Toronto Sellers Face Strong Incentives to Transact Now

Toronto house prices have been falling steadily.

Toronto house prices have been on a steady decline lately, and it’s a bit of a tough situation. Currently, benchmark house prices in Metro Toronto have dropped by 26.2% from their peak and have seen a 9.5% decrease over the past year. Just in the last three months, prices have fallen by 4.4%.

If you’re a motivated seller, it’s worth considering that waiting until spring to list your home could lead to prices that are 5% to 10% lower than what you might get today.

So, what can sellers do right now to make their properties more appealing to buyers? After all, with trends suggesting that buyers might find similar homes for 5% to 10% less come January, it’s important to create a sense of urgency.

It's a balanced market trending in favour of buyers.

The current market for detached houses is balanced, with both buyers and sellers having equal negotiating power. Inventory levels have improved for buyers, with months of inventory increasing from 4.3 to 5.2 compared to last year, which is a rise of 21 percent.

It appears the industry and market are still adjusting to more normal market conditions after years in a seller's market.

Demand has improved slightly.

Purchase demand has increased by 9 percent year-over-year in August, but projections for 2025 indicate lower purchases than the previous four years.

New home sales are currently at extremely low levels, surpassing the downturn experienced in the 1990s. In July, sales remained at lows not seen in decades, with only 359 new home sales recorded. This figure represents a 48% decrease from July 2024 and is 82% lower than the 10-year average.

The benchmark price for a newly built house is $1,488,940, which is down 48% from a year ago, but over $200,000 higher than the benchmark price for existing resale homes.

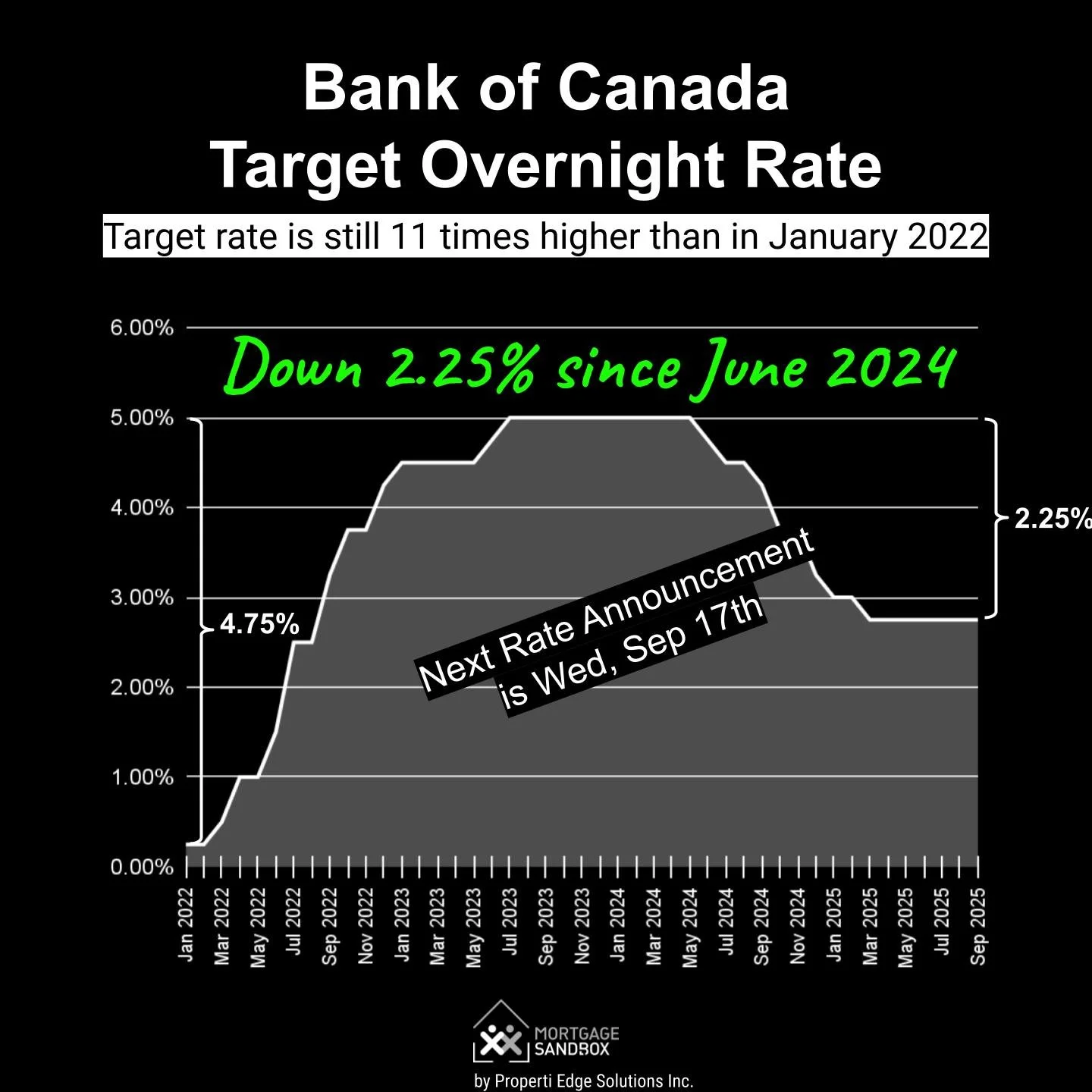

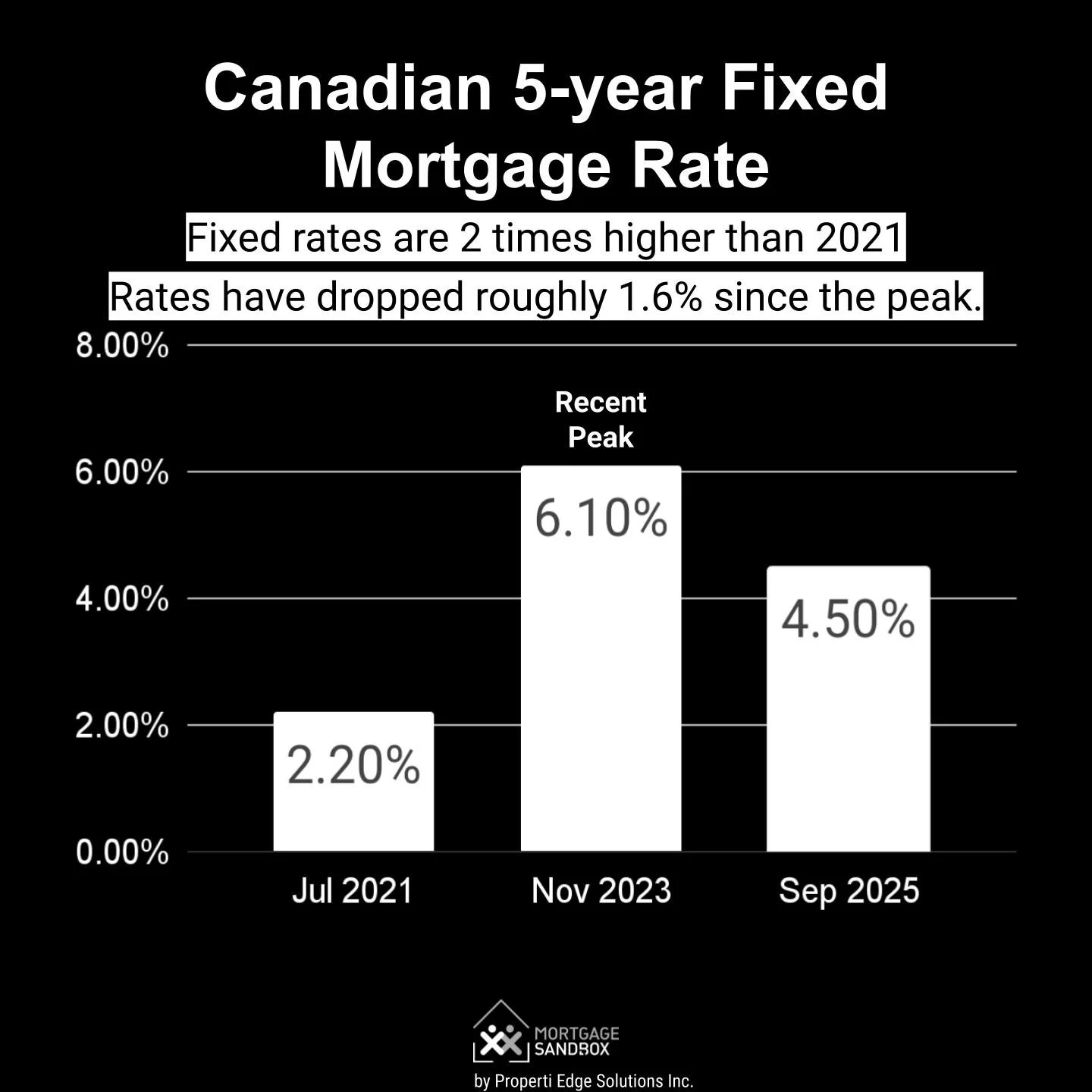

Mortgage interest costs remain high.

Mortgage interest costs remain high. The rate on a fixed-rate mortgage is more than double what it was in 2021, and the property market is still adjusting.

People who were hoping for lower rates in the near future are facing disappointment, as rates have been rising slightly since May 2025.

Condo apartment market overview.

The condo apartment market is currently a buyer's market, giving buyers an advantage in negotiations. Inventory levels have bushed further in favour of buyers, with the months of inventory increasing from 5.9 to 6.7 compared to last year, which is a 14 percent rise.

Purchase demand has decreased by 3 percent, while the supply of active listings has gone up by 9 percent.

The benchmark price for condo apartments is now $571,500, reflecting a 4 percent drop over the past three months, which is favourable for buyers. Meanwhile, the median price for these apartments is $565,000, down 5 percent, also benefiting buyers.

Collapse in Condo Demand.

Apartment demand is significantly below previous years. Is the $571,500 benchmark price too steep for an entry-level home at current mortgage rates?

Apartment presales are plummeting.

Developers are seeking government intervention to support the construction market. However, the benchmark price for a new apartment is $1,029,527, which is over $400,000 more than the price of a resale home. Additionally, purchasing presales comes with certain risks.

Market Outlook.

Several factors are contributing to the cooling of the housing market:

Higher Mortgage Rates: Mortgage rates have doubled compared to what many people were accustomed to during the pandemic.

Cautious Consumer Sentiment: Only 40 percent of Canadians believe that home prices will be higher this time next year.

Increased Housing Supply: A significant number of homes are currently under construction, adding more supply to a market already experiencing downward price pressure.

Low Employment Growth in Metro Toronto: Employment levels in Metro Toronto remain roughly the same as they were in 2023 and are trending downward.

Changing Seller Dynamics: Sellers, who were once encouraged by bidding wars, now find themselves in a position where they must negotiate and offer concessions or incentives to attract buyers.

Metro Toronto New Home Units Under Construction Year-over-Year

Key Takeaways

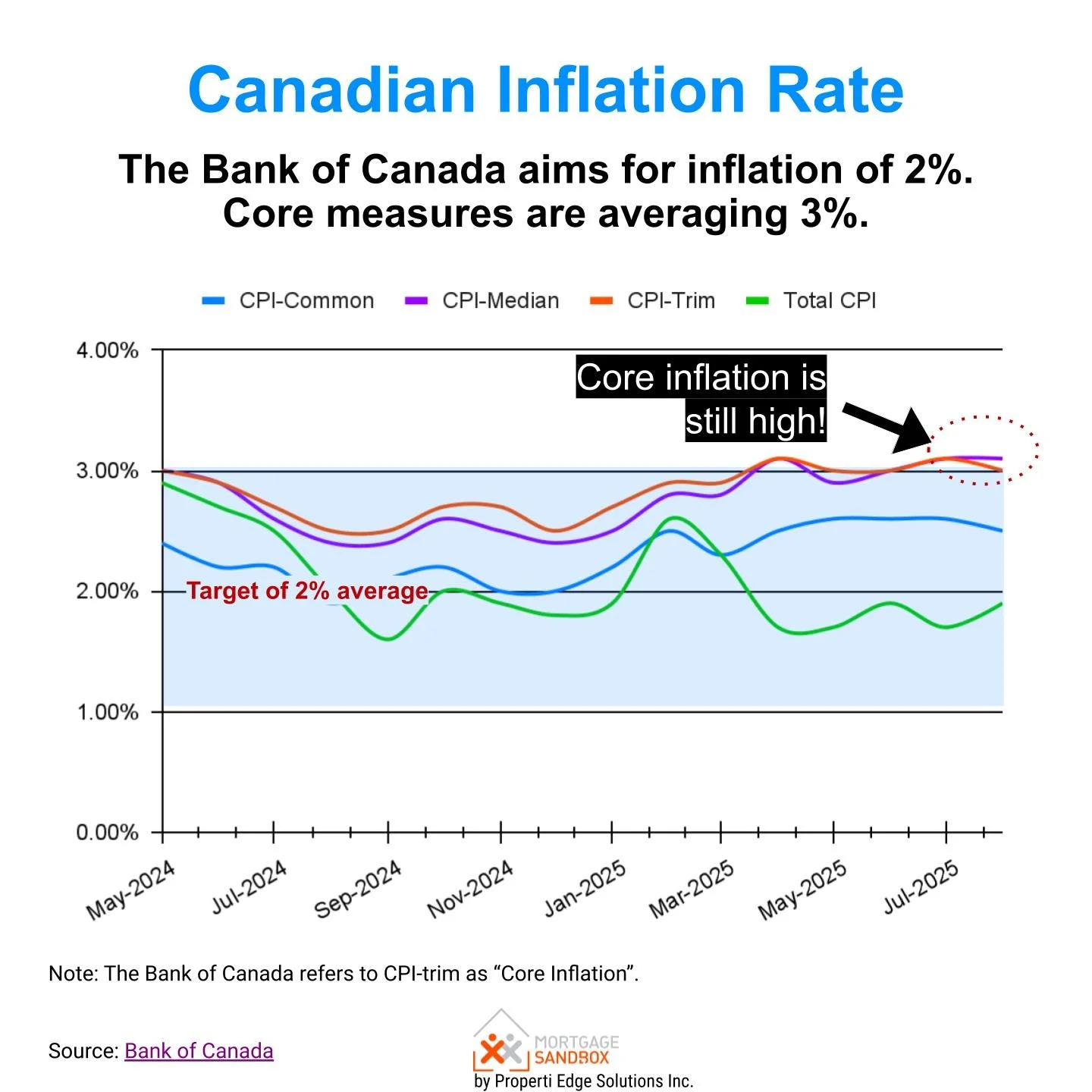

Canadian Inflation Rate Indicators

Focus on facts.

Pay close attention to data and historical trends in a buyer's market, and look beyond headlines that are designed to provoke an emotional response.

Prepare to be surprised.

Some analysts predict that the Bank of Canada may soon lower interest rates to assist Canadians with economic challenges. However, the Bank's main priority is controlling inflation, and it might hesitate to implement rate cuts until inflation is firmly under control, as several inflation indicators remain too high.

If interest rates do decrease, this could boost housing demand. However, the overall situation remains uncertain. In the event of a recession caused by tariffs, which could lead to declines in both population and full-time employment, lower interest rates may be less effective in stimulating housing demand.

Look for opportunities.

The condo apartment market is anticipated to weaken further in 2025. While the number of purchases may increase, this may be more due to price concessions rather than a genuine increase in demand.

Bank of Canada Sep 17 Decision is a Coin-toss