Five Forces Driving B.C. Home Prices

Last updated:

At the highest level, supply and demand set house prices and all other factors drive supply or demand. At Mortgage Sandbox, we use a five-factor framework to analyze the market: core demand, non-core demand, government policy, supply, and popular sentiment.

While economic forces drive the market in the long run, sentiment can push prices beyond sustainable levels in the short term.

Summary

British Columbia's housing market is in a profound and necessary correction. The "long process of resetting valuations" initiated in 2022 is ongoing and has accelerated due to recent macroeconomic shocks.

A perfect storm of forces has shifted the market decisively in favour of buyers: a dramatic reversal in population growth has undercut core demand, a historic retreat of investor capital has crippled non-core demand, and a surge in new housing supply has flooded the market just as sentiment has soured.

The result is a market characterized by falling sales, swelling inventories, and declining prices in key segments like Metro Vancouver, with the condo sector facing particular distress.

While there is a long-term need for more housing, the immediate challenge for 2026 is absorbing the current oversupply. A return to a balanced market will likely require further price adjustments to restore fundamental affordability, a process that is likely to extend through most of the year

1. Core Demand: Weakening Fundamentals

Core demand, driven by household formation for primary shelter, has weakened significantly due to policy shifts and economic strain.

Population Growth

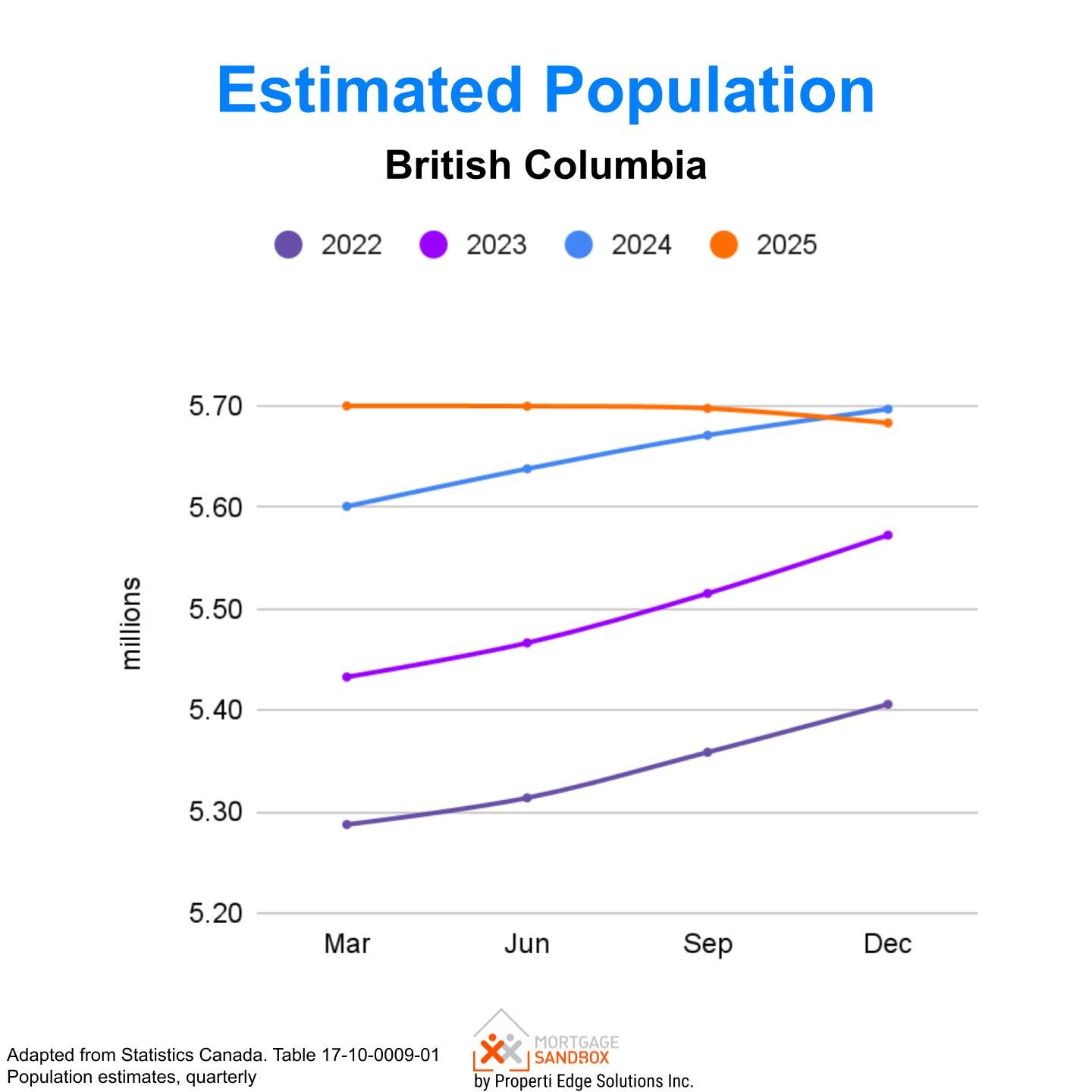

The federal government's study permit cap and adjustments to other immigration streams are having a measurable effect. Statistics Canada data for late 2025 confirms a net slowdown in population growth for B.C., particularly in the key cohort of new non-permanent residents. This directly reduces the number of new households being formed.

Affordability & Prices

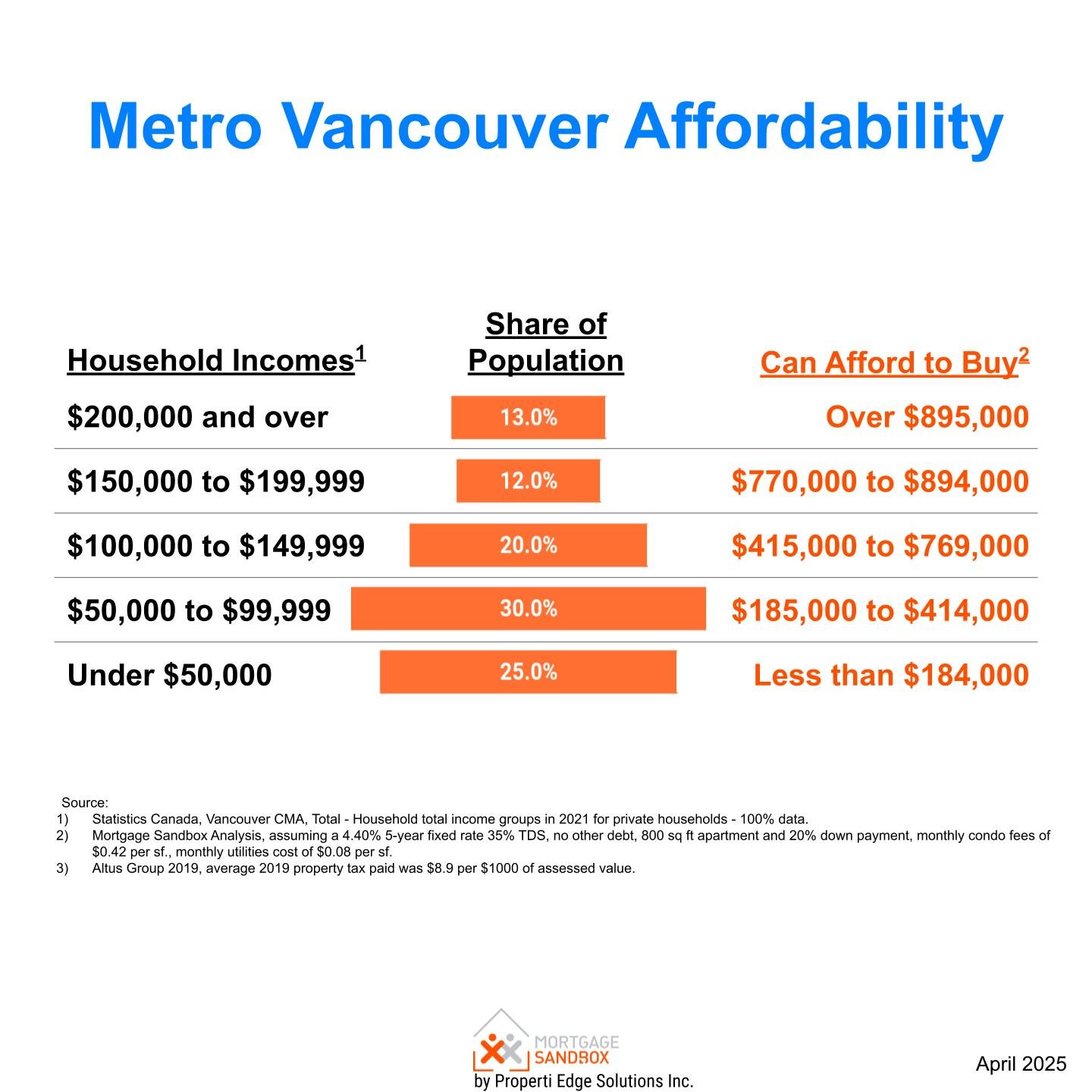

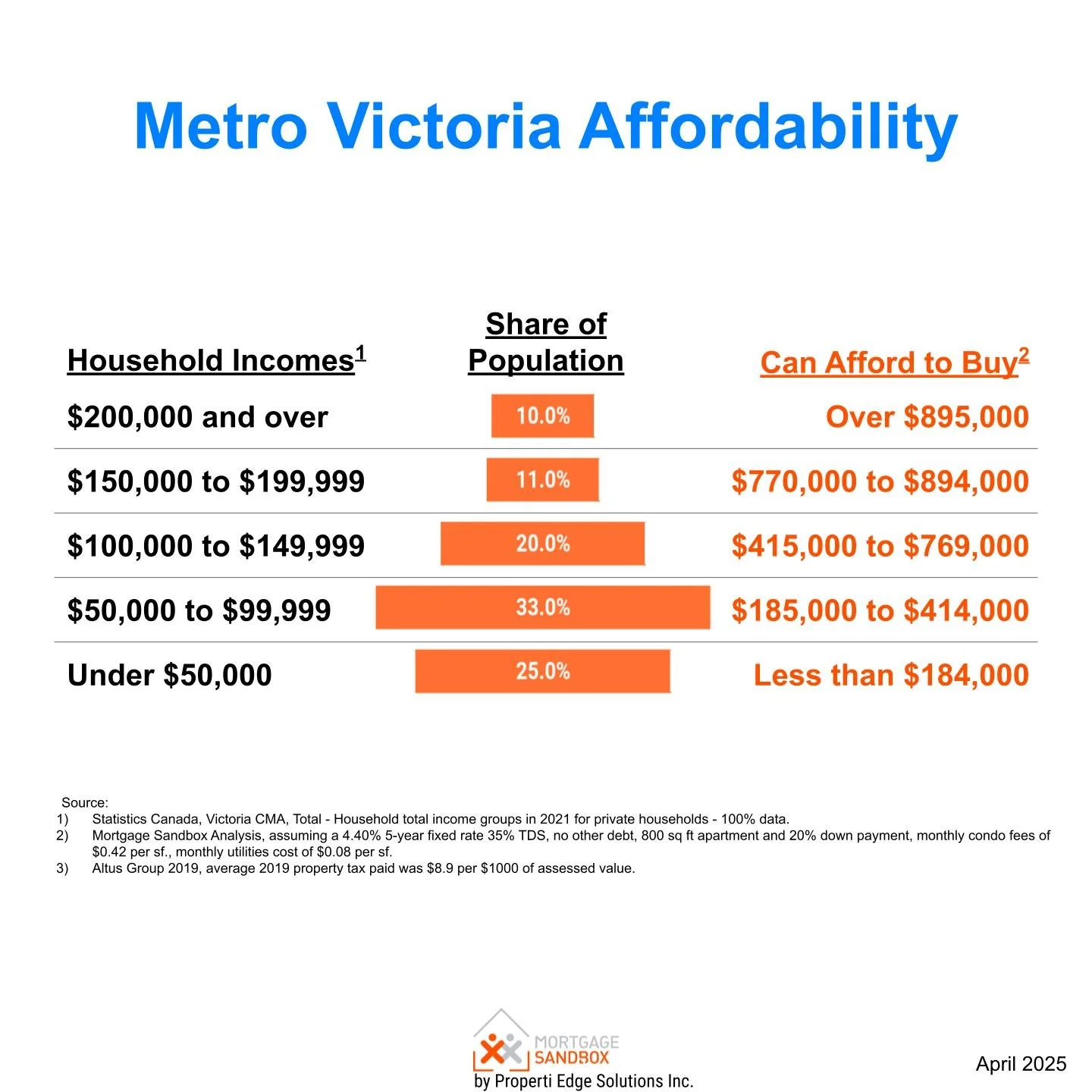

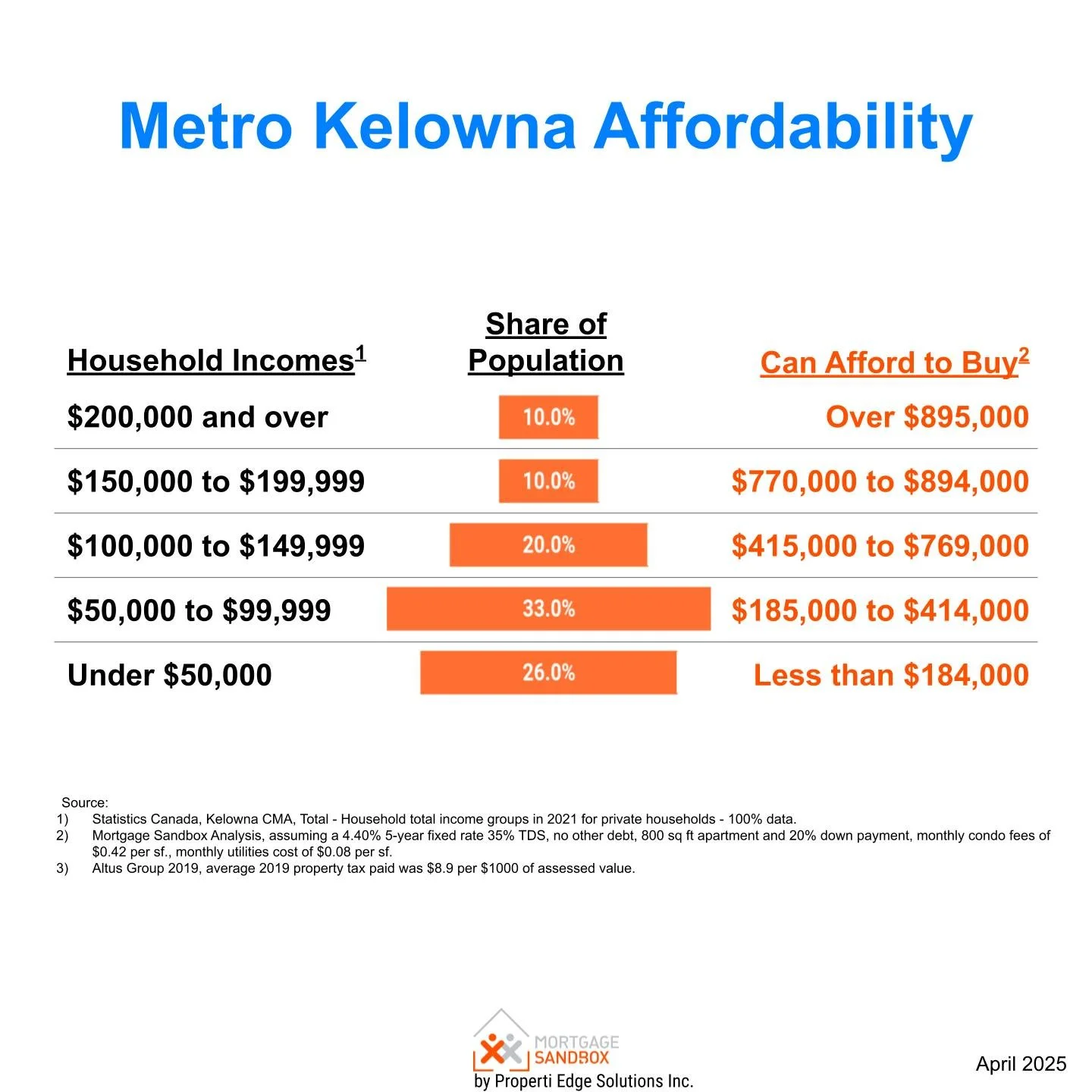

While prices have retreated from their peaks, ownership costs remain near historic highs relative to income. Mortgage lending guidelines limit borrowers to using no more than 40% of their income for homeownership costs. According to RBC Royal Bank, homeownership costs in Vancouver were 89% of median household income, whereas in Victoria, they were 68%. In other words, B.C. home prices are above sustainable levels according to long-term economic fundamentals.

Condo owners need more savings and mortgage financing to upgrade to a house when there is a large price gap. During the pandemic, house values in British Columbia increased more rapidly than apartment prices. However, in recent months, the gap between house and condo prices has stabilized and is now starting to shrink. This narrowing price gap makes it easier for condo owners to consider upsizing to a house.

Financing Costs

People typically finance home purchases through their savings, mortgage loans, and the equity they have built in their homes.

Falling home prices across British Columbia are reducing people's home equity, which is the difference between the home's market value and the remaining mortgage balance. This decrease is limiting their ability to finance a move up the property ladder.

Additionally, the mortgage rate relief that began in 2023 has ended. The Bank of Canada's recent decisions and guidance have led to expectations of higher variable and fixed mortgage rates in 2026. For prospective buyers, this translates to reduced purchasing power. For current homeowners, especially those facing mortgage renewals in 2026-2027, this could result in significantly higher monthly payments, leaving them with less disposable income for other spending or savings.

Employment

The job market has softened. Full-time employment growth has not kept pace with the working-age population, leading to a slight uptick in unemployment. Job security concerns are contributing to buyer caution.

Overall Core Demand

The foundation of buyer demand is weakening. Stagnant incomes are meeting higher financing costs, while key demand drivers, such as population growth, are decelerating. Government programs like the FHSA provide support but are insufficient to offset these larger macroeconomic headwinds.

Need a Realtor?

We match you with local, pre-screened, values-aligned Realtors and Mortgage Brokers.

2. Non-core Demand

Non-core demand—from investors, speculators, and foreign capital, is highly sensitive to sentiment and returns. Since non-core demand is ‘optional’ (i.e., not used to shelter your own family), it is more volatile than core demand. This segment is now in retreat.

Long-term Rental Investor Pullback

The economics of rental investment have turned negative in major cities, with mortgage payments and carrying costs far exceeding achievable rents, creating negative cash flow.

New federal mortgage rules restricting the use of rental income for qualification have further constrained investor leverage and purchasing power.

Foreign Capital

The Federal Government, using its housing agency, has announced a temporary ban on home purchases by non-Canadians from January 1, 2023, to January 1, 2027. The foreign-buyer ban won’t apply to students, foreign workers, or foreign citizens who are permanent residents of Canada; however, the additional hurdles will reduce the flow of capital to Canadian real estate compared to previous years.

Short-term Rentals

As tourism in Canada has rebounded post-pandemic, the landscape for short-term rentals has become more complex than it was a few years ago.

In many municipalities across British Columbia, short-term rentals (STRs) must be operated from the host's principal residence, which is the home where they live for most of the year. This regulation aims to promote long-term housing solutions. Typically, rentals can include a room in the host's house, a basement suite, or a laneway home on the same property.

Key BC Airbnb Rules:

Principal Residence Requirement: Hosts cannot rent out non-primary properties (such as investment condos or second homes) as short-term rentals.

Permitted Rentals: Hosts may rent a room in their house, a basement suite, or a laneway home, provided it is their principal residence.

Municipal Bylaws: Local governments (including Vancouver, Kelowna, and Victoria) may require specific business licenses, and some areas have stricter regulations.

Fines: The province has increased penalties to $3,000 per infraction, per day, for violations of local bylaws.

Airbnb is no longer a straightforward business. There is a growing awareness that if it becomes too easy for hosts to profit and they start disrupting the market, the government will likely implement new regulations to make it more challenging.

Currently, Vancouver has approximately 8,000 short-term rentals, Victoria has around 944, and Kelowna 1,200. Short-term rentals demand is not a significant factor driving demand in these areas.

House Flippers

When house prices rose consistently, it was easier for house flippers to make money. The market has softened, and house flipping is beginning to look risky.

This might be partly because, on January 1st, the B.C. government introduced a new tax on the sale of real estate held for less than two years. A tax rate of 20 percent will apply to income from properties sold within 365 days of purchase. It will gradually decline to zero between 366 and 730 days.

Note: The flaw with the chart below is that most flippers will "live in the property" for at least 1 year before selling so they can claim it as their principal residence and avoid capital gains tax on the sale. The regulators don’t count flips that occur within 18 months. The rate of flipping could be much higher.

Dark Money

Dark money refers to funds derived from criminal activities or money that is illegally transferred into Canada. This includes both legitimately earned income transferred unlawfully from countries with capital controls (such as China) and legitimate earnings transferred from nations under international sanctions (such as Iran, Russia, and North Korea).

These funds are often laundered through the real estate market to obscure their illegal origins. In some instances, the true owner of a property is concealed through the use of a straw buyer, while in other cases, the property is held by a shell company. Additionally, some real estate agents or lawyers may accept cash from these illicit sources to assist individuals in hiding the origins of their funds. For example, in 2015, a realtor in British Columbia was discovered with hundreds of thousands of dollars hidden in her closet at home.

To combat money laundering, British Columbia has introduced a new land registry. However, some economists question its effectiveness. Kevin Comeau from Transparency International argues that the system does not require "proactive" verification of the true beneficial owner of a property. This means that the ultimate owner, whose name is not listed on the land title, does not need to be verified—it operates on an honor system. Consequently, this system provides little value to law enforcement agencies and others who search the registry.

Currently, there is an investigation into 18 allegations of mortgage fraud. The mortgage brokers are accused of collaborating with an unregistered broker, Jay Kanth Chaudhary, who allegedly facilitated over half a billion dollars in fraudulent mortgage loans.

There is no evidence to suggest that the role of dark money in British Columbia's real estate market has diminished.

Overall Non-core Demand

Given the foreign buyer restrictions and volatility in the rental market, we anticipate that capital inflows toward residential real estate for non-core uses will decrease at least until mid-2027. This adds some downward pressure on B.C. home prices.

Find out how much you can afford to buy!

3. Government Policy

Policy is pulling in two directions, attempting to boost long-term supply while managing a near-term demand slowdown.

Aggressive Supply-Side Initiatives

The provincial government is pursuing aggressive zoning reforms, such as legalizing multi-unit housing on single-family lots, to address chronic supply shortages. The impact of these measures will be long-term.

Demand-Downside Interventions

Federal policies, including the foreign-buyer ban (in effect until 2027) continues to cool demand. The most impactful policy, however, is the federal immigration pivot, a deliberate effort to reduce housing demand pressure.

Demand-Upside Interventions

Recent federal changes include extending the amortization period for insured mortgages to 30 years for first-time home buyers. Additionally, Canada has introduced a new First-Time Home Buyers' (FTHB) GST/HST Rebate for newly built homes to improve affordability. This program offers a rebate of up to the full federal GST (or the federal portion of the HST), potentially saving homeowners up to $50,000.

While both measures aim to stimulate demand, their impact has thus far been limited due to significant economic uncertainty.

Overall Government Influence

Overall, the immigration freeze has the most significant impact, putting downward pressure on demand and prices.

4. Plentiful Supply

The housing supply dynamic has inverted. After years of scarcity, a wave of new units is arriving just as demand is contracting.

Resale Glut

A potent new source of supply is the "carrying-cost motivated seller" . Investors facing negative cash flow and dim price-appreciation prospects are listing properties en masse. In the GTA and GVA, this investor flight has been a primary driver of rising active listings . This trend is most acute in the condo segment.

New Construction

Home construction in Metro Vancouver is booming. All major centres in B.C. are experiencing high construction activity. While housing starts are lower than the peak, they remain relatively strong.

As these projects are scheduled for completion within the next 18 months, they may enter a soft market. Many of the homes under construction are pre-sold or rental buildings. Regardless, their new occupants will vacate or sell their current residences, adding to the resale market or rental pool.

Pre-sales:

Pre-sales are purchases of unbuilt and completed brand-new homes from developers. Typically, a developer must sell 70% of homes in a building before starting construction, so housing starts are a good indicator of successful pre-sales.

Pre-sales are purchases of brand-new homes from developers.

The chart below provides good data for Vancouver, where the market has weakened.

This shows that a larger proportion of newly started construction likely consists of purpose-built rental buildings.

Popular Sentiment

Market psychology has shifted from fear of missing out (FOMO) to pervasive caution, creating a self-fulfilling cycle of inaction.

The Ipsos-Reid and Nanos Canadian Confidence Index shows that Canadian consumer confidence has slipped over the past few months. Less than 40 per cent of Canadians believe home prices will rise over the next twelve months.

Although consumer sentiment is a key factor in real estate price trends, sentiment alone is not an accurate predictor of future prices.

Market Outlook & Regional Nuances for 2026

Here is a quick summary:

Core demand is weaker due to higher mortgage rates, a shrinking population, and weak job growth.

Non-core demand is weaker due to a ban on foreign buyers, falling rents, and some of the country’s tightest restrictions on short-term rentals.

Existing supply is rising, and there are high numbers of homes under construction, many of which will be completed in the next 18 months.

Consumer confidence in higher future real estate values is mildly negative, indicating that prices are likely to weaken.

While it is not guaranteed, the current conditions dramatically increase the risk of a significant market correction.

See our B.C. Home Price Forecasts

Like this report? Like us on Facebook.