Condo values in Hamilton-Burlington travel back four years

After years of sharp swings, Hamilton-Burlington’s housing market has settled into something that looks, at least for now, balanced. Buyers and sellers have roughly equal power. Prices, though, have slipped from the peaks of the pandemic and its aftermath. For detached houses, townhouses, and especially condo apartments, values have moved closer to levels last seen four years ago.

Detached houses

The benchmark detached house in the region now costs about $850,200, down 4 percent in the past three months. The median sits at $715,000, flat over the same period but still well below the high of $1.16 million reached in February 2022. Buyers have more choice, with months of inventory up to 5.1 from 4.5 last year. Sellers no longer hold all the cards. While it’s a balanced market, it’s not a buyer’s market - current inventory levels are healthy.

Townhouses

Townhouses are in a steadier position. Prices and supply have barely changed in the past year. Buyers and sellers are meeting on even ground, and the market looks calmer than other property types.

Condo apartments

The sharpest shifts are in condos. The benchmark condo price is $496,400, down 2 percent in the past three months and 22 percent below the high of $632,900 in April 2022. Inventory has risen sharply, with months of supply climbing 41 percent from last year to 4.5. For buyers, this means more bargaining power. For sellers, it is a sign that the frenzy of the past few years is firmly behind them.

Why prices are slipping

Several forces have dragged values lower.

Return-to-office Mandates

First, many firms are calling staff back to Toronto offices.

During the pandemic, thousands of workers fled to cheaper homes in places like Hamilton, betting that remote work would last forever. That bet is now in doubt. The Ontario government has also joined the return-to-office push, raising questions about whether it was ever reasonable for Hamilton homes to fetch $1 million when downtown Toronto is such a long commute away.

Higher Mortgage Rates

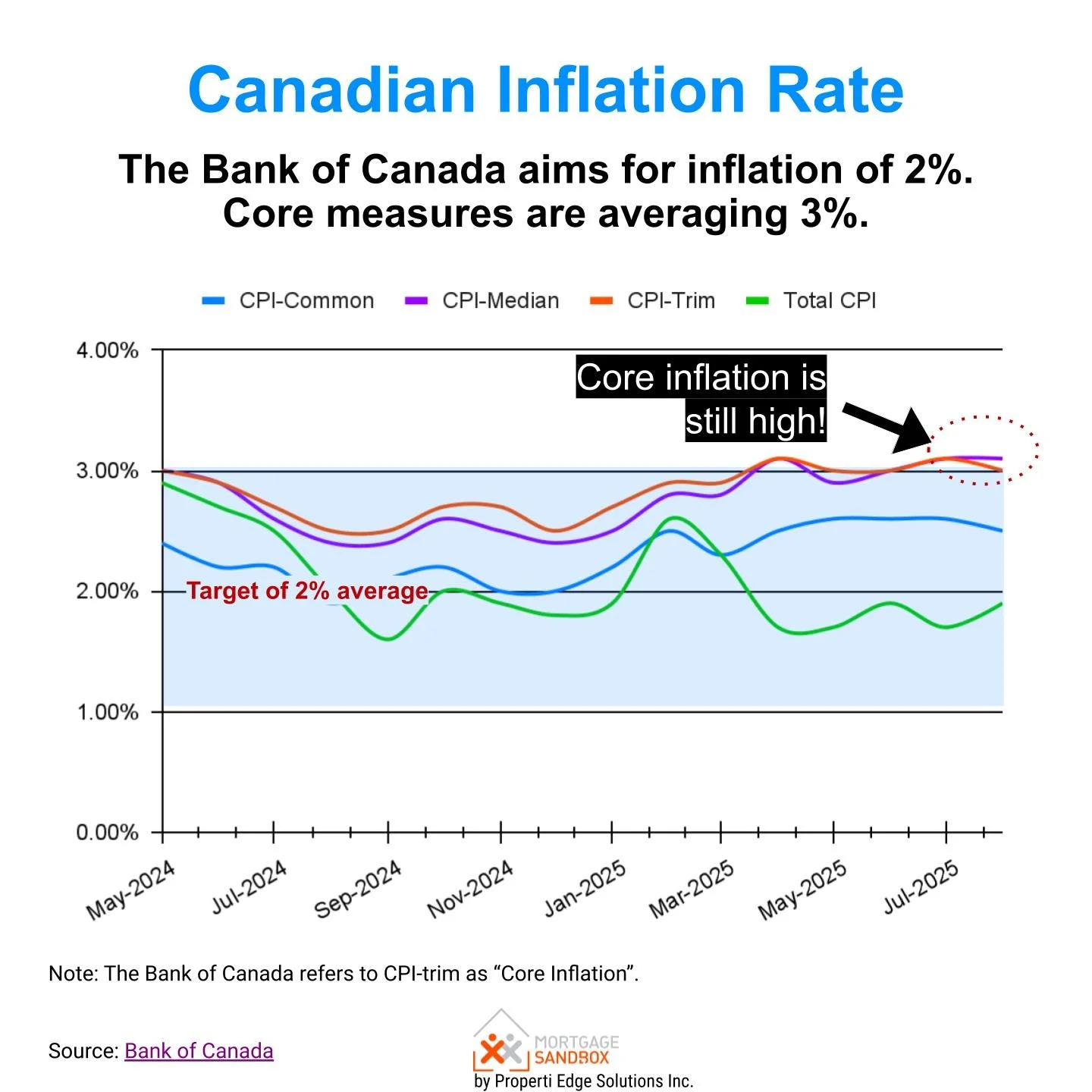

Second, higher mortgage rates cut the amount people can borrow. With borrowing costs biting into budgets, demand has softened.

Economic Weakness

Third, wider economic worries from inflation and trade tensions to job security are making buyers more cautious.

Growing Supply

Fourth, supply is building. This is not because more houses are being built, but because more owners are listing their homes, and many would-be buyers are choosing to rent instead.

Hamilton home construction is still booming, when these homes are complete in 18 to 24 months will they enter a strong or soft market?

Shaken Confidence in Real Estate

Finally, faith in ever-rising property values has cracked. For years, Canadians believed housing was a sure bet. Even the pandemic failed to dent the idea. But when rates surged, the illusion faded. Now the market is searching for a new balance. If prices overshot on the way up, they may still have further to fall before buyers feel they are getting fair value again.