Rental Mortgage Rule Changes Could Trigger Major Shift for Canadian Property Market

The Canadian Bank regulator, the Office of the Superintendent of Financial Institutions (OSFI), has finalized significant changes to mortgage regulations that will reshape Canada's rental property investment landscape, effective in 2026.

The most important change relates to the treatment of mortgages for rental properties.

These modifications to lender requirements, while aimed at stabilizing the financial system, will create substantial market consequences that extend far beyond individual rental property investor portfolios.

What’s Changing.

There are a couple of key changes that impact rental properties:

Higher Borrowing Costs for Rentals: Starting in 2026, banks will be required to classify mortgages as "income-producing residential real estate" (IPRRE) when rental income accounts for more than 50% of the mortgage qualifying income. This classification denotes a higher risk, resulting in higher costs for lenders, who will pass these costs on to borrowers through increased interest rates and stricter terms.

More Difficult to Qualify for a Mortgage: The most consequential change prohibits double-counting income streams. Under previous rules, it was possible for investors to count the same personal employment income or existing rental income to support mortgage applications across multiple property purchases. OSFI has eliminated this practice, requiring each mortgage to stand independently. Mark Joshua, OSFI's Director of Capital and Liquidity Standards, confirmed that "income that was used on the first mortgage is removed or corrected for when assessing additional properties".

The Elephant in the Room.

While it’s clear these rules apply to mortgages, refinancing mortgages, and mortgages for rental properties, it’s not clear if this applies to mortgage renewals. The question everybody should be asking is, “Will these mortgage rules apply to mortgage renewals?!”

If this is the case, then all of the existing condo rental stock will be subject to higher mortgage rates.

If all condo rental owners have to pay an extra half percent on their $500,000 mortgage, that’s an additional $200 per month.

Potentially Pulls the Rug Out from 25% of the Market.

The recent changes could significantly impact 25% of the market. This timing aligns with a surge in investor involvement in Canadian real estate. Investors currently account for 25% to 30% of all home purchases across the country, marking the highest percentage ever recorded.

In Toronto's condominium market, the concentration is even more evident, with 40% of all condo units owned by investors and 65% of smaller units, those under 600 square feet, are held for investment purposes.

Toronto isn’t alone; Ontario has become a property investment hotspot, and British Columbia isn’t far behind. Curiously, data wasn’t available for Alberta.

The data indicates that university towns have high investor ownership, which does provide comfort that the property will be rented, so long as supply doesn’t outpace the student population.

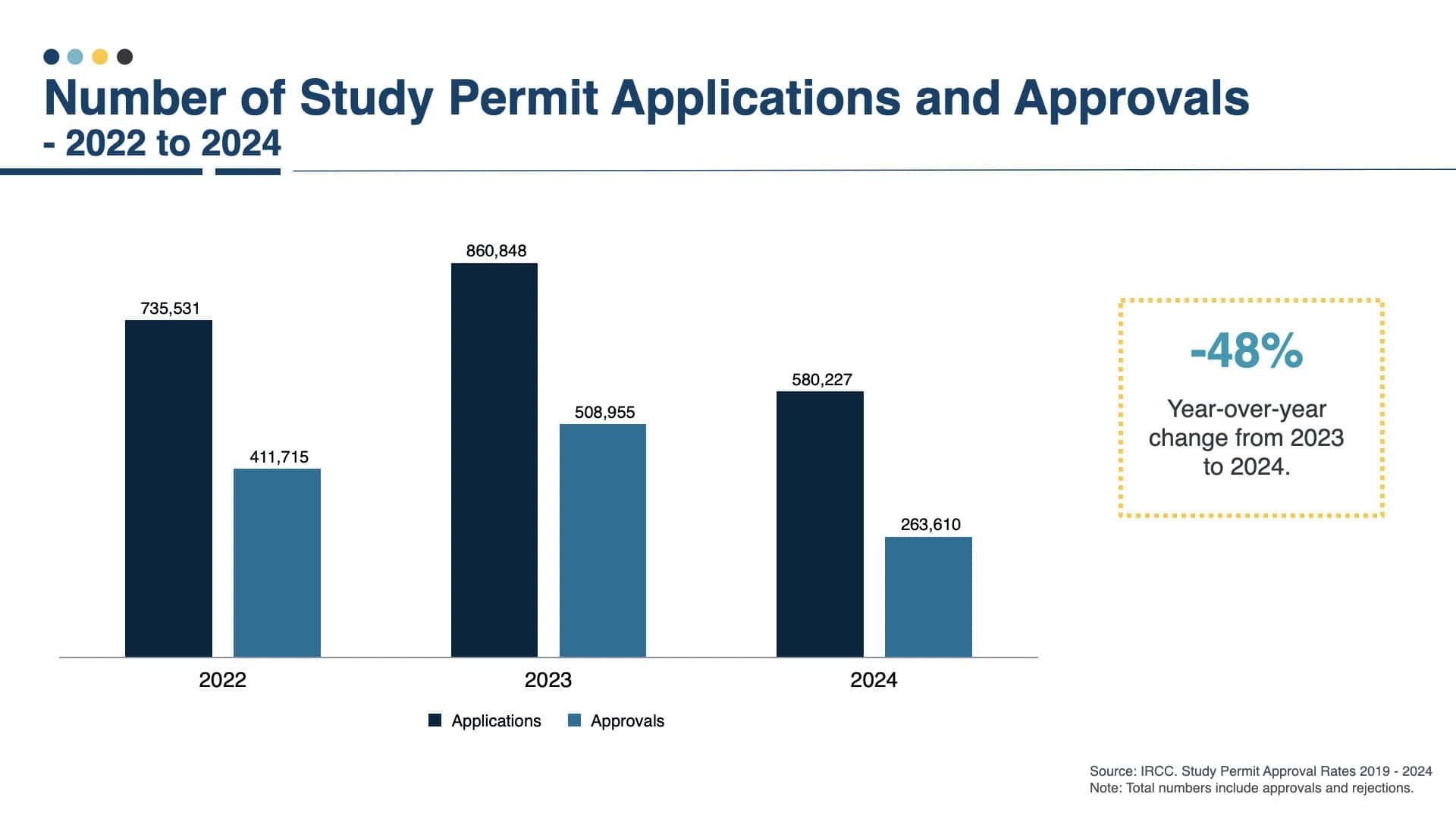

Recent changes to Canadian immigration policy have introduced an intake cap for student visas. The target is set at 437,000 study permits for the years 2025 and 2026, reflecting a 10% reduction from the 2024 target of 485,000. While there is no specific percentage change noted for the years 2020 to 2023, there was an overall trend of increasing international student numbers observed in the early 2020s, prior to the implementation of this cap in early 2024. The new policy aims to reduce the number of temporary residents in Canada to 5% of the population by 2027. If universities are forced to accept more local students, many may choose to commute from their parents’ homes rather than rent near campus. The net effect could be negative, highlighting the risks associated with the rental market. This may explain why regulator has required banks to hold more capital to support rental property mortgages.

Impact on Market Demand: Fewer Buyers

Investment purchases account for 25-30% of all property transactions in Canada, with a higher concentration in university towns and cities like Toronto and Vancouver, where there are significant condominium markets. A substantial increase in borrowing costs for investors, resulting in a decrease in their activity, could lead to significant demand destruction.

If the new regulations lead to a cut in investor purchases by half, total market demand could drop by 12-15%. This would apply considerable downward pressure on an already weakening market that is experiencing declining sales volumes and price corrections in various regions.

Rental Market Consequences

There are concerns that since 41% of Toronto condominiums serve as rental properties, a significant decline in investor purchases might hinder future growth in rental supply. However, a recent report by Urbanation and CIBC indicates that developers are already shifting their focus towards building purpose-built rental properties. These are intended to be sold to pension funds and real estate investment trusts rather than to individual investors looking to buy condominiums.

The concern is that purpose-built rental construction may not be able to compensate for the reduced number of investor-supplied units. While some institutional investors may increase market share, they typically focus on larger, professionally managed developments rather than the diverse unit types individual investors provide.

Alternative Financing Channels

The regulations create opportunities for credit unions and private mortgage companies, which are provincially regulated rather than federally regulated.

These institutions can continue considering global income approaches, though typically at interest rate premiums of 1-3%. Some lenders still offer investment property financing with 5% down payments based solely on property rental income, providing continued access for cash-flow positive investments.

Long-term Market Restructuring

These changes represent a fundamental shift toward institutional ownership of rental housing. While individual investors face financing constraints, large-scale institutional investors with patient capital maintain competitive advantages. This concentration may reduce the diversity of rental housing options and potentially increase average rental costs as professional management companies optimize returns.

The condominium development sector may also require restructuring. With pre-construction sales heavily dependent on investor purchases, developers may need to modify unit designs, pricing strategies, or financing approaches to maintain project viability.

Some projects may convert to purpose-built rental to access institutional capital markets.

Market Outlook

The confluence of reduced investor financing, extended foreign buyer restrictions, and weakening market fundamentals suggests a significant recalibration ahead.

These measures may improve property availability and affordability for buyers who intend to occupy a home.

The regulatory framework takes effect gradually, with full implementation expected by 2026. This transition period allows market participants to adapt strategies, though the fundamental shift in the treatment of income-based qualification represents a permanent change in Canada's real estate financing landscape.

The ultimate market impact will depend on how effectively alternative financing channels can serve displaced investor demand and whether institutional capital can offset reduced individual investor participation in providing rental housing supply. Early indicators suggest this transition will create winners and losers, with the overall effect being a more constrained but potentially more stable property market.

Sources

Canadian Real Estate Investors Capture A New Record Market Share, Better Dwelling

Ever-Shrinking Condos Are the Choice of Investors in Toronto and Vancouver, New York Times

Toronto's condo rental market spiked in 2024, data shows, RENX

Residential Mortgage Industry Report, CMHCInvestment property mortgage rates explained: what your clients should know, Wealth Professional

Investors among residential real estate buyers, 2018 to 2020

Are ‘mom-and-pop’ investors pricing out first-time homebuyers? Global News