mortgage loans, and the equity they have built in their homes.

Falling home prices across Alberta are reducing people's home equity, which is the difference between the home's market value and the remaining mortgage balance. This decrease is limiting their ability to finance a move up the property ladder.

Additionally, the mortgage rate relief that began in 2023 has ended. The Bank of Canada's recent decisions and guidance have led to expectations of higher variable and fixed mortgage rates in 2026. For prospective buyers, this translates to reduced purchasing power. For current homeowners, especially those facing mortgage renewals in 2026-2027, this could result in significantly higher monthly payments, leaving them with less disposable income for other spending or savings.

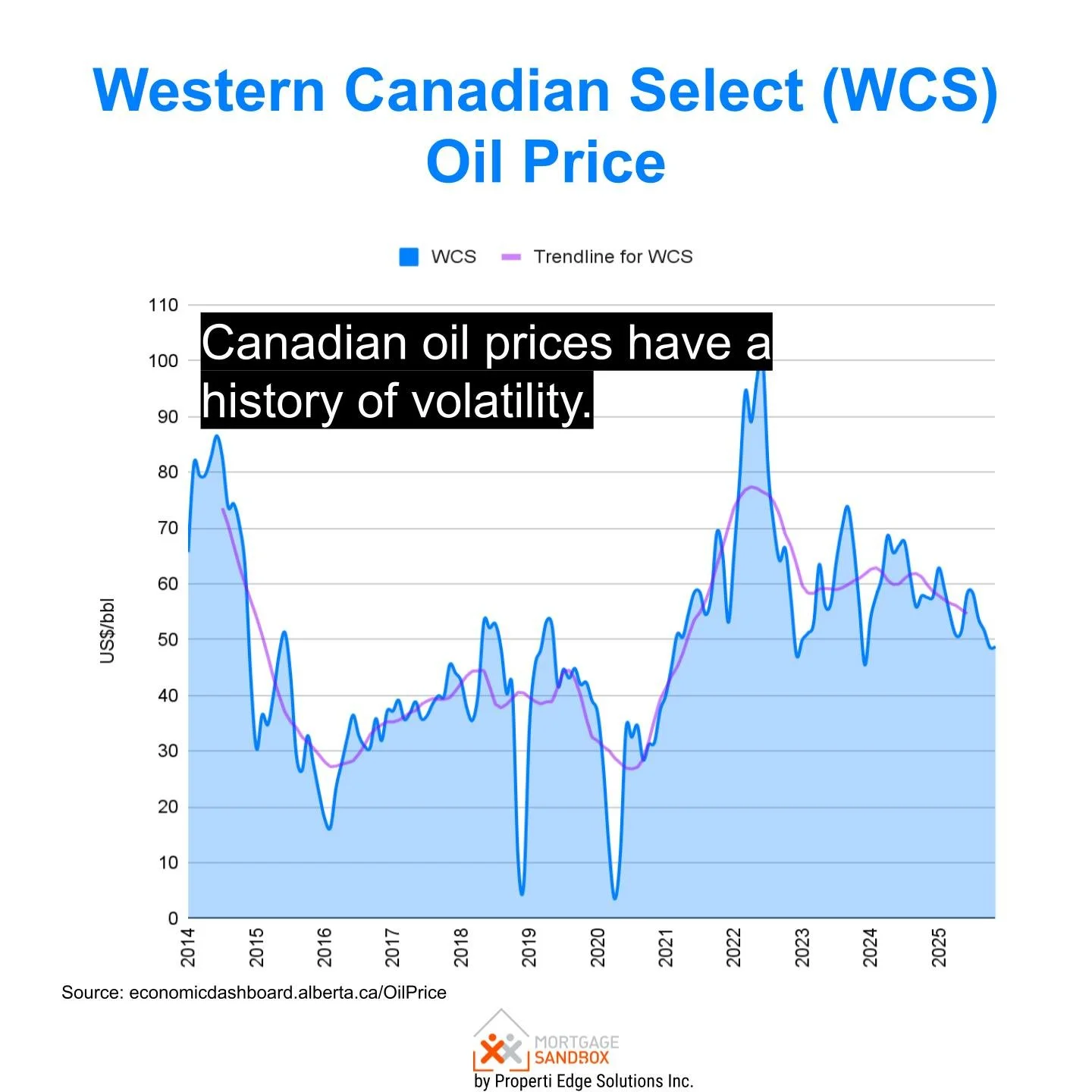

Employment

The job market has softened. Full-time employment growth has not kept pace with the working-age population greowth, leading to a slight uptick in unemployment. Job security concerns are contributing to buyer caution.

Calgary and Edmonton have unemployment rates above the Canadian average.

Homeownership Costs

Overall Core Demand

The foundation of buyer demand is weakening. Stagnant incomes are meeting higher financing costs, while key demand drivers, such as population growth, are decelerating. Government programs like the FHSA provide support but are insufficient to offset these larger macroeconomic headwinds.

Find out how much you can afford to spend!

2. Non-core Demand

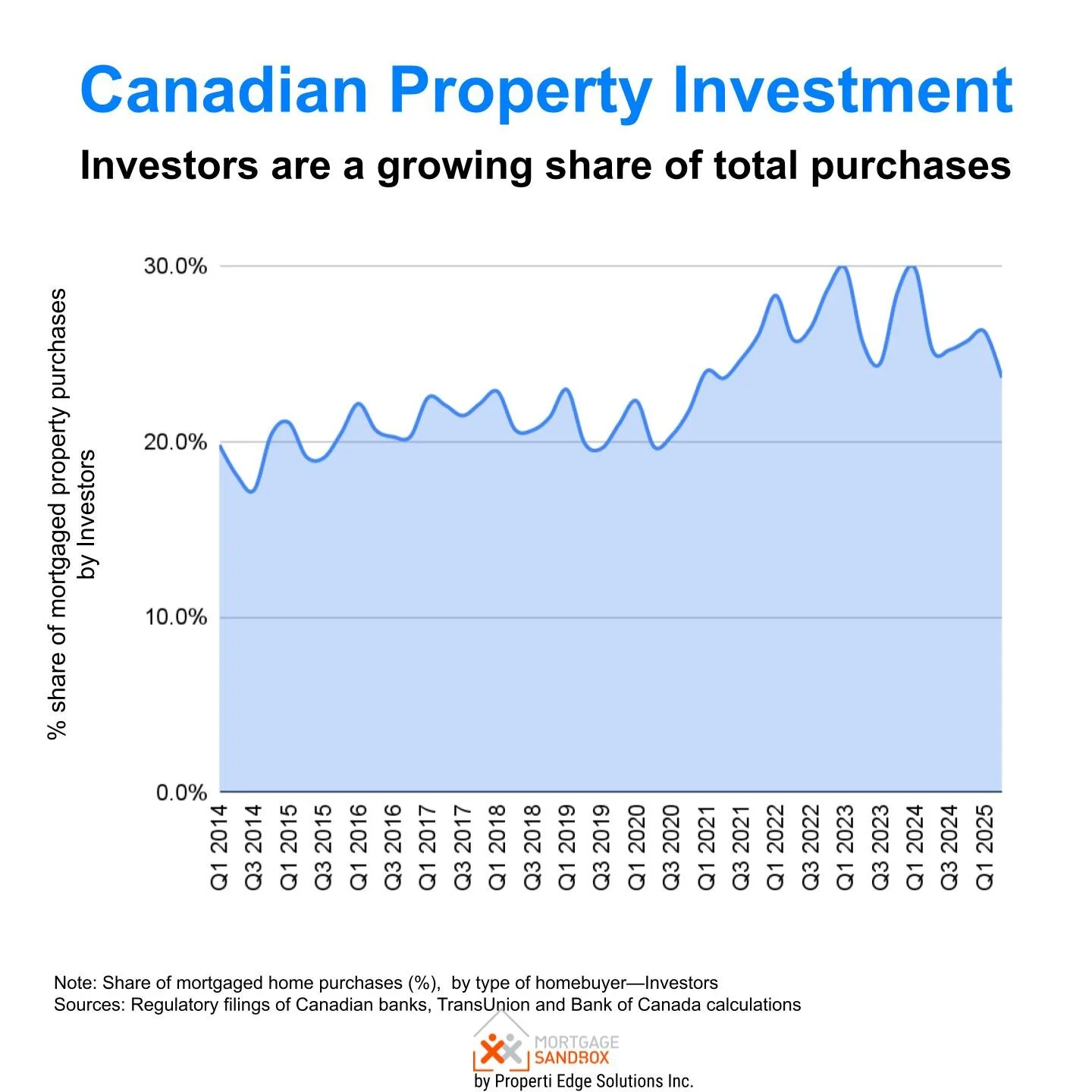

Non-core demand—from investors, speculators, and foreign capital, is highly sensitive to sentiment and returns. Since non-core demand is ‘optional’ (i.e., not used to shelter your own family), it is more volatile than core demand. This segment is now in retreat.

Long-term Rental Investor Pullback

The economics of rental investment have turned negative in major cities, with mortgage payments and carrying costs far exceeding achievable rents, creating negative cash flow.

New federal mortgage rules restricting the use of rental income for qualification have further constrained investor leverage and purchasing power.

Foreign Capital

The Federal Government, using its housing agency, has announced a temporary ban on home purchases by non-Canadians from January 1, 2023, to January 1, 2027. The foreign-buyer ban won’t apply to students, foreign workers, or foreign citizens who are permanent residents of Canada; however, the additional hurdles will reduce the flow of capital to Canadian real estate compared to previous years.

Short-term Rentals

Tourism in Canada has rebounded following the pandemic, leading to a more complex landscape for short-term rentals than it was a few years ago.

Currently, Edmonton has approximately 5,500 short-term rentals, while Calgary has around 8,300. In both cities, short-term rentals account for less than 2% of the total housing supply. Therefore, they are not a significant factor driving demand in these areas.

House Flipping

House flipping in Calgary and Edmonton was on the rise and is much more prevalent than in Vancouver or Toronto, but recently flips have been falling. Since we need to wait 12 months to record a flip, this is a lagging indicator. At its peak, flips accounted for 8% of all transactions in Calgary. It is likely that a drop in flipping activity is a contributor to softer demand in Alberta.

There’s a chicken-and-egg problem here. The market softened, and house flipping began to look risky. As a result, flippers stepped back, contributing to further softening.

Note: The flaw with the chart below is that most flippers will "live in the property" for at least 1 year before selling so they can claim it as their principal residence and avoid capital gains tax on the sale. The regulators don’t count flips that occur within 18 months. The rate of flipping could be much higher.

Dark Money

Dark money is the proceeds of crime or money that is transferred to Canada illegally. Dark money includes funds earned legitimately that are transferred illegally from countries with capital controls (e.g., China) and legitimate earnings moved from nations subject to international sanctions (e.g., Iran, Russia, and North Korea).

To hide the illegal origin of the funds, they are laundered through the real estate market. Sometimes the property's true owner is hidden through a Straw Buyer, and other times the property is owned by a shell company.

Sometimes, a real estate agent or lawyer will accept the illegal cash to help the nefarious individuals hide its true origins. In 2015, a B.C. realtor was caught with hundreds of thousands of dollars in her closet at home.

A report says Alberta is to blame for most of Canada’s money laundering, and we see no evidence of a diminished role for dark money in local real estate.

Overall Non-core Demand

Given the foreign buyer restrictions, the drop in flipping, and the weak rental market, we anticipate capital inflows into residential real estate for non-core uses will decline at least until mid-2027. This adds some downward pressure on Alberta home prices.

3. Government Policy

Demand-Downside Interventions

The Federal Government, using its housing agency, has announced a ban on home purchases by non-Canadians effective January 1, 2023. There are some exceptions for those with temporary work permits, refugee claimants, and international students.

The four-year ban, expiring in 2027, was implemented to allow the government to assess whether it reduces speculation and commoditization in the property market.

The most impactful policy, however, is the federal immigration pivot, a deliberate effort to reduce population pressures and the resulting housing demand.

Demand-Upside Interventions

Recent federal changes include extending the amortization period for insured mortgages to 30 years for first-time home buyers. Additionally, Canada has introduced a new First-Time Home Buyers' (FTHB) GST/HST Rebate for newly built homes to improve affordability. This program offers a rebate of up to the full federal GST (or the federal portion of the HST), potentially saving homeowners up to $50,000.

While both measures aim to stimulate demand, their impact has thus far been limited due to significant economic uncertainty.

Overall Government Influence

Overall, the immigration freeze has the most significant impact, putting downward pressure on demand and prices.

4. Rising Supply

The housing supply dynamic has inverted. After years of scarcity, a wave of new units is arriving just as demand is contracting.

Resale Glut

A significant new source of supply in the real estate market is the "financially strained motivated seller." Investors facing negative cash flow and poor prospects for price appreciation are increasingly listing their properties.

In the Greater Toronto Area (GTA) and the Greater Vancouver Area (GVA), this trend of investors exiting the market has been a major factor in the rise of active listings. This phenomenon is particularly pronounced in the condominium segment.

In recent years, Alberta has seen a significant increase in out-of-province purchases. Investors priced out of Vancouver and Toronto brought their business model to Calgary and Edmonton. Although the issue is less severe in Alberta, it has still affected the province.

New Construction:

Calgary and Edmonton are experiencing record levels of homes under construction, surpassing those of previous years.

As these projects are scheduled for completion within the next 18 months, they may enter a soft market. Many of the homes under construction are pre-sold or rental buildings. Regardless, their new occupants will vacate or sell their current residences, adding to the resale market or rental pool.

Pre-sales:

Pre-sales are purchases of unbuilt and completed brand-new homes from developers. Typically, a developer must sell 70% of homes in a building before starting construction, so housing starts are a good indicator of successful pre-sales.

Alberta pre-sales are hotter than average. To mitigate the risk of unfavourable market conditions in 2026-27, developers have rushed projects to market to lock in buyers and financing.

Popular Sentiment

Market psychology has shifted from fear of missing out (FOMO) to pervasive caution, creating a self-fulfilling cycle of inaction.

The Ipsos-Reid and Nanos Canadian Confidence Index shows that Canadian consumer confidence has slipped over the past few months. Less than 40 per cent of Canadians believe home prices will rise over the next twelve months.

Although consumer sentiment is a key factor in real estate price trends, sentiment alone is not an accurate predictor of future prices.

Market Outlook & Regional Nuances for 2026

Here is a quick summary:

Core demand is weaker due to higher mortgage rates, a shrinking population, and weak job growth.

Non-core demand is weaker due to a ban on foreign buyers, falling rents, and a shrinking market for property flippers.

Existing supply is rising, and there are high numbers of homes under construction, many of which will be completed in the next 18 months.

Consumer confidence in higher future real estate values is mildly negative, indicating that prices are likely to weaken.

While it is not guaranteed, the current conditions dramatically increase the risk of a significant market correction.

Find out where prices are headed in Alberta

Like this report? Like us on Facebook.