The Search for Fair Value in Canadian Property Markets Continues

The Canadian housing market is currently seeking a new equilibrium and an appropriate price point.

During the pandemic, home prices surged due to low interest rates, a belief that real estate was a guaranteed investment, and the assumption that even a global crisis would not affect property values. However, that perception has now changed. Rising interest rates have forced buyers and investors to face a harsher reality: homes do not always yield double-digit returns regardless of the underlying economic conditions. The pressing question now is what constitutes "fair value" in this market.

Mortgage rates and affordability

One of the key factors limiting demand has been the increase in mortgage rates. For example, if a household has saved $100,000 and can afford a monthly mortgage payment of $2,500:

At a mortgage rate of 3%, they could secure a mortgage of approximately $530,000, which would allow them to purchase a home valued at around $630,000.

However, if the mortgage rate rises to 5%, the same monthly budget would only enable them to afford a home with a price tag of about $530,000 ( and a mortgage of $430,000. A 2% increase in mortgage rates results in a homebuyer budget 15 percent lower.

The reduced borrowing capacity due to higher mortgage rates forces buyers to adjust their expectations, postpone their purchases, or consider properties located farther from their desired areas. Currently, a significant number of potential buyers are either delaying their purchases or choosing to sell their mortgage-laden homes and rent instead.

This cooling effect is precisely what the Bank of Canada expected when it raised its policy rate into the “neutral” range of 2.25–3.25%, a level intended neither to stimulate nor restrict the economy but to restore long-term balance. The bank did this because out-of-control inflation was weakening the strength of the Canadian dollar.

Return-to-office and regional demand

There is a famous real estate quote, "There are three things that matter in property: location, location, location!"

Location dynamics in Canada have shifted. During the pandemic, remote work made far-flung exurbs attractive. Families swapped small city flats for bigger homes in places like Hamilton, even as prices soared close to $1 million. Now, return-to-office mandates from both private employers and the Ontario government raise doubts about the sustainability of those values. Two-hour commutes look less appealing, leaving exurban markets particularly exposed.

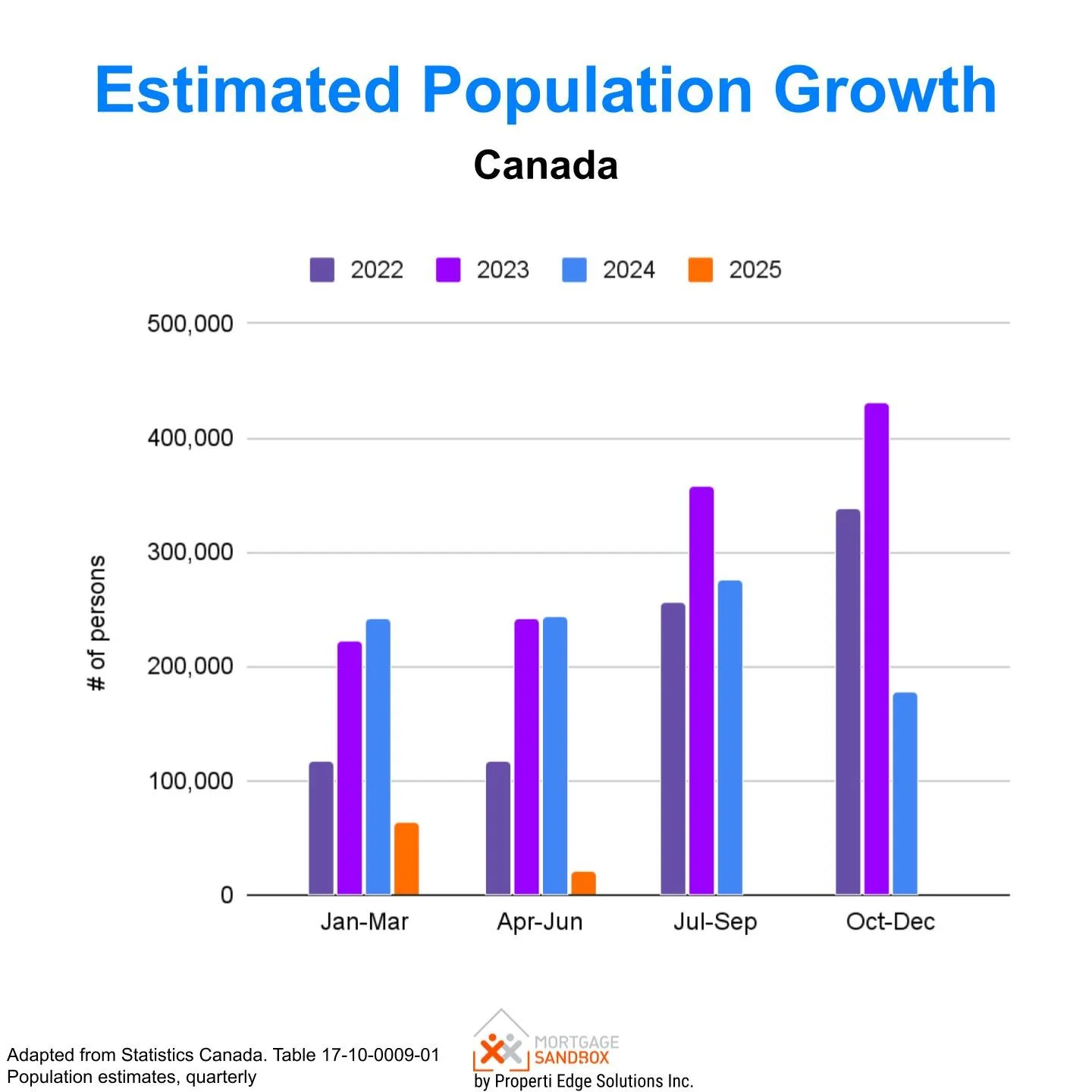

Population and immigration policy pressures

Immigration and population growth once underpinned bullish forecasts. But federal caps on foreign students and a pause in immigration growth weaken this narrative. With nearly three-quarters of Canadians supporting fewer newcomers, it is unlikely that a sudden policy reversal will revive demand in the near term.

Economic uncertainty

Inflation, trade tensions, and employment concerns further dampen sentiment. Buyers hesitate when the economic outlook is cloudy. The symptom is visible in the market: more listings, longer selling times, and price reductions. Yet this is not the result of a sudden glut of new housing stock. Supply constraints remain severe, and Canada will take years to build its way out of the shortage.

A crisis of faith

Faith in ever-rising property values has cracked. For years, Canadians believed housing was a sure bet. Even the pandemic failed to dent the idea. But when rates surged, the illusion faded. Now the market is searching for a new balance. If prices overshot on the way up, they may still have further to fall before buyers feel they are getting fair value again.

The belief that Canadian property values are invulnerable was always dangerous. Canada’s housing market has repeatedly ranked among the most overvalued in the world. In 2019 and 2021, Bloomberg Economics placed Canada as the second-largest housing bubble in the OECD. Toronto topped the UBS Global Real Estate Bubble Index in 2022, with Vancouver also listed among the riskiest. By 2024, a Rates.ca report estimated the market was 60% overvalued, with Canada’s price-to-rent ratio 88% above its historical average and its price-to-income ratio 32% above.

Prices are projected to continue falling in 2025, driven by trade tensions, weaker population growth, and rising unemployment, particularly in Ontario and British Columbia. Yet property remains deeply unaffordable in most markets. Canadians know peak values were unsustainable, but because they could not rationally explain the surge, they struggle now to see where the floor might be. Until that faith is restored, the wobble will continue.