Bank Of Canada Target Rate Likely to Stay at 1.75%

HIGHLIGHTS

|

Wednesday, December 4th, marks the Bank of Canada’s eighth scheduled interest rate announcement of the year. To the surprise of many, the target rate has been held 1.75% all year and is widely expected to remain unchanged. In the past, industry advocates fearful of recession have called for rate cuts, but modestly solid growth in the first half of the year and new vigour in the struggling western Canadian real estate market have eased these fears.

Growth was stronger than the anticipated 3.7% between April and June but a poll by Reuters suggests that growth may have slowed to 1.2% from July to September. This slowdown was caused by the longest rail strike in a decade and a shut-down of the leaking keystone pipeline. If this forecast is realized, then the Bank of Canada will be under pressure to cut rates in 2020. This is in line with the expectations of 4/5 Canada’s big banks who expect a rate cut in 2020. However, National Bank is going against the grain by forecasting unchanged rates in 2020 before a rise in 2021, suggesting they expect a more positive economic outlook by the end of 2020. In line with National Bank, 54% of the 24 economists polled by Reuters recently expect no rate cuts in 2020. All these contradicting forecasts leave us with one conclusion about the future of the target rate; its trajectory is uncertain and will ultimately be determined by economic news or information that is not yet available. It is almost certain, that the rate will not rise in the short-run.

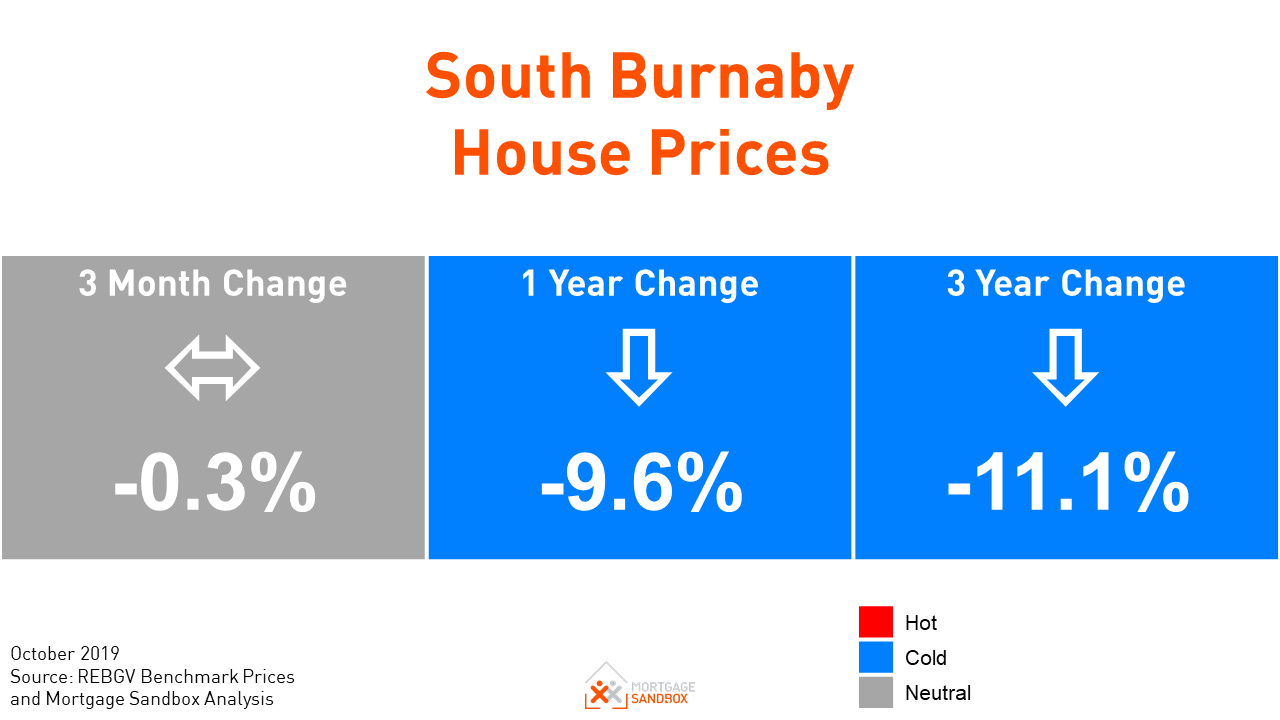

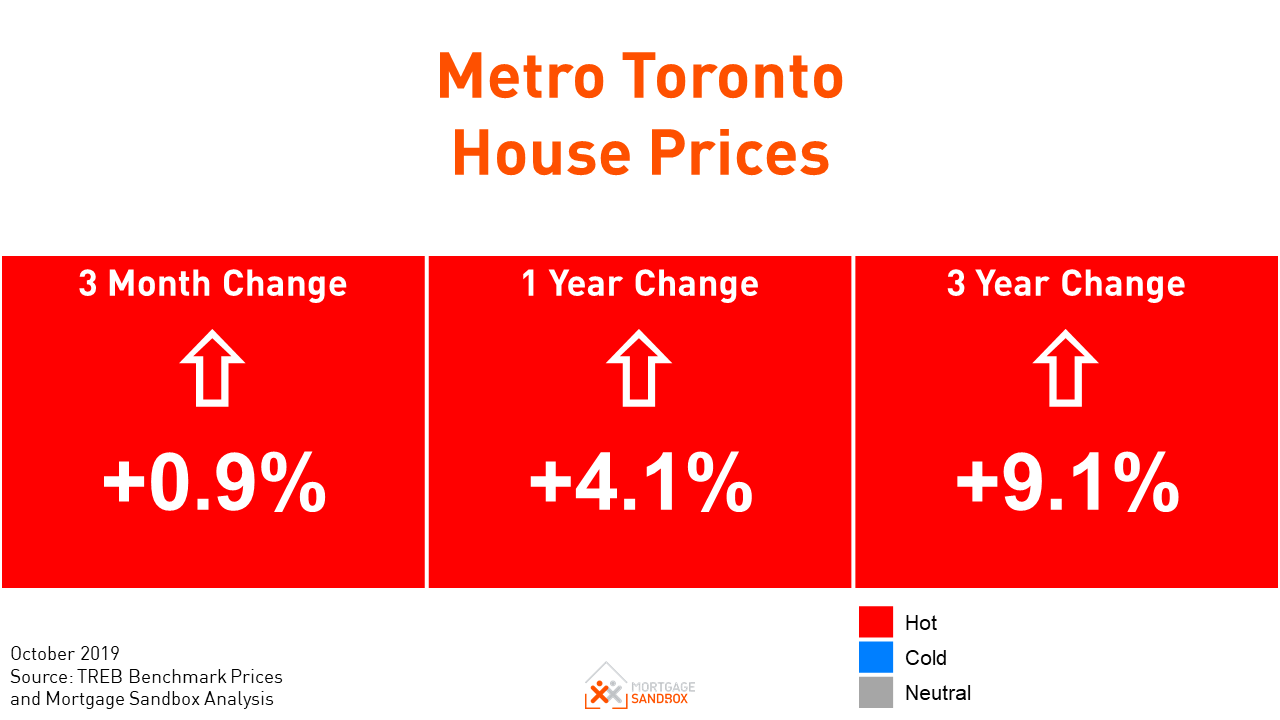

Housing markets in the West slowed dramatically at the end of 2018 and in the early stages of 2019, but the Canadian real estate bubble has not burst in the way many, including Mortgage Sandbox, expected. The annual real estate cycle usually sees a slowing of growth or a more rapid decline during the Fall, but this has not materialized in Western Canada. Most local markets have turned from decline to slow growth this Fall. In the East, Ottawa continues to be the shining light of Canadian real estate with prices continuing to skyrocket and the Toronto housing bubble has also failed to burst. Many fear that cutting the target rate now would further reduce mortgage rates and pour fuel on the housing market fire.

In summary, there will be widespread surprise if rates are indeed cut next Wednesday. All 30 economists polled by Reuters predicted no change in rates at the upcoming December 4th announcement. Keeping the target rate at 1.75% is still adding fuel to the economic engine and keeps the central bank in a good position to weather an economic storm posed by global threats (The US-China trade war to name one).