Metro Montreal

Real Estate Trends and Price Forecast

HIGHLIGHTS

Metro Montreal home values have been volatile since 2021, and are now trending upward again heading into 2026–2028.

Unlike other Canadian cities, at this time of year, Montreal has a relatively tight supply in several segments, which is supporting prices.

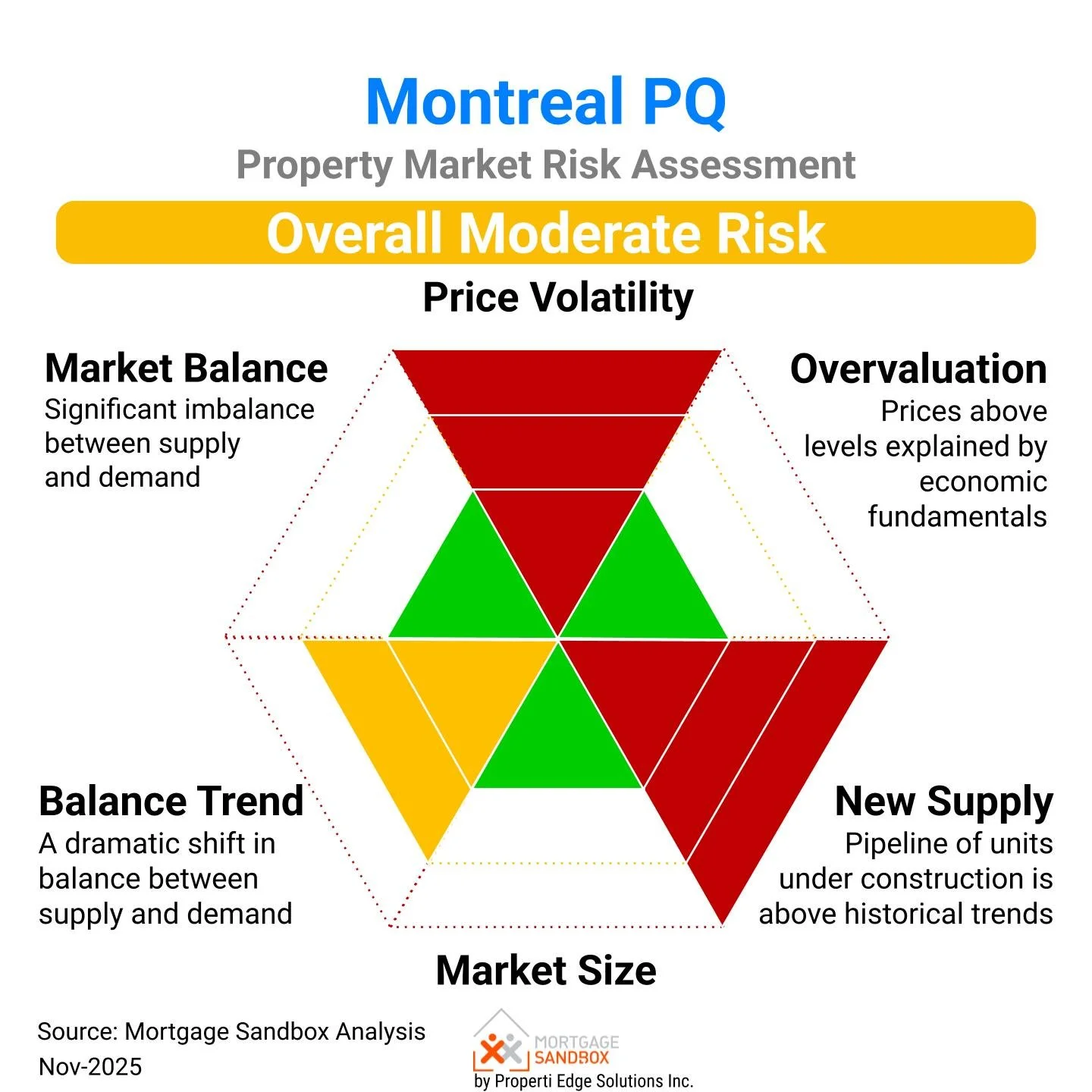

Multi‑factor analysis identifies Metro Montreal as a moderate‑risk real estate market.

Mortgage rates have eased from their peak, but remain high relative to the 2010–2020 average, limiting buyer budgets.

Economic uncertainty is rising due to Canada’s immigration policy shift and the Trump administration’s tariffs, which could further weigh on the market.

This article covers:

What is the state of the Montreal real estate market?

Which way are prices going?

Should I sell?

Is now a wise time to purchase?

What is the state of the Montreal real estate market?

Overview of the Montreal Property Market

Metro Montreal is a sophisticated city of 4.3 million people that has earned recognition as one of the world's top 100 cities, coming in at number 35. Many would say that, culturally, Montreal is the most European city in North America.

Montreal is a city that offers a unique and vibrant living experience, blending North American and European influences. Here's a breakdown of why it's considered a great place to live:

Cultural Richness: Montreal is known for its diverse, multicultural population, resulting in a rich tapestry of festivals, events, and cultural experiences.

Vibrant Arts and Entertainment: Montreal has a thriving arts scene with numerous museums, galleries, and theatres. It's famous for its lively music scene and numerous festivals, including the Montreal International Jazz Festival.

Foodie Paradise: The city boasts a diverse culinary scene, offering everything from traditional Quebecois dishes like poutine to international cuisine.

Affordability: Compared to other major Canadian cities such as Toronto and Vancouver, Montreal generally offers a more affordable cost of living, particularly for housing.

Walkability and Bike-Friendliness: The city is relatively easy to navigate, with walkable neighbourhoods and an extensive network of bike paths.

European Charm: The architecture and feel of many parts of Montreal give it a distinct European feel, making it unique in North America.

While Montreal experiences cold winters, the city's vibrant atmosphere and numerous amenities make it an attractive place to live.

Sales at the end of 2025 across all property types were the strongest seen in the past four years, although they remain weaker than the peak years of 2019, 2020, and 2021. Supply conditions vary by property type, but overall, the market is best characterized as balanced as we head into 2026, with neither buyers nor sellers holding a significant advantage.

Metro Montreal Detached House Prices

Detached house prices remain elevated by historical standards, but recent patterns are mixed and highlight an evolving market rather than a straightforward boom or bust. Seasonal softening still tends to appear later in the year, so short‑term fluctuations need to be interpreted carefully.

We believe politicians hope to guide the market toward a typical annual real estate cycle with price growth of 1% to 3% annually— in line with income growth.

Detached housing currently sits in balanced‑market territory, with buyers and sellers sharing negotiating power. Inventory has improved modestly in favour of buyers, and demand has eased, while the total number of listings has held roughly steady. At the same time, benchmark prices for detached homes have edged higher in recent months, whereas typical sale prices in the middle of the market have moved lower.

This split suggests that higher‑quality or better‑located detached homes are still commanding firm prices, while more average properties are facing greater price sensitivity from buyers. Heading into 2026–2028, the detached segment remains stable but more selective, with outcomes heavily dependent on location, condition, and pricing strategy.

Metro Montreal New Construction Home Prices

The prices of new homes appear to be rising in the short term. Long-term new and pre-sale prices have been relatively flat since 2022. Pre-sale buyers should avoid paying a premium.

Does this concern you? Read the Pros and Cons of Buying Pre-sale Homes

New home prices have shown an upward trend in the short term but have remained mostly stable over the past few years. Pre-sale buyers should be cautious about paying high premiums in the current market.

The demand for new homes has increased significantly. As a result, the influx of new supply into the market is rising. Currently, construction activity is above average compared to typical conditions, which may result in a short-term imbalance in the medium-term home market, similar to what has happened in Toronto.

Market Risk

The Mortgage Sandbox Analysis indicates that Montreal is currently at moderate risk of experiencing a significant market correction. As we head into 2026, the market appears balanced, with months of inventory remaining consistent with last year across property types.

Since 2021, prices have seen considerable volatility; however, they generally remain affordable compared to other large Canadian cities. With construction levels significantly higher than a year ago, market absorption challenges may emerge.

In a large property market like Montreal, with a robust pool of buyers, sellers are likely to find interested buyers even during slower phases of the market cycle.

|

Not sure about your bank's renewal offer?Try our mortgage offer evaluator Powered by Properti Edge |

Metro Montreal Condo Apartment Prices

Condo apartment prices dipped in 2023 but have since resumed a gradual upward trend. Today, the condo market is a buyer’s market, though and it is trending further in favour of buyers.

The current market is a buyer's market, giving buyers an advantage in negotiations. Inventory levels have improved significantly in favour of buyers, with months of inventory higher than a year ago. Demand (i.e., purchases and sales) has declined, while the supply of active listings has risen, reducing the absorption rate. Over the past three months, the benchmark price for condo apartments has remained relatively stable, and the median value has also remained unchanged.

With more people working from home or hybrid, we expect developers will begin marketing larger (i.e., 2 and 3 bedrooms) apartments to meet buyer preferences. As the supply of more generous floor plans comes to the market, it may depress the values for small floor plan condos.

At Mortgage Sandbox, we would like developers to build 4 and 5 bedroom condos because:

Not everyone can afford to buy a house for their family.

Canadians who work from home need more room to segregate workspace from living space.

Many Canadians with longer working hours find it challenging to stay on top of necessary house upkeep (i.e., mowing lawns, clearing eaves, shovelling sidewalks).

Many people prefer to live in higher-density neighbourhoods with all the essential amenities within walking distance.

Metro Montreal Townhouse Prices

Still a challenge for first-time homebuyers

A Montreal household earning $76,000 (the median Metro Montreal household before-tax income) can get a $260,000 mortgage. If they were to save a $65,000 down payment, they could only buy a home valued at $323,000. The Median condo apartment price is over $400,000, so for them to buy a typical condo apartment, a household needs an inheritance or a very generous gift from family. For most people, that is not possible.

What about the rest of Canada?

Read the Toronto Real Estate Forecast, Ottawa Forecast and the Metro Vancouver Forecast.

Need a Realtor?

We match you with local, pre-screened, values-aligned Realtors and Mortgage Brokers.

2. Which way are prices going?

There is a lot of uncertainty in the forecasts for looking out toward 2028. Many of the forecasters we've surveyed have different expectations for:

Will the federal government’s recent migration policy pivot lead to a shrinking population?

Will mortgage rates drop to the 2 to 3 percent range that Canadians have grown used to?

Will Canada’s trade wars with the United States lead to a recession?

How do we arrive at our forecast range? Check out our full assessment of the five factors that drive these forecasts. These five forces help explain why several forecasters are anticipating price drops.

|

Need a local Realtor?We match you with local pre-screened, Realtors and Mortgage Brokers pre-disposed to work well with you Powered by Properti Edge |

At Mortgage Sandbox, we provide a price range rather than attempting a single prediction because many real estate risks can impact prices. Risks are events that may or may not happen. As a result, we review various forecasts from leading lenders and real estate firms, and we then present the most optimistic estimates, the most pessimistic predictions, and the average forecast for 2026 to 2028.

Would you like to learn more about real estate risk? We’ve written a comprehensive report explaining the level of uncertainty in the Canadian real estate market.

Our forecast inputs:

3. Should I Sell?

From a seller’s perspective, current conditions in early 2026 are broadly favourable but not overwhelmingly tilted in one direction. Detached houses and condos both sit in balanced territory, but recent gains in benchmark prices (especially for houses) and the volatility of past years mean there may be an opportunity for well‑located, well‑presented properties to achieve strong prices.

Also, the annual real estate cycle usually favours sellers in the first half of the year. If you plan to sell, now may be a better time to sell than later in the year, particularly because a U.S. trade war or weaker economic conditions could derail the market.

Sellers should always consult a mortgage broker early to prioritize flexible loan conditions and reduce the risk of mortgage cancellation penalties.

Planning to Sell? Check out our Complete Home Seller’s Guide.

|

Need an estimated home buying budget?We will tell you what you can afford with transaction fees and taxes baked in, and fewer surprises. Powered by Properti Edge |

4. Is now a wise time to purchase property?

It’s hard to say. Mortgage rates are relatively high and falling, and we are in a balanced market where buyers can negotiate but still face competition in desirable segments.

The annual real estate cycle usually favours buyers in late summer and autumn. If you wait, home values might be higher, and your mortgage will likely have a higher rate.

If you are considering buying, drive a hard bargain and pay as close to market value as possible. Also, don’t bite off more than you can chew when it comes to financing.

Are you Planning to Buy? Check out our Complete Home Buyer’s Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

|

Do you have a financing strategy?Try our strategy assessment to maximize your risk-adjusted investment returns. Powered by Properti Edge |

Here are some recent headlines you might be interested in:

What's in store for Canada's housing market in 2026? (CBC | Jan 15)

Ottawa pushes for policy changes to boost first-time homeownership (BNN Bloomberg | Jan 06)

Economy, job stability concerns delaying some first-time home purchases (CTV News | Dec 04)

Montreal-area home sales fall 8.5% in November (Global News | Dec 04)

Like this report? Like us on Facebook.