Bank of Canada Sep 17 Decision is a Coin-toss

Homeowners, investors, and borrowers are all asking the same question ahead of the Bank of Canada’s September 17 meeting: will the central bank lower interest rates again, and what does that mean for the mortgage rate forecast?

Economic Weakness Pressures the Bank of Canada

The Canadian economy is showing signs of strain. GDP shrank by 1.6% in the second quarter of 2025, the steepest decline since the pandemic. Exports collapsed 27% after Washington imposed sweeping tariffs, and unemployment has climbed to nearly 7% nationwide, with Toronto and Edmonton already above 8%.

Population growth has slowed, and full-time employment in Canada’s three largest cities, Toronto, Vancouver, and Montreal, has not grown for months. Weak growth usually points to lower borrowing costs, raising hopes of cheaper mortgages ahead.

Inflation Complicates the Mortgage Rate Forecast

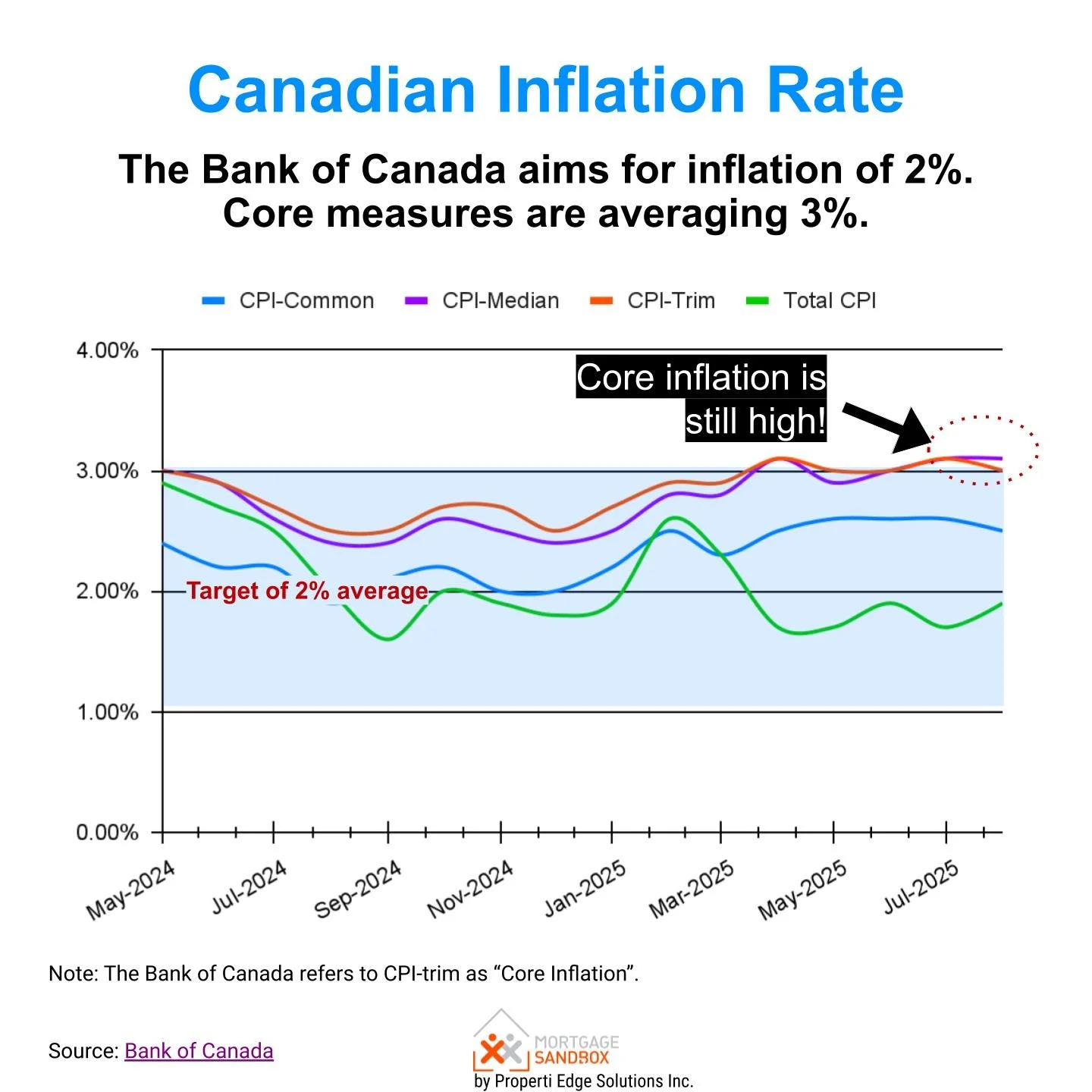

Canada Inflation Aug 2025

The latest inflation data has been released, and it complicates the picture. Canadian headline inflation rose to 1.9% year-over-year in August, slightly lower than expectations for a 2.1% reading but still up from 1.7% in July. The removal of the carbon tax from energy prices in most provinces in April continued to bias the annual rate lower, but a slower decline in gasoline prices pushed headline inflation higher and made July’s slowdown short-lived.

While the headline rate remains subdued, CPI excluding food and energy products stayed steady on a year-over-year basis at 2.4%. Meanwhile, the Bank of Canada’s trim and median measures stayed elevated, hovering around 3%. All core metrics remain persistently above the BoC’s 2% inflation target, underscoring entrenched inflationary pressures.

Policy Rates and Market Expectations

The BoC has already cut rates by 2.25% points since June 2024, bringing its overnight rate to 2.75%. But borrowing costs remain far higher than pre-pandemic levels, and mortgage rates are still straining household budgets.

According to a Reuters poll, foreign-exchange analysts expect the Canadian dollar to strengthen over the next year, largely because the BoC is nearly finished cutting while the U.S. Federal Reserve is just beginning its easing cycle. Markets are now pricing the odds of a September cut as close to 50-50.

What This Means for Borrowers

The mortgage rate forecast depends on which risk the BoC chooses to prioritize: recession or inflation. Economic activity is deteriorating, and unemployment is high, but inflation is not yet tamed.

Taken together, the new data highlight the fine balance the Bank of Canada must strike in its policy decision. The headline number points to a less urgent need for action, but the persistent elevation of core inflation makes an immediate cut difficult to justify. As such, the most likely outcome is that policymakers hold steady this month. That would mean mortgage rates stay elevated for longer, disappointing borrowers hoping for immediate relief.

For now, the best mortgage rate forecast is caution. Cuts are still on the table, but the Bank of Canada’s hands look tied until inflation falls convincingly toward its target.