Could a Falling Prime Rate Finally Ignite Canada's Housing Market?

After a prolonged slowdown, a question is quietly circulating among prospective homebuyers and sellers across Canada: has the turning point finally arrived?

The Bank of Canada's recent interest rate cuts, which have brought the key rate down to 2.5% as of September 17, 2025, are injecting a dose of optimism into a sluggish real estate sector . This marks a significant drop from the 5% peak in 2023 and has pulled the prime rate at major banks down to 4.7% .

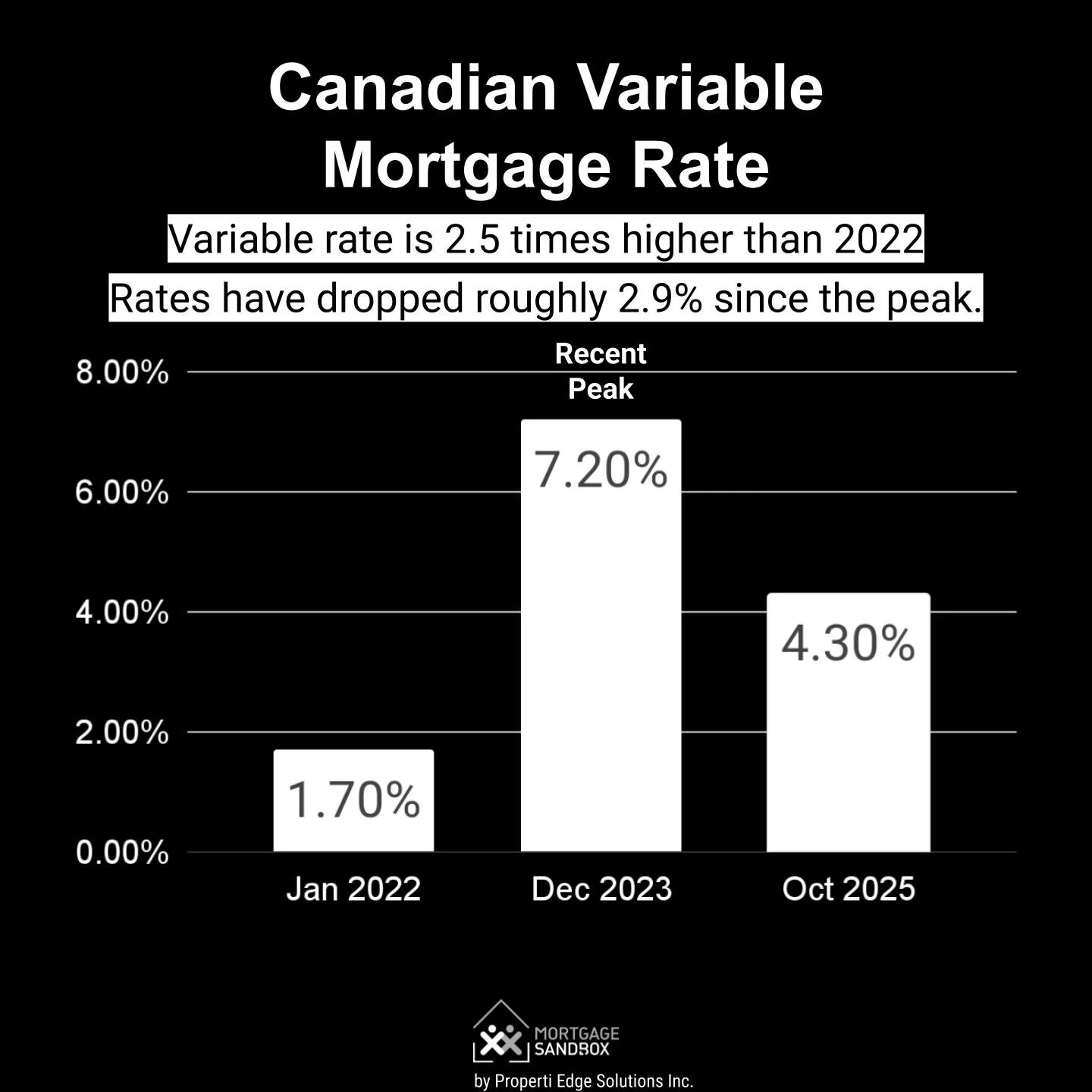

This shift is directly translating into lower borrowing costs. Five-year variable-rate mortgages have fallen approximately 2.9% from their highs, with average rates now around 4.3%.

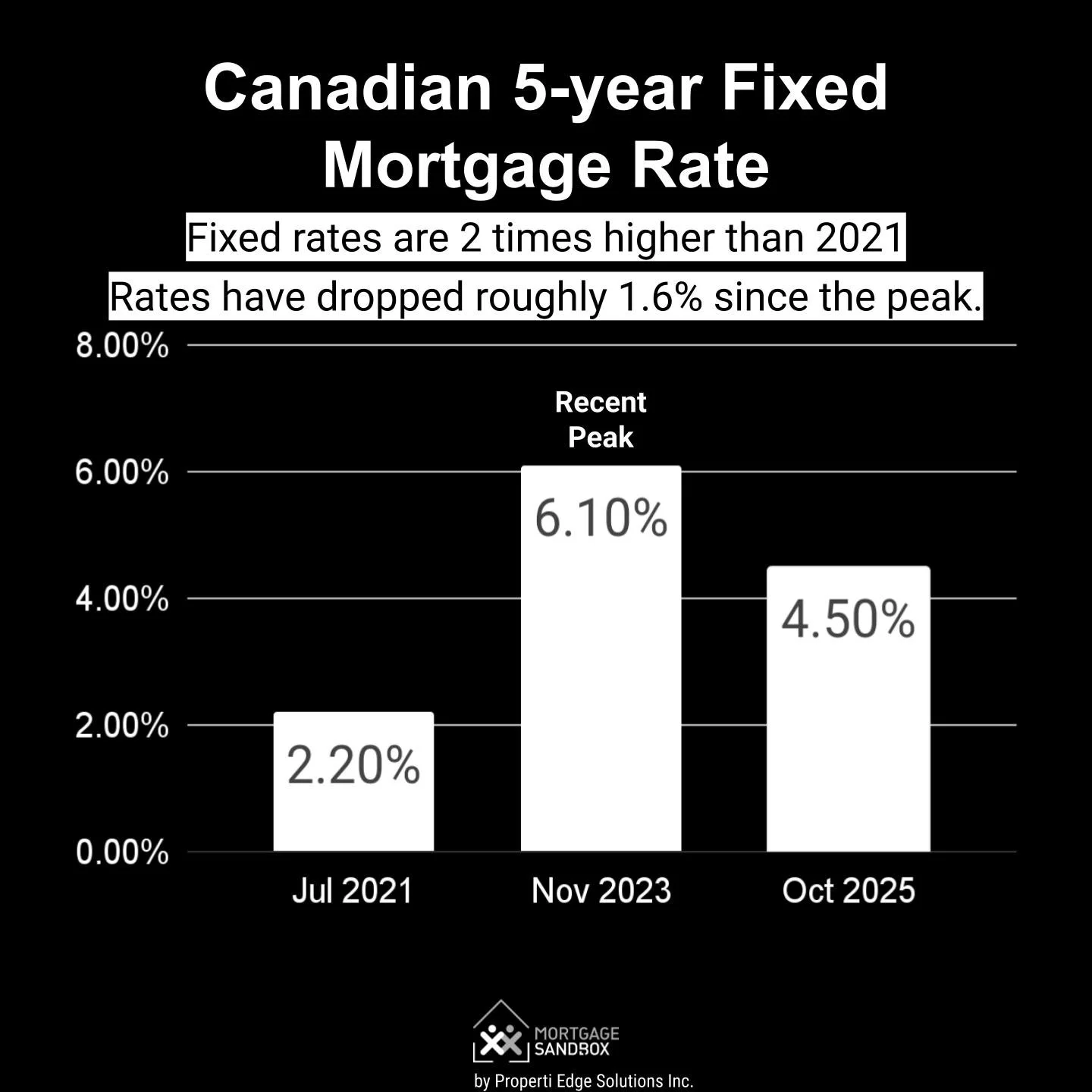

Similarly, five-year fixed-rate mortgages have seen a decline of about 1.6%, offering rates near 4.5% . This is more than just a minor relief; it's a crucial improvement in affordability, especially because the more conservative fixed-rate is used in the federal mortgage stress test, qualifying more people for home loans .

The early signs of a response are emerging. The Canadian Real Estate Association (CREA) reported that national home sales rose for the fifth consecutive month, with average prices climbing nearly 2% from the previous year . Some industry professionals are noticing a change. "Personally, I have seen significant improvement in my business activity over the last couple of weeks," noted Toronto-based mortgage broker Mary Sialtsis, following the latest rate cut .

Significant Headwinds Remain

Despite the positive momentum, several formidable challenges stand in the way of a full-scale market boom.

1. Rates Are Still Historically High: While the downward trend is welcome, the current rate environment remains a world away from the ultralow levels of 2021. Today's rates are still double what they were just a few years ago, representing a fundamental and lasting shift that continues to strain affordability for many Canadians.

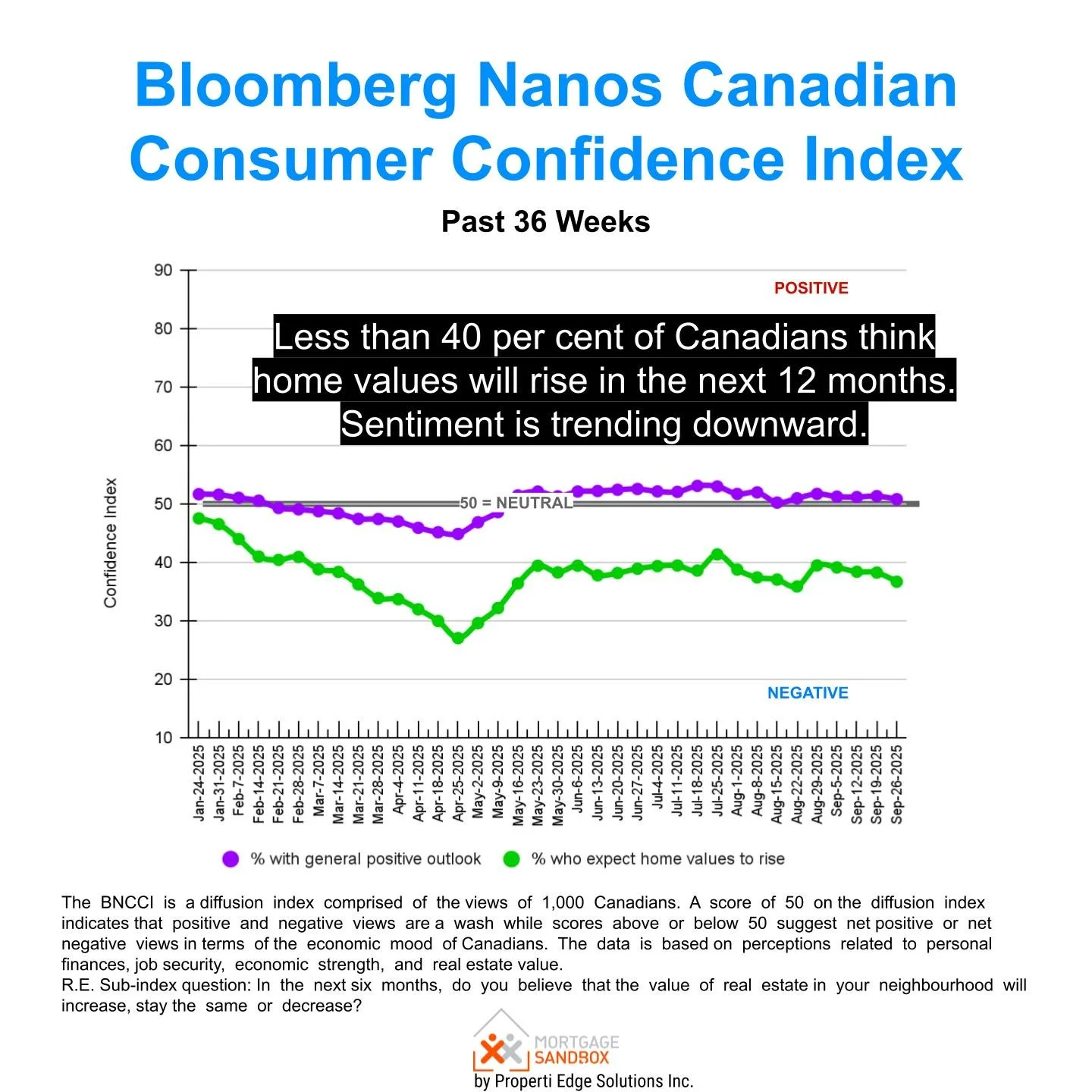

2. Cautious Buyer Sentiment: Perhaps the largest hurdle is psychological. With ongoing economic uncertainty, many Canadians are hesitant to make such a significant financial commitment. "People just pulled right back and said, 'We're not going to make any big decisions like this, I don't know if I'm going to have a job,'" explained Shaun Cathcart, a senior economist at CREA, highlighting the caution caused by factors like the U.S. trade war. If buyers believe prices will stagnate or fall, they are likely to wait, creating a self-fulfilling cycle of weak demand.

3. A Weak Labour Market: The economic foundation for new homebuyers has deteriorated. Canada's unemployment rate rose to 6.9% in August. Without strong and consistent job growth, the pool of qualified homebuyers cannot expand significantly.

4. Ample Housing Supply: The market dynamics have shifted in favor of buyers in many regions, marking a significant change from the frenzied seller's markets of recent years. With a greater supply of listings available, buyers now possess more negotiating power, which typically exerts downward pressure on prices or leads to price stagnation.

The Government's Counterplay

In response to the dual challenges of affordability and economic stimulus, the federal government has launched a new initiative. In mid-September, Ottawa announced the creation of Build Canada Homes, a new agency with a mandate of $13 billion to build 50,000 factory-built homes on federally owned land and to accelerate the construction of non-market housing across Canada. This initiative is part of a broader plan to double Canada’s current rate of residential construction over the next decade, aiming to reach 500,000 homes per year. If successful in significantly increasing the supply of non-market housing, this initiative is likely to result in stagnant or declining rents across Canada.

Moreover, in many markets, investors account for over half of the demand for condo apartments. If people anticipate a future with an ample rental supply, investors might divert their funds into non-property assets.

The Bottom Line

The recent drop in interest rates is a necessary and welcome step toward improving housing affordability in Canada and promoting economic investment. It has provided a glimmer of hope and initial signs of increased activity in the market.

However, a true and sustained turnaround will require changes in economic fundamentals, supply outlook, and public sentiment. The path forward relies on a combination of continued monetary policy support, a stable job market, and, most importantly, the restoration of buyer confidence. Once this sentiment aligns with the improving interest rate environment, it will spark the next market pivot.

The Bank of Canada's next interest rate announcement is scheduled for October 29, 2025, and it will be closely monitored for indications of future policy direction.