Mortgage Rate Prediction: Will the Bank of Canada Cut Rates on September 17?

Homeowners, investors, and borrowers are all asking the same question ahead of the Bank of Canada’s September 17 meeting: will the central bank lower interest rates again, and what does that mean for the mortgage rate forecast?

Economic Weakness Pressures the Bank of Canada

The Canadian economy is showing signs of strain. GDP shrank by 1.6% in the second quarter of 2025, the steepest decline since the pandemic. Exports collapsed 27% after Washington imposed sweeping tariffs, and unemployment has climbed to nearly 7% nationwide, with Toronto and Edmonton already above 8%.

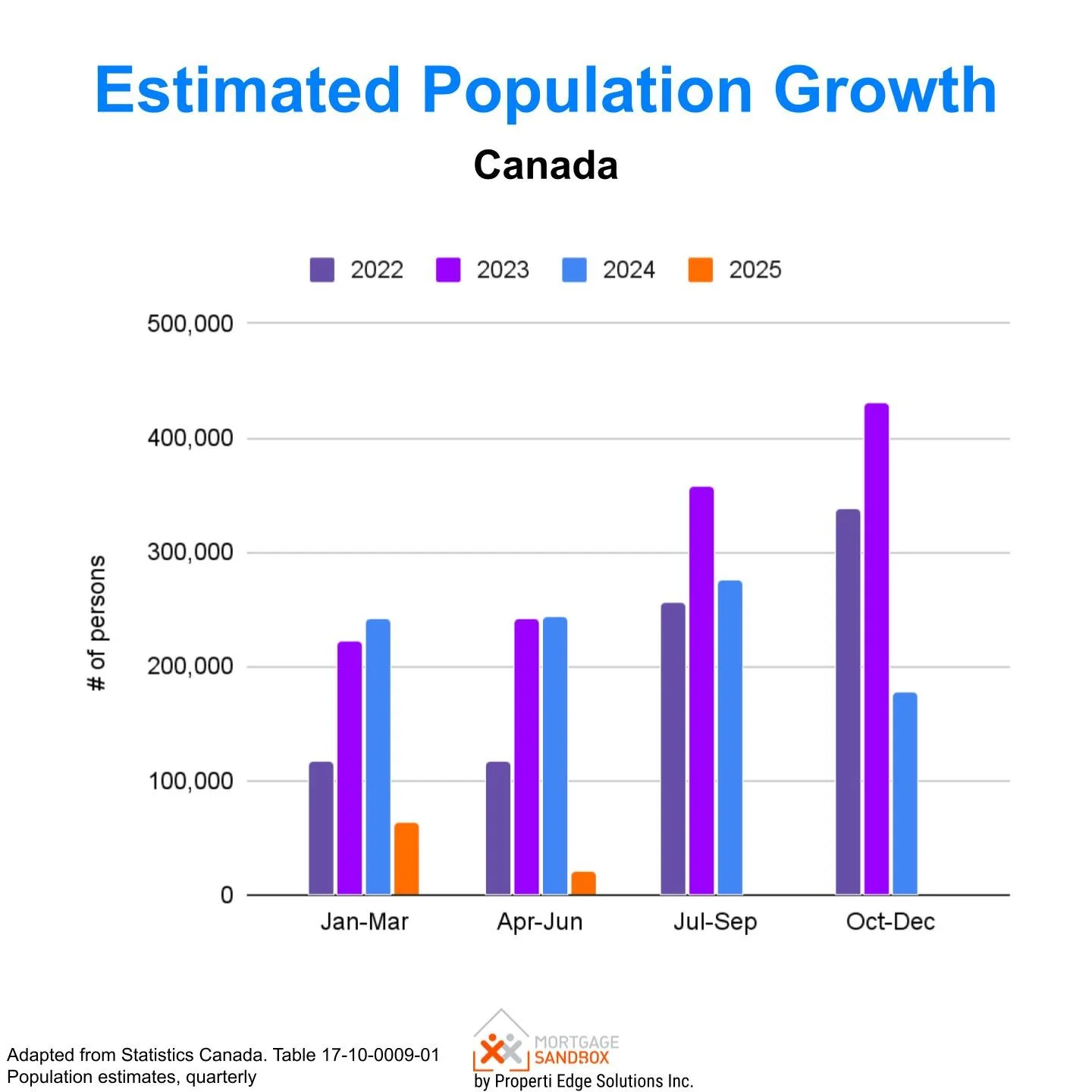

Population growth has slowed, and full-time employment in Canada’s three largest cities, Toronto, Vancouver, and Montreal, has not grown for months. Weak growth usually points to lower borrowing costs, raising hopes of cheaper mortgages ahead.

Inflation Complicates the Mortgage Rate Forecast

Yet inflation complicates the picture. The Bank of Canada’s preferred measures still hover around 2.5%, and core inflation, measured by CPI-trim, has pushed back above 3%. That is well above the 2% target. The next inflation reading, due September 16, just one day before the BoC announcement, could be decisive. If the data confirm sticky price pressures, the mortgage rate forecast may shift from near-term cuts to a longer pause.

Policy Rates and Market Expectations

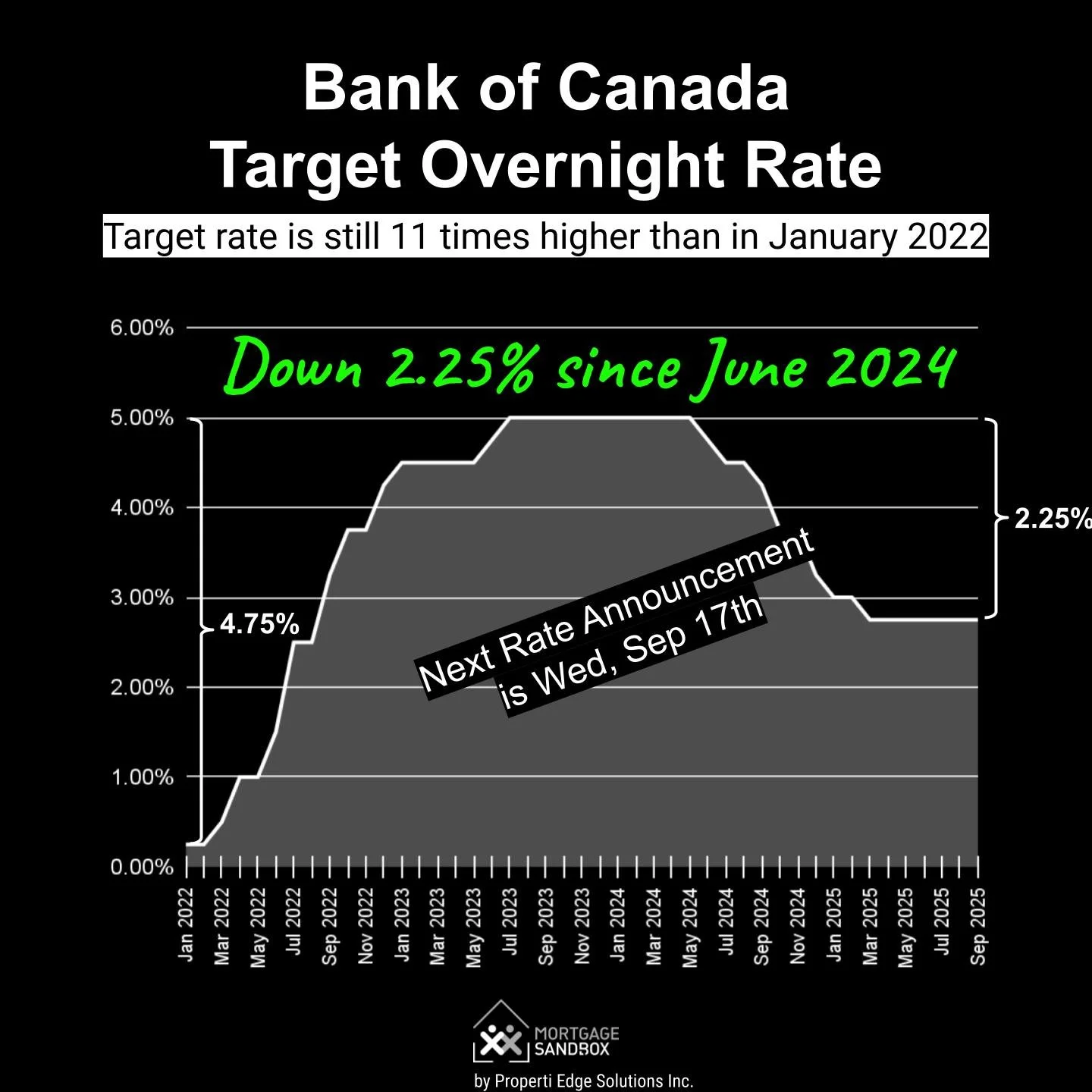

The BoC has already cut rates by 2.25% points since June 2024, bringing its overnight rate to 2.75%. But borrowing costs remain far higher than pre-pandemic levels, and mortgage rates are still straining household budgets.

According to a Reuters poll, foreign-exchange analysts expect the Canadian dollar to strengthen over the next year, largely because the BoC is nearly finished cutting while the U.S. Federal Reserve is just beginning its easing cycle. Markets are now pricing the odds of a September cut as close to 50-50.

What This Means for Borrowers

The mortgage rate forecast depends on which risk the BoC chooses to prioritize: recession or inflation. Economic activity is deteriorating, and unemployment is high, but inflation is not yet tamed.

Unless the September 16 inflation release shows clear improvement, the most likely outcome is that policymakers hold steady this month. That would mean mortgage rates stay elevated for longer, disappointing borrowers hoping for immediate relief.

For now, the best mortgage rate forecast is caution. Cuts are still on the table, but the Bank of Canada’s hands look tied until inflation falls convincingly toward target.

Mortgage Rate Forecast FAQs

Mortgage rates are unlikely to fall sharply in the near term. Nearly all economic analysists expect one rate cut of a 0.25% and a majority expect 0.50% by the end of 2025. The Bank of Canada has already lowered its policy rate but is cautious about inflation. Unless inflation drops closer to 2%, further cuts may be delayed.

Markets see the odds of a cut at the September 17 meeting as roughly 50-50. If inflation remains above 3%, the BoC may wait until later in 2025 before reducing rates again. Nearly all economic analysists expect one rate cut of a 0.25% and a majority expect 0.50% by the end of 2025.

Variable mortgage rates move in line with the BoC’s overnight rate. Fixed mortgage rates are influenced more by bond yields, which respond to inflation expectations and global interest-rate trends.

Weak GDP growth, higher unemployment, and stalled job creation increase pressure on the BoC to cut rates. However, as long as inflation is above target, the central bank may prioritise price stability over growth.

Unlikely. Rates near zero were an emergency measure during COVID-19. Even with further easing, most forecasts suggest Canadian mortgage rates will settle at higher levels than in the 2010s.