The Calgary Property Market Seeks a New Equilibrium

The Calgary housing market is undergoing a pronounced correction, yet not the collapse some headlines might suggest. After a period of exceptional pandemic-driven heat, the market is recalibrating.

The central narrative is one of normalization: demand has retreated from its peak, supply has rebounded from historic lows, and prices are adjusting downward in a controlled manner. The city is grappling with what a post-pandemic "normal" looks like amid significantly higher borrowing costs.

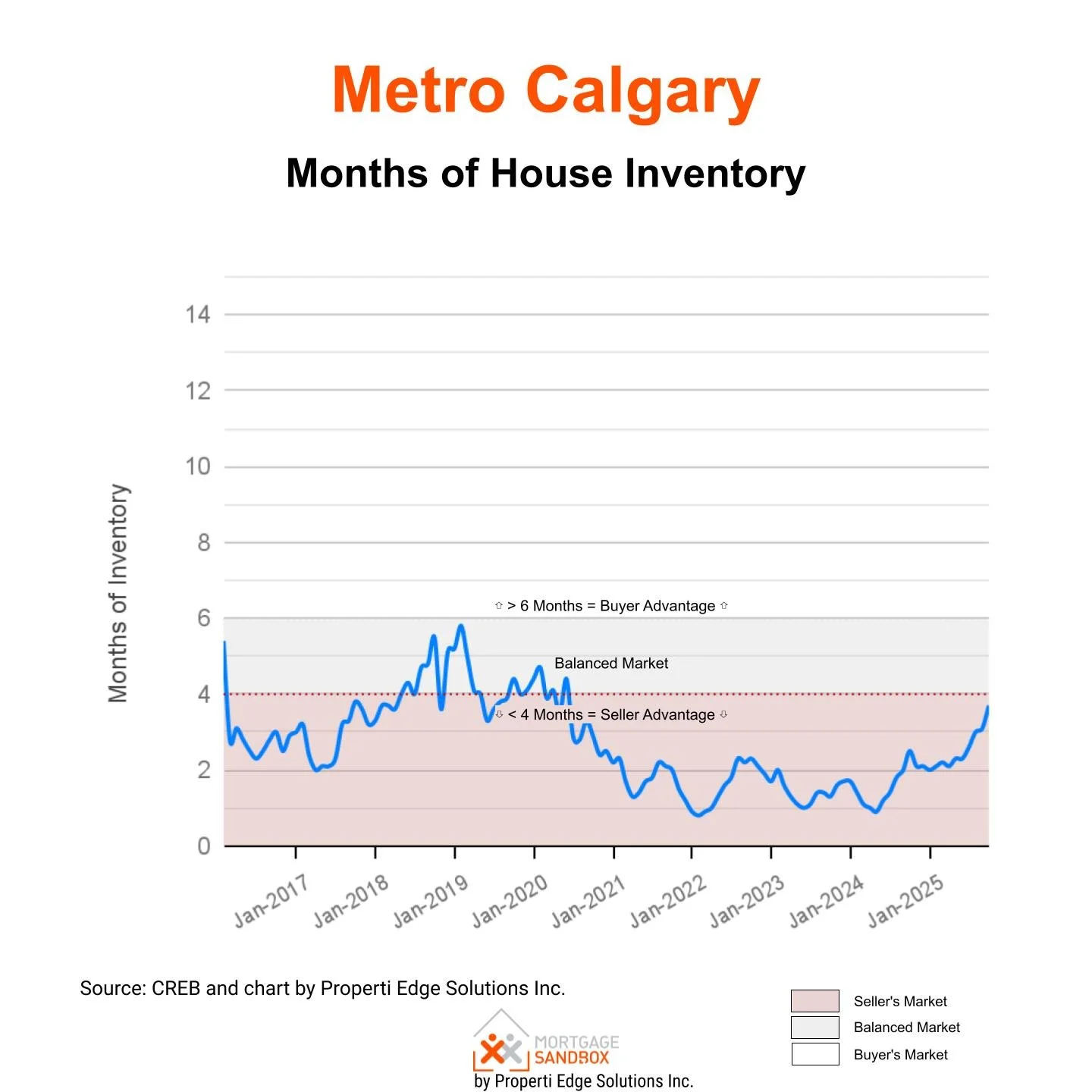

A Seller's Market, But a Weakening One

The detached home sector continues, technically, to favour sellers. However, their advantage is diminishing. While inventory remains relatively low by long-term historical standards, it is rising swiftly. The months of inventory, a key measure of market balance, have jumped 48% year-over-year, from 2.5 to 3.7. This increase provides buyers with more choice and negotiating power than they have had in years.

This shift in dynamics is reflected in prices. The benchmark price for a detached home now stands at $749,900, representing a 2% decline over the past three months. The median price has seen a steeper drop, falling 4% to $690,000 in the same period.

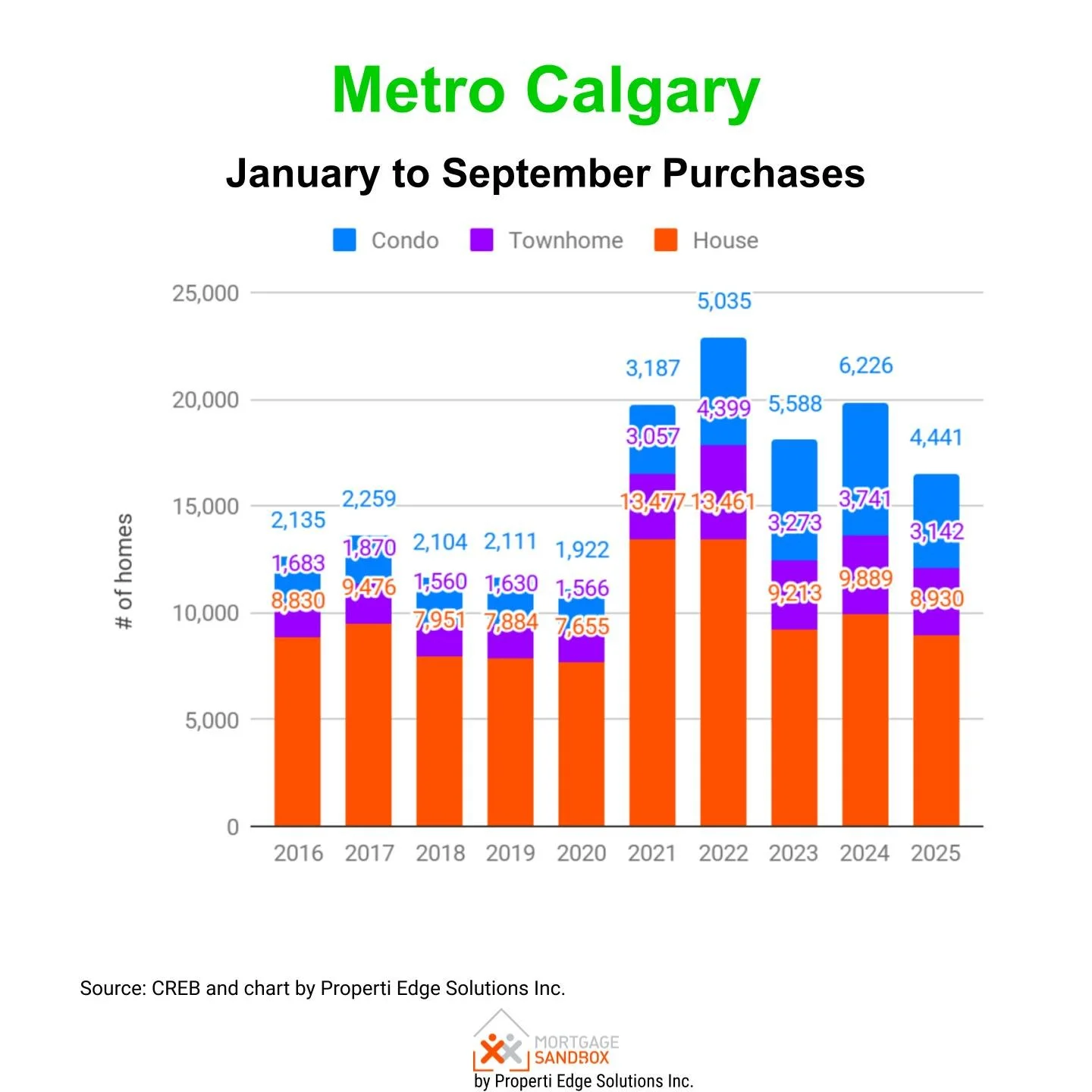

Crucially, this price softening is not driven by a flood of new listings, but by a moderation of demand. Purchase activity for houses has decreased by 9% compared to last year, reaching its lowest point in three years. Despite this, demand remains slightly above pre-pandemic levels, with 859 purchases in September compared to 826 in September 2019.

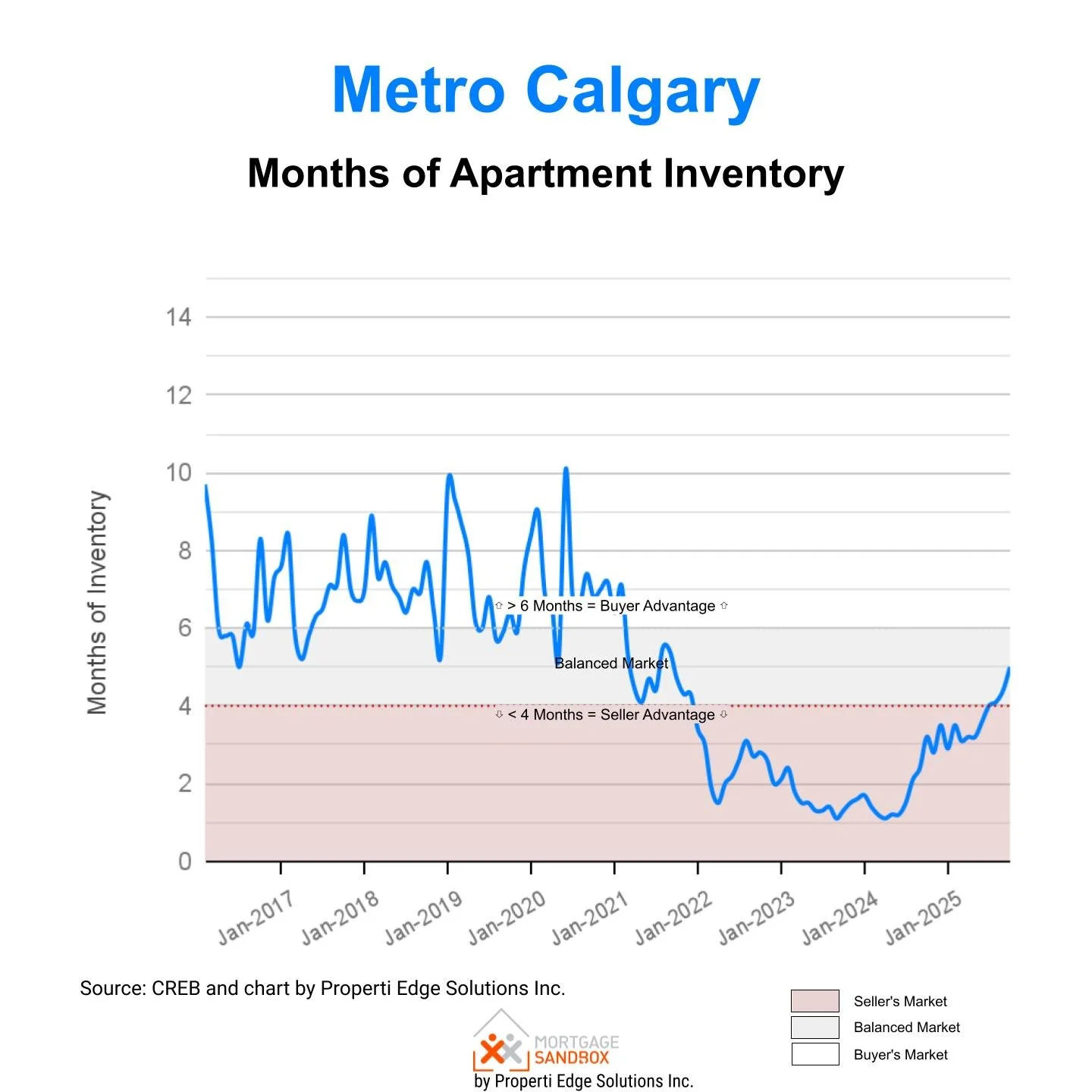

A Diverging Condo Market

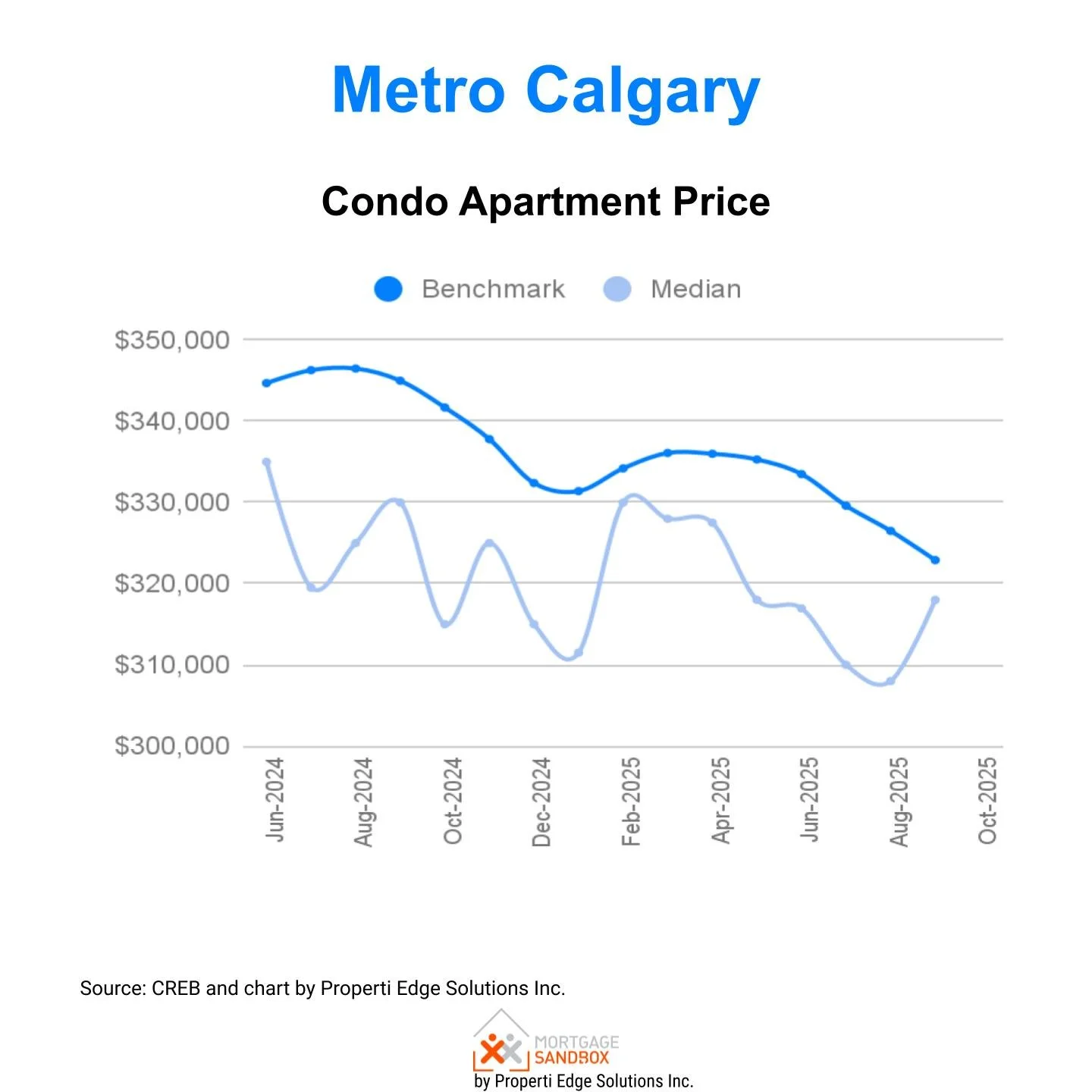

The condominium apartment market presents a more balanced and, in some aspects, weaker picture. It has shifted decisively into balanced territory, granting neither buyers nor sellers a distinct upper hand. The inventory surge is more pronounced here, with months of supply increasing by 56% to 5.0.

This has precipitated a sharper annual collapse in purchase demand, which is down 20%. The benchmark apartment price has decreased by 3% over the past three months to $322,900. With active listings ballooning by 23% year-over-year, further price pressure appears likely.

The Interest Rate Anchor

The primary driver of the market's cooling is the high cost of borrowing. Mortgage interest costs have soared, with fixed rates approximately double their levels in 2021. This has drastically reduced purchasing power and tempered buyer enthusiasm. Nationwide consumer sentiment reinforces this caution, with fewer than 40% of Canadians anticipating higher home prices next year.

Prospects for immediate relief are slim. The Bank of Canada maintains a cautious stance, prioritizing the sustained return of inflation to its 2% target. While a typical five-year variable-rate mortgage, at 4.3%, has recently dipped below fixed-rate offerings, the era of ultra-low rates is likely over for the foreseeable future. The central bank's deliberate approach means rate cuts in the next six months are possible only if clear, sustained evidence of tamed inflation emerges.

Market Outlook: A Cautious Rebalancing

The Calgary market is in a transitional phase. The extreme conditions of the past three years have abated, giving way to a more measured pace of activity. Several factors indicate a continued cooling trend: higher mortgage rates, increased supply, and cautious buyer psychology. The condo market is expected to weaken further into 2025, where any uptick in sales may be attributable to price concessions rather than renewed demand strength.

For buyers, the environment has improved, offering more choice and slightly less frantic competition. For sellers, the era of effortless sales at peak prices has come to an end, necessitating a return to realistic pricing and negotiation. The market is not in crisis; it is in search of a sustainable footing, having left its pandemic frenzy behind.