A comprehensive review of real estate in Toronto and a forecast for 2020/2021

All in Toronto

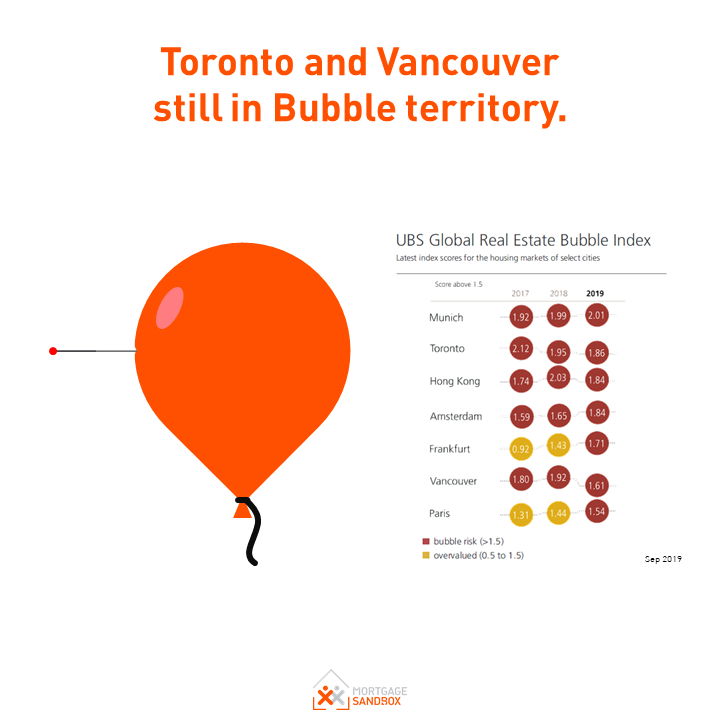

Is Canadian Real Estate Less Risky Now?

Home prices in Vancouver and Toronto are now lower. Does that mean the bubble is deflated and real estate is less risky?

Most people think real estate is a low risk and high return investment however many experts disagree. This article explains why many economists are concerned about risk in Canadian real estate and it’s potential to derail the economy.

Top 5 recession warning indicators

Learn about the key indicators, why they’re significant and where to find them yourself.

IMF Solution to Housing Affordability

To Tackle Housing Affordability in Canada, Build More Houses

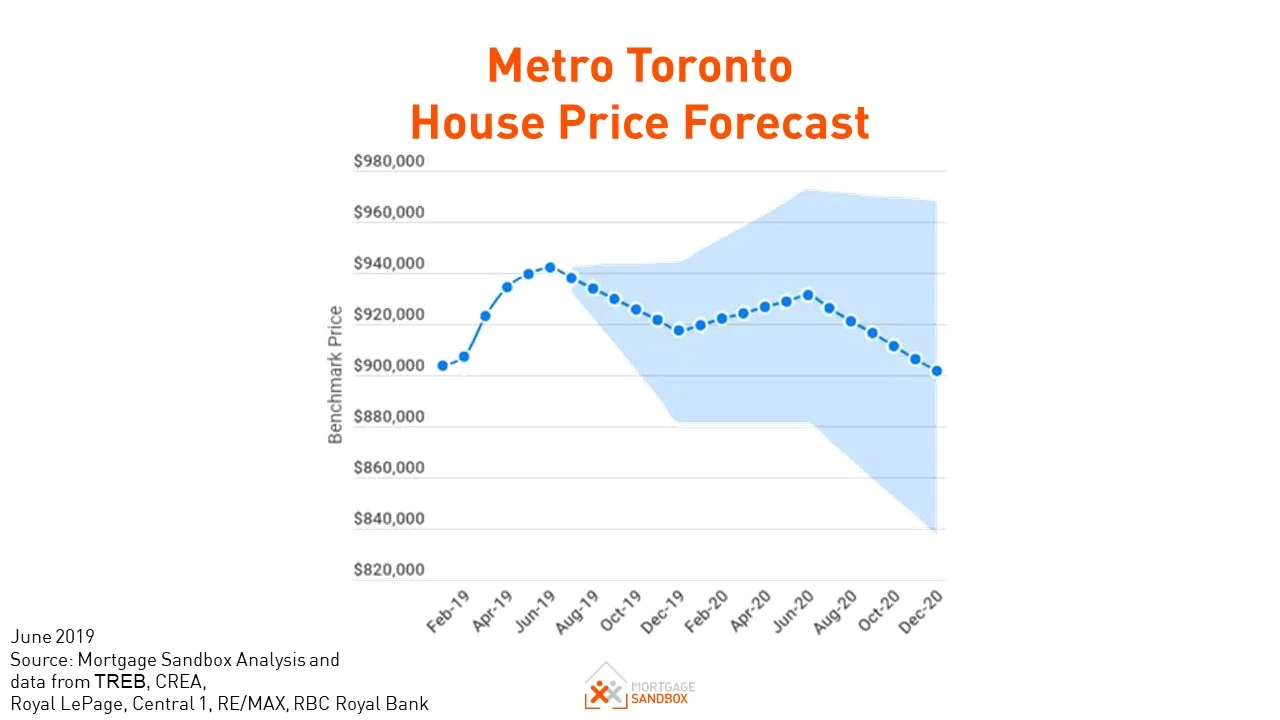

Metro Toronto House Price Forecast to December 2020

The first half of 2019 has seen Toronto real estate climb back up after a gloomy fall 2018. However, market indicators suggest that a significant price correction might be on the way. What's in store for the end of 2019 and throughout 2020.

When will we stop Recycled Listings?

Recycled listings consistently skew statistics, like average days on market and sales-to-new listings, to make the real estate market look hotter so that home buyers will feel rushed and offer more money for their home than the true market statistics would support.

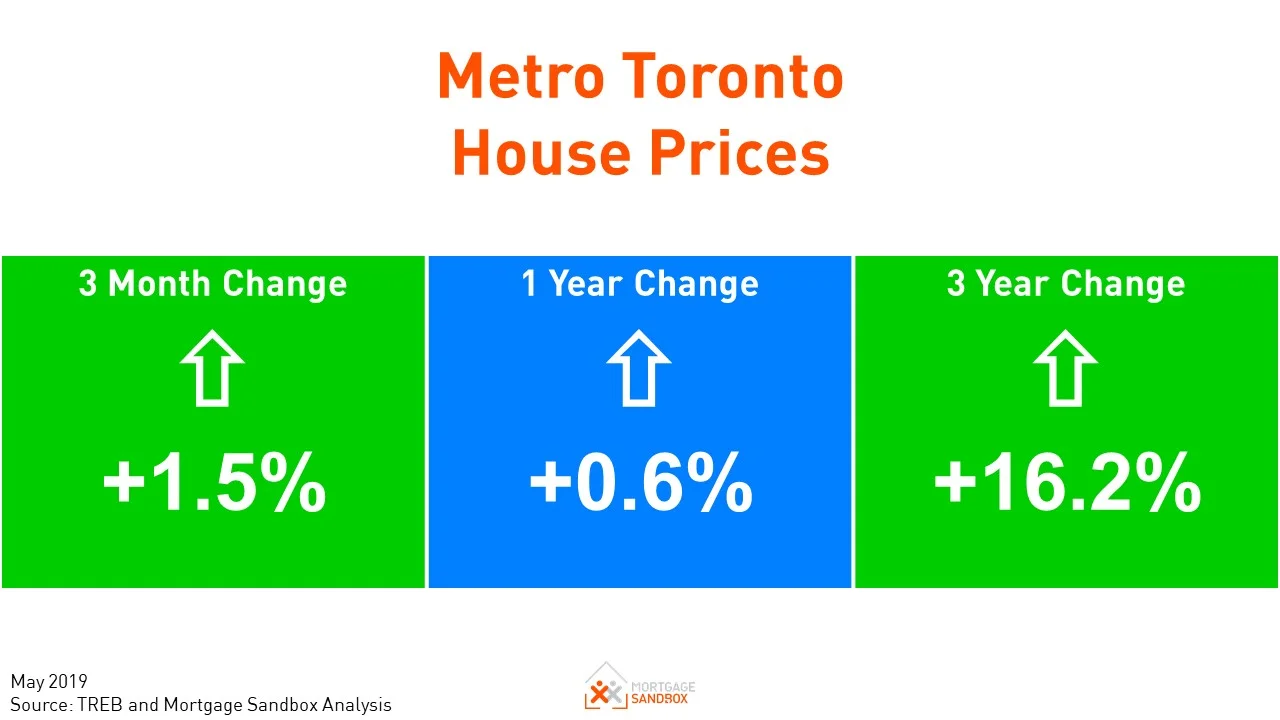

Metro Toronto Home Prices on the Rise

Latest Toronto house price trends and price forecast.

Where are all the 4-bedroom condos?

45% of homes proposed in the City of Vancouver are suites and 1-bedrooms suitable only for small households. Barely any 3-bedroom apartments are built when 24% of new apartments in Metro Vancouver should have 4-bedrooms. We need to more homes and the right mix of homes fast or else by 2021, 150,000 hard-working people will be underhoused.